- within Tax topic(s)

- within International Law, Environment and Finance and Banking topic(s)

The Prime Minister has delivered the national budget for the year 2025-26, the first under the new Mauritian Parliament. The government's strategy is less about bold leaps and more about steady course correction, as external risks and domestic constraints continue to shape the economic agenda. The outlook is pragmatic, with reform driven by necessity rather than ambition.

Our key takeaways are:

Fiscal measures

- Under the Fair Share Contribution ("FSC Tax"), individuals with chargeable income and local dividends ("FSC Income") exceeding Rs 12 million annually will pay a 15% FSC Tax on FSC Income. Domestic companies with annual chargeable income above Rs 24 million will be subject to an FSC Tax of either 2% or 5%.

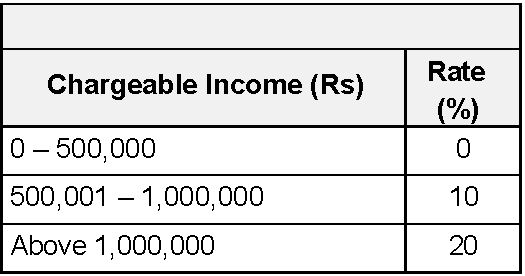

- A welcome reduction in progressive personal income tax bands as below:

- The VAT registration threshold will be reduced from Rs 6 million to Rs 3 million from 1 October 2025.

BRP at 65 years

- To address the current unsustainable Basic Retirement Pension (BRP), the eligibility age for BRP will be progressively raised to 65 years, aligning the BRP age eligibility with the normal retirement age.

Real Estate

- Smart City projects approved after 5 June 2025 will not be eligible for the prevailing fiscal incentives. Further, a fee equivalent to the Morcellement fee will be payable. Projects underway will continue to benefit from existing VAT recovery and income tax holiday for components of smart cities already initiated.

- Non-citizens acquiring residential property under schemes run by the EDB will henceforth be liable to registration duty at 10%, instead of 5%. Conversely, land transfer tax on the resale of residential property previously acquired under the EDB Schemes will be the higher of 10% of the value of the property or 30% on the gain realised on the resale of the property.

- Promoters selling residential units under these schemes will also pay a higher land transfer tax (10% instead of 5%).

- The EDB will prescribe sustainability features to be incorporated in new Smart City projects.

Non-Citizen (Property Restriction)

- The Non-Citizens (Property Restriction) Act will prohibit the disposal or acquisition of an apartment in a building of at least 2 floors above ground floor constructed on State Land or Pas Géométriques by a non–citizen.

- Current schemes allowing non-citizens to purchase residential property, provided the value threshold of USD 500,000 has been met, will be abolished.

Regulatory Reforms

- Data Protection: The data protection framework will be further aligned with international practice.

- Virtual Asset Service Providers: Virtual Asset Service Providers licensed under the VAITOS Act 2021 will be eligible to an 80% partial tax exemption on income from activities like exchange, transfer, safekeeping, and administration of virtual assets, provided they meet substance requirements.

- Competition Enforcement: The introduction of a Price Monitoring Information System will broaden the mandate of the Competition Commission, enabling price regulation and allowing for sector-wide pricing and profitability audits.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.