- within Insolvency/Bankruptcy/Re-Structuring, Criminal Law, Government and Public Sector topic(s)

- with readers working within the Law Firm industries

Introduction

Part III of the Insolvency and Bankruptcy Code, 2016 ('Code') deals with insolvency resolution & bankruptcy of individuals and partnership firms. This part was brought into force on 01.12.20191. Within this part, Chapter III (ss. 94 to 120) lays down the provisions relating to the insolvency resolution process, whereas Chapters IV and V (ss. 121 to 178) lay down the provisions relating to the bankruptcy process.

For individuals such as personal guarantors ('PGs') to corporate debtors ('CDs'), as defined under s. 5(22) of the Code, the adjudicating authority ('AA') for insolvency and bankruptcy proceedings is the National Company Law Tribunal ('NCLT')2. Appeals therefrom lie to the National Company Law Appellate Tribunal ('NCLAT')3, with the Hon'ble Supreme Court serving as the final appellate authority4. In contrast, for other individuals and partnership firms under Part III, the AA is the Debt Recovery Tribunal ('DRT')5, with appeals before the Debt Recovery Appellate Tribunal ('DRAT')6, and the Hon'ble Supreme Court being the final authority7.

The relevant framework governing the insolvency resolution process of PGs comprises the Insolvency and Bankruptcy Board of India ('IBBI') (Insolvency Resolution Process for PGs to CDs) Regulations, 2019 ('PG I-Regulations') and the Insolvency and Bankruptcy (Application to AA for Insolvency Resolution Process for PGs to CDs) Rules, 2019 ('PG I-Rules'). Similarly, the bankruptcy process of PGs is governed by the IBBI (Bankruptcy Process for PGs to CDs) Regulations, 2019 ('PG B-Regulations') and the Insolvency and Bankruptcy (Application to AA for Bankruptcy Process for PGs to CDs) Rules, 2019 ('PG B-Rules').

In Mudraksh Investfin(2025)8, the NCLAT clarified that for PGs, the threshold amount for initiating personal insolvency proceedings is Rs. 1 crore, which is at par with that applicable to CDs9. The contract of guarantee, through which a PG becomes a surety for a CD, is a contractual arrangement governed by Chapter VIII of the Indian Contract Act, 1872. However, once the PG defaults, the insolvency or bankruptcy proceedings are initiated under the Code.

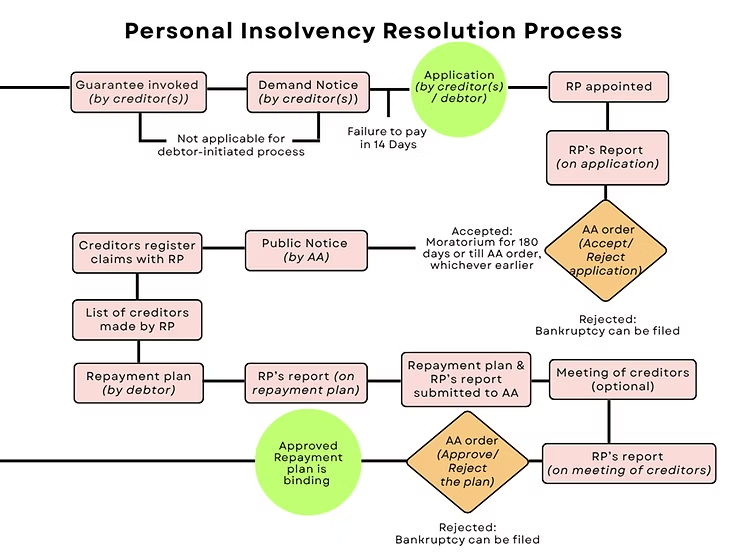

Insolvency Resolution Process

I. Initiation & Pre-admission

When a CD defaults, the creditor may invoke the personal guarantee and call upon the PG to discharge the CD's liability to the extent specified in the contract of guarantee. If the PG fails to honour the invocation, it constitutes a default by the PG. The creditor must then serve a demand notice10, and if the debtor fails to make payment within fourteen days11, the creditor can file an application under s. 95 of the Code to initiate the insolvency process.

