- within Technology topic(s)

- in United States

- within Immigration, Law Department Performance and Environment topic(s)

- with readers working within the Metals & Mining, Oil & Gas and Transport industries

Clive Humby, a British Mathematician, had predicted data as the oil of the 21st century, nearly 2 (two) decades ago in 20061. This is perfectly explained in the analogy: raw data has to be processed, just like crude oil must be refined in order to have value. However, the metaphorical mining of data requires a dedicated ecosystem of hardware and software infrastructure, network connectivity, computing power, etc. for storing and processing the data and transmitting the results, at super-fast speeds i.e., DATA CENTRES ("DC").

The DC industry is growing at phenomenal pace with the global DC market projected to rise to more than USD 450 billion industry in 20252 and the Indian market is projected to grow to USD 9.2 billion in 2025.3 India is experiencing a digital wave with more than two decades of robust growth in the information technology and information technology enabled services ("IT-ITES") sectors such as:

- Cloud storage and computing

- Consumer demand for data

- Software-as-a-Service ("SaaS"), Platform-as-a-Service ("PaaS") and Infrastructure-as-a-Service ("IaaS")

- Internet of Things

- Artificial intelligence ("AI") – generative and non-generative models

- Machine Learning methods and models (for e.g. Deep Learning, Anomaly Detection, etc.)

The above sub-sets of the IT-ITES sector have altogether increased the need and demand for DCs, but particularly, it's the advent of AI (especially generative AI) which requires a much more intensive computational infrastructure and higher density facilities. For instance, processing an average ChatGPT query requires approximately 10 times as much electricity than a Google search.4 The graphics processing units (GPUs) used for AI are substantially more powerful than the existing cloud storage and computing functions; with rack densities likely to go from 41 kilowatts (kW) to an astounding 250 kW per rack. This can be demonstrated by the fact that Nvidia's latest AI chips consume up to 300% more power than their cloud computing counterparts. Industry demand will likely double in the next five years5 and for sustaining this AI revolution, all support infrastructures for including power, cooling tech, network connectivity, must constantly evolve and adapt.

Another substantive contributor to the growing need for DCs – Internet of Things ("IoT") technology plus the digitisation and digitalisation of all aspects of life. With millions of the global population having at least 3 to 5 devices with internet-connectivity and 'smart' capabilities, the quantum of data being generated every-day is growing at a pace beyond imagination. India's billion+ populace is consuming data for education, business, social and healthcare as well as leisure, at exponential scales and holds the potential to generate data requiring storage and/or processing, far exceeding what the existing DC infrastructure can handle and holds the potential to revolutionise not only the way we do business but also the way we live.

Apart from technological advancements, an unexpected boost for the DC sector has come in the form of consistent statutory and regulatory measures for data localisation. This includes not only the enactment of the Digital Personal Data Protection (DPDP) Act, 2023 but also the norms prescribed by sectoral regulators like the Reserve Bank of India (RBI), Insurance Regulatory and Development Authority of India (IRDAI), etc.

In fact, the combination of the Digital Privacy and Digital Personal Data Protection Act, 2023 ("DPDP Act") and the Reserve Bank of India (Information Technology Governance, Risk, Controls and Assurance Practices) Directions, 2023 dated November 7, 2023 ("RBI IT Governance Master Circular") – coming into force, has not only increased the need for more DCs but also enforced a tight timeline for establishing local DCs for storing data of Indian citizens.

RIDING THE DIGITAL WAVE:

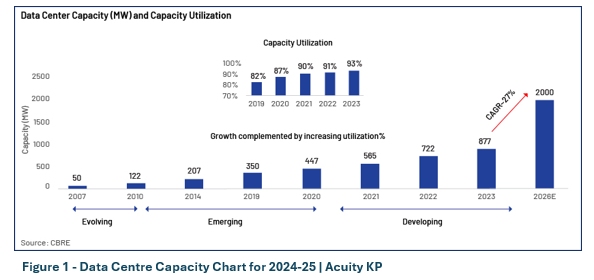

India's journey into the digital world started in the 1990s however, the first commercial DC in the country came up only in 2000 at Vashi, Navi Mumbai and a decade later, the national capacity was only at 122 MW6. The Indian states of Karnataka, Maharashtra and Tamil Nadu had already initiated policy measures to leverage the dot-com bubble with Karnataka being first state to enforce an IT & ITES policy in 1992 and Tamil Nadu and Maharashtra followed through in 1997 and 1998 respectively. States like Karnataka, Maharashtra, Andhra Pradesh (erstwhile) and Gujarat, have been continually coming up with updated IT-ITES policies giving various direct and indirect benefits to inter-alia promote investment in more DCs in their respective states; thereby, consistently maintaining their lead.

