- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Retail & Leisure industries

- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Basic Industries, Chemicals and Oil & Gas industries

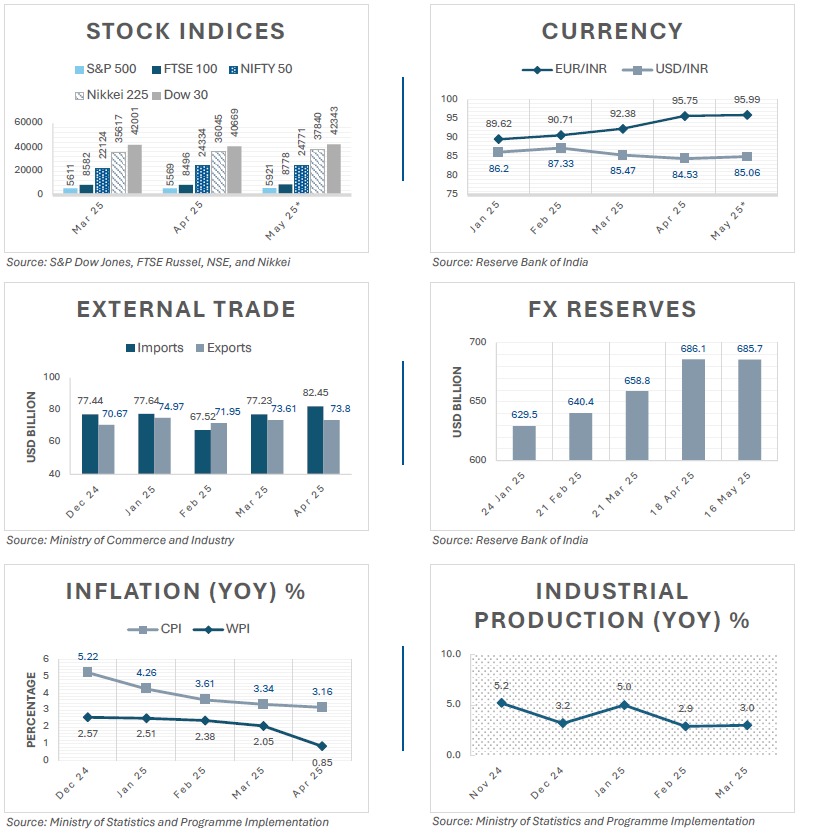

INDIAN ECONOMY

Snapshot of key indicators | May 2025

HIGHLIGHTS

- Ministry of Corporate Affairs reported 50% increase in company incorporations in April 2025 in comparison to April 2024.

- Tobacco (66.43%); coffee (47.85%); and electronic goods (39.51%) saw the highest growth in merchandise export in April 2025.

- April 2025 records the lowest CPI and WPI inflation levels since July 2019 and March 2024 respectively.

- The highest inflation in April 2025 was seen in gold (30.8%); refined oil (23.7%); silver (23.3%); mustard oil (19.6%); and apple (17%).

- The top 3 positive contributors for industrial production in March 2025 were the manufacture of electrical equipment (15.7%); motor vehicles, trailers and semi-trailers (10.3%); and basic metals (6.9%).

- Union Bank of India projects a significant decrease in industrial production growth to 1.2% in April 2025.

RBI enforces a uniform code for digital lending

RBI (Digital Lending) Directions, 2025

In a decisive shift towards a structured framework in digital lending, the Reserve Bank of India (RBI) has issued the RBI (Digital Lending) Directions, 2025 (Directions), a comprehensive set of guidelines consolidating earlier circulars and addressing persistent issues such as unregulated third-party involvement, data misuse, and predatory lending practices.

