- within Antitrust/Competition Law topic(s)

- with readers working within the Retail & Leisure industries

- within Antitrust/Competition Law topic(s)

- within Antitrust/Competition Law, Insolvency/Bankruptcy/Re-Structuring, Government and Public Sector topic(s)

- with readers working within the Utilities and Law Firm industries

This article delves into the challenges of the Competition Commission of India (CCI) in enforcing competition law. It addresses market dominance, anti-competitive practices, and procedural hurdles. The analysis highlights gaps in enforcement, the impact of leadership vacancies, and the difficulties posed by rapidly evolving technology markets. It underscores the need for enhanced CCI capabilities to ensure fair competition, protect consumer interests, and adapt to India's complex regulatory landscape.

Introduction

Recently, Reliance Jio raised their mobile recharge tariffs. Initially, I thought it was to recoup the 0.01% wealth they had lost after throwing one of the most lavish weddings, but shortly thereafter, even Airtel went on to increase their data and call tariff. The first thing that crossed my mind was, 'wait..., there was another wedding? Who got married in the Mittal family now?' However, my mother quickly brought me back to reality when she openly announced to the world the love affair I had with my phone. Shocking behaviour, but what else is one to do but move on?

Upon delving into the telecom industry, I discovered it operates as an oligopoly, with a handful of major players calling the shots. This structure means that when one company decides to up its prices, others often follow suit. The result? We, the consumers, have no option but to bear the brunt of these price hikes.

The incident with Reliance Jio and Airtel is a stark reminder of how competition, or the lack thereof, impacts our daily lives. Consumers suffer when dominant market players can freely increase prices. However, we can take reassurance in the fact that antitrust laws and regulatory oversight step in, ensuring that such unchecked competition does not harm consumers and keeps businesses in line.

Healthy, fair, and regulated competition is the cornerstone of the overall development of the economy. It ensures that resources are allocated efficiently, stimulating innovation and productivity and resulting in the highest quality of products for consumers at the best (lower) possible rates. This consumer-centric productivity can only be achieved when manufacturers, distributors, and service providers are incentivized to innovate and reduce costs, primarily by placing societal interests above their own profit-making motives. A very small example of such consumer-centric behaviour is the smartphone industry, which has developed so that the 'smartphone necessity' is being fulfilled for people from all walks of life. Various brands have made smartphones affordable and accessible for every consumer, irrespective of class, age, education, income, etc. Fortunately, or unfortunately enough, such technology continuously evolves to become a 'need' from a 'want,' giving us hope for a brighter future.

Having said that, it is also essential to realize that the competitive process is not automatic. In a laissez-faire economy, market forces may naturally mitigate distortions, yet contemporary economies are not purely laissez-faire. Market distortions often arise from coordinated actions by entities holding a powerful market position rather than from merely competitive forces. Thus, government intervention is necessary to identify and rectify such distortions. Competition, or antitrust, laws are established to address these issues, with regulatory bodies overseeing market activities and enforcing compliance with legal standards.

There exists a prevailing notion that competition can inadvertently lead to its own detriment, wherein certain firms may establish dominant positions that impede fair competition. Consequently, codifying legal frameworks that protect and promote market competition is imperative to prohibit anticompetitive practices and behaviours across various market participants. Antitrust laws seek to regulate market conditions by preventing monopolistic structures and unfair business practices.

Antitrust law aims to safeguard and advance market competition within national jurisdictions. Today, the world is a global village where business technologies are shared. Mergers and acquisitions take place to grow businesses. Still, simultaneously, arbitrary trade practices also prevalently exist where the dominant party takes advantage of its position and has an adverse effect on the competition.

Historical Background and Development of Competition Law in India

Post-independence, India witnessed extensive government intervention in the private sector, with a significant focus on promoting the public sector as a means to stimulate economic growth. This period, commonly referred to as the 'License Raj,' mandated that private enterprises secure prior governmental approval to operate/conduct business. High tariffs and import quotas were also imposed on private companies to regulate the entry of foreign goods into the market.

