Vaish Associates Advocates are most popular:

- within Tax, Privacy, Government and Public Sector topic(s)

- with readers working within the Retail & Leisure and Law Firm industries

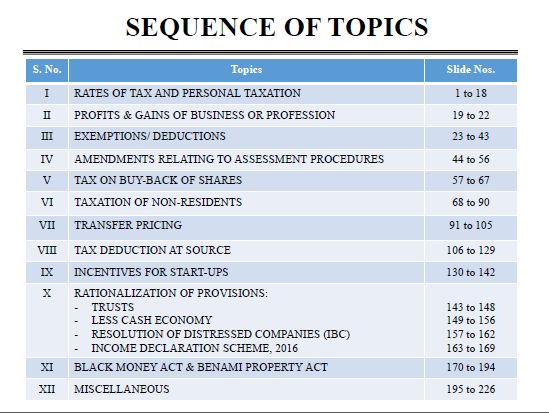

SEQUENCE OF TOPICS

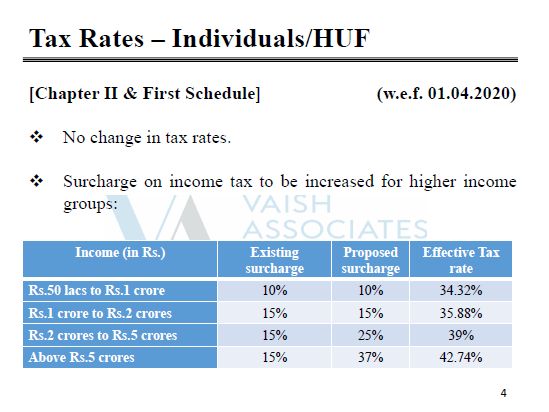

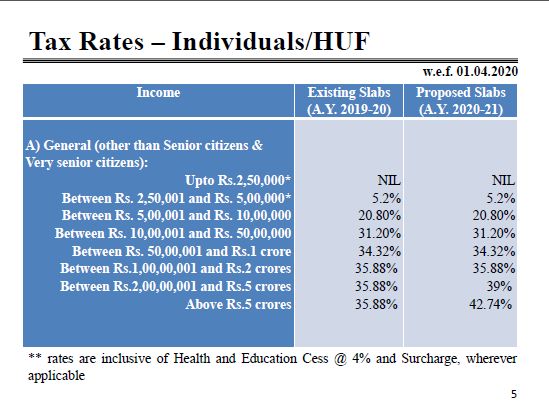

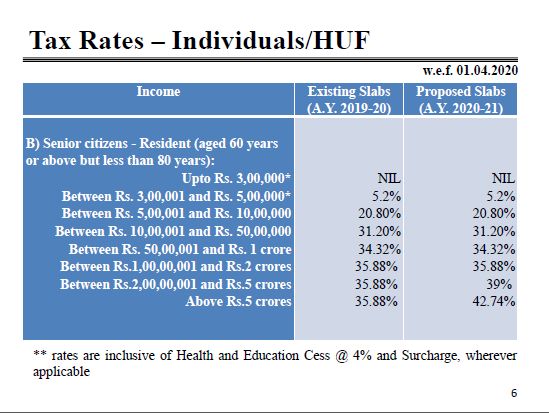

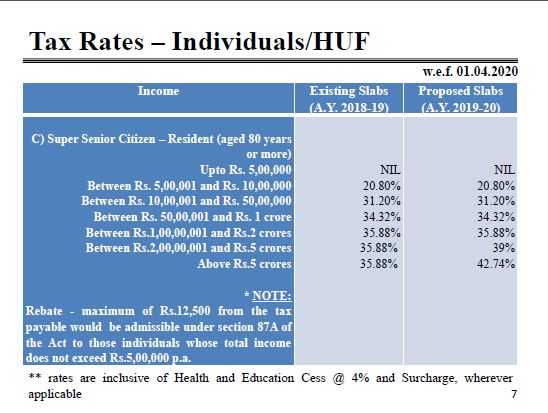

- RATES OF TAX AND PERSONAL TAXATION

- PROFITS & GAINS OF BUSINESS OR PROFESSION

- EXEMPTIONS/ DEDUCTIONS

- AMENDMENTS RELATING TO ASSESSMENT PROCEDURES

- TAX ON BUY-BACK OF SHARES

- TAXATION OF NON-RESIDENTS

- TRANSFER PRICING

- TAX DEDUCTION AT SOURCE

- INCENTIVES FOR START-UPS

- RATIONALIZATION OF PROVISIONS:

- TRUSTS

- LESS CASH ECONOMY

- RESOLUTION OF DISTRESSED COMPANIES (IBC)

- INCOME DECLARATION SCHEME, 2016

- BLACK MONEY ACT & BENAMI PROPERTY ACT

- MISCELLANEOUS

To read this Presentation in full, please click here.

© 2018, Vaish Associates Advocates,

All rights reserved

Advocates, 1st & 11th Floors, Mohan Dev Building 13, Tolstoy

Marg New Delhi-110001 (India).

The content of this article is intended to provide a general guide to the subject matter. Specialist professional advice should be sought about your specific circumstances. The views expressed in this article are solely of the authors of this article.