- within Government, Public Sector, Coronavirus (COVID-19) and Insurance topic(s)

- with readers working within the Banking & Credit industries

Welcome to the first of our five-part blog series about Guyana, an American ally that has emerged as one of the fastest-growing economies in the world, driven by an oil boom that has transformed the country's economic trajectory.1 Positioned as a key source of revenue for ExxonMobil and its partners, the country is now attracting considerable foreign direct investment, well beyond the oil and gas sector. As foreign investors turn their attention to Guyana, understanding both the domestic regulatory landscape and the implications of U.S. law becomes essential. In this series, we explore current trends in Guyana's economic and regulatory development and examine how U.S. legal frameworks, including the Foreign Corrupt Practices Act and the Trump Administration's focus on foreign terrorist organizations, affect investment decisions in this evolving frontier market.

Key takeaways from Part 1 are:

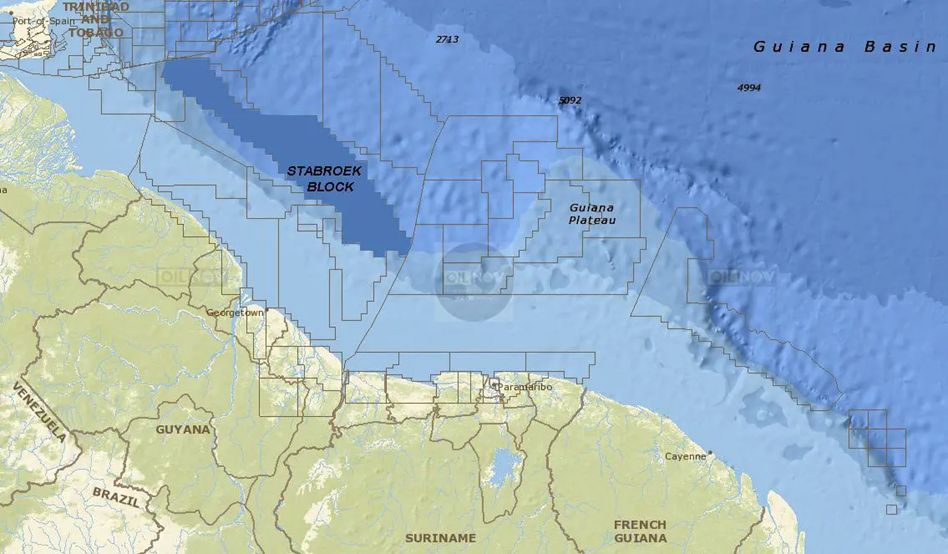

- Guyana is the fastest growing economy per capita globally, driven by offshore oil discoveries in the Stabroek Block and annual GDP growth exceeding 40% between 2022 and 2024.

- Heavy foreign direct investment is flowing into Guyana's hospitality, infrastructure, energy services, and manufacturing sectors, signaling a shift toward broader economic development and long-term commercial potential.

- Guyana's regional and geopolitical importance is rising, underscored by high-level U.S. engagement; its proximity to Venezuela, the Caribbean, and Latin America; and its role as an English-speaking, culturally West Indian nation in South America, making it an attractive destination for American investors.

Part 2, slated for release on December 1, 2025, will focus on Guyana's recent energy and infrastructure boom.

Country Overview and Economic Development

The relatively tiny and unknown country is a key American partner and ally that is poised to grow in commercial and geopolitical significance, as signaled in part by a March 2025 visit by the then-newly appointed U.S. Secretary of State Marco Rubio.2 Guyanese entities and individuals stand to be increasingly involved in in acquisitions, divestitures, energy and infrastructure project financing, and cross-border and government investigations, including those related to FCPA, human trafficking, fraud, and money laundering matters. Investors in Guyana and multinational companies active in the region should be familiar with the potential compliance risks raised by this increase in business and enforcement activity.