In Mr. Deepak Kumar Singhania(2025)12, the NCLAT observed that while a demand notice is a statutory prerequisite, it does not by itself amount to invocation of the guarantee, which must be carried out in accordance with the terms of the contract of guarantee. Similarly, a PG may also file an application to initiate his own insolvency under s. 94 of the Code, provided he is not already undergoing insolvency or bankruptcy and is not an undischarged bankrupt. Further, in Vijender Antil(2025)13, the NCLAT held that an application filed by a PG can be rejected if he lacks the financial capacity to bear the expenses of the process or to propose a viable repayment plan.

The filing of an application - whether by the creditor or by the PG - automatically triggers an interim moratorium under s. 96, which continues until the application is either admitted or rejected by the NCLT/AA. During this period, no legal proceedings can be initiated or continued in respect of any debt. In Brij Bhushan Singal(2022)14, the Delhi High Court held that where there are multiple guarantors for a CD, the liability of each guarantor is independent. The creditor's failure to recover from one guarantor does not bar recovery from another, and the interim moratorium applicable to one guarantor does not automatically extend to co-guarantors.

Once an application for insolvency resolution is filed, the AA directs the IBBI to nominate a Resolution Professional ('RP'), who is then appointed by order of the AA. However, where the application is filed by the creditor or debtor through an RP, the AA seeks confirmation from the IBBI to ensure that no disciplinary proceedings are pending against the proposed RP before making the appointment15. The RP then examines the application, submits a report, and recommends to the AA whether it should be admitted or rejected.

In Iqbal Jumabhoy(2025)16, the NCLAT clarified that the AA is not bound by the RP's recommendation, and the decision to admit or reject the application rests solely with the AA. The AA must pass its order within fourteen days from the submission of the RP's report. Upon rejection, the creditor(s) or the PG may proceed to file for bankruptcy under Chapter IV of Part III17.

II. Post-admission & Preparation of Repayment Plan

Upon admission, a final moratorium comes into effect for a period of 180 days, or until the AA passes an order on the repayment plan, whichever happens earlier18. During this period, creditors are barred from initiating or continuing any legal proceedings, thereby providing the PG a breathing space to enable effective resolution of insolvency. This aligns with the core objective of the Code, which is to promote timely and orderly resolution. In Anil Kumar(2025)19, the NCLAT clarified that the 180-day moratorium period is mandatory, and once it expires, it cannot be extended by the AA.

Following admission, a public notice is issued by the AA inviting creditors to file their claims20. These claims are submitted to the RP21, who verifies and compiles them into a list of creditors22. The enlisted creditors are then entitled to participate in the subsequent stages of the process.

Unlike the corporate insolvency resolution process ('CIRP'), this process does not involve a committee of creditors ('CoC'), and the creditors are not categorised as financial or operational creditors. The PG, in consultation with the RP, prepares a repayment plan setting out the manner in which debts are to be restructured or repaid. The plan may also authorize the RP to manage the PG's funds or assets if necessary23.

In Aarti Singal (2025)24, the NCLAT held that if, during the CIRP of the CD for whom the PG had given a guarantee, a resolution plan was approved and only part of the debt was paid, the balance debt can still be pursued against the PG. The exact liability of the PG, however, must be determined at the repayment plan stage.

The Regulations specify the mandatory and optional contents of the repayment plan. The plan must, inter alia, include details of the repayment schedule, sources of funds, excluded assets and debts of the guarantor, and a minimum family budget that allows the guarantor and their dependents to meet reasonable living expenses during the repayment period25. In Naseer Ahmed (2025)26, the NCLAT held that failure by a PG to file a repayment plan entitles the creditors to initiate bankruptcy proceedings under Chapter IV of Part III of the Code.

