- within Government and Public Sector topic(s)

- in Australia

- with readers working within the Law Firm industries

- within Government and Public Sector topic(s)

- with readers working within the Law Firm industries

- within Government, Public Sector, Privacy and Employment and HR topic(s)

- with Inhouse Counsel

Downstream Investment and Indirect Foreign Investment form part of the legal framework of Foreign Direct Investment ("FDI") in India. Both the terms Downstream Investment and Indirect Foreign Investment are loosely used interchangeably by some people in the industry which creates confusion between the two concepts. In this article, we ascertain the difference between downstream Investment and Indirect Foreign Investment, if any and the consequent different legal compliances.

Downstream Investment

Downstream Investment, as defined in Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 means investment made by an Indian entity with total foreign investment, or an investment vehicle in the capital instruments or the capital of another Indian entity. Essentially, when an Indian company which already has received foreign investment, makes an investment through subscription of equity instruments in another Indian entity, then that investment shall be treated as downstream Investment.

Indirect Foreign Investment

Indirect Foreign Investment means downstream investment received from an Indian entity which is not owned and controlled by resident Indian citizens or is owned or controlled by persons resident outside India ("PROI"). Simply put, if an Indian entity which has received foreign investment and is controlled by PROI (not controlled by resident Indian citizens), makes an investment (through subscription of capital instruments) in an Indian entity, then that investment would be treated as Indirect Foreign Investment.

Ownership of an Indian company means the beneficial holding of more than fifty per cent of the equity instruments of such company. Control means the right to appoint majority of the directors or to control the management or policy decisions, including by virtue of shareholding or management rights or shareholders agreement or voting agreement.

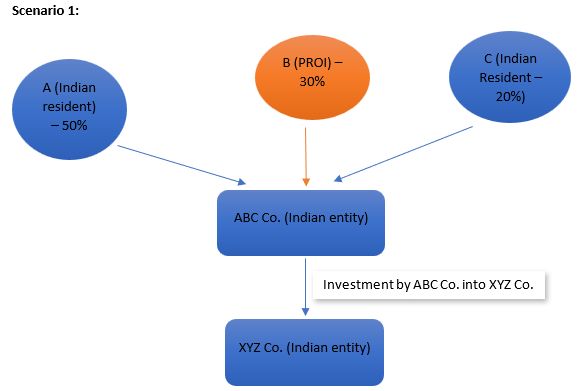

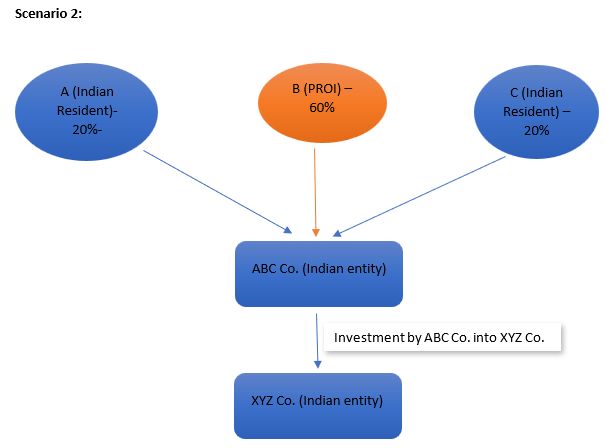

Let us understand the concept of Downstream Investment and Indirect Foreign Investment through illustrations:

Here, A, B, C are the shareholders of ABC Co., an Indian entity. ABC Co. has received FDI from B, a PROI. Therefore, any subsequent investment made by ABC Co. in an Indian entity (XYZ Co. here) will be treated as Downstream Investment.

Here, just like in scenario 1, A, B, and C are the shareholders of ABC Co. ABC Co. has received FDI from B, who is a PROI. However, unlike in scenario 1, the subsequent investment made by ABC Co. into XYZ Co. would be treated as indirect foreign investment. The difference is that ABC Co. is being controlled by a PROI (B, in this case).

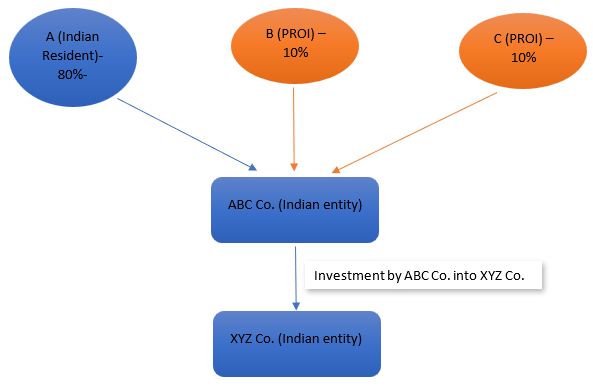

Scenario 3

Following scenarios 1 and 2, the investment made by ABC Co. into XYZ Co. would be treated as a Downstream Investment as the PROIs here (B and C) do not own more than 50% holding in ABC Co. However, the other point of distinction between Downstream Investment and Indirect Foreign Investment is control. In this scenario, let's just assume that B or C jointly or severally have control (right to appoint majority of directors of ABC Co.), then the investment by ABC Co. into XYZ Co. would be treated as Indirect Foreign Investment. On the other hand, if B and C neither own nor control ABC Co., then the investment by ABC Co. would be treated as a Downstream Investment.

Summary

Two major points come out of our above-mentioned analysis:

- All Indirect Foreign Investments are Downstream Investments, but all Downstream Investments are not Indirect Foreign Investments;

- The primary point of difference between Downstream Investment and Indirect Foreign Investment is ownership or control by PROIs in the first layer of an Indian company.

Regulatory compliance Indirect Foreign Investment and Downstream Investment

Indirect foreign investment is treated on par with FDI as per Rule 23(1) of the NDI Rules. Any Indian entity receiving indirect foreign investment shall comply with the entry route sectoral caps, pricing guidelines, and other conditions applicable to FDI.

In the case of a Downstream Investment, the entity making the Downstream Investment must file form DI. For the sake of clarity, an Indian entity need not comply with sectoral caps and pricing guidelines as applicable to FDIs to make a downstream investment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.