- within Environment topic(s)

- with readers working within the Insurance industries

Foreword

This is the first global KPMG study on ESG due diligence1 in M&A transactions. It builds on our 2022 industry-leading international study on ESG due diligence in the Europe, Middle East and Africa (EMA) region that showed clear evidence of the rising importance of ESG due diligence in transactions, the practical challenges faced by deal practitioners, as well as first glances at "what good looks like."2 In 2023, our follow-up study in the US found similar developments, albeit slightly less pronounced than in the EMA region.3

Since conducting the previous studies, the world has changed. In many geographies, M&A markets have decelerated in the face of higher interest rates. Geopolitical and economic uncertainty has increased, shifting the priorities of many businesses. And, in some geographies, there is a vivid public debate about the merits and justification of including ESG factors in investment decisions.

In light of these developments, this study aims to achieve two main goals. First, it establishes a global baseline and creates comparability between the different regions of the world. To this end, we surveyed more than 600 dealmakers and conducted 50 in-depth client and expert interviews globally on the topic in a consistent manner. Second, it sets out to re-examine the relevance of ESG due diligence in transactions.

As you will see on the following pages, the results clearly confirm previous findings. Not only is ESG due diligence still important, but in fact, a clear majority of respondents indicates that ESG in transactions has increased in priority in the past 12 to 18 months, despite the current headwinds. The motivations to conduct ESG due diligence and the challenges faced by practitioners were also in line with previous studies. While there are some nuanced regional differences, the 'direction of travel' appears to be comparable across the regions.

To avoid repetition, this report will reference trends explained in the earlier studies to make room to discuss interesting differences between the regions and dive deeper on key topics at the 'frontier' of current practice.

Specifically, we look at how leading financial investors are applying a value creation lens to ESG by combining a deep understanding of the commercial, operational, and financial risks and opportunities triggered by evolving ESG regulations and stakeholder behaviors with a disciplined focus on financial returns. We also share insights on how some of the prevalent challenges in ESG due diligence are being mitigated by leading investors and advisors.

We thank the over 600 active dealmakers who have shared their insights with us for this study and we hope, that like our initial publications, it provides valuable ideas and inspiration for practitioners to further advance their approach for ESG due diligence in 2024.

Global insights at a glance

ESG due diligence continues to rise in importance, despite headwinds. Dealmakers report an increased importance of ESG due diligence over the past 12 to 18 months, and expect further increases soon. This counters initial expectations of a decline in the importance of ESG factors due to softer M&A activity, economic uncertainty and an ESG backlash in some geographies.

Leading investors tie ESG to the investment thesis and drive financial value from it. They do this by combining a deep understanding of the commercial, operational, and financial risks and opportunities triggered by evolving ESG regulations and stakeholder expectations with a disciplined focus on financial returns during the holding period. They use tools like comprehensive baselining, integrated 100- day action plans, and a systemic scan for sources of financing to improve their investee's performance. Such performance improvements can materialize in the form of increasing revenues, decreasing costs, or de-risking of an investment, across various environmental and social and governance areas — at this moment, typically in connection with themes such as decarbonization, recycling and circularity and supply chain management.

Challenges in conducting ESG due diligence persist, but solutions are emerging. Investors struggle with selecting a meaningful, yet actionable scope with receiving quality data from target companies, and with quantifying potential findings. However, for each of these challenges, there are emerging solutions. On scoping, it is becoming increasingly clear which topics should indeed be part of an ESG due diligence workstream, with the focus moving from values to value. On data quality, we see a great opportunity for sellers and sell-side advisors to drive value from divestments by commissioning higher-quality ESG vendor documentation. And on quantification, the synergies between ESG due diligence teams and commercial and operational due diligence teams are becoming clearer.

ESG due diligence matters, but budgets don't match. Despite growing evidence of the importance and benefits of ESG due diligence, budgets remain low for ESG due diligence compared to other due diligence workstreams, such as financial, commercial or legal. This limits ESG specialists' ability to perform in-depth analysis across the many complex environmental, social and governance topics that investors seek.

ESGdue diligence continues to rise in importance, despite headwinds

Since our initial publication on ESG due diligence in 2022, the deal environment has changed significantly. Amid higher interest rates and economic uncertainty, global deal volumes reached a 10-year low in 2023.4 Furthermore, there has been suggestion of an alleged 'ESG backlash' in investing in some geographies, centered around the question of whether incorporating environmental, social and governance-related considerations in investments has a potential negative impact on financial returns, along with the related political implications.5

Despite these developments, this study confirms the high and rapidly increasing importance of ESG in M&A transactions.

