- within Intellectual Property topic(s)

- within Technology topic(s)

- with readers working within the Banking & Credit and Technology industries

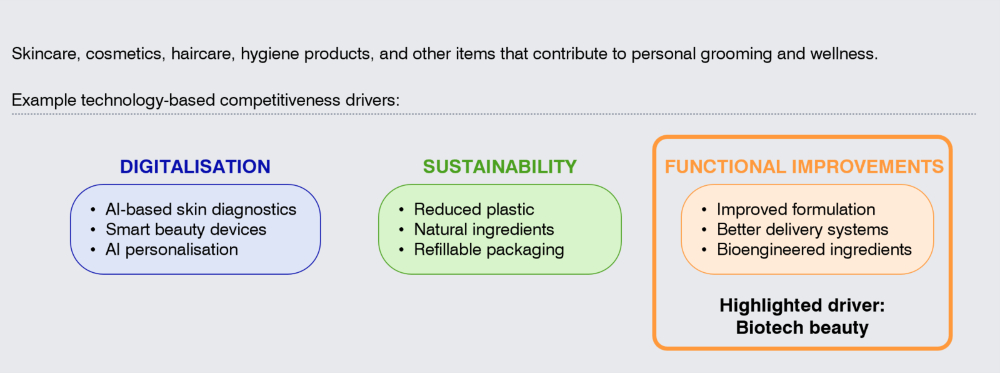

How digitalisation, sustainability and functional improvements redefine competitiveness and the role of patents in Personal Care. Highlighted technology-based competitiveness driver: Biotech beauty

In the Personal Care segment, digitalisation is transforming personal care through AI-powered skin diagnostics tools, smart beauty devices, and AI based personalisation. The rise of at-home tools and ingredient recommendations is reshaping how consumers engage with their beauty routines. At the same time, sustainability concerns is driving consumer demand for eco-conscious, cruelty-free, and plastic-free beauty solutions. This is pushing brands to adopt circular economy models, with initiatives like refillable packaging and natural ingredients gaining traction.

Functional improvements in terms of biotech beauty is at the core of the Personal care segment's evolution. As consumers demand more effective, scientifically advanced, and personalised products that go beyond traditional hydration or anti-aging features, companies are increasingly turning to biotech to develop cutting-edge formulations and delivery systems, and precision-driven solutions.

The biotech beauty surge in Personal Care illustrates how technological and scientific advancements increase patent relevance, enabling companies to secure differentiating competitive advantages, strengthen market positions, and potentially drive profitability through enhanced product performance and consumer appeal.

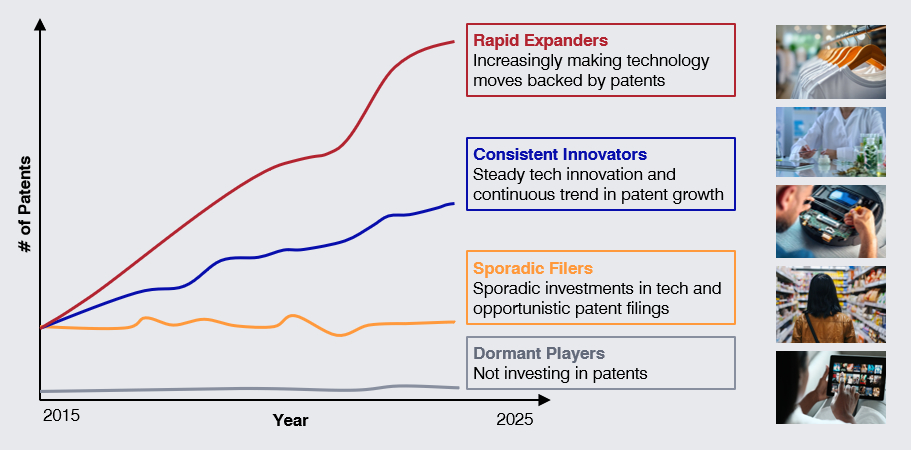

Companies like L'Oréal, Unilever, and Inolex are 'Consistent Innovators', regularly filing patents in bioengineered ingredients and improved formulations. A few 'Rapid Expanders', such as Amorepacific, are starting from relatively small patent portfolios but rapidly contributing to the shift toward biotech beauty, especially through improved biotech-based delivery systems. In this segment, many players are still 'dormant', having yet to actively pursue patent strategies. They face heightened risk by lacking patent protection and must critically examine whether their innovation capabilities are strong enough to develop and sustain meaningful patent portfolios.

Personal Care

Examples of how Personal Care companies are using patented biotech beauty innovations to secure market leadership and drive high-margin growth.

