- in United States

- within Employment and HR, Corporate/Commercial Law, Government and Public Sector topic(s)

BACKGROUND

The Ministry of Finance has recently notified amendments to the Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 ('NDI Rules') vide the Foreign Exchange Management (Non-Debt Instruments) (Fourth Amendment) Rules, 2024 ('Amendment'). The key amendments are summarized below:

SWAP OF SHARES

1.1. Before the amendment1:

- Indian companies were permitted to issue equity instruments to persons resident outside India against the swap of equity instruments of another Indian company.

- Thus, the issue of shares by an Indian company to a non-resident against acquisition of shares of a Foreign company was not permitted.

1.2. Amendment1:

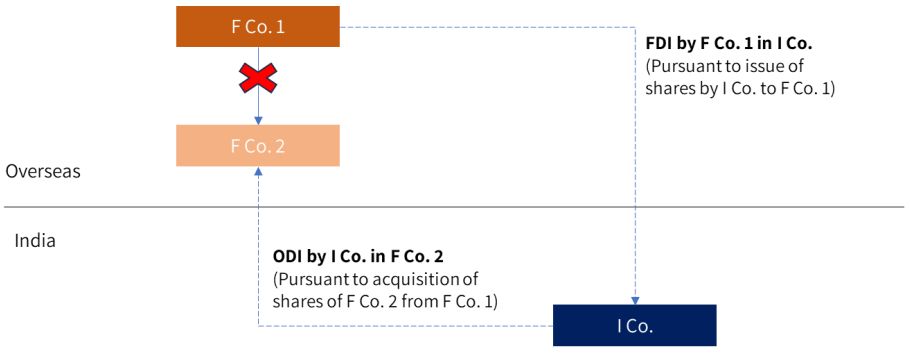

a) The amendment now allows Indian companies to issue equity instruments to persons resident outside India against the swap of equity capital of a foreign company, popularly known as FDI – ODI swap.

Illustration:

Permissible swap prior to the amendment

- Prior to the amendment, I Co. 2 could issue shares to F Co. only for acquiring shares of anotherIndian Company, I Co. 1.

Permissible swap after the amendment

- After the amendment, I Co. can issue shares to F Co. 1 for acquiring shares of another Foreign Company, F Co. 2. (Popularly known as FDI – ODI swap).

b) Further, Rule 9A has been added which permits transfer of equity instruments of an Indian company between a person resident in India and a person resident outside India by way of:

- swap of equity instruments of an Indian company; and

- swap of equity capital of a foreign company in compliance with Foreign Exchange Management (Overseas Investment) Rules, 2022 ('OI Rules').

Aurtus Comments:

- This is a welcome amendment which will provide more flexibility in case of cross border structuring.

- Further, it may be noted that the new ODI regime permits Indian entities to undertake ODI by way of swap of securities. So, the amendment to the NDI Rules now aligns its provisions with those under the OI Rules wherein an Indian company is permitted to undertake ODI by way of swap of securities.

DOWNSTREAM INVESTMENT

2.1. Before the amendment:

- Investment made by an Indian entity which is owned and controlled by NRI on a non-repatriation basis was not considered for calculation of indirect foreign investment while analysing Downstream Investment. However, the NDI Rules were silent with respect to investment made by NRI / OCI on a non-repatriation basis through a company, a trust and a partnership firm, incorporated outside India which is owned and controlled by such NRI / OCI.

2.2. Amendment:

- Investments made by an Indian entity which is owned and controlled by NRI or OCI, including a company, a trust and a partnership firm, incorporated outside India and owned and controlled by NRI or OCI, on a non-repatriation basis, shall not be counted towards indirect foreign investment while analysing Downstream Investment.

Aurtus Comments:

- Currently, direct and indirect investment on non-repatriation basis by NRIs is considered akin to domestic investment.

- The amendment would provide consistency in the current provisions whereby henceforth investments made by NRI and OCI, including through companies, partnerships, and trusts incorporated outside India, on a non-repatriation basis, will no longer be counted towards indirect foreign investment

CONCLUSION

- Overall, the amendments made in the NDI Rules especially with respect to facilitating cross border share swaps and providing clarity on Downstream Investments are a welcome move. These amendments emphasize the Government's commitment to creating a foreign investor friendly environment, with continued measures to simplify rules and promote 'Ease of doing Business' in India.

Footnote

1. Amendment made vide Notification dated 16 August 2024 [Foreign Exchange Management (Non-debt Instruments) (Fourth Amendment) Rules, 2024]

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]