The National Informatics Centre (NIC) launched its first data centre in Hyderabad in 2008, followed by additional centres in Pune in 2010 and Delhi in 2011. It was only in 2015, that the Government of India launched the 'Digital India' mission for transforming India into a digital economy and society with the government delivering digital infrastructure – cradle-to-grave digital identity, universally accessible digital literacy initiatives, mobile / phone banking, etc. – as core utility and on demand.

On tracking the evolution of India's DC capacities against the backdrop of State and Central laws and policies, we at Kochhar & Co., noticed that India's DC capacity has taken a quantum leap and grown almost 359% over the last decade, from 207 MW in 2014 to almost 900 MW in 2024.7 It seems that our pre-COVID DC capacity of 447MW is on-track to quadruple to 2000 MW i.e. 2 GW by 2026.8

While DC policies are not boosting the sector to the desired scale or pace, an indirect push is coming from allied legislation. For instance, the RBI IT Governance Master Circular particularly important since it mandates the banking and financial sector as a whole to comply with detailed requirements on inter-alia DC locations, Business Continuity Plans' and Disaster Recovery' (DR) strategies. Now, Regulated Entities should have primary and secondary DCs necessarily located in India, preferably in different seismic zones (to mitigate risks from regional disasters), which are compliant with standards like Tier-3 certification and having data backups – tested regularly for any integrity & security issues. This has significantly increased the demand for geographically dispersed but within India, secure, and compliant DCs within India to meet Regulated Entities' recovery time objectives (RTOs) and recovery point objectives (RPOs), while ensuring data integrity and security. Apart from the sectoral regulators' requirements for the banking and financial services, insurance, etc. industries, the Companies Act 2013 and the DPDP Act also mandate data localisation and have contributed to growth of DCs in India.

The above statutes, however, assist only so far as creating a need and timelines (in some cases) for more DCs being set up in India. Practically however, DC companies face several issues at the planning, construction and execution stages which can be resolved only by more targeted legislations by the Centre and state governments. States like Karnataka, Maharashtra, Andhra Pradesh (erstwhile) and Gujarat which have had up-to-date IT-ITES and DC policies and giving various direct and indirect benefits to inter-alia promote investment in more DCs in their respective states, have emerged as the biggest winners in the DC race.

A comparative chart of policy benefits offered by different Indian states can be seen below:

In stark contrast to these states initiatives, the Centre has been slow to pick up pace in the IT-ITES sector and thus, India is lagging in the DC industry. In our view, the Central Government has fallen behind in introducing uniform policies, improving ease of doing business for DC developers, giving necessary infrastructural support to DCs by way of encouraging industries / sectors like IT hardware and software developers, clean energy companies, etc. To illustrate, the leading states of Karnataka and Maharashtra are on their 5th or 6th IT-ITES policies with heavily nuanced provisions for subsidies, tariff exemptions, etc. whereas the Central Government has merely published a draft policy i.e. Draft Data Centre Policy 2020 ("Draft DC Policy") which is yet to be finalised and enforced. Furthermore, several states have already accorded 'essential service' status under The Essential Services and Maintenance Act 1968, to the IT-ITES industry, (Tamil Nadu and Karnataka since 2013 and Maharashtra since 2015) and permit DCs units (as an essential service) to work 24x7x365 days.

The Telecom Regulatory Authority of India ("TRAI") had also published its consultation paper on 'Regulatory Framework for Promoting Data Economy Through Establishment of Data Centres, Content Delivery Networks, and Interconnect Exchanges in India' on November 18, 2022 ("2022 Consultation Paper") with detailed recommendations for promoting the DC industry. However, the same is languishing in cold storage alongwith the Draft DC Policy. We perceive that this legislative gap is possibly one of the factors preventing India from overtaking other key regional players like Singapore, Malaysia, Japan in the Asia-Pacific (APAC) region. In fact, Singapore continues to be the preferred DC destination despite a 3-year moratorium on new DCs between 2019 to 2022; with Malaysia as the preferred alternate to Singapore.

