Background

Due to the new transparency register, almost all companies in Germany are obliged now to register specific information about their Beneficial Owner(s). This obligation should be taken seriously because failure to register is punishable by high fines.

In Germany, the Transparency Register and Financial Information Act" (TraFinG) came into force on August 1, 2021 as the implementation of EU Directive 2015/849 of May 20, 2015 and EU Directive 2018/843 of May 30, 2018. Since this date, at least in Germany, all companies subject to registration are obliged to identify their Beneficial Owner(s) and declare it/ them to the transparency register. Previously the transparency register was merely a register that obtained its information from other registers, so that most of German registered companies could avoid a registration. This has now changed completely! All German companies need to be registered in the transparency register as it has become a complete register. Which companies are required to register when and what the term "Beneficial Owner" means shall be explained in the following.

Companies subject to the register

According to Section 20 (1) of the German Anti Money Laundering Act ("Geldwäschegesetz/GWG"), all legal entities under private law as well as all registered partnerships are obliged to notify the transparency register. In particular, companies can no longer claim that registration in the transparency register is not necessary because the required data is already available from entries in other official registers such as the commercial register (so called "notification fiction"). Therefore, more than 2.3 million companies in Germany need to register with the transparency register for the first time.

After initial ambiguities as to whether stock exchange-listed companies should also be covered by the register obligation, these ambiguities have been clarified by the final version of the current Transparency Register and Financial Information Act - there is a notification requirement. The only exception is for registered associations ("eingetragene Vereine").

Beneficial Owner

The key element of the transparency register is the notification of the Beneficial Owner as defined in Section 3 (1) GWG ("Beneficial Owner"). Such a Beneficial Owner is basically any natural person who directly or indirectly holds more than 25 percent of the capital shares or voting rights of a company or exercises control over the company in a comparable manner. It is important to emphasize once again that both direct and indirect participation are considered. It may be the case that there is no Beneficial Owner at all.

Especially due to the consideration of the indirect shareholding, the conditions for beneficial ownership may unexpectedly arise, particularly in the case of a free float. Therefore, companies should very carefully examine the existence of its Beneficial Owner(s), especially in more complicated circumstances, and consider all relevant factors.

Identification

The identification of the Beneficial Owner(s) is generally unproblematic if natural persons are involved who solely exceed the threshold of 25% (direct shareholding) or otherwise exercises control over the company. In this context it is important, that trust agreements and voting rights are also taken into account, so that a register obligation can also occur via such agreements.

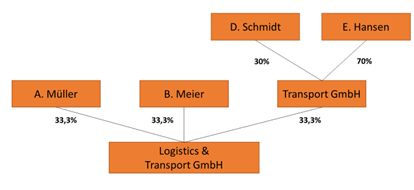

The identification of indirect participation, in which the shareholder does not participate in the company in his own name, but exercises his control via an intermediary company in which he in turn holds an interest, is more complicated. This will be illustrated with an example and a corresponding diagram.

In this case constellation, Mr. Müller and Mr. Meier are Beneficial Owners due to a direct shareholding. Transport GmbH itself (as legal entity) cannot be an Beneficial Owner. For this reason, the audit extends to the participation level above, i.e. the shareholders of Transport GmbH. At this level, the required shareholding rises from more than 25% to more than 50%. Therefore, Mr. Schmidt, who holds only 30% of Transport GmbH, is not to be classified as Beneficial Owner of Logistics & Transport GmbH. In contrast, Mr. Hansen is also the Beneficial Owner of Logistics & Transport GmbH due to his 70% shareholding in Transport GmbH.

If no shareholder exceeds the above thresholds and therefore no Beneficial Owner exists at all, all managing directors must be entered in the transparency register as so-called "fictional" Beneficial Owners.

Information subject to registration

The company must ensure that for each person who qualifies as a Beneficial Owner, the first and last name, date of birth, residence, nature and extent of beneficial interest and all nationalities are reported to the Transparency Register. It is important to mention that apart from the basic obligation to notify, there is also an obligation to keep this information up to date.

Transition periods

Although the Transparency Register and Financial Information Act has already entered into force on August 1, 2021, depending on the type of company, the obligated companies are generally granted a transitional period to complete the registrations. This is March 31, 2022 for stock corporations, European corporations (SEs) and partnerships limited by shares, June 30, 2022 for limited liability companies, (European) cooperatives or partnerships, and December 31, 2022 for all other companies. However, it has to be pointed out that these transitional periods only apply to those companies that have so far been allowed to invoke on the notification fiction. Whether the transitional periods apply must be examined on a case-by-case basis because they do not apply in certain constellations.

Please note that failure to register can result in fines of up to a maximum of EUR 5 million or ten percent of the annual sales of the offending company.

Recommendation

All companies located in Germany should carefully verify their registration obligations and register the Beneficial Owner(s) quickly if not already done in order to avoid the risk of being fined. If there are changes in the shareholding structure of the company, the entry in the transparency register may need to be updated. In particular in cases of changes in indirect participation, registration obligations can easily arise that are not immediately apparent.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.