Trusts in India are governed under the provisions of the Indian Trusts Act, 1882 (the "1882 Act"). In terms of the 1882 Act, a 'Trust' is an obligation annexed to the ownership of property, and arising out of a confidence reposed in and accepted by the owner, or declared and accepted by him for the benefit of another, of another and the owner.

The person who reposes or declares the confidence to create the trust is known as the "author of the trust" / "settlor". The person who accepts the confidence is called the "trustee". The person for whose benefit the confidence is accepted by the trustee is called the "beneficiary". The subject matter of the trust is called "trust property". The "beneficial interest" or "interest" of the beneficiary is the right against the trustee as owner of the trust property. The instrument by which the trust is declared is called the "instrument of trust" / "trust deed" / "indenture of trust".

In terms of the 1882 Act, the essential ingredients for a trust are as follows:

- The author of the trust or the settlor, who sets aside certain property for the benefit of the beneficiary(ies);

- The trustee(s), to manage the trust property for the beneficiaries;

- Beneficiary(ies);

- Subject matter of the trust, there must be a clearly delineated trust property; and

- Instrument of trust / trust deed / indenture of trust clearly and precisely setting out the objects of the Trust.

The creation of a trust results in transfer of rights associated in the trust property to the trustees for the benefit of the beneficiary(ies). The trustees, depending on the nature of the trust, transfers the trust property / income / earnings derived from the trust property for the benefit of the beneficiaries.

In India, a trust may be set up as a: (i) private trust; or (ii) public trust. A private trust is established / created and governed under the provisions of the 1882 Act whereas public trust in India is established / created under the state-specific legislation for public trusts adopted in that state. For instance, a public state registered in states of Gujarat and Maharashtra needs to be registered under the Bombay Public Trusts Act, 1950. Other laws that may govern public trust include - the Charitable and Religious Trusts Act, 1920, the Religious Endowments Act, 1863, and the Charitable Endowments Act, 1890.

Private Trust

A private trust is established / created under the 1882 Act for specific individual(s) / beneficiary(ies) who are identified under the instrument of trust. A private trust is established / created for a specific purpose and terminates on expiry of the purpose of the trust or happening of any event identified under the instrument of trust or after the death of the beneficiary(ies).

The 1882 Act governs private trusts and is not applicable to: (a) Public or private religious charitable endowments; (b) Property of Hindu Undivided Family; and (c) Wakf.

A private trust may be set up either as:

- Discretionary Trust – A type of a trust wherein the share of each beneficiary is not fixed by the Settlor and the trustees, at their own discretion, have the power to determine the share of the beneficiaries in the trust property and who amongst the beneficiaries shall derive the benefit from the said trust property.

- Determinate Trust – A type of a trust wherein benefit to be derived by the trust property is fixed by the settlor at the time of drawing up the instrument of trust. In a determinate trust, the trustees have no discretion on the distribution of the trust property.

- Revocable Trust – A type of a trust which can be cancelled by the settlor at any time during his life.

- Irrevocable Trust – A type of a trust which does not come to an end until the term / purpose of the trust as provided under the instrument of trust has been fulfilled.

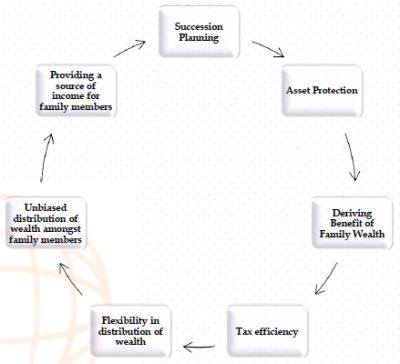

Reasons for creation of a Private Trust

Registration of a Private Trust

In terms of the 1882 Act, a private trust in relation to an immovable property must be registered under the Registration Act, 1908 ("1908 Act"). Registration of a private trust in relation to movable property is optional.

Taxation of Private Trusts

Sections 160 to 164 of the Income Tax Act, 1961 ("1961 Act") sets out the Indian regime for a trust's taxation. Section 160(1) (iv) of the 1961 Act recognizes the trustee of a trust to be its representative for tax purposes. Section 161(1) of the 1961 Act provides for a situation where a trustee could be taxed in a representative capacity "in like manner and to the same extent the beneficiaries would have to pay tax." Section 161(1A) provides for a situation where the trust could be taxed at maximum marginal rate, if the income of the trust includes business profits. Section 164 of the 1961 Act lays that in case the beneficiaries are not identifiable and their share of income is not ascertainable, the trust is to be taxed at maximum marginal rate.

Public Trust

A public trust is set up for the benefit of general public at large. In case of a public trust, the beneficiaries are incapable of being ascertained. In case of dedication of a trust property to a public trust, it is essential that there be an unambiguous and definite intention to part with the trust property for charity for the benefit of the beneficiaries.

There is no central legislation governing the formation and functioning of public trusts in India and such public trust in India are established / created under the state-specific legislation for public trusts adopted in that state and where there are no state-specific legislations, with guidance from the 1882 Act.

The essential ingredients for a public trust are as follows:

- A public trust must be for the benefit of the community / class of community as distinguished from private individuals capable of being ascertained;

- There must be a unambiguous and definite intention to part with the trust property for charity for the benefit of the beneficiaries; and

- The transfer of property in favour of the trust should be by way of an instrument of trust.

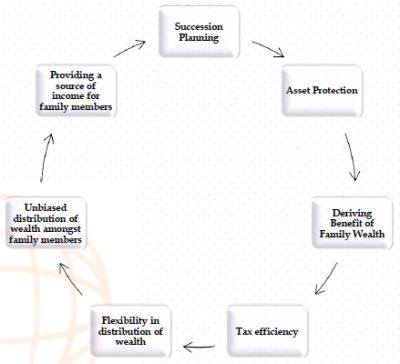

Reasons for creation of a Public Trust:

Registration of a Public Trust

All public trusts irrespective of the state in which they are settled must be registered under the 1908 Act.

Taxation of Public Trust

In terms of Section 11 of the 1961 Act, income of public trust for a religious or charitable purpose are exempt from payment of tax on their income given that such trusts are registered under the 1961 Act in Form 10A.

Section 2 (15) of the 1961 Act defines "charitable purpose" which includes relief of the poor, education, yoga, medical relief, preservation of environment (including watersheds, forests and wildlife) and preservation of monuments or places or objects of artistic or historic interest, and the advancement of any other object of general public utility. However, the advancement of any other object of general public utility shall not be a charitable purpose, if it involves the carrying on of any activity in the nature of trade, commerce or business, or any activity of rendering any service in relation to any trade, commerce or business, for a cess or fee or any other consideration, irrespective of the nature of use or application, or retention, of the income from such activity, unless: (i) such activity is undertaken in the course of actual carrying out of such advancement of any other object of general public utility; (ii) the aggregate receipts from such activity or activities during the previous year do not exceed twenty per cent of the total receipts, of the trust or institution undertaking such activity or activities of that previous year.

Originally published July 5, 2017

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.