INTERNATIONAL JOURNEY OF CUSTOMS

The General Agreement on Tariffs and Trade (GATT), established in 1947 from the 1944 Bretton Woods Conference, played a pivotal role in shaping the modern global trading system by reducing the trade barriers and promoting economic recovery post war.

The World Customs Organisation (WCO), headquartered in Brussels, Belgium, was established in 1952 as Customs Co-operation Council (CCC) and renamed in 1994. The WCO has 183 members countries, representing over 98% of international trade. WCO develops international standards and best practices, conducts research on trade trends, and coordinates efforts to combat cross-border crime through Customs Enforcement Network (CEN). It also conducts research and analysis on emerging trends and challenges in international trade and customs administration, providing guidance to its members. WCO also issues technical advisories from the issues raised by the member countries and generally customs authorities follow such advisories for the determination of the value of imported goods.

CUSTOM'S GOVERNANCE IN INDIA

The governance of Customs in India is overseen by Central Board of Indirect Taxes and Customs (CBIC), which operates under the Department of Revenue, Ministry of Finance, Government of India. CBIC formulates policies on customs and indirect taxes, implements customs laws, and prevents illicit activities like smuggling and tax evasion. Customs is enforced through the field formations of CBIC including Customs Commissionerate's, Central Excise Commissionerate and Directorates. CBIC also represents India in international customs forums and organisations, fostering cooperation and collaboration on customs matters with other countries. CBIC has launched the Single Window Interface for Facilitating Trade (SWIFT) for electronic customs submissions and automated systems like the Indian Customs EDI System (ICES) and Indian Customs Risk Management System (ICRM) to enhance efficiency.

To ensure compliance with the Customs laws, CBIC conducts audits and inspections of customs records and premises. It also conducts anti-smuggling operations to prevent the illicit movement of goods across borders and protect national security and economic interests.

Following are the broad categories of advisory and litigation issues that arise under Customs:

- Customs Valuation

Customs valuation is a subject matter of dispute and major challenges are found in determining the transaction value of imported goods, especially in cases involving related parties, royalties, or the inclusion of additional costs. Customs authorities may question the transfer pricing arrangements between related entities, leading to valuation disputes. - Classification issues

Classification issues may arise under harmonised system of nomenclature, impacting the applicable customs duties and tariffs. Further issues related to the origin of goods can lead to disputes regarding preferential tariff treatment, especially in cases involving free trade agreements or rules of origin requirement.

Other areas may involve anti-dumping and countervailing duties, safeguard measures, seizures and penalties, dispute resolution etc.

RULES OF CUSTOMS VALUATION

Customs valuation refers to the process of determining the customs value of imported goods for the assessment of customs duties and taxes. WCO provides guidelines and principles for customs valuation through its valuation agreement, also known as the agreement on implementation of Article VII of the GATT 1994. The Customs Valuation (Determination of Price of Imported Goods) Rules, 2007 ('Indian Customs Valuation Rules') are based on GATT 1994. The Customs Act, 1962 provides for the transaction value to be the value of imported goods when they are imported from an unrelated party and the price of the goods is not impacted by such relationship.

WCO valuation agreement consists of six main Articles and Indian Customs Valuation Rules are summarised to depict how customs valuation rules align with WCO valuation agreement:

| WCO Article | Indian Customs Valuation Rule | Valuation Method |

|---|---|---|

| Article 1 Transaction Value | Rule 3: Transaction Value | It provides the primary method for determining the customs value, based on the transaction value of imported goods i.e. the price actually paid or payable for the goods when sold for export to the country of importation. The transaction value is acceptable only in cases where the relationship between the parties has not influenced the value. |

| Article 2 Identical goods | Rule 4: Value of Identical Goods | For imported goods, the value of identical goods is to be adopted. Such goods are defined to be the same with respect of physical characteristics, quality, and reputation, produced in the same country by the same person at the same commercial levels and in the same quantity |

| Article 3 Similar Goods | Rule 5: Value of Similar Goods | For imported goods, the value of similar goods is to be adopted. Similar goods are not alike to the imported goods but have like characteristics and component materials, perform the same functions and are commercially interchangeable, produced in the same country by the same or different persons, and imported into India at or about the same time |

| Article 4 Deductive Value | Rule 7: Deductive Value Method | Where the transaction value cannot be determined, it allows the use of the deductive value method using sale price and deductions on account of various factors involved. |

| Article 5 Computed Value | Rule 8: Computed Value Method | It provides for the valuation of imported goods based on cost of material and overheads involved. This method is resorted when the value cannot be determined based on transaction or deductive value method. |

| Article 6 Fall back method | Rule 9: Residual Method | It allows customs administrations to use reasonable means consistent with the principles and general provisions of the agreement to determine the customs value when none of the above methods can be applied. |

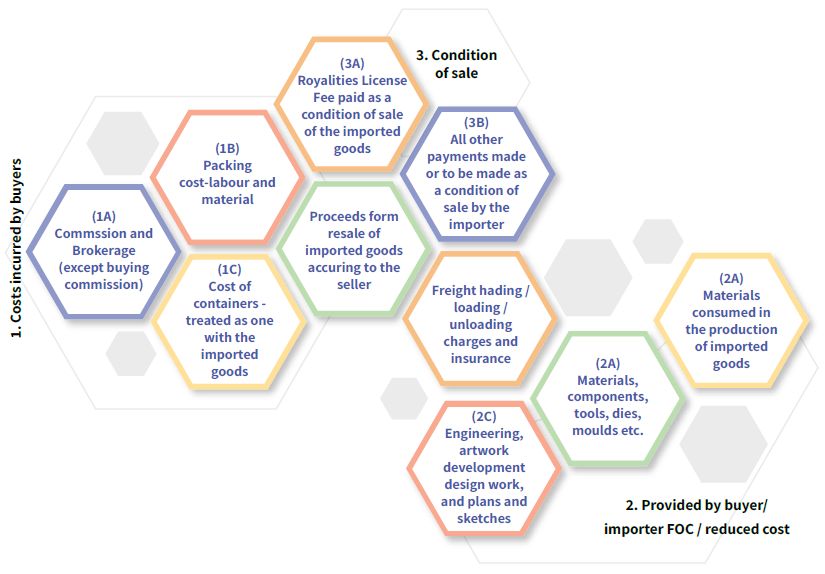

Further, Customs Valuation (Determination of Price of Imported Goods) Rules, 2007 also provides for Rule 10, which in addition to the value determined sequentially in accordance with the above rules, provides for including the specific expenditures into the value of the imported goods.

SPECIAL VALUATION BRANCH

India's Customs Department houses a specialized unit known as the Special Valuation Branch (SVB) for investigating and determining the assessable value of transactions involving related parties or special circumstances. SVB promotes transparency in the customs valuation, reducing the risk of disputes and ensuring compliance with international trade regulations. It helps prevent undervaluation or misdeclaration of imported goods, ensuring fair trade practices.

The SVB investigates related party imports and complex situations requiring adjustments in the declared transaction value, including instances of payment of royalties, license fees [as specified in Rule 10(1)(c)], and proceeds from subsequent sales [as specified in Rule 10(1)(d)/ 10(1)(e)] by the importer to the foreign seller or any other person at the behest of such foreign seller. CBIC vide Circular No. 05/2016-Customs dated 09.02.2016, revamped the entire SVB process. The Circular now provides a detailed guideline for the investigation of related party imports and other cases by SVB.

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.