- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Law Firm industries

- with readers working within the Law Firm industries

- within Corporate/Commercial Law, Family and Matrimonial and Compliance topic(s)

A. INTRODUCTION

The recent LinkedIn India case has brought Significant Beneficial Ownership ("SBO") rules under the spotlight. The concept of SBO was introduced in India with the Companies Act 2013 ("the Act"), to promote corporate transparency and uncover ultimate beneficiaries with significant control over companies. Under the Act, there is a requirement for the identification of an SBO i.e., an individual/natural person who meets certain criteria as discussed below. It's essentially a corporate treasure hunt, where the objective is to discover who's really calling the shots.

Once an SBO is identified, the SBO and the Indian company ("Company") are required to undertake related compliances which include the SBO providing a declaration to the Company within 30 days of acquiring such significant beneficial interest in the Company i.e., the date on which the shares were first acquired by the SBO, etc., and consequential filings to be made by the Company with the Ministry of Corporate Affairs ("MCA").

This note briefly contains the relevant provisions for the identification of the SBO of the Company, related compliances on the identification of an SBO, if any, and the consequences of failure to comply with the provisions relating to SBO under the Act.

Why were SBO Rules needed?

The SBO rules are an essential upgrade from India's earlier corporate regulations, like the Companies Act, 1956. Previously, identifying who controlled a company's shares or influenced its decisions was challenging, which could lead to misuse by entities wanting to hide illicit financial activities. As a part of global efforts to prevent money laundering and tax evasion, the updated rules are designed to identify any individual (acting alone or with others) who directly or indirectly holds at least 10% of a company's shares or voting rights or exercises significant influence.

The goal is straightforward: to unveil the real decision-makers behind corporations and ensure that companies can't use complex ownership structures to shield ultimate beneficiaries from regulatory scrutiny.

- IDENTIFICATION OF THE SBO OF THE COMPANY

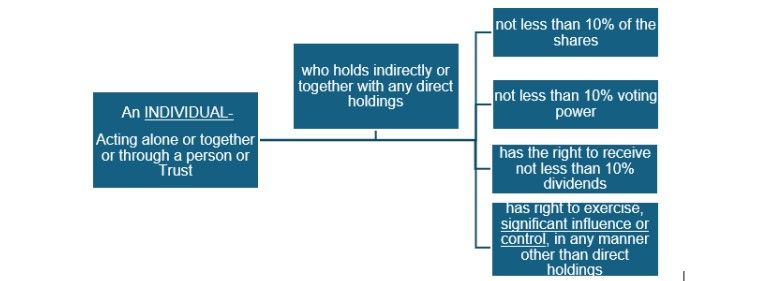

Who is SBO? 1

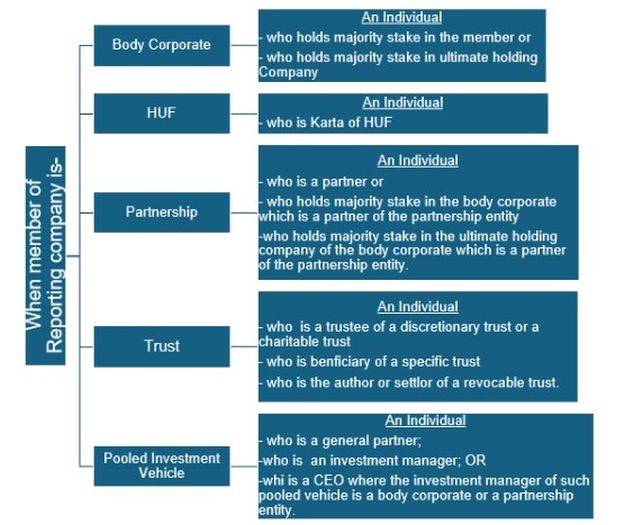

What if member of the reporting company is an entity? How to determine indirect interest.

- Compliance Requirements

To comply with SBO regulations, companies and individuals must file specific forms:

1. Form BEN-1: Declaration by the individual who is an SBO.2

a. Form BEN-3: Register of SBOs maintained by the company.4

a. Form BEN-2: Return to be filed by the company to the Registrar.3

a. Form BEN-4: Notice seeking information about SBOs.5

| Step | Particulars | Timeline |

|---|---|---|

| Once the SBO is identified, the Company shall issue letter to SBO requesting SBO to provide his / her details and signed Form BEN-1 for filing SBO details with the MCA. | As soon as SBO is identified. | |

| SBO to provide signed Form BEN-1 to the Company along with the requisite details and documents. | As soon as SBO is identified. | |

| e-Form BEN-2 to be filed by the Company with MCA. | Within 30 days from Step 2 | |

| Register of SBO to be updated as per BEN-3. | Within 30 days from S |

- Penalties for Non-Compliance

The Act prescribes stringent penalties for non-compliance:

- For SBO6: Failure to make the SBO declaration may result in a fine of INR 50,000 (USD 666) and an additional INR 1,000 per day for a continuing offense, capped at INR 200,000 (USD 2,666).

- For the Company7: If SBO information is not provided or is unsatisfactory, the Company may apply to NCLT to impose restrictions on the shares, including limits on transfer, dividend rights, voting rights, or other rights. Restrictions can be lifted upon application within a year; otherwise, shares may be transferred to the Investor Education and Protection Fund.

