- within Intellectual Property topic(s)

- within Technology topic(s)

At a glance

- Transitioning to a circular economy business model offers significant opportunities, but positioning in emerging circular ecosystems creates friction surfaces, as players target the same spaces and value pools.

- Linear value chain-focused IP strategies are typically geared toward prevention and therefore inadequate to support circular business plays. Instead, companies must adopt IP strategies promoting collaboration and ecosystem formation, while safeguarding own revenue and profits.

- This article explores the shift from prevention to enablement

in circular business IP strategies, using industry examples from

plastics and chemical recycling, including:

- BASF: IP to help build circular ecosystems

- Michelin: IP to promote differentiation of circular economy solutions

- Plastic Energy: IP to catalyze adoption of circular economy solutions

The circular business opportunity

Businesses are increasingly transitioning from traditional linear value chains toward embracing circular, sustainable practices. This is driven by government regulation, customer demand and – frankly speaking – by environmental necessity.

The circular economy not only supports sustainability but also offers significant economic benefits. Much like how digitalization has transformed industries in the past decade, circularity is set to reshape value pools and create new business opportunities.

Accenture projects that circular economy markets could unlock $4.5 trillion in GDP growth by 20301, while recycled plastics alone present a $120 billion revenue opportunity in North America.2 Investment in circularity is accelerating, with circular-focused public equity funds valued at $9.5 billion by November 2021, a 28-fold increase since 2019, and corporate and sovereign bonds rising fivefold to $21 billion3.

New friction when positioning in circular ecosystems

Circular business models and positioning strategies

Transitioning to a circular economy business model offers significant opportunities but also introduces challenges, particularly around positioning within new, circular industry ecosystems. The steps needed to successfully realize circular business plays share many similarities with Winning in digital ecosystems. Companies need to target attractive circular business use cases and protect key control points in the ecosystem to capture a considerable but fair share of the value created.

Companies must select their roles carefully, whether as service providers, system integrators, or ecosystem facilitators. As circular ecosystems are still emerging, many businesses – both incumbents and newcomers – compete for similar roles. As a result, new friction surfaces between players are likely to appear. Navigating these dynamics adds complexity to capturing value in circular business opportunities.

