We are pleased to bring you this issue of the Africa tax Desk regional newsletter.

In this issue, we review the key tax measures that have taken place in selected African countries from 2022 to date.

Botswana

Tax Amnesty Program

With effect from 1 July 2021 the Botswana Government introduced a Tax Amnesty Scheme through the Botswana Income Tax (Remission of Penalties and Interest) Amnesty Regulations, 2021/22 and the Value Added Tax (Remission of Penalties and Interest) Amnesty Regulations, 2021/22.

The tax amnesty scheme provides eligible taxpayers with outstanding Income Tax and VAT liabilities, relating to tax years/periods ended on or before 30 June 2021, an opportunity to regularize their tax affairs, in the amnesty period, by filing outstanding tax returns and settling outstanding principal tax liabilities in return for 100% waiver of penalties and interest. Penalties and interest relating to non-compliance with transfer pricing documentation requirements were excluded from the amnesty.

Value Added Tax

On August 2022, the Government instituted measures to address the impact of rising inflation in Botswana. The measures include a reduction in the VAT rate through Statutory Instrument No. 96 of 2022 for a six-month period with effect from 3 August 2022. For the period, the standard VAT rate on supplies of goods and services is reduced from 14% to 12%. The VAT rate on supplies of cooking oil and liquified petroleum gas is reduced from 14% to 0% from 3rd August 2022 and later charge to 12% with effect from 3rd February 2023.

The period of reduction of the VAT standard rate was further extended to 31 March 2023.

Transfer Duty

On 11 August 2022, the Botswana National Assembly passed a Transfer Duty (Amendment) Act No.40 of 2022 which amended Section 20 of the Transfer Duty Act (Chapter 53:01) to provide for the exemption from transfer duty of the acquisition of immovable property, by a holder of a licence under the Special Economic Zone Act (SEZA). The exemption is applicable where the said property is utilized in the carrying on of any approved business activity. The effective date of the amendment is 25 October 2022. Transfer duty is levied at the rate of 5% for transfer to a citizen (including a company owned in the majority by citizens) and at the rate of 30% where the transfer is to a non-citizen. This, in addition to other incentives such as the special corporate tax rates of 5% for the first 10 years of operation and 10% thereafter, enhances the attractiveness of the Special Economic Zones.

Eswatini

Tax compliance certificates

In December 2022, the Eswatini government issued a Gazette detailing various issues pertaining to tax compliance certificates regulations. The Gazette effectively revokes the Income Tax (Clearance Certificate) Regulations of 1988.

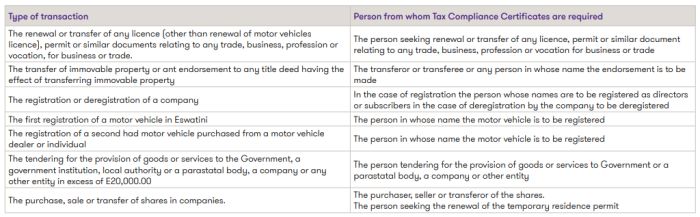

Transactions requiring income tax compliance certificates and the persons from whom income tax compliance certificates shall be required are set out in the table below.

An application for income tax compliance certificate shall be made to the Commissioner General in respect of each transaction prescribed in Regulations. A person requiring an income tax certificate shall apply for the certificate either in person or through their

Each tax compliance certificate is valid for a maximum period of 12 months with the exception of the performance of any theatrical, musical, sporting or any other entertainment in Eswatini by a non-resident entertainment or sportsperson. In such cases,

- An application for a tax compliance certificate shall be in respect of each separate performance

- The validity of each tax certificate shall be for the duration of the performance and

- The certificate for a particular performance shall cease to be valid after the performance has been made.

Transactions requiring income tax compliance certificates and persons from whom income tax compliance certificates are required are outlined below:

Tax Updates - Regional Tax Publication, March 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.