III. Creditor Approval

After the plan is prepared, the RP submits a report on the repayment plan, along with a copy of the plan, to the AA. The report must state whether the plan complies with applicable laws and whether a meeting of creditors is required27. Accordingly, holding a meeting of creditors is not mandatory, and the RP may specify reasons for dispensing with it.

However, if a meeting is deemed necessary, the RP issues a notice to all creditors, enclosing the plan and the RP's report28. During the meeting, creditors vote to approve, reject, or modify the repayment plan. Any modification, however, requires the consent of the PG29. Creditors may also vote by proxy, by appointing an individual who is not an associate of the PG to attend and vote on their behalf.

The RP determines each creditor's voting share in proportion to the debt owed to them30. Secured creditors may vote during the meeting, but if they choose to do so, they must temporarily forgo their right to enforce security while the repayment plan remains in force. Alternatively, if they wish to retain that right, they may vote only in respect of the unsecured portion of their debt31.

Approval of the repayment plan requires a majority of more than three-fourths in value of the creditors present and voting32. The RP then prepares a report of the meeting, indicating whether the plan was approved or rejected, and provides copies to all stakeholders and to the AA33. Based on this report, the AA passes an order approving or rejecting the repayment plan34. If the plan is rejected, creditors are entitled to file for bankruptcy35.

IV. Implementation & Discharge

The RP supervises the implementation of the repayment plan, ensuring that the PG complies with its terms, and may seek directions from the AA whenever required36. Upon full implementation, the RP submits a completion report to the AA and notifies all stakeholders bound by the plan37.

If the plan ends prematurely – whether due to default or non-implementation – the creditors may apply for bankruptcy38. In Tummala Sri Ganesh (2024)39, the NCLAT clarified that partial or initial compliance with a repayment plan does not excuse subsequent defaults; once a default occurs, the repayment plan stands prematurely terminated by operation of law.

After the plan's successful completion, the RP applies to the AA for a discharge order for the PG, which releases the PG from all debts covered by the plan. A repayment plan may also provide for an early discharge, subject to the conditions stipulated in the plan40.

Throughout the process, the RP plays a critical role in administering the resolution, monitoring repayments, conducting creditor meetings, and reporting any non-cooperation to the AA.

In essence, the personal insolvency resolution process provides a structured framework enabling PGs to negotiate repayment, obtain protection from immediate enforcement, and collaborate with creditors, while ensuring creditor rights remain safeguarded in case of default or plan failure.

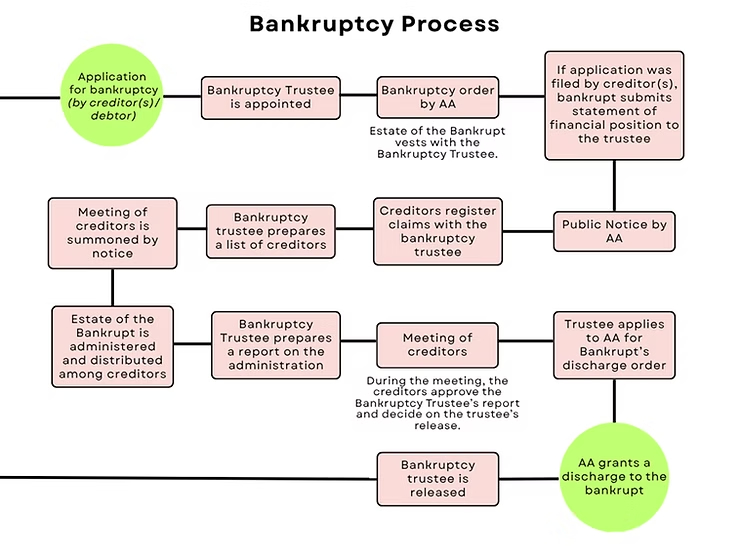

Bankruptcy Process

I. Initiation & Bankruptcy Order

The bankruptcy process may be triggered at various failure points during the insolvency resolution process. It may commence if the AA passes an order rejecting the insolvency application, rejecting the repayment plan, or determining that the plan has ended prematurely due to non-implementation or delay41. As held in Naseer Ahmed (Supra), it can also begin if the PG fails to file a repayment plan.

