By Le Net, LCTLawyers and Kenneth Teoh, Zaid Ibrahim & Co

Key Legislation

- Law on Investment (No. 59-2005-QH11)

- Law on Tendering (No. 61-2005-QH11)

- Decree on investment on the basis of Build-Operate-Transfer, Build-Transfer-Operate and Build-Transfer Contracts (No. 108-2009-ND-CP)

- Decision promulgating the regulations on pilot investment in the Public-Private Partnership

- Form (No.71-2010-QD-TTg) ("Decision on PPP")

To date, the Vietnamese Government has primarily relied on the State Budget and Official Development Assistance ("ODA") to fund infrastructure development in Vietnam. However, given the quick pace of economic growth, these sources are insufficient to meet Vietnam's infrastructure development needs. To fill this funding gap, Vietnam must look to the use of Public Private Partnerships ("PPPs"), in which Government and the private sector collaborate to carry out projects, and share the attendant, the responsibilities and risks.

1. GENERAL REGULATIONS

The concept of PPP is extremely wide, covering any cooperation between the private sector and the public sector for infrastructure development or public services. Some PPP models as Build-Operate-Transfer (BOT), Build- Transfer-Operate (BTO) and Build-Transfer (BT) were governed by the Decree on BOT and the Law on Investment.

Article 23.2 of the Law on Investment states:

"Investors shall be permitted to sign a BOT, BTO and BT contract with the competent State bodying order to implement projects for new construction, expansion, modernization and operation of infrastructure projects in the sectors of traffic, electricity production and business, water supply or drainage, waste treatment and other sectors as stipulated by the Prime Minister of the Government. The Government shall provide regulations on investment sectors; on the conditions, order, procedures and methods of implementation of investment projects; and on the rights and obligations of the parties implementing an investment project in the contractual form of BOT, BTO and BT."

Although the Government has issued the Decree on BOT as mentioned above, it seems that certain provisions in this Decree has not attracted more investors to participate.

The Decision on PPP dated 15 January 2011 opened a wide and particular legal framework for PPP in Vietnam. In general, it inherited many regulations of the Decree on BOT. This Decision has been implemented for a period of 3 to 5 years from the effective date until the Government issues a replacing decree on the investment in the PPP form.

2. DECISION ON PPP

2.1 Incentives:

Upon the Decision on PPP, foreign investors shall have certain important incentives for PPP projects, including (i) incentives in corporate income tax, import duty and withholding tax, (ii) exemption from land rent during the operation period, (iii) permission to mortgage the land and the fixed assets to raise project finance loans, (iv) right to buy foreign currencies, (v) assurance of provision of public services and (vi) guarantees for obligation of the Investor and project enterprise.

Given these incentives and other favorable macro-economic factors, such as stable political conditions, a young population and a sizable market, Vietnam should be attractive to foreign investors interested in developing infrastructure projects.

2.2 PPP projects:

Sectors for pilot investment in the PPP form include:

- Roads, road bridges and tunnels, and ferry landings for road traffic;

- Railways and railway bridges and tunnels;

- Traffic in urban areas;

- Airports, seaports and river ports;

- Clean water supply systems;

- Power plants;

- Health (hospitals);

- Environment (waste treatment plants);

- Other projects on development of infrastructure and provision of public services under the Prime Minister's decisions.

The private participating portion of a PPP project shall comprise the equity of the Investment, domestic and international commercial capital sources and other capital sources. The equity of an Investor must represent at least 30 percent of the private participating portion. On the other hand, the total value of the State participating portion in a PPP project shall not exceed 30 percent of the total investment capital of a Project, unless otherwise decided by the Prime Minister.

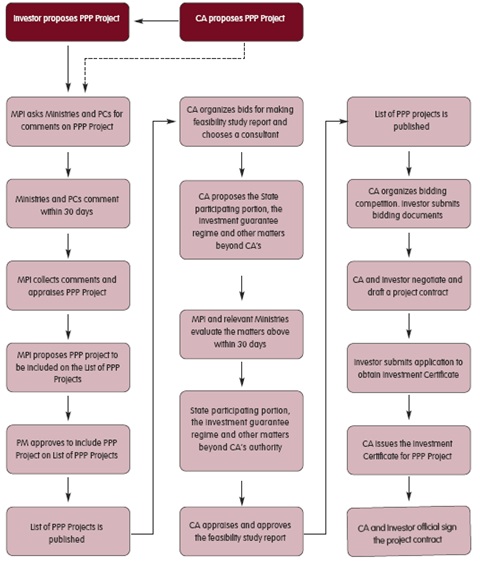

The procedures for carrying out the PPP Project are described in the chart below:

3. DECREE ON BOT

Decree on BOT is one of the most encouraging policies that considerably promote the cooperation between foreign investors and Vietnamese Government.

Decree on BOT provides regulations for investment conducted under BOT, BTO, BT contracts. According to this Decree, foreign investors are eligible for the favorable investment policies such as tax incentive policies on enterprise income tax and import duty on imported goods supplied to implement these contracts or offered free land use fee for the land where projects are implemented. In addition, Decree on BOT also sets out detailed procedures requesting foreign investors to follow during their investment in Vietnam

4. LAW ON TENDERING

The Law on Tendering does not require that public tendering be carried out for all projects that originate from the State (or one of its agencies). Public tendering is only mandatory where more than 30 percent of a project is financed by the State. 'Financed by the State' is defined to include the use of State Budget funds, Government guarantees for credit facilities, credit facilities for investment and development of the State, investment and development funds of state-owned enterprises and other capital funds managed by the State.

Certain exceptions apply to the public tendering requirement, including the following:

- Limited tendering, in cases where it is requested by a foreign donor providing the project's financing or where the project is of a highly technical or of a research or experimental nature that only a limited number of bidders are capable of satisfying the project requirements;

- Direct appointment, including cases where it is requested by a foreign donor providing the project's financing, or in special cases such as natural disasters or war, or in projects of a confidential nature or of national interest where the Prime Minister deems it necessary;

- Direct procurement, where a contract was signed for a tender package with similar contents within the previous six (6) months;

- In special cases, with the approval of the Prime Minister.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.