- within Corporate/Commercial Law topic(s)

- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Accounting & Consultancy, Business & Consumer Services and Chemicals industries

MERGERS & ACQUISITIONS AND PRIVATE EQUITY

India is one of the world's rapidly growing economies, creating an increasingly attractive and flourishing landscape for investors.1 Boasting the largest young population globally,2 India presents prospective investors with a valuable asset – youth waiting to fulfil their aspirations! Against this backdrop, and further fuelled by the recent geo-political developments, the investment landscape shows compelling tailwinds in the M&A and private equity / venture capital space, which picked up in Q3 of 2023, and may see further upswing in the year 2024. In this report, we touch upon (a) deal activities in the M&A and PE space including, in brief, sectoral deal analysis, (b) certain observations in the corporate governance space, and (c) certain developments in the legal / regulatory space which may benefit M&A and PE transactions in the near future.

Deal activity in India

Mergers & Acquisitions

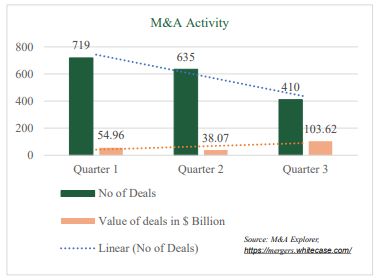

M&A suffered in India during 2023. M&A deal value at a global level saw a decrease, ranging from 41–45%.3 In India, deal value plunged by 61% in comparison to its 2022 figures.4 One possible reason behind such drop could be that in 2022 there was a mega merger between HDFC and HDFC Bank. It is expected that India's M&A activity will grow strong in the year 2024 due to global interest in Indian markets.

Private Equity

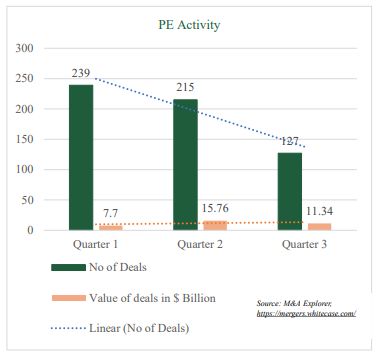

In Q3 of 2023, private equity activity remained moderate yet consistent, comprising of 127 deals totalling to USD 11.34 billion. Notably, there was an uptick in deal value from Q1 to Q2 of 2023, followed by a subsequent decline from Q2 to Q3 of the same year. This pattern is evident on a global scale, with the peak deal value occurring in Q2 of 2023 and a subsequent dip in Q3.5 On an annual basis, there is a noteworthy 44% decrease in global PE deal value for the year 2023.6 This global decline is mirrored in India, where the PE deal value experienced a 40% downfall compared to the figures recorded in year 2022.7

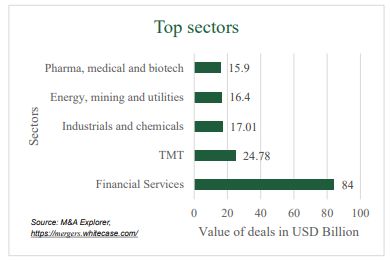

Key Sectors (by deal value)

- Financial services: In Q1 of 2023, fintech

dominated both M&A deal volumes and Additionally, fintech deals

led PE in deal volume, while banking and non-banking finance

companies took the lead in PE deal values. Notably, BPEA, EQT, and

ChrysCapital's investments of ~USD 1.1 billion in HDFC Credila

Financial Services played a substantial role in the overall PE deal

values within the financial services sector.8

- Technology, Media, and Telecommunications

(TMT): In year 2023, a visible trend emerged as global

corporations such as Accenture, Truecaller, and Adobe acquired

Indian AI-based startups, including Flutura, TrustCheckr, and

Rephrase.ai.9 Other key deals involved Saregama

acquiring majority stake in Pocket Aces Pictures Pvt Ltd. for ~USD

23 million and the merger of PVR Pictures with Inox.

- Industrials and chemicals: In the Indian

chemical industry, alkali chemicals have the largest share with

~73.3% of the total production from April to March (2022-23). It is

expected to contribute USD 383 billion to India's GDP by 2030.