Digital lending in India has surged over recent years, facilitated by Regulated Entities (REs) (banks and financial institutions) partnering with Lending Service Providers (LSPs) as agents of REs to carry out digital lending functions through Digital Lending Apps (DLAs) operated by the RE or the LSP. However, the absence of a codified regulatory framework has led to divergent practices, particularly in areas like data collection, loan disbursal, and grievance redressal, often resulting in borrower exploitation. Although the RBI had previously issued guidelines and circulars, compliance was inconsistent. To address this, the RBI has now codified a uniform standard applicable across all commercial banks, Non-Banking Financial Corporations (NBFCs), cooperative banks, and All-India Financial Institutions.

Key changes under the Directions

- Clarity on RE-LSP relationships: Any digital lending arrangement between an RE and an LSP must be governed by a formal contract that clearly defines the rights and obligations of each party. REs are required to conduct thorough due diligence of their LSPs, evaluating parameters such as technical capabilities, data protection policies, prior conduct, and compliance readiness; and periodically review their LSPs' performance and implement appropriate oversight mechanisms.

- Transparency in multi-lender platforms: For platforms where multiple lenders are involved, clear and transparent communication is required with the borrowers on all matching loan offers in a fair and unbiased manner through the DLA, including details such as lender names, loan amount, tenure, Annual Percentage Rate (APR), repayment obligations, and penalties. This will help the borrowers compare loan offers easily and make informed decisions. Once a loan is sanctioned, borrowers will automatically receive a digitally signed Key Fact Statement (KFS), sanction letter, and other important documents without undue delay.

- Stricter data and tech governance: LSPs and DLAs can now only collect borrower data on a need-to-know basis and with the borrower's explicit and informed consent. They are not allowed to access private phone data like call logs, contact lists, or media files, except for a one-time access to camera, microphone, or location during onboarding or Know Your Customer (KYC) verification, subject to explicit consent. All personal data must be stored exclusively on servers located within India. If data is processed overseas, it must be deleted from foreign servers and brought back within 24 hours.

- Loan disbursal and repayment protocols: All loan disbursals must be made directly into a verified bank account of the borrower, with certain limited exceptions such as specific statutory mandates or direct disbursals to end beneficiaries. All repayments must be made directly to the RE's account, and funds cannot pass through accounts of the LSP or other third parties. Additionally, any fees or commissions payable to the LSP must be borne by the RE and cannot be passed on to the borrower, either directly or indirectly. However, in cases where recovery is being carried out physically (e.g., through on-ground agents), cash repayments made by borrowers to such recovery agents or service providers will be permitted. In such cases, the RE must ensure that the payment is credited to the borrower's loan account on the same day.

- 'Cooling-off' period: Borrowers must now be provided with a minimum one-day 'cooling-off' period during which they may exit the loan arrangement by repaying the principal and applicable APR without penalty, except for a reasonable one-time processing fee (if disclosed upfront in the KFS).

- New reporting mandates: All loans, including short-term and deferred payment loans, must be reported to Credit Information Companies (CICs). REs must also report all DLAs, whether owned or managed by LSPs, on the RBI's Centralised Information Management System (CIMS) portal by June 15, 2025.

These Directions represent a landmark step in reinforcing digital privacy standards and restoring trust in digital lending platforms, striking a crucial balance between innovation and regulatory oversight. The emphasis on data localisation and borrower consent strengthens digital rights, while uniform protocols around disclosures and grievance redressal bring much-needed structure to India's fragmented fintech ecosystem. While implementation may pose compliance challenges, particularly for smaller REs and LSPs, the framework lays the foundation for sustainable, inclusive, and responsible growth in India's digital credit landscape.

SEBI proposes increased flexibility for co-investments

Consultation paper to introduce the Co-Investment Vehicle in the AIF structure

The Securities and Exchange Board of India (SEBI) has proposed the introduction of the Co-Investment Vehicle (CIV) to facilitate co-investments with Alternative Investment Funds (AIFs) without the necessity of a separate Portfolio Management Services (PMS) registration. Under the new framework, CIVs would be free to function as parallel schemes under the AIF umbrella, avoiding the regulatory limitations entailing the current PMS mechanism, such as diversification principles, minimum tenor requirements, and sponsor commitment requirements.

