- within Employment and HR, Government, Public Sector and International Law topic(s)

Background

Over the years, Related Party Transactions (RPT) have become a key focus area for the board of directors, not only from a tax perspective but also to improve corporate governance.

The frequency at which media reports have been published recently on instances of noncompliances or defaults with respect to RPT approval and disclosures has certainly rung an alarm to many listed entities in India. The regulator, the Securities and Exchange Board of India (SEBI), has also been very strict in imposing financial penalties and issuing stern warnings to the defaulters.

SEBI has made significant amendments to the existing SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (LODR Regulations).

The aim is to strengthen the regulatory norms, address key corporate governance issues, disclosure processes, etc., with respect to the RPTs undertaken by listed entities in India. The amendments were mostly as per the recommendations of the SEBI Working Group (WG).

These amendments shall be applicable in a phased manner, with major amendments coming into effect from 1 April 2022 and some of the amendments with effect from 1 April 2023.

The disclosure obligations of listed entities in relation to the RPT inter-alia include:

- Information to be reviewed by the Audit Committee for approval of RPTs;

- Information to be provided to the shareholders for the consideration of RPTs; and

- Format of reporting of RPTs to the Stock exchange. The provisions of these circulars are effective from 1 April 2022.

The key takeaways of the Securities and Exchange Board of India (LODR) (Sixth Amendment) Regulations 2021 are enunciated in the subsequent paragraphs.

We have covered SEBI notifications dated 9 November 2021, 22 November 2021, 30 March 2022 and 8 April 2022.

Who will be regarded as 'Related Party'?

SEBI LODR borrows the definition of Related Party from Section 2 (76) of the Companies Act, 2013, which is fairly wide and aims to cover relationships on account of common directors, key managerial persons, etc. For example, If the Director of ABC Ltd (a listed entity) is also a director in PQR Pvt Ltd, then ABC Ltd and PQR Pvt. Ltd. would be regarded as the Related Party for the purpose Companies Act as well as SEBI LODR.

Additionally, the previous definition of Related Party under SEBI LODR included entities belonging to the promoter or promoter group of the listed entity and holding 20% or more of the shareholding of the listed entity. This part of the definition has now been amended. With effect from 1 April 2022, any individual or entity forming part of the promoter or promoter group of the listed entity, regardless of shareholding, shall be deemed to be a Related Party.

Furthermore, the amended definition also includes certain deeming fiction, wherein it seeks to cover entity holding equity shares:

- of 20% or more; (with effect from 1 April 2022); or

- of 10% or more (with effect from 1 April 2023)

in the listed entity, either directly or on a beneficial interest basis (as provided under Section 89 of the Companies Act 2013) at any time during the immediately preceding financial year.

All in all, the definition of the related party has been significantly expanded to ensure appropriate disclosure to the relevant stakeholders.

Covered Related Party Transactions

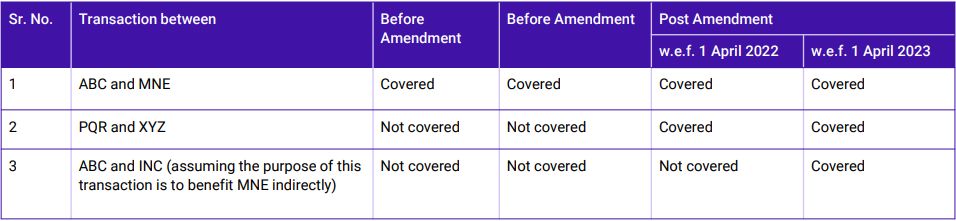

Previously, an RPT meant a transaction between a listed entity and its Related Party. However, the new definition has significantly expanded the scope of RPT. The amended definition of the related party would now include not only the transaction of a listed entity and transactions of the subsidiary with the related party of a subsidiary company. This implies that the listed entity would have to meet the approval and disclosure requirements even with respect to RPTs of a subsidiary company, where the listed entity is not a party.

Additionally, with effect from 1 April 2023, the definition deems certain categories of unrelated transactions also as RPT, i.e., such transactions, the purpose, and effect of which is to benefit a related party of the listed entity or any of its subsidiaries.

For example:

| ABC = Listed entity | MNE = Related party of a listed entity | PQR = Subsidiary of a listed entity | XYZ = Related party of PQR | INC = Unrelated party |

Related Party Transactions not covered/excluded from the definition

Following transactions are excluded from the definition of RPTs (with effect from 1 April 2022):

- Issue of specified securities on a preferential basis, as per SEBI (Issue of Capital and Disclosure Requirements) Regulations 2018.

- Uniform offers to all shareholders of dividend, subdivision or consolidation of securities, rights issue or bonus issue or buy-back of shares.

- Acceptance of fixed deposits by Banks/Non-Banking Finance Companies at the terms uniformly applicable.

Materiality of Related Party Transactions

Previously, a transaction was considered as material during a financial year if it exceeded 10% of the annual consolidated turnover of the listed entity as per the last audited financial statement of the listed entity.

Under the amended definition, RPT would be considered as material if the transaction entered into individually or taken together with previous transactions during a financial year exceeds INR 10 billion or 10% of the annual consolidated turnover of the listed entity as per the last audited financial statement of the listed entity, whichever is lower.

The monetary threshold of INR 10 billion seeks to cover high-value transactions of large corporates, which otherwise may not meet the 10% threshold.

