On July 4, 2014, the Second Restatement to the Administrative Tax Rules for 2014 (the "Rules") was published in the Federal Official Gazette. Among the most relevant amendments are rules I.2.8.6., I.2.8.7. and I.2.8.8., all applicable to the electronic filing of accounting information.

Pursuant to the Rules, taxpayers must now upload onto the digital platform of the Tax Administration Service, their electronic files in XML format trough the taxpayer's Tax Mailbox or through delivery at the local offices of the Tax Administration Service. The files submitted must contain the following accounting information:

1. Monthly accounting information charts (the "Accounting Charts") with their corresponding tax classification codes. The tax classification codes, issued by the Tax Administration Service, can be found on Schedule 24 of the Rules (http://www.sat.gob.mx/informacion_fiscal/normatividad/Documents/a24_01072014.pdf ).

2. The Accounting Charts must be uploaded for the first time on October of 2014 and then each time the same are modified.

3. Balance Sheet that includes the initial monthly balance, monthly transactions, and final monthly balance of each and everyone of all capital, assets and liabilities accounts, as well as the income statement and other special accounting ledgers. Said information must be uploaded and sent to the Tax Authorities on a monthly basis and no later than the 25th day of the month immediately following the period being reported.

4. Also, the taxpayer must send the year end closing balance along with the applicable tax reconciliation adjustments. The tax reconciliation file must be filed no later than April 20 of the year immediately following the period being reported.

Notwithstanding the tax law does not set forth an express obligation requesting the periodic filing of the monthly accounting reports, the Rules set forth that taxpayers must upload them onto their electronic accounting system.

As from 2015, the Tax Authorities may request information on the aforementioned monthly accounting reports in the two following situations: (i) as part of a tax audit or (ii) as part of the information requested for an application for a tax refund petition. [1]

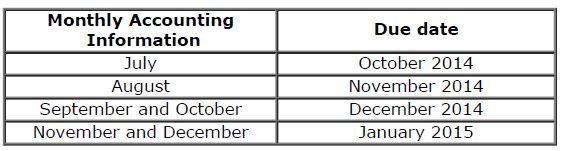

For the second half of 2014, the Tax Authorities have provided the following schedule for uploading and filing the aforementioned accounting information:

The information regarding the balance sheets for 2015 must be uploaded and sent to the Tax Authorities no later than the 25th of the month immediately following the period being reported.

Considering the aforementioned Rules and all the other additional information now available to the Tax Authorities, including that contained in the mandatory electronic invoices, the Tax Authorities will now be able to successfully carry on the electronic audits set forth in the Federal Tax Code.

We believe these new electronic accounting and filing rules do not fully comply with the constitutional requirements of legal certainty and legality, and thus the same may be challenged by an Amparo Claim.

Originally published July 06, 2014

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.