- in European Union

- in European Union

- in European Union

- in European Union

- within Intellectual Property, Technology and Criminal Law topic(s)

- with readers working within the Advertising & Public Relations industries

Introduction

On 2 August 2021, the European Commission's new framework for the cross-border distribution of investment funds will come into effect (the "CBDF"). This framework, comprising of a Directive and accompanying Regulation, has the objective of removing regulatory barriers that were identified as significant disincentives to UCITS management companies and AIFMs ("Managers") who wish to avail of the marketing passports for both UCITS and AIFs. Our advisory series considers a number of the key changes being introduced by the CBDF legislation. This first part of our advisory series focuses on the pre-marketing requirements being introduced in respect of AIFs.

"Pre-Marketing" versus Marketing

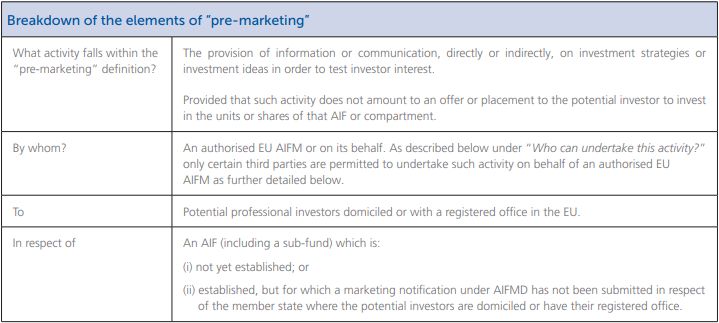

A new concept of "pre-marketing" has been introduced in respect of AIFs and helpfully a definition of "pre-marketing" has been added to AIFMD with additional guidance given as to the types of activities that would not fall within its scope.

Provision of certain information by an authorised EU AIFM, or on its behalf, to potential professional investors will constitute marketing as defined under AIFMD rather than pre-marketing where the information so presented:

- is sufficient to allow investors to commit to acquiring units or shares of a particular AIF;

- amounts to subscription forms or similar documents whether in a draft or a final form; or

- amounts to constitutional documents, a prospectus or offering documents of a not yet established AIF in a final form.

Draft offering documents can be provided to potential professional investors domiciled or with a registered office in the EU without such provision being considered marketing, but additional requirements must be met. Where such draft offering documents are provided, they shall not contain information sufficient to allow investors to take an investment decision and shall clearly state that:

- they do not constitute an offer or an invitation to subscribe to units or shares of an AIF; and

- the information presented therein should not be relied upon because it is incomplete and may be subject to change.

Pre-marketing will allow authorised EU AIFMs to test market interest in a strategy or product before establishing an AIF or obtaining a marketing passport for an AIF.

Notification process

An authorised Irish AIFM must, by way of submitting an informal letter describing the pre-marketing along with details of the strategies being pre-marketed, inform the Central Bank of Ireland (the "Central Bank") within two weeks of any pre-marketing. The Central Bank is required to promptly inform the competent authorities of the member states in which the AIFM is or was engaged in pre-marketing and such competent authorities may request further information on the pre-marketing that is taking or has taken place in its jurisdiction.

Who can undertake this activity?

The amendments to AIFMD by the CBDF provide that only an authorised EU AIFM or third parties acting on behalf of an authorised EU AIFM and falling within one of the categories of entity set out below can engage in pre-marketing:

- a MiFID firm;

- a credit institution in accordance with CRD;

- a Manager; or

- an entity acting as a tied agent

It remains unclear how the pre-marketing requirements will apply to third country AIFMs, as this is a matter for local implementing laws; however, national law cannot disadvantage EU AIFMs over their third country equivalents. As third country AIFMs cannot be treated more favourably than EU AIFMs by member states, member states may seek to align national private placement regimes ("NPPR") with the new CBDF to prevent EU AIFMs being subject to more onerous requirements under the CBDF than those applicable to third country AIFMs under NPPR requirements. Therefore, it is up to each member state to determine whether pre-marketing ahead of a required notification under their NPPR is permitted and on what terms.

Pre-marketing and reverse solicitation

Where a professional investor in a member state subscribes for units or shares in a pre-marketed AIF within 18 months of the AIFM starting to pre-market that AIF, this will automatically be considered to be as a result of marketing and consequently the AIFM will be subject to the marketing notification procedures under AIFMD. In effect, this means that there is a restriction from relying on reverse solicitation for 18 months after the AIFM engages in pre-marketing of the relevant AIF.

There continues to be some ambiguity relating to this restriction in terms of whether the restriction is to be interpreted as restricting reverse solicitation from a specific investor to whom pre-marketing took place, restricting reverse solicitation from investors in a particular member state in which pre-marketing took place or in its broadest sense a restriction on relying upon reverse solicitation at all following the pre-marketing of an AIF.

Next Steps

The CBDF regime represents a significant change to the current industry practice for Managers distributing cross-border and it is yet to be seen what systems and procedures regulators will put in place to manage the logistical changes. As of the date hereof, the Central Bank has not published a proposal or a consultation on the transposition of the Directive. Accordingly, with the deadline for implementation fast approaching Managers should now be reviewing or establishing their internal procedures to take into account the new rules. In the context of pre-marketing, AIFMs should put in place clear processes and procedures, ensuring that their pre-marketing interactions are adequately documented. Consideration should also be given by AIFMs to the potential reverse solicitation implications of the new rules.

Key Impacts of CBDF - Refresher

Walkers have previously released a number of updates relating to the CBDF which you can recap on here.

Footnotes

1. Directive (EU) 2019/1160

2. Regulation (EU) 2019/1156

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.