"ESG in deal is rapidly maturing. The ESG lens is becoming increasingly important to investors and customers. The difficulty lies in the breadth of the topic, making it critical to know how to look at it in a focused manner. That's why we focus on value not values."

Craig Mennie

Global Head of Transaction Services KPMG Australia

The importance of ESG considerations has increased further

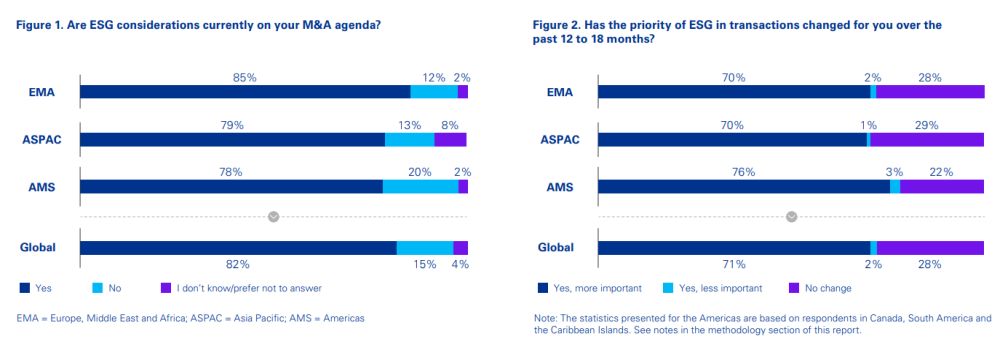

Similar to our initial 2022 study in the EMA region, four out of five dealmakers globally indicate that ESG considerations are on their M&A agenda, with little regional variation (see Figure 1). Even more explicitly, 71 percent of respondents report an increase in importance of ESG in transactions in the last 12 to 18 months (see Figure 2).

Investors expect to perform more ESG due diligence

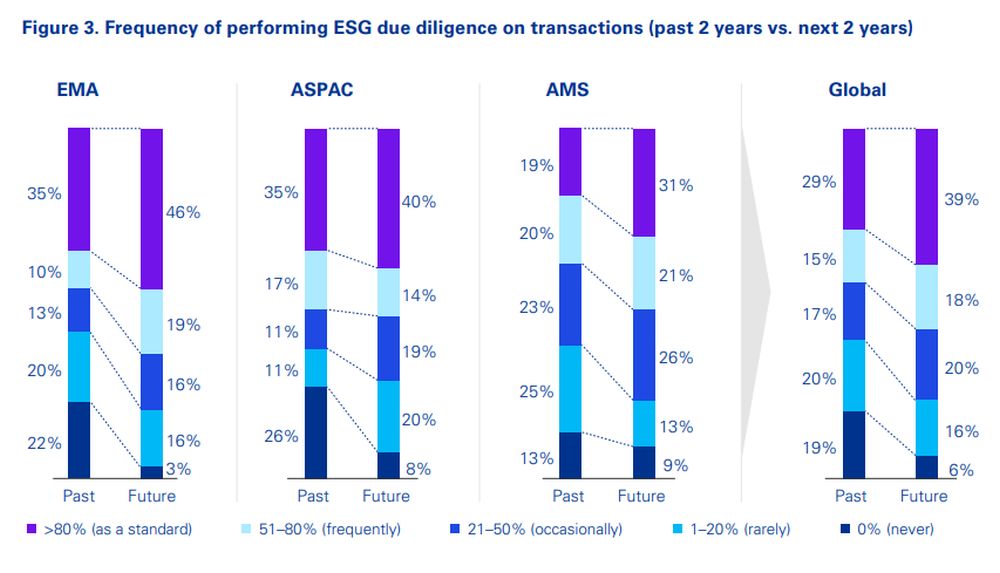

What's more: The data clearly shows that investors expect the frequency of ESG due diligence on transactions to increase even further. Globally, 57 percent of respondents say they expect to perform ESG due diligence on most of their transactions over the next two years (up from 44 percent historically). On the opposite side of the scale, only 6 percent say they will continue not to conduct any ESG due diligence over the same time period (down from 19 percent historically) (see Figure 3).

