ENS are most popular:

- within Accounting and Audit, Law Department Performance and Consumer Protection topic(s)

Below, please find issue 143 of ENS' Tax in brief, a snapshot of the latest tax developments in South Africa.

case law

- Biskit (Pty) Ltd v CSARS (6156/2023) [2025] ZAFSHC 71 (13

March 2025)

- The taxpayer sought to review the South African Revenue Service's ("Commissioner" or "SARS") seizure of a cigarette shipment, claiming the goods were "duty paid" when bought from a licensed manufacturer via a wholesaler.

- The court was required to consider firstly, whether the notice of intent to seize was a final and reviewable decision; secondly whether the seizure was procedurally fair, and lastly whether the taxpayer proved that excise duty was paid on the seized goods.

- The court dismissed the application and found that SARS' seizure was lawful and procedurally fair.

- Find a copy of the judgment here.

- Sandbaken Boerdery (Pty) Ltd v CSARS and Another

(053180/2022) [2025] ZAGPPHC 54 (21 January 2025)

- The taxpayer, Sandbaken, claimed diesel refunds from SARS under the Customs and Excise Act, No. 91 of 1964 ("Customs Act"). SARS disallowed the claims and assessed the taxpayer for interest.

- SARS' decision to disallow the diesel refunds and impose interest was upheld and the appeal was therefore dismissed.

- The court accordingly dismissed the appeal.

- Find a copy of the judgment here.

- JT International Manufacturing South Africa (Pty) Ltd v

CSARS (1330/2023)

- JT imported cigarette tobacco but failed to submit the required warehouse entry forms within 30 days. SARS demanded approximately R60 million in unpaid duties and VAT. JT requested retrospective exemption under s 75(10)(a) of the Customs Act, which SARS denied.

- The court considered whether s 75(10)(a) allowed SARS to grant retrospective exemption from compliance with rule 19A.09(c).

- The court found that (i) section 75(10)(a) does indeed allow SARS to exempt non-compliance, even after the fact, and (ii) the law does not limit the Commissioner's discretion to only pre-entry conditions.

- The appeal was accordingly upheld, and SARS was ordered to pay costs.

- Find a copy of the judgment here.

SARS publications

- Guides

- How to do the AEO Customs Sufficient Knowledge Competency

Assessment

- Traders eligible to apply for Authorised Economic Operator (AEO) status must be registered or licensed for a customs activity.

- For more information, see the AEO webpage here.

- Travel e-Log book 2025/2026

- The 2025/26 Travel e-Log book is available here.

- For more information, see the webpage here.

- How to do the AEO Customs Sufficient Knowledge Competency

Assessment

- Transfer Duty Rates

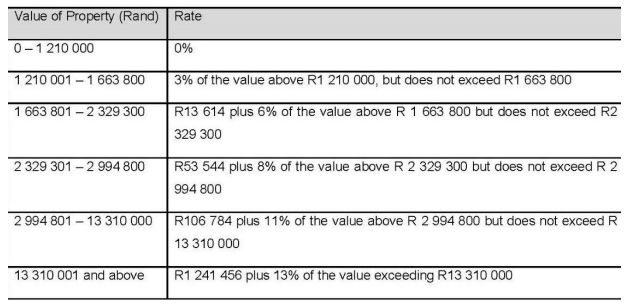

- New Transfer Duty rates effective 1 April 2025

- As announced in the Budget Speech by the Minister of Finance, updated Transfer Duty rates are applicable to properties acquired on or after 1 April 2025 and apply to all persons, including natural and non-natural persons (including Companies, Close Corporations (CC) and Trusts). See table below.

- For more information, see the webpage here.

- Find the external guide for transfer duty via e-Filing here.

- Auto merge functionality on eFiling

- The auto merge functionality on eFiling is intended to ensure that one single view exists for an entity with all its associated tax types, which includes income tax (corporate income tax, personal income tax and trust tax), valueadded tax, employees' tax, Mineral and Petroleum Resource Royalty, and customs and excise.

- A copy of the update guide to the auto merge function on eFiling is available here.

- Government Connect | Issue 27 (April 2025)

- The latest edition of the SARS Government Connect Newsletter Issue 26 (February 2025) is now available.

- Find a copy here.

exchange control

- Exchange Control Circular No. 6 | Appointment of a Restricted

Authorised Dealer in Foreign Exchange

- Old Mutual Bank Limited has been appointed as a Restricted Authorised Dealer in Foreign Exchange for purposes of the Exchange Control Regulations published under Government Notice No. R1111 of 1 December 1961, as amended.

- Find a copy of the circular here.

customs and excise

- Rate of Carbon Fuel Levy on Diesel amendment

- Amendment to Part 5A of Schedule No. 1, by the substitution of Notes 7(b) in order to provide for the newly inserted items included under item 195.13 in Part 5A of Schedule No. 1 as promulgated in the Taxation Laws Amendment Act, 2025 in Government Gazette No. 51829 on 24 December 2024.

- Find the notice here.

- Environmental Levy amendment

- Amendment in Part 3F of Schedule No. 1, by an increase of R46 per tonne in the rate of environmental levy on carbon dioxide equivalent from R190 to R236 per tonne to give effect to the Budget proposals announced by the Minister of Finance on 12 March 2025

- Find the notice here.

- Customs Duty on Sugar increase

- Amendment to Part 1 of Schedule No. 1, by the substitution of tariff subheadings 1701.12, 1701.13, 1701.14, 1701.91, and 1701.99, to increase the rate of customs duty on sugar from 286.25c/kg to 377.35c/kg in terms of the existing variable tariff formula (ITAC Minute 14/2024)

- Find the notice here.

- Customs Act | Draft amendments to rules under sections 77H and

120

- Draft amendments to the rules regarding the internal administrative appeal have been published for public comment.

- The due date for public comment is 2 May 2025.

- Find a copy of the draft amendments here.

international

- Statement of agreed outcomes from the OECD/G20 Inclusive

Framework on Base Erosion and Profit Shifting

("BEPS")

- Nearly 450 delegates from 135 countries and jurisdictions, as well as observers from 11 International Organisations, met in Cape Town from 7 to 10 April 2025 at the 17th Plenary meeting of BEPS, hosted by the government of South Africa.

- The agenda included discussions on BEPS implementation, the Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy and preparing a stocktake report for the G20 on the progress of BEPS implementation.

- Find more information here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.