- in United States

- within Intellectual Property, International Law and Tax topic(s)

- with readers working within the Aerospace & Defence, Media & Information and Metals & Mining industries

The Turkish Competition Authority ("TCA") has recently cleared nine major beef and lamb producers of allegations involving concerted practices in setting prices and restricting supply, concluding that no evidence supported claims of anti-competitive coordination. Although the decision does not find any infringement, it provides insights into the market. It once again reminds us of the TCA's approach to the presumption of concerted practice. Additionally, with beef and lamb representing a substantial portion of household expenditures, the TCA's scrutiny initiated ex officio reflects broader concerns about inflation's impact on essential goods and the competition authority's role in addressing price increases that directly affect consumers' daily lives.

Livestock Market in Turkey's Inflationary Environment: Third Time's the Pattern

The investigation comes at a time when Turkey continues to grapple with significant inflationary pressures, with beef and lamb prices drawing particular attention. According to industry data from the National Meat Council, the annual increase in the prices reached approximately 41% in 20241, though this remained below both the consumer price index (44.37%) and the food inflation rate (43.58%).

Within this inflationary economic environment, the significant strain on household budgets has made the marketmarket a natural focus of competition scrutiny. Indeed, in statements to the press last year, the President of the TCA emphasized the TCA's strong commitment to combat inflation and the rising cost of living, asserting that they would do their part to ensure that citizens have access to meat and meat products at affordable prices, thereby prioritizing consumer welfare2.

This latest clearing decision represents the TCA's third examination of the beef and lamb market since 2022. The TCA previously conducted preliminary investigations in June 2022 and October 2023, both concluding that price increases were driven by structural issues rather than anti-competitive conduct. TCA also launched a market inquiry in 2023 accordingly. While the report of this market inquiry is still pending, a third and latest preliminary investigation in the market—the subject of this article—was conducted.

In that regard, this decision exemplifies the TCA's recent strategic shift towards more intense enforcement in markets experiencing significant inflationary pressures, reflecting a broader policy approach that prioritizes consumer welfare during periods of economic volatility. This enforcement trend is most prominently demonstrated through the Authority's landmark Retail I decision, which targeted a hub-and-spoke cartel involving major market chains and suppliers. The decision's significance extends beyond its substantial financial impact—imposing administrative fines totaling 2.7 billion TL (approximately 258 million euros) on five chain markets and one supplier—to represent a deliberate policy decision to vigorously pursue anti-competitive practices in markets where price increases directly burden consumers.

The Authority's increased scrutiny has included investigations into a variety of essential goods, including hygienic masks, lemons, and bottled water, demonstrating a methodical approach to markets facing significant price volatility. While not all investigations have resulted in violation findings, such as this decision at hand, TCA has strategically used these proceedings to signal its commitment to rigorous competition law enforcement in inflation-sensitive markets, effectively serving both deterrent and regulatory guidance functions.

Market Structure Insights from the Decision

While the decision discussed defining the market as the livestock product market, it refrains from providing a conclusive market definition. On the other hand, it provides important insights into the market, which we intend to examine further.

In 2023, beef and lamb accounted for 42.9% of Turkey's total meat production, with production increasing by 8.8% to reach 2.384 million tons, whereas world meat production in 2023 increased by 0.8% compared to 2022, reaching approximately 365.2 million tons.

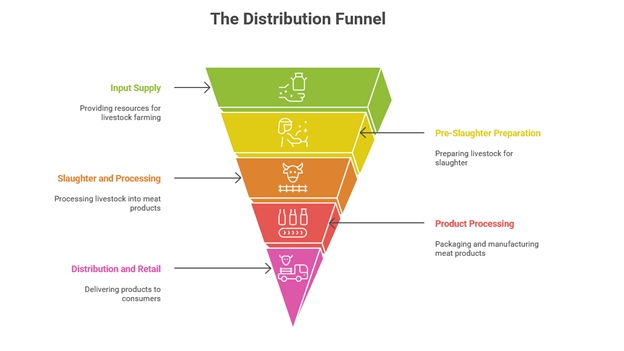

The decision also comprehensively exhibits the value chain in the Turkish market, spanning from production to point of consumption. Accordingly, the Turkish livestock products distribution system represents a hybrid model combining traditional and modern distribution methods. It analyses the distribution network in five distinct stages:

