- within Tax topic(s)

- in United States

- with readers working within the Retail & Leisure industries

- within Intellectual Property, Strategy and Privacy topic(s)

NEXT GENERATION OF GST REFORMS

The GST Council, in its 56th meeting, unveiled the "next generation of GST reforms" referred to by the Hon'ble Prime Minister in his Independence Day address. Highlights of the recommendations are provided below:

- Intermediary Services – Place of Supply Aligned to Recipient of Supply Section 13(8)(b) to be omitted. Default rule would apply, i.e. Place of Supply to be location of recipient. Resultantly, marketing services, fulfillment services etc. provided to a recipient abroad currently taxable in India would be seen as export of service. Notably, services provided by Global Capability Centers (GCC) were also being disputed as taxable in India on this score by tax offices, denying the export of service determination of such services. The amendment should do away with such disputes.

- Refunds – Key Measures Risk-based Provisional Refunds (from November, 2025). I.e. 90% refund for zero-rated supplies through data-driven risk evaluation. Similarly, 90% refund for inverted duty cases to be rolled out. Removal of low value threshold under Section 54(14) of Rs. 1000 for export shipments.

- Operationalization of GST Appellate Tribunal

Timeline

- Appeals to be accepted before September 2025 end.

- Hearings to commence before December 2025 end.

- Limitation for Backlog appeals: 30 June 2026.

Principal Bench to function as National Appellate Authority for Advance Ruling (NAAAR)

Rate related Recommendations

The GST rate structure is being simplified from 4 tiers to 2 tiers. Standard rate of 18 per cent and Merit rate of 5 per cent being retained – with the 12 per cent slab being abolished. Special De-merit rate of 40 per cent being introduced, with compensation cess being phased out.

Rate related changes being implemented with effect from 22 September 2025.

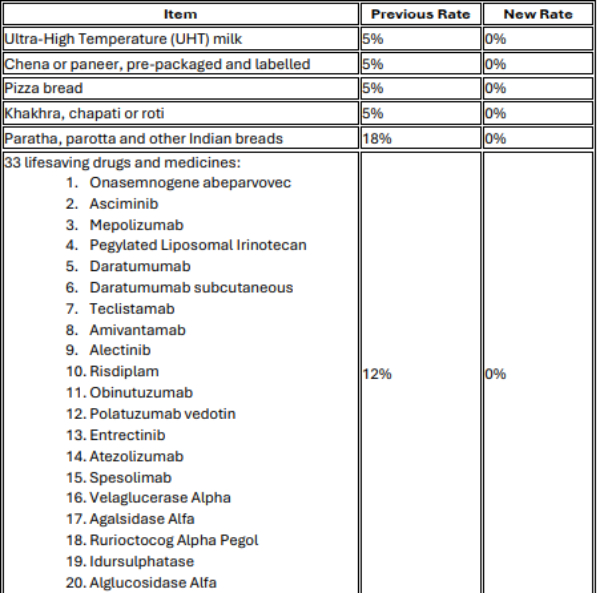

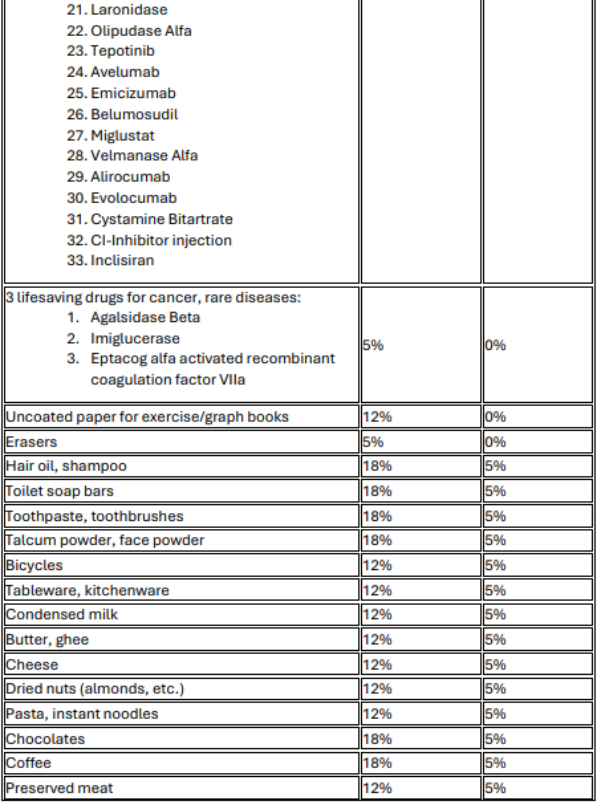

Table of GST Rate related recommendations.

To view the full article clickhere

© 2025, Vaish Associates Advocates,

All rights reserved

Advocates, 1st & 11th Floors, Mohan Dev Building 13, Tolstoy

Marg New Delhi-110001 (India).

The content of this article is intended to provide a general guide to the subject matter. Specialist professional advice should be sought about your specific circumstances. The views expressed in this article are solely of the authors of this article.