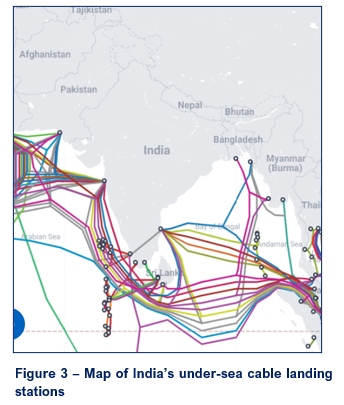

It is pertinent to appreciate that apart from the policy incentives, all coastal states, especially Maharashtra and Tamil Nadu, are the biggest DC investment hubs since they have one of the most critical components for DCs – undersea cable landing stations. Mumbai and Chennai have the highest number of undersea data-cable landing stations in India and are, therefore, critical links for Asia Pacific Region – connecting the Eastern and the Western regions of the globe. Consequently, these 2 metros are the leaders of the country' DC numbers and capacity.

From legal and operational standpoints, we believe that for India to strengthen its favourability and strength as a DC hub, India must push through with a clear and stronger policy environment, conducive to DC developer and operators. We strongly believe that the Indian government should introduce and implement inter-alia the following incentives and measures on priority basis:

FISCAL:

- Providing free of charge Right of Way ("ROW") to DCs as well as telecom service / infrastructure providers, for laying and maintaining optical fibre cables (OFC).

- Lower land conversion / acquisition premium, etc. costs, lease rental subsidies.

- Lower / subsidised power and water tariffs / charges for DCs / DC parks.

- Subsidised water charges for DC / DC Parks.

- GST waivers and/or incentives.

NON-FISCAL:

- Granting 'essential service' status to DC units under the Essential Services Maintenance Act, 1968 ("ESMA") at the national level.

- Giving DC sector 'infrastructure' status, enabling it to avail long-term credit at easier terms.

- Establishing a National Single Window System (NSWS) for central and state level approvals and permissions.

- Modifying existing licensing frameworks to permit DCs to establish captive fibre networks and/or lay their own dark fibre, with necessary regulatory safeguards.

- Permitting DCs / DC parks to obtain power supply from dual power grid networks, consume renewable energy directly from power producers via open access system, without restrictions or additional surcharges.

- Declaring 'water supply to DCs as special purpose, not subject to any interruption.

- Making available redundant / alternate water supply to DCs / DC Parks.

- Exempting DCs / DC Parks from inspections under provisions of industrial acts/laws applicable to factories, shops and commercial establishments.

INFRASTRUCTURAL:

- Creating DC-specific building/construction norms permitting additional FSI, standards for load bearing capacity for high-density racks, fire suppression systems, etc.

- Evolve guidelines for construction, setting up and operation of 'green' DCs and grading them periodically basis pre-established criteria; and incentivise green DCs by linking green rating to further subsidies and incentives.

- Create India-specific standard-based certification for (a) DCs and (b) DC security certification frameworks.

- Encourage setting-up more under-sea CLS along the entire eastern and western coastlines and also waive off ROW charges.

- Setting up a DC Industry Council which will be responsible to draft and implement a DC Incentivisation Scheme (DCIS) as well as DC Readiness Index framework / norms which will grade the different states.

- Encourage participation by India companies (with foreign or domestic investors) in DC developments by fiscal and non-fiscal benefits.

- Establishing DC Economic Zones either by setting-up new zones and/or expanding existing SEZs for the same.

- Promote domestic manufacturing of IT as well as non-IT components of DC development and give incentives for usage of the same, to increase domestic value addition and reduce dependence of imported DC equipment.

