- within Employment and HR topic(s)

- with readers working within the Business & Consumer Services industries

The Central Board of Direct Taxes (CBDT) released its 7th Annual Report on the Advance Pricing Agreement (APA) Programme for FY 2024–2025, marking a record year in terms of agreements signed, bilateral cooperation, and tax certainty. The APA Programme continues to reinforce India's position as a stable, transparent, and investor-friendly jurisdiction for resolving transfer pricing disputes and fostering a predictable tax environment for multinational investors.

The APA Programme has emerged as one of India's most successful tax certainty initiatives, providing long-term assurance to both taxpayers and foreign investors. As of March 2025, the CBDT achieved its highest-ever number of APA signings in a single financial year since the programme's inception in 2012, reflecting growing taxpayer confidence and global recognition of India's dispute-prevention framework. Over the past two years, the CBDT has expanded its focus beyond unilateral APAs, actively engaging with treaty partners to conclude a growing number of Bilateral APAs (BAPAs).

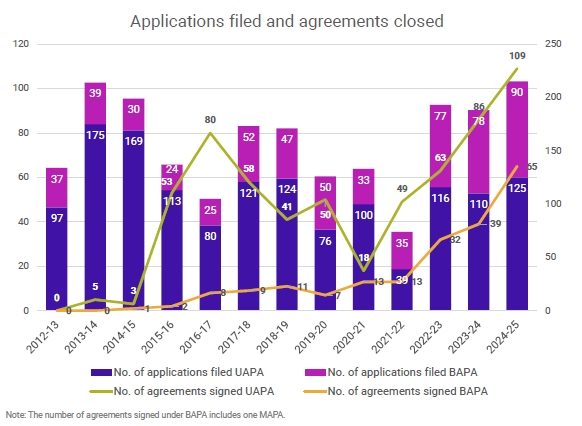

The previous annual report, issued in November 2024, covered data up to FY 2023–2024. The current year stands out not only for the record number of agreements but also for a key milestone, India's first signing of a Multilateral APA (MAPA). In FY 2024–2025, the CBDT signed 174 APAs, including 65 BAPAs (one MAPA), the highest number of bilateral agreements in any year since the programme began. Cumulatively, India has entered into 815 APAs as of March 2025.

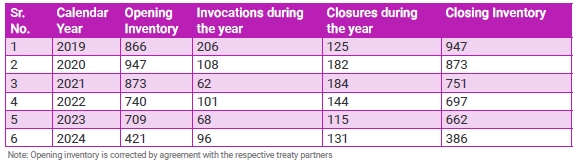

The summary of the number of applications filed and the number of agreements signed (year-wise) is given below for ease of reference:

There has been a notable increase in the number of applications filed compared to previous years. The growing preference for BAPAs reflects rising confidence in achieving swift and efficient resolutions with many of India's treaty partners.

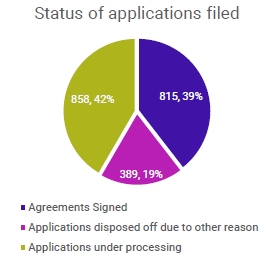

A total of 2,062 applications have been filed in the past 13 years, of which 815 applications have been concluded as of 31st March, 2025. Out of the balance of 1,247 pending applications, 389 applications were disposed off for other reasons leaving 858 applications, which are currently in process.

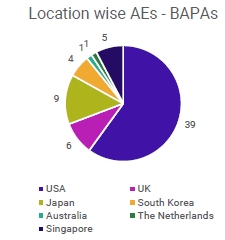

A total of 200 out of the 815 agreements signed are BAPAs (including 1 MAPA), the maximum of which are signed with the USA, followed by the UK and Japan. With the inflicted confidence in the resolutions by India with the treaty partners, a significant increase of 66% was reflected in signing of the BAPAs as achieved in FY 2024-2025.

