- within Government and Public Sector topic(s)

- in Asia

- with readers working within the Technology industries

- within Media, Telecoms, IT, Entertainment and Technology topic(s)

Bulgaria, like many other countries, has implemented robust Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) legislation to enhance transparency and combat financial crimes. One critical aspect of this legislation is the requirement for entities operating within Bulgaria to declare their Ultimate Beneficial Owners (UBOs). In this article, we delve into the specifics of UBO disclosure, legal obligations, and penalties for non-compliance.

- Legal Framework

The new AML/CFT legislation was promulgated in Bulgaria in March 2018 through the Law on Measures against Money Laundering. The new legislation repealed the previous text of the law and introduced amendments and supplements to enhance anti-money laundering efforts. The latest amendments, effective from July 16, 2024, emphasize the importance of UBO identification and reporting.

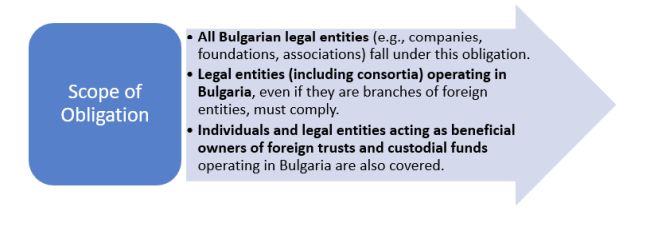

- Who Must Declare UBOs?

Entities established in Bulgaria, including legal entities, other legal formations, and individuals acting as "Contact Persons," are obliged to disclose UBO information, as regulated by the National Real Estate Registry.

Accurate and up-to-date information about beneficial owners and their associated rights must be provided in accordance with these requirements.

- Defining Beneficial Owners

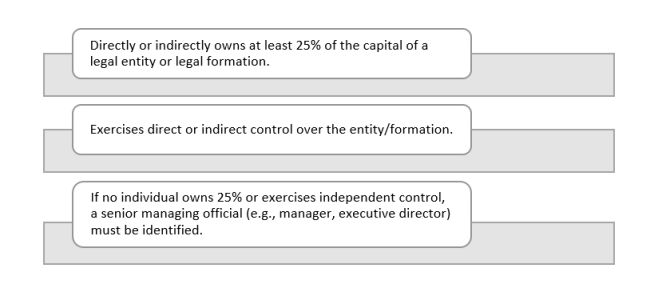

A UBO is an individual who:

- Public Access to UBO Information

The European Union directive mandates that UBO information must be public.

Access is granted to various entities, including:

- State Agency for National Security

- Bulgarian National Bank

- Financial Supervision Commission

- Banks and other financial institutions

- Notaries, lawyers, registered auditors, and leasing companies

In terms of assets, including trusts, custodial funds, and similar foreign legal entities, established in compliance with the jurisdictions allowing trust management of assets, the beneficial owner is considered to be:

- The founder (if any)

- The trustor (proprietor)

- The trustee/custodian

- The beneficiary

- The person benefiting from the trust

- Any other individual exercising control over asset trust management

- Penalties for Non-Compliance

Failure to register UBOs in the respective register results in fines and asset penalties. As of July 16, 2024, the penalty has been increased from 1,000 BGN to 5,000 BGN.

- Contact Person Requirement

Legal entities or formations without representatives permanently residing in Bulgaria must designate a contact person in the Commercial Register or the BULSTAT Register. The designated contact person must have permanent residency in the country.

To sum up, understanding and complying with UBO regulations is crucial for businesses and individuals operating in Bulgaria.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.