Further, India is the 6th largest producer of chemicals in the

world and 3rd in Asia, contributing 7% to India's

GDP.10 The industrials and chemicals sector's

notable deal value suggests investor's interest in

manufacturing, industrial production, and chemical industries. In

February 2023, Adani Group acquired controlling stakes in both

Ambuja Cements and ACC from Holcim for a combined value of USD 10.5

billion. This single transaction catapulted them to become the

second-largest cement producer in India.11

- Pharma, medical and biotech: The pharma, medical, and biotech sector demonstrate a considerable deal value, indicating a continued focus on healthcare innovations, pharmaceutical advancements, and biotechnological developments. In the year 2023, the M&A space witnessed a remarkable 161% surge in deal values, primarily fuelled by Nirma's acquisition of a 75% stake in Glenmark Life Science for USD 689 12 However, there was a decline in cross-border deals, with only one inbound deal – Gleneagles Development's acquisition of Ravindranath GE Medical Associates for USD 90 million. In the PE space, both values and volumes decreased from the previous quarter (Q2 of 2023). A noteworthy trend in health tech emerged with 12 deals recorded in the quarter. The standout deal involved significant investments from Temasek Holdings, and other investors, in Pharmeasy for value of USD 2 billion. This signals a strong demand for digital health solutions in India, indicating substantial investment interest in the health tech segment.13 We note that this could be because of the potential for consolidation in the health sector, due to the fragmentation of the hospital provider base in India.

Key deals

- AMG Media Networks acquired majority stake in

IANS: AMG Media Networks Limited (AMNL), a wholly owned

subsidiary of Adani Group, has acquired a 5% stake in news agency

IANS India Private Limited.14

- Axis Bank - Citi Bank acquisition: Axis Bank

acquired Citibank's consumer banking business in India for USD

4 billion.15

- Temasek's investment in Manipal Hospitals:

Temasek, a Singapore-based investment company, invested USD 2

billion in Manipal Hospitals, a leading healthcare provider in

India.16

- BPEA EQT and ChrysCapital's deal in HDFC

Credila: Baring Private Equity Asia

(BPEA), EQT, and ChrysCapital invested USD 1.3

billion in HDFC Credila, a non-banking financial company that

provides education loans in India.17

- ADIA and GIC's follow-on investment in Greenko

Energy: Abu Dhabi Investment Authority

(ADIA) and GIC, a Singaporean sovereign wealth

fund, invested USD 1.55 billion in Greenko Energy, a leading

renewable energy company in India. 18

- Carlyle's buyout of VLCC Wellness: Carlyle, a global investment firm, acquired VLCC Wellness, a leading wellness and beauty services provider in India, for USD 1 billion.19

To view the full article, click here.

Footnotes

1. World Bank, Overview (27 September 2023), access here

2. UNFPA, What we do (visited on 26 December 2023), access here

3. BCG, M&A Set to Pick Up in 2024 Despite Ongoing Headwinds (26 October 2023), access here

4. Business Standard, M&A deals plummet to $70.9 bn in 2023, down 63% from previous year's high (17 December 2023), access here

5. EY, Private Equity Pulse: Five takeaways from Q3 2023 (25 October 2023), access here

6. SP Global, The Private Equity and Venture Capital Deal Landscape Q3 2023 (25 October 2023), access here

7. Economic Times, Inflows from private equity, venture capital funds to domestic comanies plunge to $27.9 billion in 2023 (27 December 2023), access here

8. Grant Thorton, Financial Services Sector Dealtracker (2023), access here

9. Inc 42, The Big Moves Of 2023: A Look Back At The Biggest Acquisitions In The Startup Ecosystem (01 December 2023), access here

10. India Brand Equity Foundation, Indian Chemicals Industry Analysis, access here

11. Mint, Year-Ender 2023: Top 10 mergers and acquisitions that are reshaping industries across India, access here

12. Business Today, Nirma's acquisition of majority stake in Glenmark Life Sciences to make Glenmark Pharma debt-free, access here

13. Grant Thorton, Pharma and healthcare Dealtracker (2023), access here

14. Business Today, Adani Group acquires majority stake in news agency IANS, access here

15. Reuters, Axis Bank closes Citi India deal at lowered price of USD1.41 billion (01 March 2023), access here

16. Reuters, Temasek buys 41% stake in India's Manipal Health for & 2 billion (10 April 2023), access here

17. VCCircle, BPEA EQT, ChrysCapital strike USD 1.3 Billion deal with HDFC Credila (19 June 2023), access here

18. India Global Business, IGB Archive (06 June 2019), access here

19. Carlyle, News Release (10 January 2023), access here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.