- within Environment, Transport, Government and Public Sector topic(s)

After several delays, final delegated measures underpinning the Sustainable Finance Disclosures Regulation (SFDR) were published on 25 July 2022 with an effective date of 1 January 2023.

The SFDR delegated measures (Level 2) set out additional disclosure obligations in respect of:

- fund managers' website disclosure of the principal adverse impacts (PAIs) of investment decisions on sustainability factors under SFDR Article 4 (the entity-level PAI disclosure rule)

- fund disclosure of environmental or social (E/S) characteristics under SFDR Articles 8, 10 and 11 (product-level disclosure rules)

- fund disclosure of sustainable investment objectives under SFDR Articles 9, 10 and 11 (product-level disclosure rules).

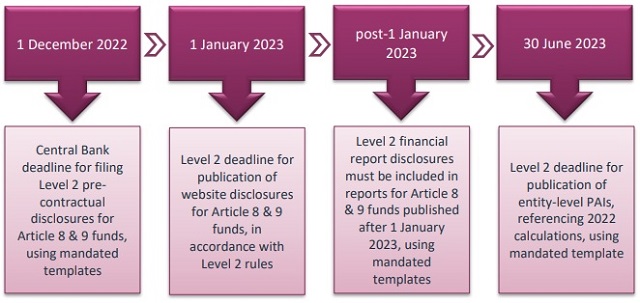

Level 2 Compliance Timeline

Level 2 disclosures of entity-level PAIs are required to be published on the fund manager's website by 30 June 2023.

Level 2 pre-contractual and website disclosures for Article 8 and 9 funds must be published from 1 January 2023 and financial report disclosures must be included in any relevant fund reports published after this date (irrespective of the relevant financial/reference period).

The Central Bank has committed to providing a fast-track approval process ahead of the 1 January 2023 compliance deadline for Level 2 pre-contractual disclosures and while regulatory guidance is expected to issue shortly, the Central Bank has verbally confirmed a filing deadline of 1 December 2022 for the process. As such, fund managers have approximately 11 weeks in which to finalise Level 2 pre-contractual disclosures for any Article 8 and 9 funds under management and submit these for noting by the Central Bank.

Fund managers then have a further 4 weeks (including the Christmas period) in which to finalise and publish Level 2 website disclosures for Article 8 and 9 funds, in advance of the 1 January 2023 compliance deadline.

For those funds with a late Q3/early Q4 financial year-end, preparations must also be progressed this quarter for publishing Level 2 financial report disclosures in Article 8 or 9 funds' reports published after 1 January 2023.

This guide aims to assist fund managers' Level 2 compliance preparations and includes (i) key Level 2 considerations; (ii) a decision tree to facilitate funds managers scoping of Level 2 obligations; and (iii) a detailed summary of the Level 2 disclosure rules.

Fund Managers' PAI disclosures: 10 key Level 2 considerations

- From 1 January 2023, fund managers explaining non-compliance with the entity-level PAI disclosure rule must ensure existing website statements of non-compliance (made pursuant to Level 1) align with Level 2 requirements for the format and positioning of such statements (see Summary of Level 2 Disclosure Rules section below).

- Fund managers explaining non-compliance with the entity-level PAI disclosure rule are not precluded from establishing/managing funds that consider product-level PAIs. However, any such funds should be excluded from the website and pre-contractual non-compliance statements.

- Fund managers complying with the entity-level PAI disclosure rule must first disclose the PAIs of investments by 30 June 2023, referencing 2022 calculations, on the manager's website.

- Level 2 requires PAIs to be calculated over a calendar year using a prescribed set of 64 mandatory and optional indicators across corporate, sovereign, and real estate investments. In any given year, PAI calculations must be carried out on at least four calculation dates (31 March, 30 June 30 September, and 31 December) with the average of the impacts disclosed by 30 June of the following year as the PAIs of the previous year.

- Fund managers complying with the entity-level PAI disclosure rule for the first time are, by way of exemption to the calendar-year calculation period rule, permitted to disclose PAIs by reference to the period beginning on the date on which PAIs are first calculated in the previous year until 31 December of that year.

- PAIs must be disclosed using the mandatory website disclosure template set out in Annex I, Level 2. The template requires a summary disclosure of the PAIs, a detailed disclosure of impacts against the mandatory and optional PAI indicators, a historical comparison (where available), details of the manager's relevant policies and procedures and its adherence to international standards for due diligence and reporting (see Summary of Level 2 Disclosure Rules section below).

- Publicly available data should be used for calculating PAIs and where not readily available, fund managers should use best efforts to source data either direct from investee companies, by carrying out additional research, cooperating with third party data providers or external experts or making reasonable assumptions.

- Fund managers are expected to calculate PAIs of both direct and indirect investments by applying a look-through approach to indirect holdings e.g., via other funds, fund of funds, holding companies, SPVs and derivatives (see here for further details).

- Fund managers are expected to calculate the PAIs of instruments financing sustainable projects e.g., a bond, by reference to the impact of the project or type of project funded by the instrument (see here for further details).