Belief in monetary value remains strong

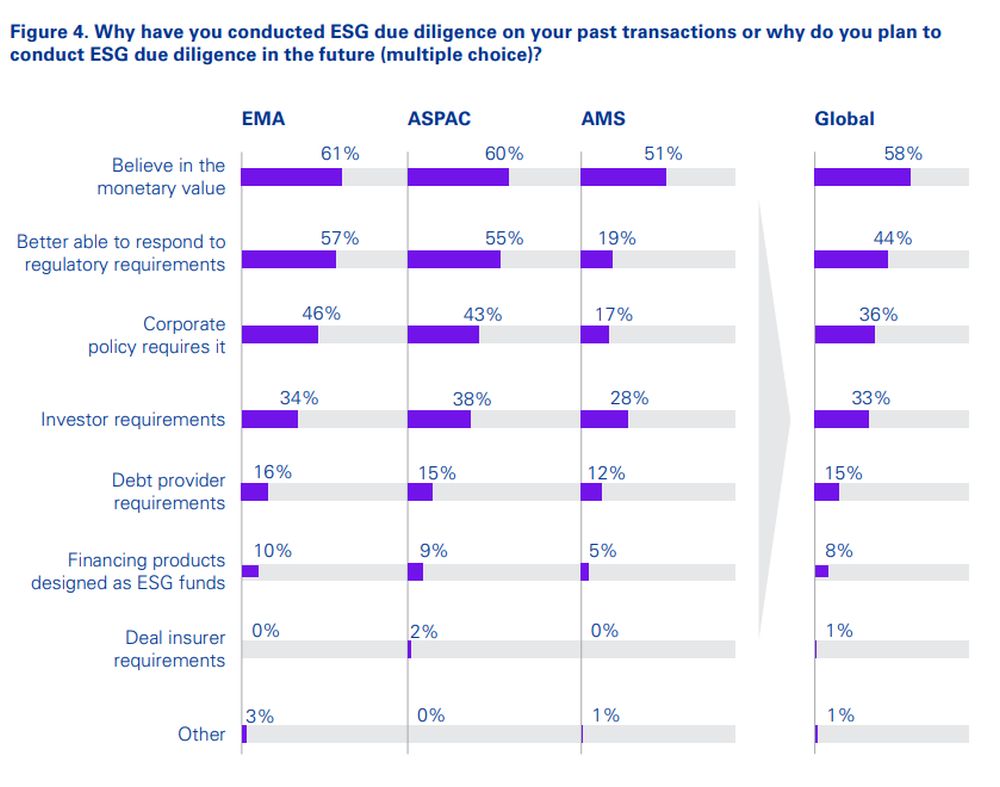

Dealmakers report conducting ESG due diligence primarily because they believe in the monetary value of identifying sustainability-related risks and opportunities early in the deal process. As one European investor shared: "It's important for us to understand the size of potential risks or opportunities at the pre-signing stage so that we can factor them into our valuation. Also, if we need to invest to bring a target up to speed, we need to know what this will cost us before we settle on a purchase price."

Investors are also motivated by the belief that ESG due diligence helps meet regulatory requirements, as noted by 44 percent of global respondents (see Figure 4). However, there are significant regional difference in this regard. EMA (57 percent) and Asia Pacific (ASPAC) (55 percent) rank regulation requirements much more prominently than in the Americas (AMS) region (19 percent).

Footnotes

1. Throughout this publication, "ESG Due Diligence" refers to the process of considering environmental ("E"), social ("S") and governance ("G")-related factors in the context of the pre-signing due diligence in an M&A transaction (buy-side or sell-side)

2. KPMG 2022 EMA ESG Due Diligence Study, published November 2022: https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2022/11/ema-esg-due-diligence-report.pdf

3. For example, the study of the US market showed that 74 percent of US investors have ESG on their M&A agenda (vs. 82 percent of investors in EMA) or that 27 percent of US investors expect to conduct ESG due diligence on >80 percent of their transactions going forward (vs. 48 percent of EMA investors). See KPMG LLP 2023 US ESG Due Diligence Study, published July 2023: https://kpmg.com/us/en/articles/2023/esg-due-diligence/us-esg-due-diligence-study.html

5. https://www.ft.com/content/a76c7feb-7fa5-43d6-8e20-b4e4967991e7

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.