In such cases, the creditor(s) or the PG himself, as the case may be, may file an application for bankruptcy within three months of such order of the AA42. In Bharath Chandran(2025)43, the NCLT held that this three-month period is directory rather than mandatory, and delay may be condoned if it does not prejudice the rights of the parties involved.

An insolvency professional may be proposed as the bankruptcy trustee in the application itself44. The AA appoints the proposed trustee after confirmation from the IBBI that no disciplinary proceedings are pending against him. If no name is proposed, the AA appoints a trustee nominated by the IBBI45. The trustee acts independently and is required to administer the bankrupt's estate in a fair and impartial manner, under the supervision of the AA.

Upon filing the bankruptcy application, an interim moratorium automatically takes effect on all legal actions and proceedings in respect of the PG's properties, and no new proceedings may be initiated during this period. The interim moratorium continues until the AA passes the bankruptcy order46, and any disposition of property made during this period is void47. Once the bankruptcy order is passed, the bankruptcy is deemed to have commenced and continues until the bankrupt is formally discharged by the AA48.

II. Post-Order Process & Distribution of the Bankrupt's Estate

Upon commencement of bankruptcy, and until discharge, certain disqualifications and restrictions are imposed on the bankrupt (PG). For instance, a bankrupt cannot act as a director of any company, cannot travel abroad without the permission of the AA, cannot hold or contest public office, and is disqualified from acting as a public servant, among other statutory restrictions49.

The estate of the bankrupt vests with the bankruptcy trustee, who manages and distributes it among the creditors50. The estate includes all properties belonging to or vested in the bankrupt as on the bankruptcy commencement date, whether movable or immovable. However, it excludes property held by the bankrupt in trust for others and properties defined as 'excluded assets' under s. 79(14) of the Code51.

Where the bankruptcy order is passed on an application made by a creditor, the bankrupt is required to submit a statement of financial position to the trustee52. This statement provides a clear picture of the assets and liabilities of the bankrupt to the trustee's assessment.

The AA then issues a public notice inviting claims from creditors, who register their claims with the trustee53. The trustee prepares a list of creditors and convenes a meeting of creditors, during which a CoC is established. Only the creditors listed by the trustee are entitled to vote in proportion to their respective voting shares. Voting may take place in person, electronically, or through a proxy, as specified in the notice 54.

The bankruptcy trustee has wide powers under the Code: he may hold property, enter into contracts, institute or defend legal proceedings, and take necessary actions to manage the estate. He may also sell assets, redeem pledged or hypothecated property, or transfer shares held by the bankrupt 55. However, for certain major actions, such as running the business, mortgaging property, or settling creditor claims, the trustee must obtain prior approval of the creditors56.

The trustee may further apply to the AA to declare any transaction entered into by the bankrupt during the prescribed look-back period as void if it is found to be fraudulent, undervalued, or preferential in nature 57.

Generally, the trustee is responsible for auctioning the bankrupt's properties to realize value for creditors. However, where the property is perishable or likely to lose value due to delay, the trustee may conduct a private sale. Participation in such sales is subject to restrictions – certain persons are prohibited from purchasing the property without prior approval of the AA. These include the trustee or any professional appointed by him, any creditor or associate of the bankrupt, and any company in which the bankrupt or a creditor is a promoter or director, among others 58.

The creditors are required to submit details and proof of their debts, including any security interests held against such debt 59. The trustee verifies the claims, sets off any mutual dues between the bankrupt and the creditors, and distributes the available funds accordingly60.