During this time, the government substantially supported major business conglomerates, recognizing their contributions to the economy. Consequently, these large entities found obtaining the necessary licenses and permissions relatively easy, leading to a disproportionate concentration of economic power within a select few industrialists. This monopolistic dominance resulted in various anti-competitive practices detrimental to the public interest, contravening the foundational principles enshrined in the Indian Constitution.

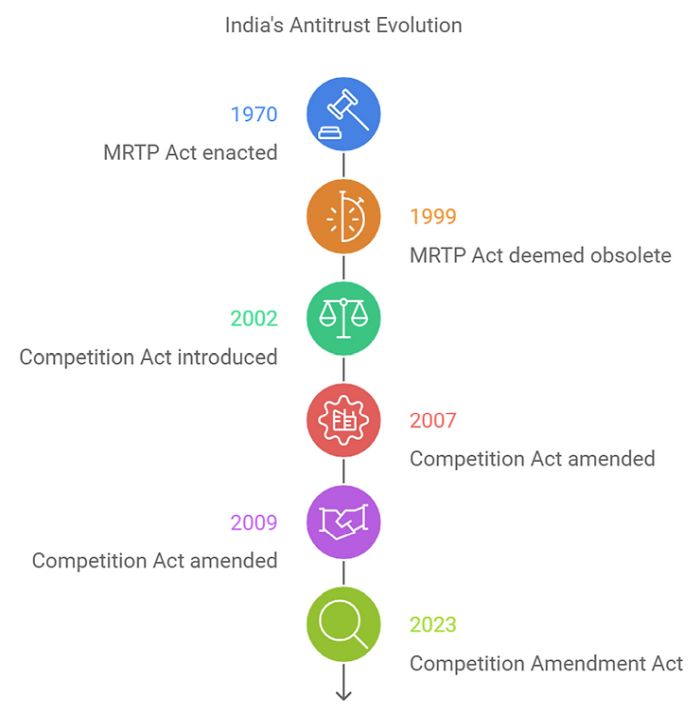

In response to the adverse effects of such monopolistic behaviour, The Monopolies and Restrictive Trade Practices Act, 1969 ('MRTP Act') was enacted as India's inaugural antitrust legislation. The MRTP Act came into effect on 01.06.1970. The primary objective of the MRTP Act was to curtail the concentration of economic power to a limited number of entities and to prohibit practices detrimental to the public interest, including discriminatory and monopolistic conduct. This legislation was grounded in the Directive Principles of State Policy enshrined in the Indian Constitution, which mandates the state to promote policies that foster social welfare and equitable economic order.

To oversee the enforcement of the MRTP Act, the Monopolies and Restrictive Trade Practices Commission ('MRTPC') was established. The MRTPC was empowered to investigate and penalize enterprises engaged in monopolistic or restrictive trade practices. However, the MRTP Act was somewhat redundant and failed to address the challenges of contemporary competition. With India's shift towards globalization, privatization, and liberalization ('LPG'), the MRTP Act was deemed outdated and ineffective in meeting the evolving economic landscape. The existing monopolies struggled to address the diverse needs of a population exceeding one billion. Recognizing the importance of enhancing market competitiveness, Finance Minister Yashwant Sinha, in his 1999 budget speech, articulated that the changing global economy rendered the MRTP Act obsolete in several sectors, thus necessitating a transition that focuses on promoting competition rather than on monopoly regulation.

As a result, the government constituted a committee to evaluate competition-related issues and propose new legislative frameworks aligned with contemporary needs. Subsequently, the Competition Act was introduced to address these issues and align Indian competition law with international best practices. Notably, the Act was amended in 2007 to regulate mergers and acquisitions that could adversely affect competition. Further amendments in 2009 explicitly prohibited anti-competitive agreements and abuse of dominant market position and emphasized the importance of competition advocacy.

The implementation of the Competition Act, 2002 ('Act') is overseen by the CCI, a statutory body tasked with tackling the issue of appreciable adverse effects on competition in the Indian marketplace and monitoring anti-competitive practices in India, thereby ensuring a fair and competitive market environment.

