- within Insolvency/Bankruptcy/Re-Structuring topic(s)

Inbound and domestic M&A

Source - Venture Intelligence

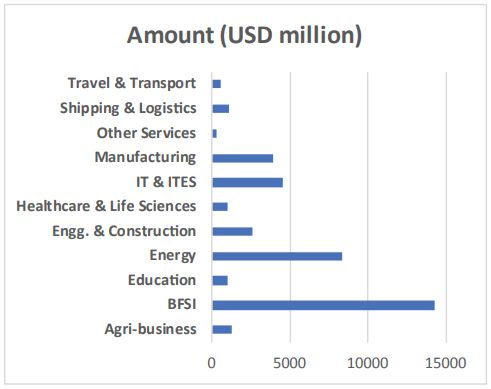

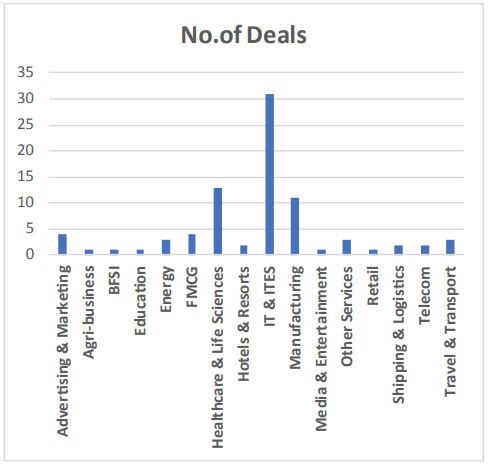

- The period April 2019 – November 2019 saw 279 inbound and domestic M&A deals with announced value of USD 24.45 billion across 134 transactions, as compared to 343 inbound and domestic M&A deals with an announced value of USD 60.74 billion across 153 transactions for the same period in the previous year.

- This marks a 18.6% decline in terms of total deal volume, when compared to the same period last year.

- IT and ITeS, BFSI, and healthcare and life sciences dominated league tables in terms of deal volume whereas BFSI, energy, IT and ITeS, and engineering and construction dominated league tables in terms of deal value.

Source - Venture Intelligence

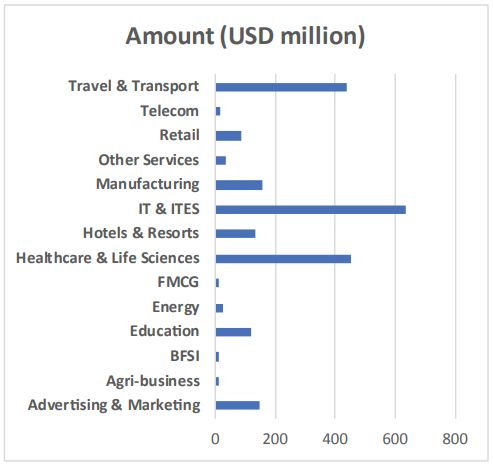

- The period April 2019 – November 2019 saw 49 outbound M&A deals with an announced value of USD 1.3 billion across 23 transactions, as compared to 71 outbound M&A deals with an announced value of USD 7.49 billion across 40 transactions for the same period in the previous year.

- This marks a 30.9% decline in terms of deal volume, when compared to the same period last year

- IT and ITeS, healthcare and life sciences and manufacturing dominated league tables in terms of deal volume.

- IT and ITeS, travel and hospitality, advertising and marketing dominated league tables in terms of deal value.

Important Trends

The drop in outbound, domestic and inbound M&A is likely on account of global uncertainties and a slowdown in the Indian economy.

Domestic M&A comprised 62.2% by value and 68.8% by volume between April 2019 – November 2019, indicating significant domestic interest in M&A activity. While the domestic M&A deal count is consistent with past trends in the same period, there has been a significant increase in deal value attributable to domestic M&A.

Manufacturing, healthcare and lifesciences, and IT/ITeS remain "hot" sectors which continue to attract significant investor interest.

The liquidity squeeze plaguing NBFCs has perhaps contributed to deal activity in the BFSI sector.

To view the full article, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]