Unilever strengthens market position with patented microbiome innovations

Unilever's extensive research into the skin microbiome has led to over 100 microbiome-related patents in the past decade, establishing one of the largest proprietary databases in the field. Such innovation can drive product differentiation and revenue growth. For instance, Vaseline Pro Derma, formulated with patented Pro-Ceramide Technology, aims to enhance skin barrier strength and moisture retention by supporting natural ceramide production. In China, this product range accounts for 20% of the brand's business, indicating strong consumer demand. Embedding patented microbiome technologies into its products positions Unilever to build consumer trust, differentiate its offerings, and sustain growth in the competitive personal care market.

Inolex actively enforces patents to defend market position

Inolex, a US-based cosmetics ingredients manufacturer, has developed patented preservative technologies as safer, natural alternatives to traditional preservatives for premium beauty and personal care products. Its biotech-driven formulation, combining caprylhydroxamic acid (CHA) and diols, allows brands to market products as "preservative-free," potentially positioning them as premium offerings. In April 2024, Inolex filed a lawsuit against Actera Ingredients, Inc., alleging that Actera's TeraStat product infringed Inolex's patented preservative-free formulations. The litigation remains unresolved as of March 2025. While the outcome is uncertain, the lawsuit highlights Inolex's proactive strategy of enforcing its IP rights to safeguard its innovations and secure its competitive market position.

L'Oréal's strategic IP-backed innovation collaboration with NanoEnTek

L'Oréal has collaborated with Korean start-up NanoEnTek to develop innovative beauty solutions, such as a skin-age calculator based on "lab-on-a-chip" technology. This device, which leverages NanoEnTek's patented microfluidic technologies, analyses skin cells at a cellular level to predict ingredient responsiveness and potential skin issues. The jointly developed Cell BioPrintTM device combines L'Oréal's skincare expertise with NanoEnTek's technological advancements. Such patented innovations, developed through strategic collaboration, could enable L'Oréal to enhance its personalised beauty offerings and potentially increase market share.

Amorepacific targets high-margin growth through patented beauty tech innovations

Amorepacific, a South Korean beauty and cosmetics company, has patented its biotechnology innovations to enable brand differentiation. Its Lipcure BeamTM, a beauty-tech device integrating lip diagnosis, care, and makeup application, features patented light-responsive riboflavin technology aimed at enhancing collagen production and moisture retention. Positioned within the high-margin luxury beauty device segment, such patented innovations could contribute to the company's profitability. Securing patents on premium biotech-driven innovations may help Amorepacific maintain its premium market positioning and achieve sustained revenue growth, though commercial success ultimately depends on consumer adoption.

In the personal care segment, companies are increasingly leveraging biotech innovations to deliver scientifically backed solutions. The aim is often to create high-margin products that command premium pricing while building consumer trust through quality, innovation, and convenience. By securing exclusive rights to advanced formulations and bioengineered ingredients, these companies seek differentiation, stronger market positions, and sustainable long-term revenue streams.

Conclusion

From tech-enhanced fashion to zero-waste food production, technology is reshaping innovation and competition in the consumer goods sector. As technology-based competitiveness becomes increasingly important, companies must make deliberate, business-driven decisions about how they approach patents.

- For "Rapid Expanders", challenges include to avoid over-filing or filing in areas that don't add value, and to ensure patents are actively used to support business goals – not left as inactive cost items on the P&L.

- "Consistent Innovators" must regularly recalibrate their efforts to stay aligned with evolving strategic priorities and market dynamics. Like the Expanders, they must also ensure that their patent portfolios are actively leveraged, rather than quietly accumulating as overhead cost.

- "Sporadic Filers" may need to reassess whether an opportunistic approach is sufficient in the long term. If investment increases, systematically selecting the right areas is key to making patents count and avoiding unnecessary cost.

- "Dormant Players" must consider whether they can afford the risk of having no patent position in a tech-driven market, and whether they have the innovation capabilities needed to start building meaningful portfolios.

Independent of profile, companies need a business-driven and proactive approach to patents, both to stay ahead and avoid being caught off guard. This means being able to clearly answer:

- Why are we (or aren't we) investing in patents? What is the intended impact on revenue, cost, and risk?

- Are we organised for proactive and impactful IP management? Do we have the right stakeholder interfaces?

- Do we have the capabilities and skillsets needed to execute effectively?

Without clear answers to these questions, patent departments in consumer goods companies may struggle to compellingly articulate the value of patents and their contribution to technology-based competitiveness. This increases the likelihood of being seen primarily as cost centres, making it difficult to secure appropriate investment. Ultimately, companies may face misalignment between their business and technology ambitions, falling short in protecting and capitalising on them.

Patent filing profiles in consumer goods segments

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.