India witnessed significant advancements in its competition and antitrust regulatory framework with the advent of the Competition Amendment Act, 2023, which introduced several new regulations designed to enhance market integrity and mitigate anti-competitive practices. For example, the requirement for the appellants to deposit 25% of the penalty prior to the consideration of their appeal, an amendment to the definition of the relevant product. Establishment of a new threshold, i.e., transactions involving acquisition, merger, or amalgamation that meet or exceed Rs. 2,000 Cr and involve entities with substantial business operations in India, will now necessitate approval from the CCI.

Framework of the CCI

The main function of CCI is to create an environment that promotes equilibrium between the consumer and their satisfaction and the businesses and their growth. The CCI is statutorily bound to eliminate practices that have Appreciable Adverse Effects on Competition ('AAEC') in the relevant markets. According to CCI, AAEC means any agreement that hampers or is likely to hamper the competition in the relevant market. In the Competition Commission of India v. Coordination Committee of Artists and Ors.1, the Hon'ble Supreme Court of India held that the relevant market can be a relevant geographic market as well as the relevant product market and the determining factors to consider have been defined under ss. 19(6) and 19(7) of the Act. The CCI tackles the following aspects:

- Anti-competitive Agreements, including cartels

- Abuse of dominant position by enterprises

- Regulations on combination (mergers, acquisitions, and amalgamations)

- S. 3 - Anti-competitive Agreements: Under s. 3 of the Act, the CCI actively monitors and regulates anti-competitive agreements, including cartels. This section prohibits any agreement that causes or is likely to cause an appreciable adverse effect on competition within India. Cartels, which are arrangements between competitors to fix prices, limit production, or share markets, are particularly scrutinized. The CCI has the authority to investigate such agreements and impose penalties on entities engaging in anti-competitive practices.

| Sr No. | Types | Description | Example |

|---|---|---|---|

| 1. | Price Fixing | An agreement between competitors to set prices at a certain level undermines market competition. | When several coffee shops in a neighbourhood agree to charge a pre-decided amount for a latte instead of offering a competitive price. |

| 2. | Limit production and/or supply | Competitors agree to reduce their production or supply of goods to maintain higher prices. | Oil companies decide to cut back on oil extraction to keep prices high, which impacts gas prices at the pump. |

| 3. | Agreement to allocate markets | Competitors divide markets or customers to avoid competition in certain areas. | Phone companies demarcating their business territories and agreeing to provide services in the allocated markets only. |

| 4. | Bid rigging or Collusive bidding | Competitors conspire to set bids for contracts, ensuring one wins while keeping prices high. | Construction firms coordinate to submit inflated bids, ensuring one wins the contract while keeping prices up. |

| 5. | Tie-in arrangement | A seller requires buyers to purchase a secondary product as a condition of buying the primary product. | A software company requires customers to buy a certain antivirus program when purchasing their operating system. |

| 6. | Exclusive supply/distribution arrangement | A supplier restricts distributors from selling products from competing suppliers. | A soft drink manufacturer only allows certain restaurants to serve its drinks, preventing others from offering competing brands. |

| 7. | Refusal to deal | A business refuses to do business with a company to stifle competition. | A major supplier decides not to sell products to a retailer that also sells a competitor's products. |

| 8. | Resale price maintenance | A manufacturer sets minimum prices that retailers must charge for their products. | A shoe company insists that all stores sell its shoes at a minimum threshold price without offering discounts. |

InCoal India Limited and Ors. Vs. Competition Commission of India and Ors. 20232, Coal India Limited ('CIL'), the largest coal producer in India, faced allegations of abusing its dominant market position by incorporating unfair terms within its fuel supply agreements ('FSAs') with power producers and other purchasers. The CCI determined that CIL violated competition law by including terms in its FSAs that constrained the negotiating power of buyers and imposed exorbitant costs. In 2014, the CCI imposed a substantial penalty of Rs.1,773.05 crore on CIL. Additionally, the CCI mandated that CIL revise its FSAs to eliminate such unfair practices, thereby ensuring transparency and equity in its commercial dealings. The Supreme Court of India ruled against the statutory monopoly of CIL, holding that CIL is not exempt from the operation of the Competition Act.

