- with Senior Company Executives, HR and Finance and Tax Executives

- in Asia

- in Asia

- with readers working within the Banking & Credit industries

Key Takeaways

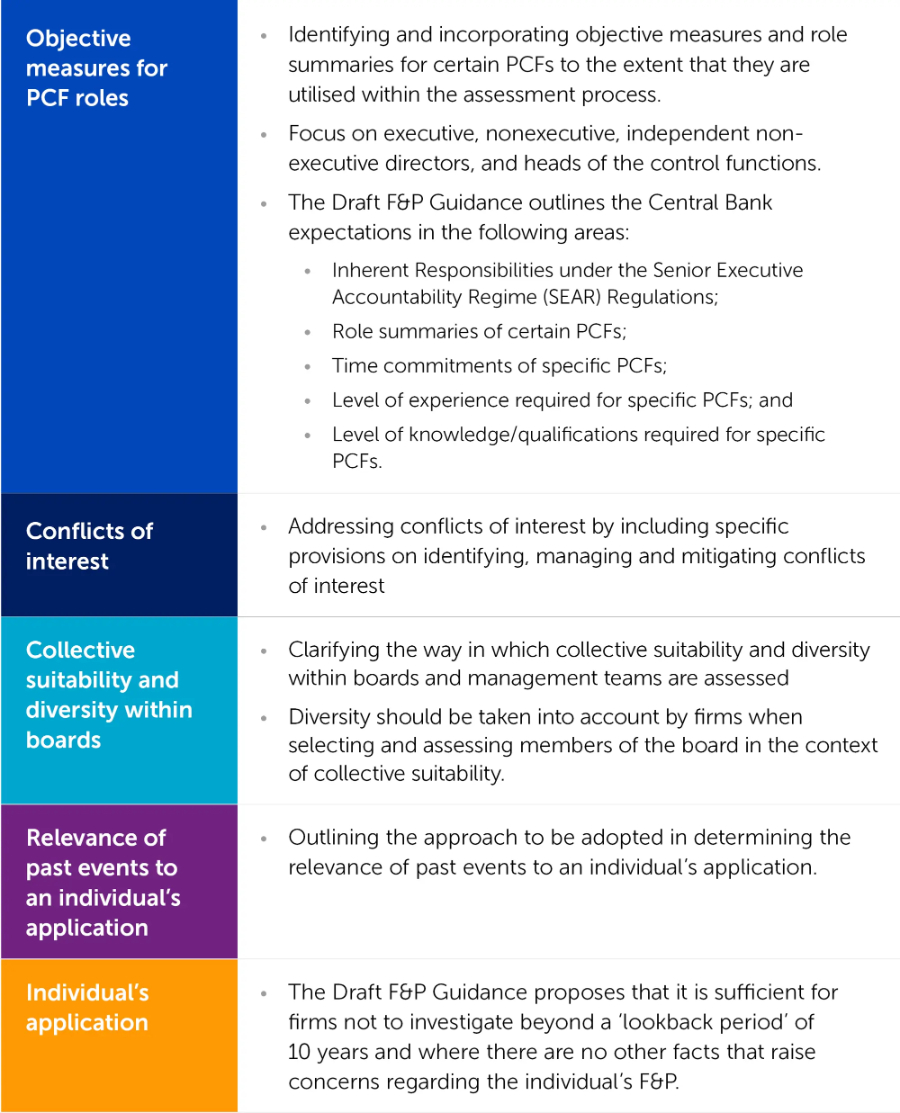

- Revised Guidance on F&P Standards: The Central Bank

proposes consolidated and enhanced guidance, including details

around objective measures for PCF roles, conflicts of interest,

suitability within boards, and a 10-year lookback period for

assessing past events in applications.

- PCF List Overhaul: The Central Bank proposes a

cross-sectoral alignment of PCF roles, with further changes to come

by 2027 with the planned three-year review of SEAR.

- Gatekeeper Process Reform: New F&P Gatekeeper Manual standardises interview procedures, enforces transparency, and introduces a commitment to a 90-day timeframe for application processing.

The Central Bank of Ireland (Central Bank) has published Consultation Paper 160 (CP160) outlining proposed changes to the Fitness and Probity (F&P) regime.

These changes follow the publication of a report by Mr. Andrea Enria, former Chair of ECB Supervisory Board (Enria Report) which contains a package of 12 recommendations published in 2024 as part of a review of the F&P gatekeeping framework.

