- within Insurance topic(s)

- in United States

- within Strategy and Environment topic(s)

- with readers working within the Business & Consumer Services industries

Foreword

Saudi Arabia's insurance industry has long been a key player in the region, becoming one of the largest insurance markets in the Gulf Cooperation Council (GCC). The sector has experienced notable growth and transformation over the past decade, driven by a combination of regulatory reforms, evolving market dynamics, and increasing demand for comprehensive risk management solutions. In particular, the sector is benefitting from Vision 2030 which is designed to diversify the Kingdom's economy away from oil dependency. As a result, insurance has become a critical component of Saudi Arabia's financial landscape.

The government, through various regulatory frameworks and initiatives, has contributed significantly to the growth of the insurance market. The demand for insurance products continues to rise as the country undergoes rapid economic diversification and modernizes key infrastructure projects. Moreover, with rising awareness among individuals and businesses about the importance of financial protection, the insurance industry is on a solid growth trajectory.

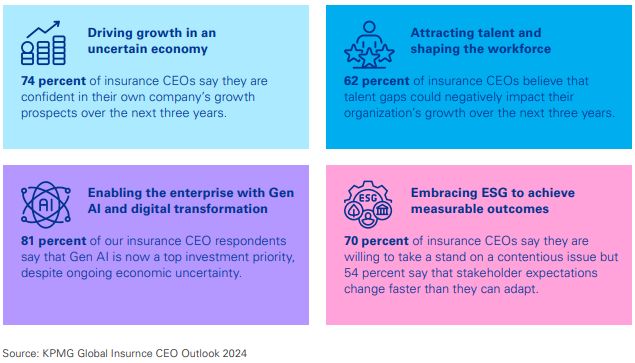

In this publication, we delve into the growth drivers of the insurance industry in the Kingdom, a detailed performance review for Q3 2024, insights from the KPMG Global Insurance CEO Outlook, and the broader outlook for the industry in the context of Saudi Arabia's economic transformation.

Growth drivers in the local market

Government regulation and mandates Regulatory reforms by the Insurance Authority (IA) have made it easier to conduct business in the insurance sector. IA's efforts to enhance market transparency and protect policyholders has created a more stable environment for insurers.

Additionally, mandatory motor insurance has created a steady demand for vehicle insurance policies. The government's emphasis on improving social welfare systems is also contributing to the broader adoption of personal and life insurance policies.

Technological advancements (InsurTech)

Digital transformation within the insurance sector, including the rise of InsurTech, is driving innovation and making insurance more accessible. The use of mobile apps, online platforms, and AI-driven solutions enhances customer experience, improves claims processes, and increases operational efficiency.

Insurers are offering customized products and digital services that meet the preferences of younger, tech-savvy customers.

Vision 2030 initiatives

Vision 2030 is a major driver of growth in various sectors, including insurance. The vision emphasizes economic diversification, modernization, and privatization, which encourages demand for various insurance products, particularly in health, life, and property insurance.

The government's efforts to boost the non-oil economy and increase private sector involvement foster a favorable environment for insurance. The expansion of small and medium-sized enterprises (SMEs) is also contributing to increased demand for business insurance products.

Expanding tourism and pilgrimage

With the growth of the tourism sector, including the rise in international visitors for Hajj and Umrah pilgrimages, there is an increased demand for insurance products for visitors.

The government's efforts to develop Saudi Arabia into a global tourist destination will further contribute to the need for comprehensive insurance coverage for tourists.

Challenges and risks facing the industry

- Pricing pressure and market competition

Despite the growth in premiums, price competition remains a challenge in the Saudi insurance market, especially in the motor insurance segment. Many insurers face pressure to offer lower premiums to attract customers, which can lead to thinner margins. The growing popularity of direct insurance sales via digital channels further intensifies price-based competition.

- Regulatory compliance and evolving standards

With the rapidly changing regulatory landscape, insurance companies must remain agile and adaptive to new regulatory requirements. This includes managing the introduction of new mandatory insurance laws and ensuring adherence to evolving financial solvency and corporate governance standards.