- S. 4 - Abuse of Dominant Position: S. 4 of the

Act addresses the abuse of dominant position by enterprises. A

dominant position is defined as a position of strength enjoyed by

an enterprise in the relevant market, which enables it to operate

independently of competitive forces. The CCI investigates instances

where a dominant enterprise engages in practices that may exploit

its position, such as predatory pricing, refusal to deal, or

imposing unfair conditions on consumers. The goal is to ensure that

dominant players do not stifle competition or harm consumer

interests.

In the case of Belaire Owners' Association v. DLF Limited, HUDA & Ors. 20143, the CCI determined that DLF had violated s. 4(2)(a)(i) and (ii) by imposing unfair or discriminatory conditions in its service agreements. The CCI found DLF guilty of abusing its dominant market position and imposed a hefty penalty of Rs.630 crore. Additionally, the CCI instructed DLF to stop enforcing these unfair conditions in its agreements with buyers in Gurgaon. DLF was required to revise the identified unfair terms within three months of receiving the order.

- Ss. 5 & 6 - Regulations on Combinations:

Under ss. 5 and 6 of the Act, the CCI also regulates combinations,

including mergers, acquisitions, and amalgamations. These sections

require that any combination that meets certain thresholds be

notified to the CCI for approval. The CCI assesses whether the

proposed combination would lead to an appreciable adverse effect on

competition in the relevant market. By regulating combinations, the

CCI aims to prevent market concentration that could harm

competition and consumer welfare.

The Tata group's recent acquisition of Air India and subsequent plan to merge it with Vistara were granted CCI approval. The CCI also approved the merger between Viacom18, promoted by Reliance Industries, and Star India, a subsidiary of Walt Disney. This merger is poised to establish India's largest media and entertainment entity.

A Toothless Tiger? CCI and Its Challenges

The CCI was founded with the optimistic aspiration of serving as the protector of fair competition and antitrust regulations within the nation. Established in 2002, the Act aimed to eliminate anti-competitive conduct, mitigate monopolistic tendencies, and safeguard consumer rights. Unfortunately, the CCI's performance has significantly deviated from its original purpose. Rather than functioning as a formidable entity to oversee market conduct, it has frequently been labelled a 'paper tiger' and criticized for its lack of effective enforcement, which raises concerns regarding the robustness of India's antitrust framework. The unsatisfactory performance metrics of the CCI highlight a fundamental problem: empowering an authority without adequate enforcement capabilities or political resolve, which renders even the most well-meaning regulatory agencies ineffective in addressing anti-competitive behaviours.

