- within Finance and Banking topic(s)

- in United States

- with readers working within the Banking & Credit, Business & Consumer Services and Law Firm industries

1 Introduction

The highly dynamic local and global tax environment requires a careful examination of today's tax function. Tax functions may need to change to better manage risks, address capability gaps, and create value for their organisations. The process of change poses a challenge for many organisations. Those in the Nigerian Financial Services (FS) Industry are not left out.

The aggressive nature of revenue-generating agencies places greater responsibility on the tax function like never before. The revenue authorities' actions constrain the tax function, often reducing it to a compliance-focused unit rather than a potential strategic partner in its corporate vision and business strategy.

In this survey, we polled major industry players in the Nigerian FS Industry and analysed their responses. This report highlights the various areas that may be impeding the tax function's transformation target with recommendations on steps to take in order to achieve an optimal tax function.

2 Industry Overview

Sub-sector and Designation of respondents

Respondents were senior level executives from various sub-sectors within the Nigerian FS Industry.

The Banking sector, the largest sub-sector in the Nigerian FS Industry, made up 40% of the respondents. It was closely followed by the Insurance sector, a growing sub-sector within the FS Industry, at 33%. Pension Fund Custodians sector constituted 13% of the respondents.

Executive Directors and Chief Finance Officers (CFOs), combined, made up 60% of the respondents. Tax Managers and Financial Controllers also responded to the survey at 33% and 7% respectively.

Current state of tax functions in the FS Industry

The tax function is constantly evolving, depending on the strategic objectives of the organisation.

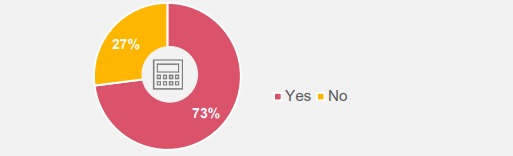

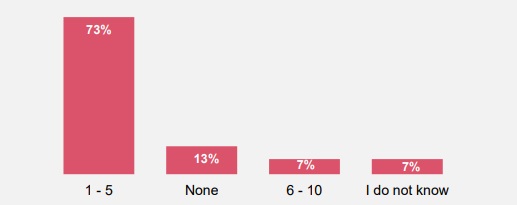

Based on the survey, organisations in the FS Industry, especially the Banking sector, are moving towards creating fully fledged tax functions that are staffed with about 5 employees in their tax unit.

The evolution of the tax function seems to be driven by the complexity and volume of transactions. Other factors could also determine the structure of the tax function, including, but not limited to, the cost versus the benefits of having a tax function and the possibility of automating most of the tax processes and keeping a lean function.

Key Takeaways

As an organisation goes through the journey of creating a fully fledged tax function, it is important that they consider how optimised their tax function is, as well as identify possible processes that could be outsourced or insourced.

In the future, the structure of the tax function will change depending on the type of organisation. Reorganising the function around tasks that refocus the energy of employees towards more strategic processes would define a successful tax function.

Do you have a tax function?

Size of your tax function?

About half of tax functions do not have a documented tax strategy/tax policy

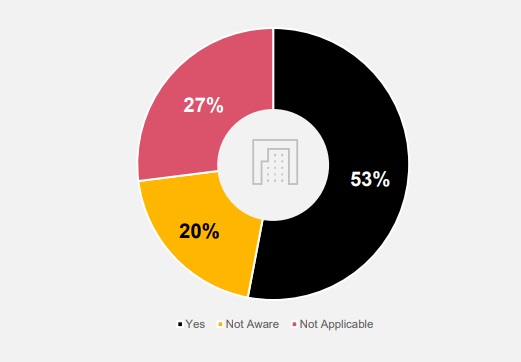

47% of tax functions either do not have a tax strategy or are not aware of one.

A little over half of the respondents (53%) say that the organisation they work for has a documented tax strategy. 27% of respondents, say that the organisation they work for does not have a documented tax strategy, while 20% of respondents are not aware whether or not their organisation has one.

Key Takeaways

For a function which is supposed to drive value in the organisation, our survey revealed an absence of a clear strategy for nearly half of tax functions in the Nigerian FS Industry.

Majority of organisations in the Nigerian FS Industry may have a fully resourced tax function, but some may have been set up without a documented tax strategy.

Tax as a function should have a documented strategy that aligns with the overall business strategy.

Does your organisation have a documented tax strategy/tax policy?

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]