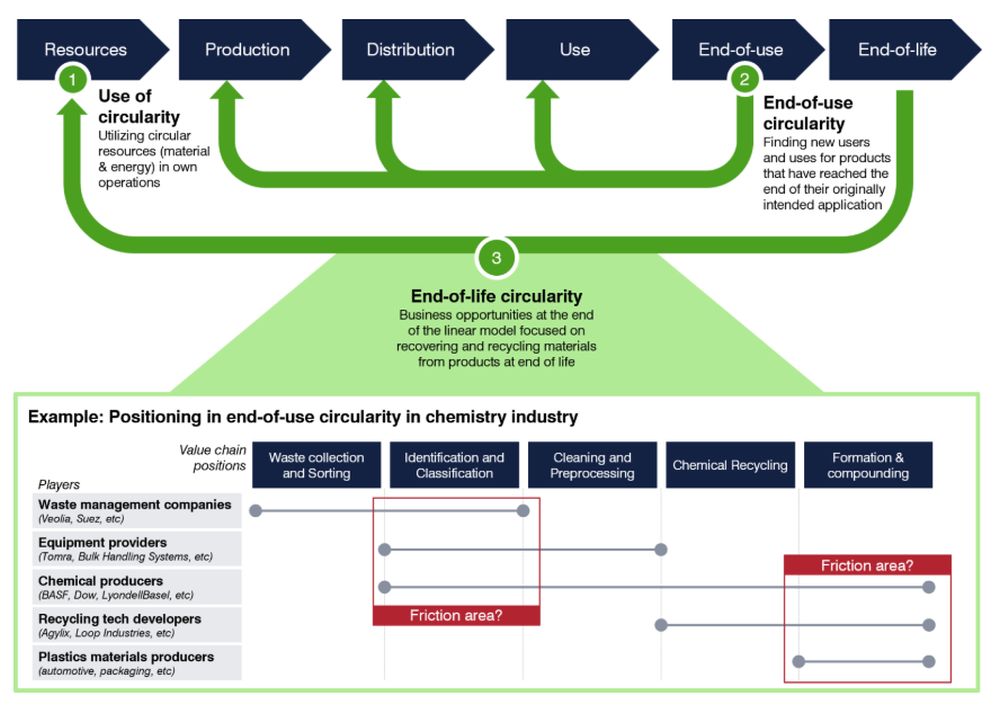

An example is provided by the chemical recycling value chain (Figure 1). Here, chemical companies, sorting system providers, waste management & recycling firms and plastics producers all seek their own positions along the circular value loop, and overlapping interests are starting to emerge. While these overlapping interests may lead to friction, closing the loop and enabling circularity can only be achieved by coordinated collective action from several players in the industry. While the traditional thinking may have companies jealously guarding their positions, it is imperative to have a partnership and open ecosystems approach to business building in circular economies.

This dynamic situation calls for careful consideration on how a company controls its wanted position, effectively handles risks with third party (re-)positioning, while incentivizing key complementary partners to engage, to avoid a 'tragedy of the commons' scenario.

Figure 1: Circular business opportunities and positioning friction example

Linear IP strategies are a poor fit for circular business

Intellectual property (IP) management plays an important part in securing control around your wanted positions. In the context of a linear value chain this typically translates into the primary role of IP being to protect a company's differentiating advantages and to block others from pursuing their wanted positions – or at least prevent the opposite from happening.

This strategy has served many companies operating in a linear value chain well for a long time. If you are shifting to a circular economy business model, however, but plan on continuing solely with a linear IP strategy, you will find yourself on the road to failure. An IP strategy only fit for a linear value chain won't do the job in a circular setting.

'Linear' incumbents have limited IP portfolios of circular solutions

It only makes sense that a 'linear-focused' company's IP portfolio is built to protect business positions in a linear value chain. As a result, the portfolio does not contain any IP covering circular capabilities since this has not previously been deemed business-relevant.

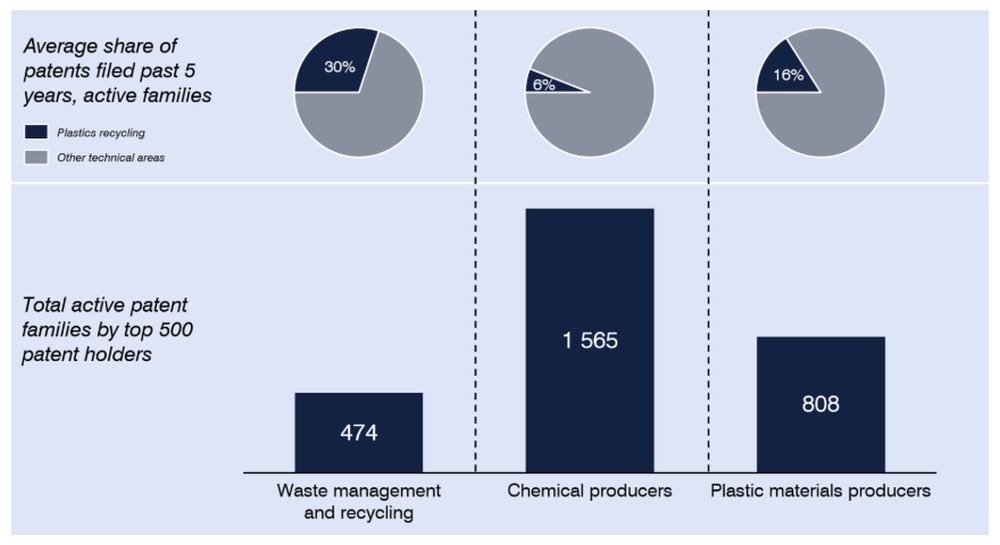

Figure 2: Plastics recycling patent landscape

Take the plastics circularity area as an example (Figure 3). The patent landscape in 2024 is limited, with the 500 largest patent holders collectively owning ~10 000 active patent families. Chemical producers collectively hold 1 500 active patent families in the plastics recycling space. Notably, the share of patents related to plastics recycling is a mere 6% of chemical producers' total filings in the last years, on average. In contrast, waste management & recyclers file ~30% of all new patent application in the area.