Enhanced role of Audit Committee members

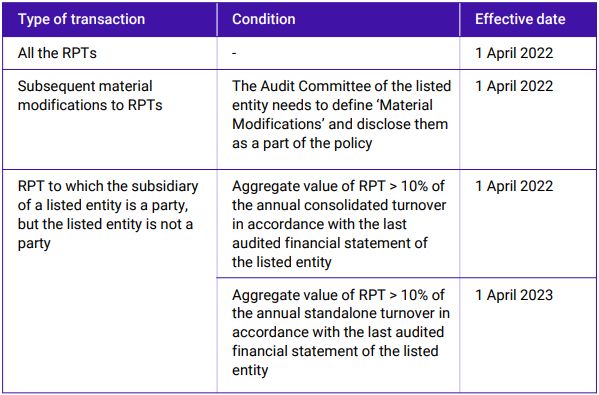

Previously, all RPTs required prior approval from the Audit Committee.

The amended regulations require prior approval of the Audit Committee of the listed entity:

Approval by the Shareholders for material Related Party Transactions

Prior approval of the shareholder of a listed entity is needed for all material RPTs and subsequent material modifications of such transactions.

Related Party Transactions that don't require Audit Committee/Shareholders' approval

The Regulations also clarify that certain RPTs would not require audit committee/shareholder approval as mentioned below:

- Between two wholly-owned subsidiaries of the listed holding company, whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval.

- In addition to the above, approval of the Audit Committee is not required with respect to an RPT if the listed subsidiary is subject to compliance with Regulation 23 and Regulation 15(2) of the LODR Regulations. Also, with respect to the unlisted subsidiary companies of the listed subsidiary, prior approval of the Audit Committee of the listed subsidiary company would suffice.

- Furthermore, the SEBI vide its circular dated 30 March 2022 has clarified that for RPTs that the Audit Committee and Shareholders have approved prior to 1 April 2022 shall not be required to obtain fresh approval from the shareholders.

- It is reiterated that an RPT for which the Audit Committee has granted omnibus approval shall continue to be placed before the shareholders if it is material in terms of Regulations 23(1) of the LODR Regulations.

- SEBI has further reiterated vide its circular dated 30 March 2022 that all existing material-related party contracts or arrangements entered into prior to the date of notification should be placed for shareholders' approval in the first General Meeting after the notification of these regulations. Basis thereon, RPTs approved by the Audit Committee prior to 1 April 2022 and continue beyond the said date and become material as per the revised materiality threshold shall be placed before the shareholders in the General Meeting.

- Also, it has been clarified that the Audit Committee's approval is not required where a transaction is entered into between a holding company and its wholly-owned subsidiary company, whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval.

Documentation/information to be placed before the approving authority

The amended regulations also provide an indicative list of information/documents to be provided by the listed entity to the Audit Committee/shareholder for their review and approval. Apparently, the requirements with respect to the intra-group financing transactions are very exhaustive. The funding entity is required to inform/justify:

- source of funding;

- whether indebtedness was caused;

- end use of the funds, etc.

Also, intangible related intra-group transactions have been assigned a key focus.

Besides, the listed entity is also required to provide justification to the approving authority as to why the proposed transaction is in the interest of the listed entity.

The SEBI, vide its circular dated 30 March 2022, has clarified that with respect to the explanatory statement which is sent to the shareholders for seeking approval with respect to RPT should provide relevant information to the shareholders to enable them to decide whether the terms and conditions of the RPTs are favorable keeping in mind and taking cognizance of the fact pertaining to transactions between unrelated entities.

Enhanced Disclosures of Related Party Transactions

The listed entities will now be required to provide the RPT disclosure every six months in the format specified by SEBI and as per the following timelines:

- Within 15 days (prior to the amendment, it was 30 days) from the date of publication of its standalone and consolidated financial results (with effect from 1 April 2022)

- On the date of publication of its standalone and consolidated financial results (with effect from 1 April 2023)

Furthermore, the SEBI has prescribed a format for reporting the RPTs to the stock exchange. The format is annexed herewith.

Way Forward

With the amended regulations in place, the scope of an RPT has been widened. The transactions undertaken by Indian listed companies and their subsidiaries shall now be under rigorous scanning with various approvals from shareholders and the Audit Committee, which comes with a lot of practical challenges and complications for a lot of listed companies.

Furthermore, the increased burden of approvals to be taken from shareholders and the Audit Committee may make things tedious and complicated due to the linkage to the size of the company in terms of its turnover. SEBI's amendments may also result in a significant increase in the compliance burden of the listed companies with increased compliance costs.

Additionally, the task of the Audit Committee has increased as it has to define 'Material Modification'(this term is not defined under the regulation) and review RPTs even if the listed entity is not the party, but its subsidiary is the party.

At the core of the matter are three important things:

- Robustness of internal process/mechanism to identify and record the RPT

- Confirming the arm's length nature of the RPT

- Documentation and disclosure to the regulator and relevant stakeholders

Various deeming fictions introduced in the definition of related party and RPT are likely to make the compliance process quite challenging. For example, the amended regulation has deemed all transactions with third parties that have the purpose and effect of benefitting a related party as an RPT. Thus, it needs to go through an approval process and disclosure. Presently, there is no clear guidance on the 'purpose and the effect of benefitting.'

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.