- Geopolitical and economic risks

Geopolitical tensions and fluctuations in oil prices continue to pose risks to the broader economic environment. While Vision 2030 seeks to mitigate these risks by diversifying the economy, global market volatility could affect overall economic performance and, consequently, the demand for insurance.

Emerging trends in insurance

As Saudi Arabia continues to evolve economically and technologically, the insurance industry is poised for several key trends that will shape its future trajectory:

- Rise of digital and InsurTech

The shift toward digital insurance solutions will accelerate in the coming years. InsurTech startups and digital transformation initiatives by traditional insurers are expected to drive efficiency and personalization in the market. Customers will increasingly

seek online insurance products, making digital distribution a key pillar of the industry's growth.

- Focus on customer-centric products

Insurance companies will focus more on personalized insurance solutions tailored to the needs of specific customer segments. Using artificial intelligence (AI) and data analytics, insurers will offer highly customized policies, predictive pricing, and real-time claims processing. The ability to harness data to anticipate risks and provide tailored coverage will help insurers stay competitive.

- Sustainability and green insurance

As global awareness of environmental issues increases, there will be a growing demand for sustainable insurance products. Insurers will likely offer green insurance options that cover renewable energy projects, environmental liability, and climate-related risks. With Vision 2030's focus on sustainability and diversification, green insurance will play an integral role in the future of the industry.

- Expansion of health and life insurance

With a young, growing population and an increasing focus on health and wellness, health and life insurance products will experience sustained growth. Private health plans will be more in demand, as will comprehensive coverage for critical illnesses, mental health support, and chronic conditions. As mandatory health insurance expands, both local and expatriate populations will increasingly seek out broader coverage options. - Emerging risks and new coverage areas

New and evolving risks, such as cybersecurity threats, climate change, and pandemics, will drive the creation of new insurance products. The growth of cyber insurance will be particularly pronounced as digital infrastructure grows. Likewise, products aimed at covering environmental damage, flooding, and climate-related disasters will see increased demand.

- Growth of reinsurance

As large infrastructure projects take shape in Saudi Arabia, the reinsurance sector will play a crucial role in managing the risks associated with these developments.

Expansion of reinsurance sector

To foster the growth of the local reinsurance market, the Insurance Authority (IA) implemented a regulation in October 2022 mandating that local insurers cede a specified percentage of their treaty business (both proportional and non-proportional) to local reinsurers (either directly or through reinsurance brokers) before approaching international reinsurers. The circular established a 20 percent local cession requirement starting 1 January 2023, which has increased by 5 percent annually, reaching 30 percent local cession requirements from 1 January 2025.

The impact of this circular is already evident as the reinsurance revenue from Saudi Arabia business for the exclusive reinsurer, Saudi Reinsurance Company, surged by 77 percent during the nine-month period ended 30 September 2024, compared to the same period in 2023, driven by the local cession mandate.

To further strengthen the market, the IA issued a circular on 14 November 2024, reinforcing the requirement for insurers to cede 30 percent of their business (this time including both treaty and facultative reinsurance) to local reinsurers starting 1 January 2025. The circular outlines detailed procedures for implementing this 30 percent cession requirement, emphasizing the need for insurers to maintain documentation showing they offered the 30 percent share to local reinsurers. Additionally, licensed reinsurers must keep records of the insurance risks presented to them, along with the reasons for their participation or non-participation at specific share levels.

Currently, five insurance companies are licensed to conduct reinsurance activities in Saudi Arabia, along with Saudi Reinsurance Company that exclusively deals in reinsurance. All these companies have indicated that they expect increased revenue from reinsurance services starting in 2025 as a result of the IA's circular.

In line with these developments, the IA has mandated that all licensed reinsurers update their reinsurance strategies in accordance with the new guidelines and submit them for approval within 30 business days of the circular's issuance. Insurance companies holding reinsurance licenses may face challenges in strengthening their underwriting capabilities to effectively manage reinsurance policies, which carry unique risks compared to insurance business.

To view the full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.