A question for chemical companies is whether this patent portfolio distribution is proportionate to the size of the business opportunity and the level of investments planned. For reference, McKinsey estimates that the investments needed in plastics recycling will reach 50 BUSD by 2030, and that recycled plastics will account for 39% of total feedstock by then.4 Given these numbers, chemical companies may have some work to do in re-shaping their IP portfolio in the coming years.

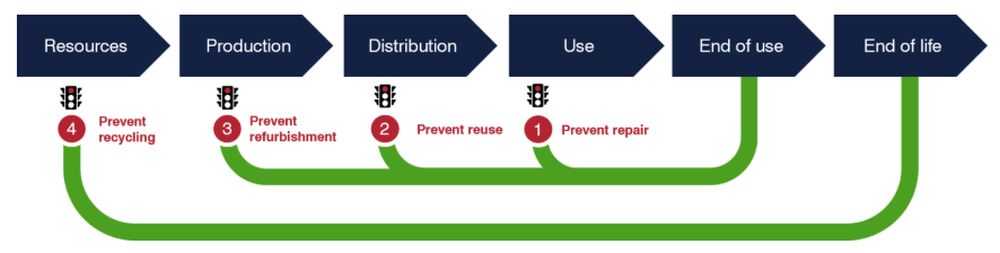

Linear IP use cases are geared to prevent circularity

Even if a company has built an IP portfolio relevant for circularity, pursuing a 'linear' IP strategy focused on blocking and protection will not contribute to successfully enabling circular business opportunities. The number of ways where IP can be (and have been) used to prevent circular business are many (Figure 3).

Figure 3: Linear IP strategy when pursuing circular business opportunities

- Prevent repair

In the pursuit of protecting a linear product business and its associated aftermarket services, it is common to prevent independent product repair. This is possible through patent and/or trademark enforcement, provided that the repair is considered to amount to reconstructing or making the original product. The strategy surely plays, and will continue to play, an important part in preventing generic solutions and copycats in the market, even for aftermarket components. A potentially unwanted effect, however, might be that not only direct product or component competitors are prevented, but also players offering complementary circularity offers in relation to an industry, who could grow the value pool as a whole. Example: OEM preventing replacement parts created with lower environment impact (ex. 3D printing) due to design patent protection. - Prevent re-use

Companies selling new products may see re-use offers as a direct threat against their revenue, prompting them to act against this. While exhaustion of rights limits the ability to prevent product re-use, there is some opportunity of preventing reselling an IP-protected product if the product quality has "changed" or been "impaired", or if the re-sale falls under parallel import. Example: Printer OEMs enforcing patents of cartridges so that recycling/refilling cartridges by third party vendors is prevented. - Prevent refurbishment

Companies try to prevent refurbishment of their product by others based on a similar rationale and using similar means as with product repairs. There is also the possibility of using trademarks to claim confusion of association or copyright to restrict derivative works. Example: Smartphone manufacturers preventing independent repair shops from buying/using refurbished original parts due to trademark infringement, or OEM's enforcing patents against re-manufacturers on the basis that the refurbished product are no longer the original products, but instead new products. - Prevent recycling

Various IP rights and tactics can also be employed by players wanting to prevent the disassembly of their products, transforming them into new materials or reusing components for new items. As an example, patents can be used if they cover the products or their parts, and if such parts are recycled to repair original/new products. In addition, recycling may be prevented using trademarks if the recycled materials display the original product marks. The fear of new competition from recycled solutions, or the reluctance to allow others build business areas their own products are common reasons for pursuing this strategy. Example: System providers preventing bottle recyclers from using deposit technologies in their operations.

Is there a business case for preventing (or enabling) circularity?

None of the provided examples of linear IP strategies support the pursuit of circular business opportunities. Obviously so – their objective is to prevent new circular business offers (i.e. recycled, re-used material and products) from competing with existing linear business offers (virgin materials and new products).