The Central Bank has published the following documents as part of the proposed changes to the F&P regime:

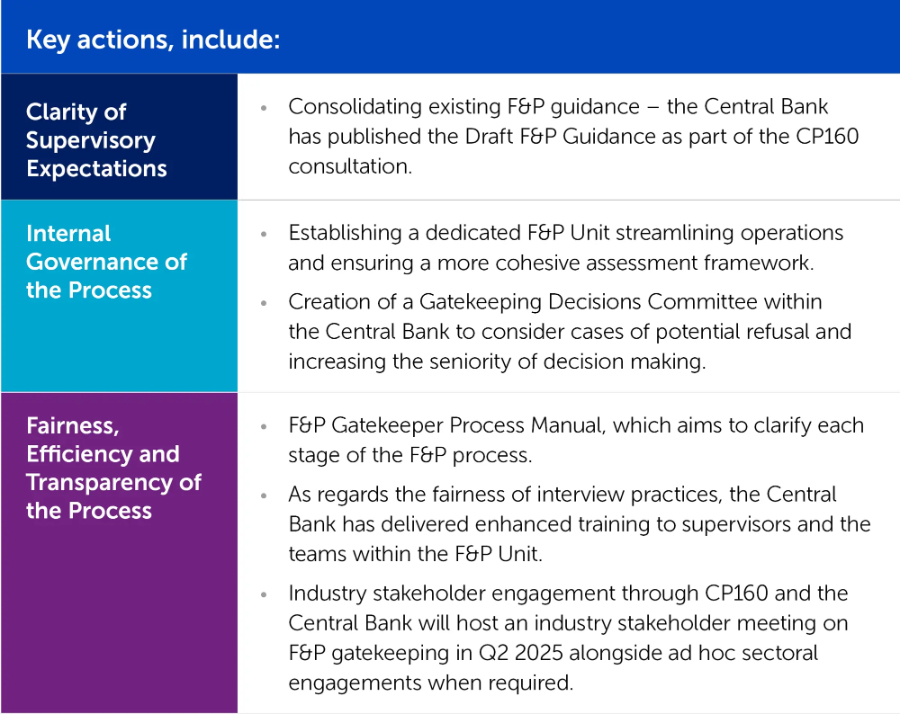

- CP160 – addresses the recommendations in the Enria Report that call for increased clarity and transparency of supervisory expectations in relation to the application of the Central Bank's F&P Standards. Chapter 3 includes a review of the list of prescribed pre-approval controlled functions (PCFs).

- Guidance on the Standards of Fitness and Probity (Draft F&P Guidance) - consolidates existing F&P guidance into a single document and provides for certain enhancements.

- Fitness and Probity Review – Report on Implementation of Recommendations (Implementation Report) - provides details on the progress made by the Central Bank regarding the recommendations in the Enria Report.

- F&P Gatekeeper Process (F&P Gatekeeper Process Manual) - clarifies the stages of the F&P process, including the engagement that regulated entities and those seeking authorisation can expect from the Central Bank, in terms of notification of interviews, interview length, time to process applications and availability of feedback.

Revised Guidance on F&P Standards

The Draft F&P Guidance consolidates all the guidance into a single document and introduces a number of enhancements to its existing Guidance on the F&P Standards.

Specifically, the Central Bank proposes to ensure industry understanding of the F&P assessment process by providing enhanced guidance in the following areas:

Changes to the list of PCFs

The Central Bank proposes a two-stage approach to the review of

the PCF list. Firstly, an initial targeted revision of the PCF list

as proposed in CP160. Secondly, a more substantive review to be

coordinated throughout 2025 and 2026 with the planned three-year

review of SEAR in 2027.

As part of the first initial revision of the PCF list, the Central

Bank proposes to remove the sector-specific categorisations so that

there will be one list of PCFs that applies to all regulated firms

(other than credit unions). The proposed revised list, which is set

out in the Annex to CP160, reduces the number of PCF roles from 59

to 45 by merging and renaming certain functions.

The Central Bank notes that the revised PCF list will not

necessitate the appointment of new PCFs by regulated firms and that

it will not impact existing approvals or applications in process.

Where a role that was previously categorised for pre-approval only

for certain industry sectors now becomes applicable to other

sectors, the Central Bank will apply its in-situ process for any

individuals occupying such a role at the time of the amendments to

the PCF list. New appointments to any such role will be subject to

the PCF approval process.

Of importance to note is that the new proposed PCF-45 Head of

Safeguarding/Client Asset Oversight will apply to all regulated

firms (other than credit unions), which previously only applied to

investment firms/credit institutions and fund management

companies.

Gatekeeper process

The F&P Gatekeeper Process Manual clarifies the stages of the F&P process, including the process that existing regulated entities and those seeking authorisation can expect from the Central Bank. In particular, the F&P Gatekeeper Process Manual provides for detailed information regarding the F&P interview process, including:

- Detailed invitations to interview;

- Commitment to 90-minute interviews;

- Panel members for interviews are selected on the basis of their qualifications and experience, ensuring these align with the regulated entity's profile and the proposed role's requirements;

- Provision of feedback after interviews;

- Cessation of "meet and greet" interviews as part of the F&P application assessment;

- Commitment to removing off record discussions with regulated entities on applications. Going forward the process will be that any discussions are on record; and

- Commitment to a 90-day timeframe for the F&P gatekeeping process.

Implementation report

The Implementation Report outlines the actions taken by the Central Bank to date in strengthening the F&P gatekeeping process against the recommendations in the Enria Report.

Next steps

The consultation will remain open until 10 July 2025. The

Central Bank will host an industry stakeholder meeting on F&P

gatekeeping in Q2 2025 alongside ad hoc sectoral engagements, when

required.

Throughout 2025 and 2026, the Central Bank will carry out a more

substantive review of the PCF list to be coordinated with the

planned three-year review of SEAR in 2027.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.