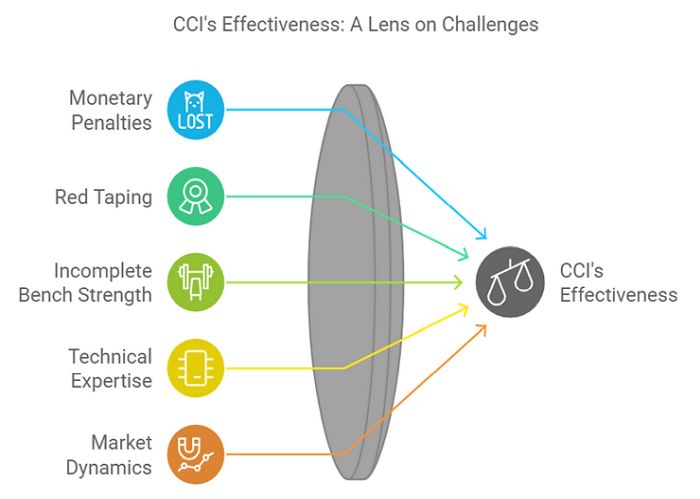

- Monetary penalties: The CCI has failed miserably in collecting the penalties levied while enforcing the statutory provisions envisioned in the Act. It is evident from the statistics that since 2011, the CCI has imposed penalties totalling Rs.18,351.64 crore but has only managed to collect a paltry Rs. 425 crore, which is just 2.3% of the total. The absence of a mandatory deposit prior to appealing a decision of the CCI has incentivized corporations to contest penalties without substantial repercussions. Even when the National Company Law Appellate Tribunal ('NCLAT') upholds the CCI's ruling, cases are frequently remanded to the CCI for recalculation of penalties. During the fiscal year 2022-234, the NCLAT resolved 160 appeals concerning 44 CCI orders. Of these, 145 appeals were dismissed; among those dismissed, 79 were remanded for reconsideration of penalties. Under the prevailing legal provisions, the NCLAT has the discretion to mandate that an appellant deposit 10% of the penalty imposed by the CCI as a prerequisite for the hearing of an appeal. This practice is rooted in the Supreme Court's decision in Ultratech Cement Ltd v. Competition Commission of India 20135, which endorsed the requirement of a partial deposit as a suitable interim measure, considering that monetary penalties are infrequently overturned. Furthermore, in Himmatlal Agrawal v. Competition Commission of India6, the Supreme Court elucidated that while the NCLAT possesses the authority to impose such a condition, it must be contingent upon a stay of the penalty order, thereby safeguarding the appellant's right to appeal without imposing an undue financial burden.

- Red Tapping: The CCI, while investigating a matter, must go through a cumbersome process, which also has been increased by the recent judgment of the Madras High Court in the MRF v. CCI7 case where the Hon'ble HC ordered that in an investigation under the Act, an entity that has not been named in the complaint (i.e. a third party) should be given prior notice and sufficient opportunity to contest its inclusion in the investigation as an opposite party. The CCI has encountered considerable challenges from higher courts, which have progressively restricted its authority. In the case of Telefonaktiebolaget LM Ericsson v. CCI 20168, the Delhi High Court ruled that patent law falls under a specific legislative framework. The Patents Act functions as a comprehensive code that adequately addresses issues related to licensing violations. Therefore, any infractions related to patent law should be addressed by the Patent Controller. This inefficiency hinders company growth and business, which are stuck in the limbo of red tape.

- Incomplete Bench Strength: Since the fiscal year 2014-15, the CCI has yet to operate at its full sanctioned capacity. The CCI's highest strength, recorded at 133 members, constituted only 67% of its authorized capacity during the fiscal years 2016-17 and 2018-19. The CCI's budget currently stands at Rs.51 crore9, which has remained unchanged since the previous financial year. On 25.10.2022, Ashok Kumar Gupta, the then Chairperson of the CCI, retired upon reaching the age of 65, resulting in a vacancy that the Central Government did not fill for nearly seven months. Consequently, the CCI was compelled to invoke the doctrine of necessity, a legal principle allowing for actions that would otherwise be impermissible under normal circumstances, enabling it to proceed with the approval of combination cases. This deficiency in leadership has led to significant delays in case resolutions, particularly in high-profile investigations involving major technology firms such as Google and Apple. The CCI has initiated investigations against Google on three separate occasions - 22.06.202110; 07.01.202211; and 15.03.202412 - all of which remain unresolved. The situation is even more critical in the case against Apple, for which an investigation was ordered on 31.12.202113. Nearly three years later, the Director General, the investigative wing of the CCI, has submitted two reports—one in 2022 and another in July 2024—both indicating that Apple has abused its dominant market position within its iOS app store ecosystem. However, these reports had to be retracted in August 2024 after Apple contended that sensitive commercial information had been disclosed to its competitors. This retraction is anticipated to cause further delays in reaching a conclusive determination regarding the case. Since October 2022, the CCI has issued only one order under s. 26(1) of the Act (initiating an investigation based on a prima facie assessment) and has not issued any orders under s. 27 (determining a contravention against an enterprise). The Alliance of Digital India Foundation ('ADIF'), the informant in the CCI's most recent s. 27 order, has alleged that Google violated directives set forth in that order. ADIF has filed multiple applications before the CCI concerning these violations, all of which remain pending. The situation has escalated to the point where the finance minister intervened to review the CCI's performance, expressing concerns over the lack of adjudication.

- Such incompetency results in increased case pendency, even before the constitutional courts are already drenched in work. The real issue with CCI is that the statute has given them only adjudication power rather than enforcement power. That adjudication power is also lacking due to a lack of human resources.

