- with Finance and Tax Executives and Inhouse Counsel

- with readers working within the Consumer Industries, Media & Information and Oil & Gas industries

There have been a number of recent Central Bank of Ireland ("Central Bank") updates relevant to exchange traded funds ("ETFs"), including updates to the Central Bank's UCITS guidance relating to ETF share classes, comments on portfolio transparency and the outcome of the review of primary and secondary market trading arrangements of Irish authorised ETFs.

ETF Share Classes

The Central Bank of Ireland ("Central Bank") recently updated its UCITS questions and answers document ("UCITS Q&A") to confirm that it is now possible to have listed share classes within a UCITS that is not designated as a "UCITS ETF", with the use of the UCITS ETF identifier now being permitted at the level of the sub-fund or listed share class. According to the updated guidance, and consistent with the approach adopted to date with regard to unlisted share classes being established within UCITS ETFs, non-ETF UCITS with listed share classes must clearly disclose the key differences between the listed and unlisted share classes.

This is a welcome update, particularly in light of asset managers' growing interest in expanding their distribution options through the use of ETFs. Managers may now launch ETF share classes within their existing UCITS as a means of entry into the ETF market. ETFs have enjoyed a cumulative annualised growth rate of 19.8% since 2008, reaching US$11.1 trillion in asset under management as of 31 December 2023 (Morningstar). As pointed out in a recent Central Bank speech, since authorising the first European ETF in 2000, Ireland has become firmly established as the jurisdiction of choice for ETF providers in Europe – with about 70% of the EU's ETFs domiciled in Ireland by assets under management.

Portfolio Transparency

In the same speech, Deputy Governor Derville Rowland noted that portfolio transparency is an important issue that has been raised by industry, particularly in relation to active ETFs. Noting the increasing interest in active ETFs in Europe, Ms Rowland confirmed that the Central Bank is open to engaging with industry to develop a proportionate and effective approach to different models of portfolio transparency in Ireland's regulatory framework. It was noted that the Central Bank is likely to settle on a principles-based approach rather than focusing on one particular model.

The Irish Funds ETF Specialist Group has made a submission to the Central Bank on portfolio transparency. This follows the publication of the Funds Sector 2030 Report, which recommended that the Central Bank keep under consideration its requirements regarding portfolio transparency for ETFs, recognising the possibility of alternative approaches.

Outcome of the Review of ETFs

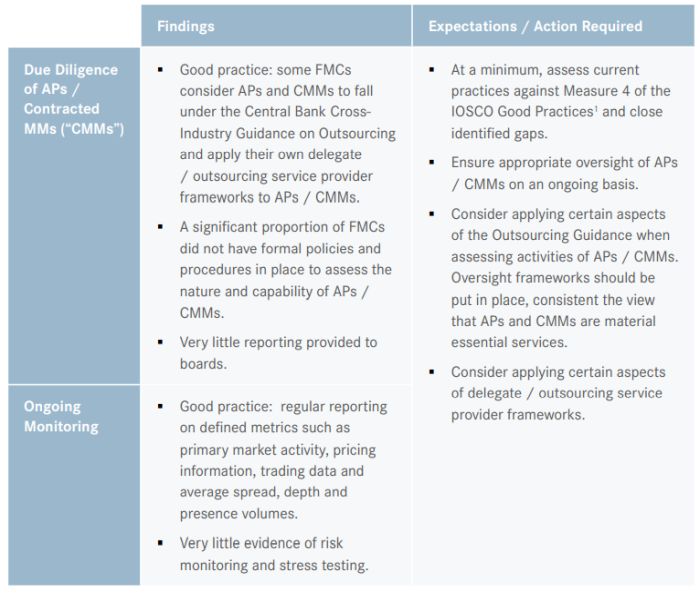

On 28 November 2024, the Central Bank published an industry letter setting out its findings and expectations following its review of the primary and secondary market trading arrangements of Irish authorised ETFs. The Central Bank's stated purpose in conducting the review was to ensure that, with regard to the roles played by authorised participants ("APs") and market makers ("MMs") and the oversight performed on those entities by fund management companies ("FMCs"), the arrangements in place are sufficient to protect ETF investors and promote the integrity of the ETF ecosystem. The review included consideration around the provision of liquidity during normal and stressed market conditions and the effective function of arbitrage mechanisms. The review found that the Irish ETF ecosystem is functioning effectively. Details of the Central Bank's findings and expectations are summarised in the table below.

An appendix to the letter sets out a list of six areas that FMCs may wish to consider in the context of AP / CMM due diligence and ongoing monitoring. The Central Bank requires that FMCs incorporate the necessary changes to their frameworks and practices by the end of Q2 2025.

Footnote

1. Measure 4 provides that "Responsible entities are encouraged to (i) conduct due diligence on APs and MMs when onboarding them to the ETF, with a view towards having those that are capable of facilitating an effective arbitrage mechanism and providing liquidity; (ii) conduct ongoing monitoring on APs and MMs for the ETF regarding, amongst others, the functioning of the arbitrage mechanism and liquidity provision; and (iii) avoid exclusive arrangements with APs and MMs if they may unduly affect the effectiveness of the arbitrage mechanism." With respect to Irish authorised ETFs, 'responsible entities' are the FMCs authorised to manage relevant ETFs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.