- within Compliance, International Law, Media, Telecoms, IT and Entertainment topic(s)

New requirements relating to cross border distribution are due to apply from 2 August 2021, when the provisions of the Cross Border Distribution Directive ("CBDD") are due to be transposed into national law and the provisions of the Cross Border Distribution Regulation ("CBDR") are due to come into effect. The requirements apply to UCITS management companies and AIFMs in relation to the marketing and distribution of UCITS and AIFs.

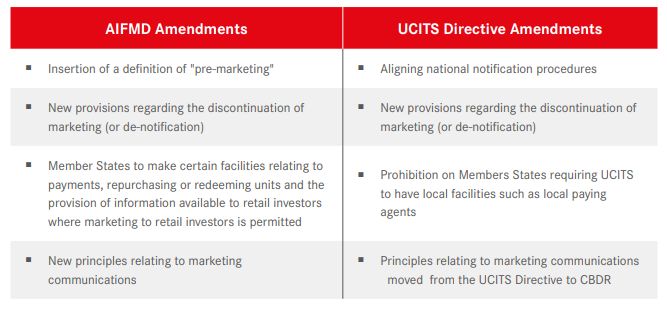

The Cross Border Distribution Directive amends both the UCITS Directive and the AIFMD in the manner set out below.

New Pre-Marketing Regime

The AIFMD is amended to introduce a new definition of "pre-marketing" and to provide for conditions for the use of pre marketing by EU authorised alternative investment fund managers ("AIFMs"). To date, there has been inconsistency between member states in relation to what activities could be undertaken before formal marketing requiring notification would be deemed to have taken place. Under the new definition, pre-marketing involves:

- the provision of information or communication, direct or indirect, on investment strategies or investment ideas;

- by an EU AIFM or on its behalf;

- to potential professional investors domiciled or with a registered office in the EU;

- in order to test their interest in an AIF which is not yet established, or which is established, but not yet notified for marketing in the member state where the potential investors are domiciled or have their registered office; and

- which does not amount to an offer or placement to the potential investor to invest in the AIF.

EU AIFMs will not be permitting to engage in pre-marketing where the information provided to potential investors:

- is sufficient to allow investors to commit to acquiring units or shares of a particular AIF;

- amounts to subscription forms or similar documents whether in draft or final form; or

- amounts to constitutional documents, a prospectus or offering documents of a not yet established AIF in final form.

Draft offering documents must clearly state that they do not constitute an offer or invitation to invest in the AIF and that the information should not be relied upon because it is incomplete and may be subject to change. An EU AIFM must send, within two weeks of commencing pre-marketing, an "informal letter" to the competent authorities of its home member state setting out the following information:

- the members states in which and the periods during which the pre-marketing is taking or has taken place;

- a brief description of the pre-marketing including information on the investment strategies presented; and

- where relevant, a list of the AIFs which are or were the subject of pre-marketing.

The CBDD provides that any investment by professional investors with 18 months of the EU AIFM having commenced pre-marketing in an AIF referred to in pre-marketing information or in an AIF established as a result of the pre-marketing, will be considered to be as a result of marketing and will be subject to the notification procedures set out in the AIFMD. This means that EU AIFMs will not be able to rely on reverse solicitation in these circumstances for a period of 18 months after conducting pre-marketing.

Download >> Cross Border Distribution Of Funds (PDF)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.