- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Accounting & Consultancy and Law Firm industries

- with Finance and Tax Executives

- with readers working within the Advertising & Public Relations industries

Background

In a country in which family structures, business dynamics, and forms of wealth are evolving rapidly, private trusts are no longer used simply for asset protection or avoiding probate — their relevance lies in mitigating uncertainty and simplifying complexity. The use of private trusts has emerged as a widely adopted method for succession planning in an organized, seamless, and tax-efficient manner.

In this series of publications, we explore key aspects of setting up a trust, including tax and regulatory implications.

In Part I, we focus on the provisions of the Indian Trusts Act, 1882 ("Trust Act").

Settlement of a private trust

The Trust Act defines "trust" as "an obligation annexed to the ownership of property, and arising out of a confidence reposed in and accepted by the owner, or declared and accepted by him, for the benefit of another, or of another and the owner".

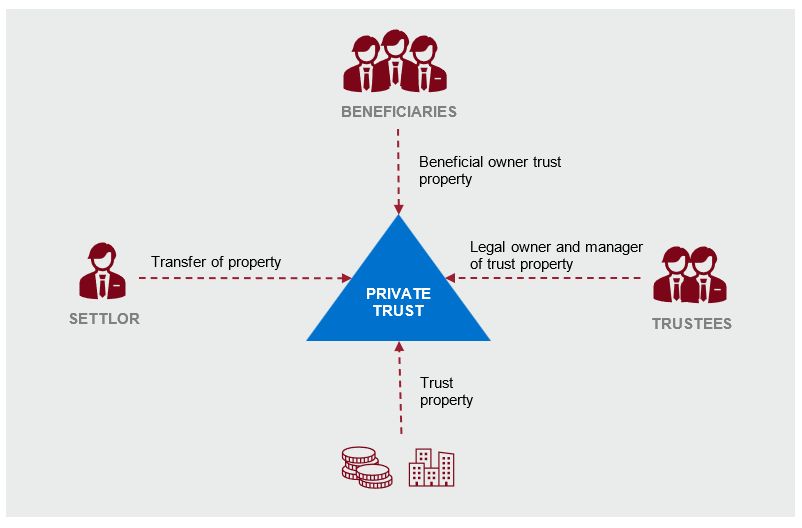

Section 6 of the Trust Act provides that a trust is created by a "settlor", by settling property owned by the settlor in favor of "trustees" for the benefit of the "beneficiaries". The trustees are the legal owners of the trust property and manage it for the beneficiaries in accordance with the terms of the trust deed.

The trust deed outlines the rights, powers and obligations of the trustees and beneficiaries. The following diagram further illustrates the trust structure:

Types of private trust

Certain types of private trusts are set out below:

- Revocable Trust: A trust in which the assets transferred by the settlor (along with any income arising from such assets) can be re-transferred to the settlor or power over such assets can be re-assumed by the settlor.1

- Irrevocable Trust: A trust in which the assets transferred by the settlor (along with any income arising from such assets) cannot be re-transferred to the settlor or power over such assets cannot be re-assumed by the settlor.

- Determinate Trust: A trust in which the share of beneficiaries is known/determinate on the date of creation of the trust.

- Indeterminate Trust: A trust in which the share of beneficiaries is not known at the time of creation of the trust or any time thereafter.

Key considerations in the settlement of a trust

- Can a settlor serve as a trustee of a trust?

One of the conditions for the creation of a trust2 is the transfer of trust property by the settlor to the trustee. However, a specific exemption from such a condition has been provided in case the settlor serves as a trustee. This indicates that the Trust Act permits the appointment of a settlor as a trustee.

- Can a settlor be a beneficiary of a trust?

There is no restriction on a settlor being a beneficiary of the Trust. However, it should be noted that a person cannot be the settlor, trustee and sole beneficiary of a trust as one cannot enforce a trust against oneself.3 If the settlor is the trustee and also a beneficiary, there will be no real purpose to having the trust, as the settlor will essentially retain full control over the trust and its assets.

- Can a non-resident be a trustee of an Indian Trust?

Section 60 of the Trust Act provides that persons residing permanently outside India or persons domiciled abroad cannot be appointed as trustees. However, such provision is subject to the terms of the trust deed. Accordingly, under the Trust Act a non-resident can be appointed as a trustee if provided in the trust deed.

Notably, since trustees are considered the legal owners of the trust property, foreign exchange control provisions (such as those prohibiting non-residents from owning immovable property) must be adhered to.

- Can a non-resident be a beneficiary of an Indian Trust?

There is no specific provision in the Trust Act prohibiting a non-resident from being a beneficiary of an Indian Trust. However, foreign exchange control provisions (as noted above) must be adhered to.

The following publication in this series will outline the tax implications of private trusts.

Footnotes

1 Section 63 of the IT Act

2 Section 6 of the Trust Act

3 Bhavna Nalinkant Nanavati v. Commissioner of Gift Tax. [2002] 255 ITR 529 (Guj HC)

This insight/article is intended only as a general discussion of issues and is not intended for any solicitation of work. It should not be regarded as legal advice and no legal or business decision should be based on its content.