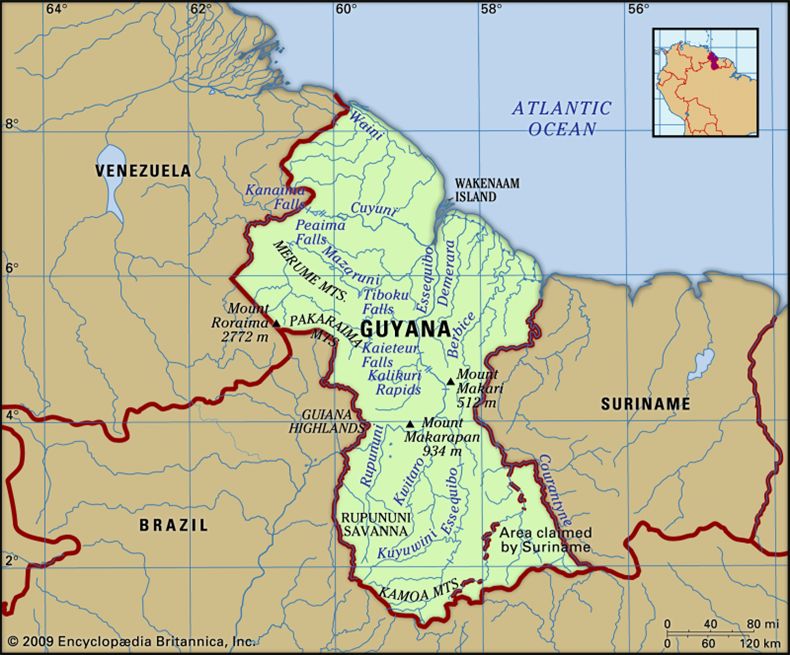

Guyana's growing importance on the world stage is due to several reasons.3 For one, it is neighbors with Venezuela, a country of focus for the Trump Administration. For another, Guyana's 83,000 square ft. mass, sandwiched between Venezuela, Suriname, and Brazil, is comprised of largely undeveloped Amazonian rainforests (where, according to folklore, the "Land of El Dorado" is hidden and Guyana's signature rum, "El Dorado," gets its name). Guyana is also the only English-speaking country on the continent and culturally considered "West Indian," having been a British colony and commonwealth until 1966. This adds to the country's appeal for foreign — and especially American — investors. Along with Jamaica and Trinidad and Tobago, Guyana is a founding member of the Caribbean Community (CARICOM), an organization established to promote economic integration and development in the region.4 And its population of nearly one million is diverse, and tracing its lineages to Africa (as former slaves), India and China (as former indentured servants), and Portugal (as former traders).

Economically, while Guyana has historically been ranked as one of the poorest countries in the Americas, the 2016 discovery of offshore oil reserves, now known as the Stabroek Block catapulted it onto a vastly different trajectory.5 Indeed, Guyana's economy has grown at a staggering pace recently and the country is now set to record the fourth-highest GDP per capita in the Americas, after the United States, Canada, and the Bahamas. Its key corporate partner in the production of oil is ExxonMobil, which has a 45% stake in the consortium the jointly operates and holds exploration and production rights in the Stabroek Block. (Chevron and China's CNOOC hold the remaining stakes, with 30% and 25% respectively.6) Other key partners, such as TotalEnergies, Baker Hughes, SBM Offshore, and Axess Group, have established operations in Guyana to support the growing energy sector. Due to the exponential growth in oil production, Guyana's gross domestic product expanded by more than 40% annually between 2022 and 2024. The imports into Guyana also reflect a changing economy. Refined petroleum, automotives, delivery trucks, and construction vehicles, and manufacturing parts account for the majority of imports, signaling that Guyana is headed towards stronger infrastructure and development.

Footnotes

1. See From a Forgotten Country to an 11bn Barrel Petrostate, The Economist (Sept. 17, 2025), available at https://www.economist.com/the-americas/2025/09/17/from-a-forgotten-country-to-an-11bn-barrel-petrostate.

2. See Secretary of State Marco Rubio and Guyanese President Irfaan Ali at a Joint Press Availability, U.S. Department of State (March 27, 2025), available at https://www.state.gov/secretary-of-state-marco-rubio-and-guyanese-president-irfaan-ali-at-a-joint-press-availability/.

3. Image from Guyana, Brittanica, accessed Nov. 6, 2025, available at https://cdn.britannica.com/08/1108-050-416D8AF2/Guyana-map-features-locator.jpg.

4. See CARICOM, Caribbean Community, https://caricom.org/.

5. Image from Ranking the Giants: Largest Oil Discoveries in Guyana's Stabroek Block after Liza, Brazil Energy Insight (May 30, 2025), accessed on Nov. 6, 2025, available at https://brazilenergyinsight.com/2025/05/30/ranking-the-giants-largest-oil-discoveries-in-guyanas-stabroek-block-after-liza/.

6. Chevron recently won an arbitration against Exxon allowing Chevron to acquire Hess's stake in a $53 billion deal. Sheila Dang, Chevron Closes Hess Acquisition After Winning Exxon Legal Battle, Reuters (July 18, 2025), available at https://www.reuters.com/business/energy/chevron-closes-hess-acquisition-after-winning-exxon-legal-battle-2025-07-18/.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.