The AIFs may establish CIVs under the same category, i.e. Category I such as startups, early stage ventures or social ventures; or Category II for other AIFs, by filing a shelf Private Placement Memorandum (PPM) with the SEBI, outlining key principles and criteria, such as the investor's capital commitment in the main AIF, based on which co-investment rights will be extended to the investors of the main AIF. The CIV will be considered registered/approved if SEBI does not issue any queries within 30 days of the filing.

The proposed framework entails the following benefits:

- Avoiding PMS registration route: By removing the need for the operationally burdensome, expensive, and compliance-intensive PMS registration, investors would be relieved of the regulatory and transactional drag that has long hampered co-investment structures.

- Access for investors to high-conviction opportunities: Unlike the traditional pooled investment structures, where capital deployment decisions rest solely with the manager, CIVs would increase investor control by allowing them to selectively participate in deals that align with their strategic vision.

- Parity for Indian fund managers with their global counterparts: The current dual registration requirement, as both AIF and portfolio manager, deters Indian managers from offering co-investment opportunities. This creates a disadvantage compared to offshore funds, which face fewer regulatory hurdles. The proposed CIV framework would remove this disparity.

- Simplifying ownership structure: The existing framework results in 'crowded cap tables', a situation wherein a company's capitalisation table has a high number of shareholders, potentially impacting future fundraising and decision-making. The proposed framework would allow 'cleaner cap tables' by structuring co-investments through the CIV, consolidating investor participation, and enhancing administrative efficiency.

- Co-investor exit flexibility: Under current norms, co-investors are generally required to exit in tandem with the AIF, limiting their ability to respond to individual strategic or market considerations. The proposed open CIV model would enable co-investors to independently time their exit, increasing autonomy and flexibility.

In addition to reducing execution timelines and compliance, the proposed framework would foster a more investor-friendly ecosystem for sophisticated investors demanding tailor-made opportunities and greater control in high-growth opportunities.

Input Tax Credit can be used for payment of GST appeal pre-deposits

Supreme Court permits using credit ledger for 10% GST appeal pre-deposits

In a major relief to companies contesting tax demands, businesses can now use Input Tax Credit (ITC) to pay the mandatory pre-deposit (10% of the disputed tax amount) for filing an appeal before the Appellate Authority under the Goods and Services Tax (GST) Act, 2017, through the electronic credit ledger.1

This is a significant shift in policy. Under the prevailing GST framework, ITC is generally restricted to offsetting output tax liability, and any unused credit can only be refunded under specific circumstances, typically when ITC exceeds output liability, such as in export or inverted duty scenarios. As such, companies disputing tax assessments were previously required to set aside working capital in cash for pre-deposit payments, despite ample ITC balances.

By allowing ITC to be used as pre-deposits for disputing a company's GST liability, the Supreme Court's decision has not only acknowledged the hardship caused by cash outflows during tax disputes but also improved the ease of doing business and liquidity, and is especially beneficial for sectors that are ITC-rich or frequently subject to reassessment, particularly in cases where the disputed tax demand runs into crores, making the 10% pre-deposit requirement a substantial cash burden.

Going forward, businesses would be well advised to reassess their litigation strategies and tax provisioning, as this change could significantly reduce the financial burden of contesting disputed GST demands, making recourse to appellate forums more accessible and less cash-intensive.

In another significant ruling, it was held that ITC cannot be denied merely because the construction involves immovable property, especially when such construction is integral to business operations.2

To read this Newsletter in full, please click here.

Footnotes

* As per the latest available data for May 2025

1. Union of India v. Yasho Industries Ltd, Special Leave Petition (Civil) No. 14841 of 2025

2. Chief Commissioner, CGST v. Safari Retreats Pvt Ltd, Review Petition (Civil) Diary No. 1188 of 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.