- Market dynamics: Market dynamics in technology-driven sectors are evolving unprecedentedly. Such rampant changes pose significant challenges for regulatory bodies like the CCI. The rapid advancement of digital platforms often outstrips the ability of traditional regulatory frameworks to respond effectively. For instance, the Uber case involving predatory pricing illustrates how market conditions can change swiftly, making it difficult for regulators to address anti-competitive practices in real-time. For instance, Uber employed aggressive pricing strategies to gain market share quickly, offering fares well below those offered by competitors. While this initially benefited consumers through lower prices, it raised concerns about the long-term viability of smaller players in the market. By the time regulatory authorities attempted to intervene, Uber had already established a strong foothold, complicating efforts to restore competition. Similarly, the rise of e-commerce giants like Amazon has led to allegations of unfair pricing tactics and the undercutting of local businesses. These companies can leverage vast resources to offer steep discounts, making it challenging for regulators to monitor and respond swiftly to potentially anti-competitive behaviour. Traditional regulatory processes can be lengthy and often fail to keep pace with the rapid changes in such markets, thus allowing harmful practices to persist.

- Technical Expertise in Navigating Complex Markets: As the landscape of business practices becomes increasingly sophisticated, the CCI faces significant challenges in effectively regulating these complexities. The rapid evolution of technology-driven sectors requires not only regulatory vigilance but also a deep understanding of advanced technical concepts. For example, the landmark case involving Google highlighted the intricacies of algorithms and search bias, illustrating the critical need for specialized knowledge to identify and address anti-competitive behaviours. In the Google case, the investigation centred around allegations of the tech giant manipulating search results to favour its own services over competitors. This scenario underscores how intricate digital ecosystems can complicate regulatory assessments. Regulatory bodies often struggle to make informed decisions without a solid grasp of how algorithms function and their potential market impacts. Consequently, the CCI's effectiveness in ensuring fair competition hinges on its ability to incorporate technical expertise into its evaluation processes. Moreover, the legal frameworks governing enforcement actions compound the challenges. Lengthy litigation periods and multiple layers of appeals can significantly delay the CCI's interventions, reducing the immediacy of its decisions. The prolonged legal battle in the Coal India case exemplifies this issue. Allegations of anti-competitive practices were brought to light, yet the drawn-out legal proceedings stalled timely regulatory action, allowing potentially harmful market behaviours to persist unaddressed. These delays not only diminish the effectiveness of the CCI's rulings but can also lead to a loss of consumer trust in the regulatory process. Stakeholders may perceive the CCI as unable to act decisively, undermining its authority and the overall perception of fair competition in the market.

Conclusion

The CCI's shortcomings are especially evident in high-profile cases involving major companies like Google, Apple, and Uber, where its investigations have been frustratingly slow and its actions often insufficient and delayed. This inefficiency is worsened by a lack of leadership and inadequate staffing, which hampers the CCI's ability to resolve cases or proactively prevent anti-competitive practices. Additionally, the fast-paced evolution of technology-driven sectors leaves the CCI struggling to keep up, making it difficult to understand the complexities of digital ecosystems and market dynamics.

Ultimately, the CCI finds itself trapped in a cycle of inefficiency, outdated legal frameworks, and insufficient political support, undermining its capacity to safeguard market competition and consumer interests. Unless the government tackles these systemic challenges—by increasing resources, simplifying legal processes, and empowering the CCI with greater enforcement authority—the CCI will continue to fall short of its responsibilities, proving ineffective in addressing anti-competitive behaviour and maintaining fair market conditions in India.

Footnotes

1. MANU/SC/0262/2017.

2. MANU/SC/0670/2023.

3. MANU/CO/0038/2015.

4. https://www.cci.gov.in/public/images/annualreport/en/annual-report-2022-231703571209.pdf

5. https://api.sci.gov.in/jonew/bosir/orderpdf/1735954.pdf

6. (2018) 17 SCC 421.

7. 2024 SCC OnLine Mad 2244.

8. (2023) 3 HCC (Del) 284.

9. https://www.indiabudget.gov.in/doc/eb/sbe17.pdf

10. https://www.cci.gov.in/antitrust/orders/details/38/0

11. https://www.cci.gov.in/antitrust/orders/details/11/0

12. https://www.cci.gov.in/antitrust/orders/details/1106/0

13. https://www.cci.gov.in/antitrust/orders/details/32/0

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.