It is understandable for linear incumbents to pursue these types of IP strategies to safeguard business opportunities that have been successful, perhaps over several decades. But with the emergence of circularity, it is imperative for business leaders to acknowledge that what got you here, won't necessarily get you there. At least not until you have assessed your options rationally and compared the business cases of protecting your linear business with co-creating a circular business.

Illustrative case study: Circular business case

Let's say you are a product manufacturer holding 20% of a 5 BEUR market with limited growth forecasts and a narrow 5% margin due to commoditization pressure. A market for refurbished products is also being formed, which is expected to become 1.5 BEUR in a couple of years and offer the same margins.

If you would pursue the linear strategy to protect your market share, the result would more or less be a retained status quo. If you instead choose to pursue a refurbishment business opportunity, you estimate that you could be able to capture 40% of the refurbishment market but lose 7% market share in the new product market.

What is the best business move – protect linear, or enable circular?

In Option 1, your business case would be 50 MEUR in profit. In option 2, it would be 62.5 MEUR in profit. This example does also not consider the hard-to-quantify cost stemming from the bad publicity of protecting linear business models from circular approaches, regulatory pressure, or own employee satisfaction from a reduced climate impact.

Circular IP strategy shift: from prevention to enablement

With changing business circumstances comes changing business needs for IP. As we have argued previously, the sustainability transition challenges exclusivity-focused IP strategies. There are several strategic shifts impacting IP management, including shifting:

- From supply chains & vertical integration to supply loops & networked collaboration. Building collaborative networks and ecosystems where various stakeholders, including competitors, partners, and customers, work together to achieve circularity.

- From products & ownership to services & access: Service-based models like leasing, renting, or Product as a Service, where companies retain ownership & responsibility over the product lifecycle.

- From mechanical technologies and finite resources to digital technologies and renewable resources.

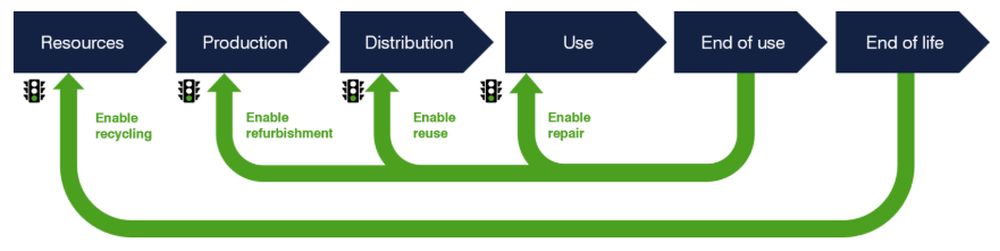

As a result of these shifts, IP professionals need a new chapter in their strategy playbook, as illustrated in Figure 5 - one which is focused on enabling circular business and not preventing it. At the same time, the playbook must enable a control position to secure a fair share of the profit pool for the players who make investments in technology and who contribute to making the ecosystems succeed commercially.

Figure 5: IP strategy when pursuing circular business opportunities

IP to enable circular ecosystems

IP can prove helpful in several ways in forming circular value chains. Offering access to one's IP portfolio could attract partners to build circular solutions around own products. Engaging in standards development related to circularity-enabling technology, contributing to sustainability patent pools or establishing IP pledges are example tactics of establishing broader alliances to foster technology adoption and collaboration. Common to these approaches is that they present a flip-side view to linear IP strategies – you aren't shutting others out for your own benefit but inviting selected players for mutual benefit.

Case study: Partnerships for joint tech development

BASF, a global leader in chemical production, early identified the potential of circular business models to capture maximum value from their products. As customer demand and recycling volumes increased, the firm faced the challenges of developing efficient recycling processes that could meet their high demands for product quality.

To tackle this challenge, BASF joined forces with Quantafuel, a provider of cutting-edge pyrolysis technology capable of converting plastic waste into high-quality pyrolysis oil, and Remondis, one of the world's largest recycling, water, and service companies. The three jointly worked to improve the pyrolysis process, and together developed technology that was used in a plastic recycling plant that the firms invested in together.