- Fund managers complying with the entity-level PAI disclosure rule must, from 30 December 2022, disclose whether they also consider product-level PAIs in respect of underlying funds (SFDR Article 7(1)). In respect of funds that consider product-level PAIs, managers must make pre-contractual disclosure of how such PAIs are identified and financial report disclosure of any such PAIs identified. In contrast to the entity-level PAI disclosure rule, disclosure of product-level PAIs is not required to be made using the Level 2 indicators. However, ESMA's recently published supervisory expectation is that the Level 2 mandatory PAI indicators (Table 1, Annex I) are used to calculate and disclose product-level PAIs (see here for further details of ESMA's supervisory expectations for compliance with Level 2).

Funds' E/S characteristics / sustainable investment objectives: 10 key Level 2 considerations

Sustainable investment under SFDR means an investment:

- in an activity that contributes to an environmental or social objective

- that does not significantly harm any social or environmental objective (the DNSH test) and

- that follows good governance practices (in the case of investee companies)

- From 1 January 2023, Level 2 requires additional pre-contractual, website and financial report disclosures for funds with E/S characteristics in scope of SFDR Article 8, and those with sustainable investment objectives in scope of SFDR Article 9. Financial report disclosure templates must be included in reports published after 1 January 2023, irrespective of the relevant reference/financial period.

- Level 2 pre-contractual and financial report disclosures are required to be made using the mandatory disclosure templates annexed to Level 2, which may not be amended other than changes to the colour and font type and size.

- Level 2 website disclosures are not subject to a template but are required to be made in accordance with detailed Level 2 rules (see Summary of Level 2 Disclosure Rules section below). Website disclosures should be used to 'expand on topics disclosed in a concise way in pre-contractual documents' and include 'a clear, succinct and understandable summary of the [financial report] information' disclosed using the relevant disclosure template.

- Level 2 pre-contractual and financial report disclosures must include funds' binding sustainable investment commitments (if any)/sustainable investment holdings (if any), noting that both the ESAs and the Commission expect that Article 9 funds only invest in sustainable investments and ancillary investments (e.g., for hedging and liquidity purposes) subject to minimum safeguards (see here for further details).

- A fund manager's methodology for assessing sustainable investments' compliance with the 'do no significant harm' (DNSH) test (see box on the right) must take account of the Level 2 PAI indicators and all sustainable investments, including those aligned with the Taxonomy, must satisfy the DNSH test. This is notwithstanding that the Taxonomy also includes a DNSH test and as such Taxonomy-aligned investments are subject to dual DNSH obligations under both SFDR and the Taxonomy. To take account of the Level 2 PAI indicators under the SFDR DNSH test, fund managers are expected to develop and establish significant harm thresholds for the Annex 1, Table 1 indicators and any relevant indicators from Tables 2 and 3, which the ESAs consider it best practice to disclose in order to prove sustainable investments' DNSH compliance. In addition to taking account of the Level 2 PAI indicators, fund managers' DNSH methodology must also include an assessment of whether the investments are aligned with the OECD Guidelines for Multinational Enterprises and UN Guiding Principles on Business and Human Rights, including the principles and rights set out in the eight fundamental conventions identified in the Declaration of the International Labour Organisation on Fundamental Principles and Rights at Work and the International Bill of Human Rights.

- Level 2 pre-contractual and financial report disclosures for Article 8 funds with environmental characteristics and Article 9 funds with environmentally sustainable investments must include any binding Taxonomy-aligned investment commitments/Taxonomy-aligned investment holdings. All Article 8 funds with environmental characteristics are subject to this disclosure requirement, including those with no sustainable investment commitments/holdings, according to the Commission (see here for further details).

- Article 8 anti-greenwashing guidance issued by ESMA to NCAs clarifies that Article 8 funds' Level 2 disclosures must be binding and any significant discrepancy between a fund's investments and its pre-contractually disclosed investment commitments may be subject to regulatory action for greenwashing (see here for further details).

- Article 9 anti-greenwashing guidance issued by ESMA to NCAs clarifies that Article 9 funds with significant non-sustainable investment holdings may be subject to regulatory action for greenwashing (see here for further details).

- Fund managers may, but are not obliged to, use the Level 2 PAI indicators as sustainability indicators for measuring a fund's success in implementing its E/S characteristics or sustainable investment objectives. A fund manager is also not obliged to use the Level 2 PAI indicators when considering any product-level PAIs, however, ESMA has published its expectation that such consideration takes account of the mandatory Table 1 PAI indicators (see here for further details).

- Both Article 8 and 9 funds are subject to the requirement for investee companies to follow good governance practices and must make pre-contractual and website disclosure of their policies to assess corporate investments' good governance practices. Funds investing in companies that do not follow such practices are considered in "breach" of SFDR, according to the Commission (see here for further details).

Am I in scope of Level 2 disclosure rules?

The decision tree below is intended for use by fund managers in determining whether, based on their approach to compliance with the first SFDR (Level 1/L1) deadline of 10 March 2021, they are in scope of Level 2 disclosure rules and if so, the relevant disclosure rules to which they will be subject from 1 January 2023 (other than where indicated). A summary of the referenced Level 2 disclosure rules follows the decision tree.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.