- within Law Department Performance and Strategy topic(s)

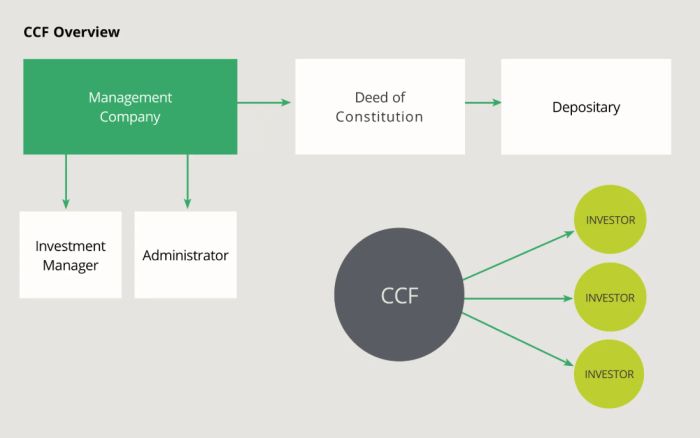

As a CCF does not itself have separate legal personality, it relies on its service providers to act on its behalf.

A CCF must have a regulated management company, either a UCITS management company, a non-UCITS management company or an alternative investment fund manager (AIFM), depending on whether the CCF is to be authorised as a "UCITS" or an "AIF".

The board of directors of the management company will be responsible for the management of the CCF. The management company must appoint a depositary to hold the assets of the CCF and carry out a number of other regulatory and oversight responsibilities. The management company and the depositary are the parties to the deed of constitution establishing the CCF.

In addition, an administrator is required to be appointed to carry out fund accounting and transfer agency services for the CCF. Other service providers, such as an investment manager or distributor, are also usually appointed.

The main offering document for a CCF is its prospectus, which describes the investment objective, policies, risk factors and other features of the CCF. As with any regulated Irish fund, the prospectus must meet the disclosure requirements of the Central Bank of Ireland.

CCFs must be authorised by the Central Bank of Ireland and the authorisation process differs depending on the type of authorisation sought (i.e. as a UCITS or AIF).

A CCF is an unincorporated body constituted under contract by a deed of constitution between a management company and a depositary.

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.