- Production and Input Supply: Encompassing animal production input supply and livestock producers, including live animals and feed expenses

- Pre-Slaughter Preparation: Involving cattle fatteners, livestock dealers, and wholesale butchers with mandatory veterinary inspections

- Slaughter and Processing: Including actual slaughter processes, cold storage, and operations by large modern enterprises and traditional butchers

- Product Processing: Covering cutting, packaging, and manufacturing of various products, including salami, sausages, and processed meats

- Distribution and Retail: Delivering products through both organized retail chains and traditional butcher shops to households and commercial markets

The market shows high fragmentation at the production level, with 92% of cattle farming enterprises having capacity below 50 head, accounting for approximately 50% of the total cattle population. This fragmentation contrasts with greater concentration at the processing and distribution stages.

The investigated companies also represented this diversity, by covering established players and newer entrants. The decision further takes into account the views of these companies. They primarily identify structural problems in the market, such as inadequate livestock breeding programs, insufficient feed production capacity, lack of coordination between livestock farmers and meat producers, seasonal supply fluctuations, absence of standardized slaughter and meat quality standards, and high production costs driven by imported inputs and financing difficulties. The producers emphasize that these systemic issues require long-term planning, improved breeding programs, better pasture management, accessible financing for small and medium-scale farmers, and enhanced industry organizations to achieve market stability.

The Reminder of the Conditions of the Presumption of Concerted Practices in Turkish Competition Law

While the decision does not establish an infringement, it sheds light on TCA's approach to the presumption of the concerted practice. Although provided for in competition law, the presumption of a concerted practice remains one of the more controversial areas. Under the Turkish Competition Act, this presumption arises where the existence of an agreement cannot be proven. However, market behavior—such as changes in prices, supply and demand balances, or the geographic scope of undertakings—resembles that observed in markets where competition is prevented, distorted, or restricted. Each party may avoid liability by demonstrating, based on economic and rational grounds, that it did not participate in the concerted practice.

The rationale for this provision lies in the fact that anti-competitive agreements are generally made secretly and proving their existence is quite tricky, sometimes impossible. Thus, if the market conditions suggest an anti-competitive agreement, the burden of proof that they are not in concerted action has been transferred to the relevant undertakings, saving the Act from becoming inoperative due to the difficulty of proof.

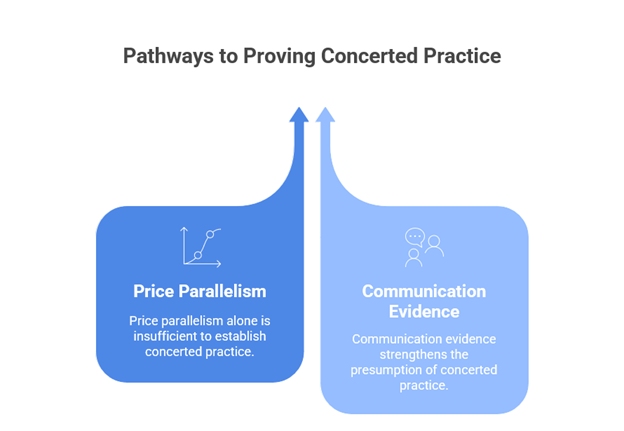

The Limited Role of Price Parallelism

The early decisions establishing the presumption of concerted practice based on only the economic evidence are limited. Özgür Çimento3 and Maya III4 Were the leading decisions adopting this approach? In the Özgür Çimento decision, the TCA determined that two cement producers had refused to supply Özgür Çimento due to concerted practice, aiming to exclude their rival from the market. The decision analysed the market and the special circumstances of the companies, including the cost and price relations, cost of delivery, and import capabilities, and concluded that there is no explanation other than concerted practice. Maya decision also analysed the price and cost relationship and suggested that the price increases could not be explained by cost increases. Additionally, the market's previous history of infringements also appears to have played a role in this assessment.