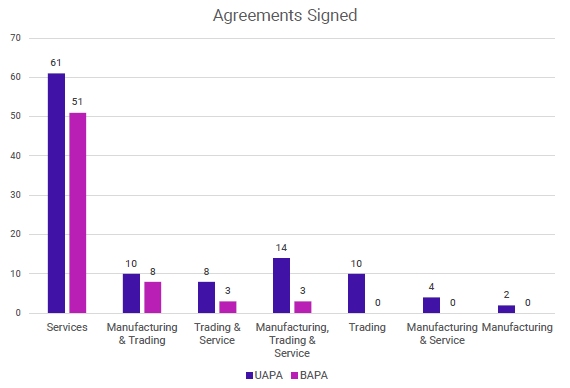

As evident from the data, the majority of agreements concluded relate to entities in the services sector, primarily captive units engaged in software development and IT-enabled services. Other than these transactions, FY 2024-2025 saw an increase in covered transactions pertaining to receipt of management/corporate support services, export/import of goods, royalty/license fees.

Management/corporate support services transaction has also been under the close scrutiny of the tax authorities. With an increase in the agreements been signed for this transaction, may help bring clarity and resolution to the long-standing differences between taxpayers and the authorities.

Notably, out of the 109 of agreement signed, 30 agreements were signed by companies having manufacturing activity, whereas 42 were involved in trading activities. This indicates that across all sectors, the companies are adopting for the APA programme.

Given India's clusters of IT companies in Bengaluru, Hyderabad, Chennai, Gurugram, and Noida, the majority of agreements pertained to the covered transaction of "provision of IT-enabled services," which accounted for approximately 40% of the total unilateral APAs signed. Transactional Net Margin Method (TNMM) has always been the preferred method to conclude the determination of Arm's Length Price (ALP) of the covered transactions.

A significant proportion of applicants entering into unilateral APAs (UAPAs) with the CBDT have chosen to renew and yet again opt for the APA programme. This trend reflects the continued confidence of taxpayers in the APA programme and their clear preference for advance certainty over the uncertainties and costs associated with transfer pricing litigation. In FY 2024-2025 alone, 71 out of the 109 UAPAs signed were renewal agreements.

The average time to conclude agreements during FY 2024–2025 dropped significantly to 35.76 months compared to 45.97 months for UAPAs and 58.90 months versus 63.11 months for BAPAs in the previous year.

The report also briefly touches upon the Mutual Agreement Procedure (MAP) cases resolved during this period.

A significant decline has been observed in the closing inventory in MAP due to India's relationship with treaty partners and the increased trust and communication with the treaty partners.

With over a decade of the APA programme, it has significantly contributed to the Government of India's mission of promoting ease of doing business. Especially for MNEs, having cross border transactions, APA has become a critical mechanism to resolve transfer pricing disputes. Over time, the CBDT has also strengthened its engagement with treaty partners, as reflected in the growing number of BAPAs and the signing of India's first MAPA.

The APA programme has cumulatively brought about certainty for over 4,400 years. The APAs signed in FY 2024-2025 itself brought tax certainty for 970 years. Taxpayers have successfully achieved assurance over transfer pricing matters for durations ranging from five to nine years (including 4 years of roll forward). The collective effect of 815 signed APAs is estimated to have brought about income certainty of approximately INR 35,000 crores. This, in turn, equates to payment of tax of around INR 10,000 crores, achieved without litigation or any ensuing disputes.

The APA Programme has not only led to decongesting of the tax tribunals and higher judiciary of transfer pricing litigation, but it has also provided certainty and ease of business for the Taxpayers as well.

In conclusion, the APA annual report for FY 2024-2025 reflects quite a few achievements of the CBDT this year. The commitment of the government and their ongoing efforts of dealing with the treaty partners as well reflects that they are focused on the benefit of the Taxpayers and providing them with an efficient mechanism for dispute resolutions and tax certainty.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]