- For Company & Directors8: Failing to file returns, maintain registers, or identify SBOs may lead to:

- Company: Fine of INR 100,000 (USD 1,333) and INR 500 per day, up to INR 500,000 (USD 6,666).

- Officers in default: Fine of INR 25,000 (USD 333) and INR 200 per day, up to INR 100,000 (USD 1,333).

- The LinkedIn India Case Study9: A Closer Look

Enter LinkedIn India, a subsidiary of the global professional networking platform, which recently found itself in a compliance dilemma regarding its ownership structure. The company was scrutinized for not sufficiently reporting its SBOs.

In 2024, regulatory authorities initiated an inquiry into LinkedIn India's adherence to Section 90. It became apparent that while the parent company maintained detailed ownership records, the Indian branch had some undisclosed beneficial owners hiding in the closet.

The recent order by the Registrar of Companies ("ROC") against LinkedIn India has brought SBO regulations into the spotlight. The ROC imposed penalties on LinkedIn India, Satya Nadella ("CEO of Microsoft"), and Ryan Roslansky ("CEO of LinkedIn"), among others, for non-compliance with SBO norms.

Penalty Imposed

The ROC imposed penalties on various stakeholders as follows:

- Each of its shareholders received a penalty of INR 280,400.

- The CEO's of Microsoft and LinkedIn were each fined INR 2 lakh.

- Other entities and directors faced penalties ranging from INR 50,000 to INR 5 lakh.

- The total amount of penalties imposed aggregated to INR 27 lakhs.

Basis of SBO Identification

The ROC identified the CEO of Microsoft and LinkedIn as SBOs based on three main tests:

- Holding-Subsidiary relationship: The ROC examined the relationship between LinkedIn India and its holding companies.

- Financial control: Microsoft's significant financial control over LinkedIn was considered.

- Reporting channels: The ability of both the CEO's to exercise control over LinkedIn India's board of directors was a key factor.

Controversy, Caution and Criticism

The LinkedIn India case underscores the importance of SBO compliance, particularly for Companies with foreign investment. As SBO regulations grow stricter, businesses operating across borders need to balance local transparency laws with respect for privacy and financial structure. Compliance with SBO norms isn't just about avoiding fines; it's about fostering ethical corporate governance and staying aligned with global transparency efforts.

The LinkedIn case has sparked debate in the legal and corporate communities. The ROC's interpretation extends beyond the parameters defined in the SBO Rules. The reliance on subjective tests, rather than strictly adhering to the objective criteria outlined in the rules, has raised concerns about potential overreach.

Furthermore, the case has highlighted issues of privacy, as private information about corporate structures and individual roles was made public through the order. This has led to discussions about the balance between transparency and confidentiality in corporate governance.

Global Context and Alternate Jurisdictions

Several jurisdictions allow companies to maintain a degree of anonymity around their SBOs, often making them attractive for holding companies, tax planning, and investment structuring. These jurisdictions have traditionally offered privacy options for owners and investors, though recent pressures from global regulatory bodies have led some to begin tightening disclosure norms.

While India enforces transparency, some countries offer a degree of anonymity for corporate ownership. Jurisdictions like Cyprus, the British Virgin Islands ("BVI"), and Mauritius, known for low-tax environments, allow entities to retain a degree of privacy regarding SBOs, though international regulations are increasingly pressuring these regions to improve disclosure standards. However, under international pressure, BVI10 has introduced some transparency measures like the Beneficial Ownership Secure Search System Act (BOSS Act)11, but data remains largely confidential and not accessible to the public.

Similarly, Cyprus12 and Mauritius1314 have adopted EU standards on Anti-Money Laundering (AML) and established an Ultimate Beneficial Owner (UBO) register, the information isn't fully accessible to the public. Only select authorities, legal entities, and individuals with "legitimate interest" have access to the beneficial ownership data, thus allowing companies to maintain a level of privacy over their ultimate owners.

Conclusion

It turns out that navigating the labyrinth of ownership can be confusing. SBOs are not just legal jargon-it's an essential aspect of corporate governance!

The LinkedIn India case serves as a wake-up call for companies operating in India to carefully review their SBO compliance. It underscores the need for clear guidelines and consistent interpretation of SBO rules to ensure fair and effective implementation. As the corporate world grapples with these regulations, it's clear that the pursuit of transparency must be balanced with respect for privacy and established legal frameworks.

Foonotes

1. Rule 2(h) of The Companies (SBO) Rules, 2018

2. Rule 3 of The Companies (SBO) Rules, 2018

3. Rule 4 of The Companies (SBO) Rules, 2018

4. Rule 5 of The Companies (SBO) Rules, 2018

5. Rule 6 of The Companies (SBO) Rules, 2018

6. Section 90 (10) of the Act.

7. Section 90 (7) of the Act read with Rule 7 of the The Companies (SBO) Rules, 2018.

8. Section 90 (11) of the Act.

9. https://www.mca.gov.in/bin/dms/getdocument?mds=san%252BPg76sI9tkgd5lcHzZg%253D%253D&type=open

11. https://www.charltonslaw.com/bvi-beneficial-ownership-secure-search-system-act-2017/

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.