In addition to the above, it would be greatly beneficial for Indian DC companies to have domestic certification standards to enable them to reduce the time, costs and effort spent on getting their DC rated and certified. At present, India does not have equivalent globally accepted standards or certification bodies to run parallelly with the EN 50600, the Singapore Standard 584, LEEDS Platinum-certificate, etc. for domestic companies developing DCs / DC Parks. If India evolves its own certifications system with standards, keeping in mind Indian legal and regulatory frameworks, sooner rather than later so the benefits could be reaped in some years. Till such time, domestic DC companies are and will remain bound to comply with foreign standards or apply for certifications to international entities while working with Indian central and state regulatory authorities

On the brighter side, the Skill India Mission has introduced several courses and programs for building a skilled work-force for IT-ITES sector. Although the up-skilling courses do not specifically focus on DCs, their management and AI/machine learning, we note that the Central Government has acknowledged the need for more tailored short and long-term courses to up-skill talent in various aspects of DC functioning, facility management, Cloud security, IoT and AI based data analytics, etc. This sentiment was echoed by Mr. Ashwini Vaishnaw, IT Minister, Government of India at the WEF, Davos, where he announced that 'We have set an ambitious target to equip at least 1 million people with AI tools and skills, enabling them to create use cases and applications that the world needs...' while noting that India currently generates about 1.5 million formal jobs a month.9

India has a natural geographical advantage over other key APAC nations except China, which is waiting to be leveraged. The scope of DC locations has expanded with AI since its training modules do not require low latency like computing, SaaS, IaaS and PaaS, etc. functions. Thus, generative AI DCs that can be located away from land and power-constrained capital cities and enterprise customers, reducing the dependence on vital gateway cities like Mumbai, Chennai, Singapore Tokyo / Seoul.10 apart from AI DCs, India should also take advantage of the needs of its own billion strong population and the burgeoning IT-ITES sector's requirement by expanding and improving our Edge DC capacity. With more GCCs setting up shop in India, we at Kochhar &Co., are of the view that the neglected Edge DC sub-sector is likely to gain traction. As consumer demands in tier-2 and tier-3 cities grow, DC companies will be compelled to move closer to their user base and away from the congested metros. IoT and the increase in 5G devices, will make low-latency Edge DCs an absolute necessity.

The end result of growth of non-metro-AI DCs as well as Edge DCs will be a DC boom in tier 2 and tier 3 cities to serve local users. At that time in the near future, edge computing will transform colocation services by shifting to de-centralised models. A popular trend in the United States of America is the 'micro DC' model which uses modular DC setups directly at network edge locations having small-scale facilities equipped with power backup, cooling systems, and other critical features that enables its installation at any fibre point, such as in parking lots and rooftops.11

India has also picked up on the edge DC trend is steadily gaining traction in the country's expanding digital ecosystem owing to the growing demand for low-latency, real-time data processing and operational agility.

Taking a cue from the 'micro DC' growth in the United States of America, leading Indian DC companies are also developing similar structures such as 'container' DCs and 'pre-fab' DCs being a portable, small-scale DC fully equipped with power backup, cooling systems, fitted within an enclosed structure like a container or a cabin which can be installed and deployed as needed, without large time and cost investments.

India must aggressively promote and incentivise innovation with sustainability, in order to achieve long-term success; here we would benefit by emulating our APAC peers like Japan and Singapore who are making the most of their limited geographical resources by capitalising on their technological advancements. A notable innovation in this regard is the floating DC park ("FDCP") proposed by Keppel, the Singapore conglomerate, as a solution that alleviates the land, water, and energy constraints of traditional DCs by using: (a) spare shipping docks; (b) seawater to cool its servers and avoid use of potable or industrial water; and (c) a hydrogen-powered green energy grid.

We are confident that the power of technology and digitisation can only be truly enjoyed by the entire population when the necessary complementary infrastructure including DCs, is built throughout the country and not just the metros. India must dig deep and strike the virtual gold by tapping into the digital revolution. Data centres are only the beginning; eventually it is AI and other emerging tech which will revolutionise our world. At that time, courtesy the strong IT-ITES and DC set-up will enable India to monetise all data generated, collected, stored and processed by us.

Footnotes

1. Clive Humby at the 2006 Conference of the Association of National Advertisers.

2. https://www.statista.com/outlook/tmo/data-center/worldwide

3. https://www.statista.com/outlook/tmo/data-center/india

5. JLL 2025 Global Data Center Outlook

6. https://www.acuitykp.com/blog/data-centres-in-india-growth-innovation-and-future-trends/

7. CareEdge Ratings Press Release dated May 08, 2024

9. https://www.weforum.org/stories/2025/01/5-key-themes-india-davos-2025/

10. JLL APAC Capital tracker Q4-2024

11. https://www.crn.com/news/data-center/edge-startup-edgemicro-launches-5-new-micro-data-centers

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.