Emphasis on Communication Evidence

In contrast to this limited number of decisions based solely on price parallelism, it is observed that the Competition Board has generally required additional evidence of communication alongside parallel conduct. In many subsequent cases, parallel conduct in the market was supported by additional evidence, such as undertakings' participation in meetings or their engagement in communication.5. In the lack of such communication evidence, TCA acknowledged that parallel conduct may be explained by economic factors and rational explanations6 such as oligopolistic interdependence7 or similarity of costs8. These decisions suggest that the presumption of concerted practice can be established by providing both examples of parallel behaviour and communication evidence. That communication evidence is barely a smoking gun, yet it shows the companies meet to discuss the prices.9 or exchange some strategic information, including stock amounts or variable costs10.

What does this decision set out

In the current case, the TCA applied this mainstream approach, requiring substantial evidence beyond mere price parallelism. Indeed, the decision gives references for some of the TCA decisions mentioned above, where the TCA seeks communication evidence alongside the market data.

The decision conducts a detailed economic analysis of the prices, sales, and the breakdown of the sales. The economic analysis revealed patterns inconsistent with coordination. Specifically, the analysis showed that while prices increased over the years with periodic decreases, and price movements were similar, the undertakings' prices varied by product, and the price change dates differed significantly in each period. Therefore, the prices and price movements did not support the allegation that the undertakings jointly determined product prices or restricted the supply. Additionally, in the on-site inspections, the TCA did not find any correspondence or documents showing that the companies jointly determined beef and lamb product prices and/or restricted the supply of those meat products.

Accordingly, TCA decided that there is no concerted practice among the companies analysed based on three facts:

- No evidence (correspondence/documents) found showing joint price determination or supply restriction.

- Data showed divergence in prices and timing of price changes and stability in beef/lamb carcass: no indication of concerted price-setting or supply restriction.

- Market conditions did not resemble markets where competition is hindered, distorted, or restricted.

The first fact pertains to communication evidence supporting the presumption of concerted price, while the second refers to parallel behavior. Above that, the final fact, as a result of these two facts, alludes to the presumption of concerted practice provision set out in the Act.

Key Implications

The clearing decision, while finding no violation, serves multiple purposes: it provides detailed market analysis and shed light into the Turkish livestock products market, reinforces the TCA's commitment to evidence-based enforcement under the presumption of concerted practice, and last but least eflects the TCA's approach of targeting markets characterized by sharp price escalations, revealing an institutional commitment to consumer-centric enforcement during economically challenging periods.

Footnotes

1. http://www.ukon.org.tr/fiyatlar.aspx

2. Şengören Özcan, Z. ve Peker, C. (2024), AB ve Türkiye'de Rekabet Hukuku ve Enflasyon Arasındaki İlişki, Baseak CORE Papers No: 21, 2024

3. TCA decision dated 20.9.2007 and numbered 07-76/908-346.

4. TCA decision dated 12.11.2008 and numbered 08-63/1050-409.

5. TCA decision dated 26.07.2007 and numbered 07-62/742-269.

6. TCA decision dated 23.03.2000 and numbered 00-11/109-54.

7. TCA decision dated 10.10.2014 and numbered 14-37/713-318; TCA decision dated 04.07.2012 and numbered 12-36/1040-328.

8. TCA decision dated 17.06.2003 and numbered 03-43/490-229; TCA decision dated 31.07.2008 and numbered 08-49/697-273.

9. TCA decision dated 26.07.2007 and numbered 07-62/742-269.

10. TCA decision dated 14.01.2006 and numbered 16-02/44-14.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.