The partnership led to significant technological advancements and was an important piece in BASFs work to become a leader in the circularity of plastics.

IP to catalyze circular market adoption

Many circular business opportunities are booming, with market demand surpassing the available supply. This is often due to cost of logistics and significant entry barriers in capital investment serving as limiting factors for growth. IP can help companies in these settings by considering IP licensing as a way to quickly expand their addressable market reach. This could e.g. be licensing to 'competitors' located in a region where you do not have own operations (e.g. in developing countries). Looking for potential licensees in adjacent applications for your technology is another tactic to consider to grow your business faster.

Case study: IP licensing

Plastic Energy, an advanced chemical recycling company, recognized the growing need for sustainable solutions in the plastic industry. In response to demand for high-quality recycled plastics, the firm had developed an innovative pyrolysis technology converting end-of-life plastics into valuable feedstock for new plastic production.

To accelerate adoption of these technologies, Plastic Energy adopted a strategic IP licensing approach. Besides running their own recycling plants, Plastic Energy licensed the technology to partners who implemented the technology in their own facilities. An example was the engineering firm Axens, which licensed the technology and combined it with their own IP, to create a more advanced recycling process.

Besides generating new revenue streams, this strategy provided positive brand recognition, close relationships with other circularity leaders, and increased diffusion and development of Plastic Energy's technology.

IP to promote differentiation of circular solutions

In today's markets, adapting products to last longer and/or be easier to repair or recycling can be an effective differentiator. Pursuing an IP strategy focused on building an IP control position around these differentiators would benefit both availability of sustainable solutions and allow companies to sustain the competitive advantage it provides.

In cases where a Product-as-Service business model is pursued as part of shifting to a circular business strategy, a corresponding IP strategy could be to focus on building IP around customer experience, service/distribution infrastructure, etc., to establish a control position, as well as drafting agreements ensuring access rights to data on the use of their products in order to offer analytics services.

Case study: IP to promote product design for circularity / product-as-a-service

Michelin, a global leader in tire manufacturing developed a tire-as-a-service offer. This included providing comprehensive tire management solutions, optimizing performance and extending tire lifespan through real-time monitoring and proactive maintenance. Michelin took active measure to protect its tire-as-a-service offering, e.g. by building a patent portfolio in the field of telematic and condition monitoring technology.

As Michelin retains ownership of the tires, having a plan for their end-of-life management became essential. To address this gap, Michelin established an end-of-life tire recycling plant as a joint venture with Antin and Enviro. Enviro has developed a patented, proprietary, and module-based recycling technology capable of extracting valuable raw materials from used tires, including carbon black and oil.

The resulting joint venture has secured a multiyear scrap tire supply agreement with Michelin, which also includes the delivery of recovered carbon black and tire pyrolysis oil (TPO) to Michelin. This arrangement ensures a sustainable loop of material reuse, further reinforcing Michelin's commitment to circular economy principles.

Conclusion

In summary, the way in which a corporate IP function can support these circular business plays comes down to using intellectual property to control key positions, build trust in the ecosystem, and strike a delicate balance between exclusivity and openness. In the chemicals industry, this comes down to:

- Building an IP portfolio around desired circular business positions. In chemistry, this could entail filing IP around different (recycled) starting materials, or around new solutions to track material flows along the value chain. Patents and will continue to be a key part of the portfolio but needs to be complemented with effective management of trade secret and data access.

- Putting the IP portfolio to use to enable circular business, not prevent it. In chemistry, this could entail offering access to one's IP portfolio to attract circular ecosystem participants, engage in collaborations with complementary partners having IP filling gaps in your own portfolio, or out-licensing circular technologies broadly to promote market adoption.

Footnotes

1. Lacy P, Rutqvist J (2016). Waste to Wealth: The Circular Economy Advantage

2. Closed Loop Partners (2021). Accelerating Circular Supply Chains for Plastics

3. Ellen MacArthur Foundation. Financing the circular economy, and UNIDO (2023). Unlocking the circular economy through green finance [Accessed: 2024-09-30]

4. McKinsey (2023). A unique moment in time: Scaling plastics circularity

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.