The Code prescribes a waterfall mechanism for the distribution of proceeds in personal insolvency, similar to that applicable in corporate liquidation. Under this hierarchy, expenses incurred by the bankruptcy trustee are paid first, followed by dues owed to workers and employees, then secured creditors, government dues, and finally, unsecured creditors61.

III. Completion & Discharge

Once the bankrupt's estate has been distributed among the creditors, the bankruptcy trustee prepares a final report on the administration and convenes a meeting of the CoC to present the same. The CoC reviews and approves the report and determines whether the trustee may be released from his duties62.

Thereafter, the trustee applies to the AA for a discharge order for the bankrupt, marking the completion of the bankruptcy process. This process must ordinarily conclude within one year from the date of the bankruptcy order, or within seven days of the CoC approving the completion of the administration of the estate, whichever occurs earlier63. Upon the passing of the discharge order, the PG is released from all restrictions and ceases to retain the legal status of a bankrupt64.

In Mr. Anil Syal(2025)65, the NCLAT held that the trustee has a statutory duty to apply for a discharge order within one year from the commencement date. This duty cannot be deferred or made contingent upon the consent of the CoC or any creditor. Where the trustee fails to perform this obligation, the bankrupt is entitled to approach the AA to bring such lapse to its notice and seek appropriate directions for discharge.

Once all processes detailed above are complete, a trustee who has concluded administration of the estate stands released from his duties from the date on which the CoC approves his final report on administration 66.

The Insolvency & Bankruptcy Code (Amendment) Bill, 2025

The Insolvency & Bankruptcy Code (Amendment) Bill, 2025 ('Bill') was introduced in the Lok Sabha on 12.08.2025. The Bill, which has been referred to a Select Committee of the Lok Sabha67, seeks to facilitate ease of doing business and bring the Code into closer alignment with its objectives of promoting resolution, enhancing procedural efficiency, and preventing misuse of the insolvency framework. Some of the key amendments related to PGs are discussed below:

- The Bill proposes to remove the applicability of the interim moratorium to insolvency proceedings against PGs68. This amendment is aimed at curbing the misuse of the interim moratorium, which was often invoked as a tactic to stall recovery and enforcement actions.

- It also introduces monetary penalties ranging from Rs. 1 lakh to Rs. 2 crores for frivolous or vexatious personal insolvency applications, in order to discourage deliberate delays and procedural abuse69.

- Further, the Bill expressly provides that bankruptcy proceedings will automatically follow if a PG fails to submit a repayment plan, thereby codifying the principle recognized in multiple judicial pronouncements, including Naseer Ahmed (Supra), to prevent stalled proceedings70.

- In cases where a repayment plan is submitted, the Bill makes it mandatory for the RP to convene a meeting of creditors to discuss and consider the plan71.

- Additionally, the Bill proposes a new provision to render transactions intended to defraud creditors avoidable, thereby strengthening the Code's deterrent mechanism against fraudulent conduct72.

Overall, these amendments seek to streamline the personal insolvency and bankruptcy framework, enhance accountability among PGs, and ensure procedural fairness while balancing the interests of both debtors and creditors.

