- with Inhouse Counsel

- in United States

- with readers working within the Banking & Credit, Basic Industries and Law Firm industries

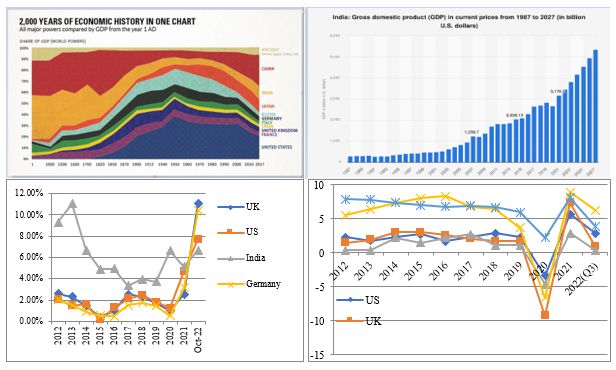

The first graph above shows that it took 60 years (from 1947 to 2007) for India to reach its first trillion dollars of Gross Domestic Product (GDP). The next trillion took 8 years (2007 to 2015) and we were at the edge of achieving 3 trillion on the eve of Covid. As our leaders and experts having been telling us repeatedly, we should add one trillion every 3-4 years henceforth. Infact as the second graph shows us, for most of history (since the 1st AD to 1820), India and China dominated the world economy, so reverting to mean just requires us to play with a straight bat and not throw away our wicket and advantage.

Our third and fourth graphs show how favourable our macros are in comparison to the United States (US), China, Germany and the United Kingdom (UK). We are growing at double the pace of any other large economy and after a very long time, we have less inflation than the US, UK and Germany. Add to this the geopolitics, Ukraine war and climate transition and the poly crisis jumps out at you ("economic and non-economic shocks are entangled all the way down" Adam Tooze). However, as Mr. Jayant Sinha has said of climate change, we need to turn the vast and urgent challenge into a huge opportunity for jobs, innovation and growth in India given our abundance of access to clean sources of energy, in particular, solar and wind. Given the deep pools of capital required and the new technologies to be adopted, as the consensus builds to achieve climate justice, India will surely be an important recipient of both.

Similarly, our leadership of the G20 comes at a pivotal moment and the China plus one strategy along with our entry into the 'Quad' puts India in a key position. No question, we will have stiff competition, especially from our ASEAN neighbours who may have a head start in skilling their labor force but none of them have the scale of the domestic market and labor pool we are blessed with (eg. Vietnam which has done really well to date is running at virtually full capacity). Therefore, we have to play to our many strengths and continue to work on our bottle necks such as infrastructure, labour productivity and social security. This is not the time for a shot gun approach but focused and execution/target based initiatives.

Just as we have done such a splendid job in building world class digital public goods, which are inspirational from the US to Asia (recently, Margrethe Vestager, the European Commissioner for Competition, while complimenting our various public digital goods said, "the Indian stack shows that if we want people to embrace technologies, we need trust and inclusiveness.....EU must emulate this.") If we can add over 240 million bank accounts in just 2 years (2015 – 16) and issue 300 million of the most sophisticated identity (Aadhar) cards in just one year (2013 – 14) and have 1.2 billion mobile accounts (half of which use smart phones), why can we not get our infrastructure to at least match if not, exceed the very basic global standards. This has to include both hard and soft infrastructure, especially education and healthcare, once again making full use of our technological/digital prowess. We cannot sustain a 7/8% GDP growth without a matching infrastructure growth.

The major issues and their solutions are well known and have been widely discussed, debated and written about for at least two decades. To cite just 2 examples, the power discoms issue and the deepening of our bond and private credit market. This has gained importance given that even at our current GDP, we need USD 30-40 billion of private credit. This is inspite of the fact that our credit/GDP ratio is a conservative 56% (largely supplied by our banks). With the benefit of the Insolvency and Bankruptcy Code (one of the 2 game changing legislations (the other being the Goods and Services Tax) passed by our Parliament in the recent years, this should be imminently doable.

Most likely the new year will be like an opening batter facing a new swinging ball on a wet wicket in England under over cast skies and with poor visibility. Not a year for a Sehwag innings, but a need to protect the wicket, ones and twos will suffice, but one needs to take full advantage of the loose balls and capitalize on our strong world class skills and macro-economic strengths. As the year passes, the sun will certainly shine through (cycles by name must turn), the ball will wear out and the outfield will dry up and we can revert to hitting boundaries and growing at 8%! Bottom line, by all means aim for a innings with the magic and artistry of G. Viswanath or Kohli, but keep in mind that the grit and determination of a Gavaskar or Dravid innings will also ensure we fulfill our potential and regain our rightful place at the top of the world order.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.