Footnotes

1 vide Notification No. S.O. 4126(E) dated 15.11.2019

2 As per s. 60 IBC

3 As per s. 61 IBC

4 As per s. 62 IBC

5 As per s. 179 IBC

6 As per s. 181 IBC

7 As per s. 182 IBC

8 Mudraksh Investfin Pvt. Ltd. v. Gursev Singh, NCLAT New Delhi, CA(AT)(I)-09/2025-NCLAT

9 The threshold for CDs has been defined as per s. 4 IBC r/w Notification No. S.O. 1205(E) dated 24.03.2020

10 As per Rule 7(1) of the PG I-Rules

11 As per s. 95(4)(b) IBC

12 State Bank of India v. Mr. Deepak Kumar Singhania, Company Appeal (AT) (Insolvency) No. 191 of 2025

13 Vijender Antil v. Phoenix ARC Pvt. Ltd. & Ors., Comp. App. (AT) (Ins) No. 2203 of 2024

14 Axis Trustee Services Ltd. v. Brij Bhushan Singal & Anr., 2022 SCC OnLine Del 3634

15 As per s. 97 IBC

16 Iqbal Jumabhoy v. Shri Manoj Kumar and Anr., Company Appeal (AT) (CH) (Ins) No. 29/2025 IA No. 115/2025

17 As per s. 100 IBC

18 As per s. 101 IBC

19 Anil Kumar v. Mukund Choudhary, Company Appeal (AT) (Insolvency) No. 38 of 2025

20 As per s. 102 IBC

21 As per s. 103 IBC

22 As per s. 104 IBC

23 As per s. 105 IBC

24 Aarti Singal v. SBI & Anr., 2025 SCC OnLine NCLAT 775

25 As per Regulation 17 of the PG I-Regulations

26 Naseer Ahmed v. Ravindra Beleyur (RP), Company Appeal (AT) (CH) (Ins) No. 232/2025 (IA Nos. 666, 667 & 668/2025) with Company Appeal (AT) (CH) (Ins) No. 234/2025 (IA Nos. 670 & 671/2025) with Company Appeal (AT) (CH) (Ins) No. 236/2025 (IA Nos. 673 & 674/2025)

27 As per s. 106 IBC

28 As per s. 107 IBC

29 As per s. 108 IBC

30 As per s. 109 r/w Regulation 11`of the PG I-Regulations

31 As per s. 110 IBC

32 As per s. 111 IBC

33 As per s. 112 IBC r/w s. 113 IBC

34 As per s. 114 IBC

35 As per s. 115 IBC

36 As per s. 116 IBC

37 As per s. 117 IBC

38 As per s. 118 IBC

39 Tummala Sri Ganesh v. State Bank of India and Anr., 2024 SCC OnLine NCLAT 1116

40 As per s. 119(2) IBC

41 As per s. 121(1) IBC

42 As per s. 121(2) IBC

43 Kerala Financial Corporation v. Bharath Chandran, "IA(IBC)/117/KOB/2025 in IA(IBC)/114/KOB/2025 in CP(IBC)/24/KOB/2022 & IA(IBC)/121/KOB/2025 in IA(IBC)/118/KOB/2025 in CP(IBC)/23/KOB/2022

44 As per s. 122(2) r/w s.123(4) IBC

45 As per s. 125 IBC

46 As per s. 124 IBC

47 As per s. 158 IBC

48 As per s. 126 r/w s.127 IBC

49 As per s.140 r/w s.141 IBC

50 As per s. 128 IBC

51 As per s. 155 IBC

52 As per s. 129 IBC

53 As per s. 130 r/w s. 131

54 As per Regulation 21(4) of the PG B-Regulatons

55 As per s. 152 IBC

56 As per s. 153 IBC

57 As per s. 164 r/w s. 165 IBC

58 As per regulation 27 of the PG B-Regulations

59 As per s. 172 IBC

60 As per s. 173 IBC

61 As per s. 178 IBC

62 As per s. 137 IBC

63 As per s. 138 IBC

64 As per s. 139 IBC

65 Mr. Anil Syal v. Mr. Ajay Gupta and Anr., Company Appeal (AT) (Insolvency) No. 523 of 2025 & I.A. No. 1993 of 2025

66 As per s. 148 IBC

67 Press Information Bureau, Government of India, "Monsoon Session of Parliament adjourns sine die," Ministry of Parliamentary Affairs, August 21, 2025.

68 As per proposed s. 96(4) IBC Amendment Bill, 2025

69 As per the proposed s. 183A IBC Amendment Bill, 2025

70 As per the proposed s. 106(1A) r/w s. 121 IBC Amendment Bill, 2025

71 As per the proposed s. 106(3A) IBC Amendment Bill, 2025

72 As per the proposed s. 164A IBC Amendment Bill, 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.