Contents

- How Cross-Border Payment Collection Services should be Regulated

On January 22, 2025, the "Working Group on Payment Services System, etc." of the Financial System Council published its report on payment services systems (the "WG" and the report published by the WG, the "WG Report"). This was followed by the publication of a bill for amendment of the Payment Services Act (the "PSA", and the bill for amending the PSA, the "Amendment Bill") on March 7, 20251 . The WG Report mainly considers and addresses matters relating to (i) remittance/payment services and (ii) crypto assets/electronic payment instruments (i.e., stablecoins). This newsletter provides an outline of the issues relating to cross-border payment collection services, which is one of the matters considered in the WG Report.

How Cross-Border Payment Collection Services should be Regulated

- Current Status and Issues

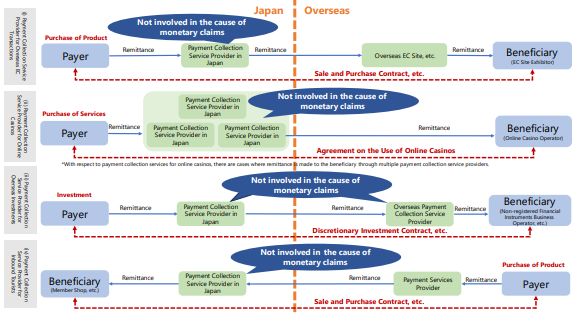

In recent years, there have been cases where cross-border funds transfers processed in the form of payment collection services (shuno-daiko) ("Cross-border Payment Collection Services") have been used for transfer of funds to overseas online casinos and for fraudulent purposes overseas, resulting in the need to regulate these services. In this connection, on December 12, 2024, the Financial Stability Board (the "FSB") published a report entitled "Recommendations for Regulating and Supervising Bank and Non-bank Payment Service Providers Offering Cross-border Payment Services: Final report", wherein the FSB discussed the risks that consumers faced in relation to cross-border funds transfers. These risks include, among others, fraud and misuse of consumers' personal data, operational risks, cyber threats, money laundering and terrorist financing risks, and risks associated with delayed payments. Accordingly, the FSB made recommendations for each jurisdiction to proportionally regulate and supervise these risks.

However, as there are many schemes in which Cross-border Payment Collection Services are provided (such as in businesses operating EC sites), and because imposing blanket regulations on all businesses that offer Cross-border Payment Collection Services would have a significant adverse impact on such businesses, some participants in the WG were opposed to the regulation of such businesses.

B. Proposals in the WG Report

It is stated in the WG Report that even though Cross-border Payment Collection Services should be regulated to a certain extent because transactions utilizing such services give rise to risks like illegal acts, money laundering and terrorism financing, and the lack of protection for Japan resident payers and beneficiaries, it is necessary to ensure that regulations are proportional to the risks and not excessive. Specifically, the WG Report concludes that it is unnecessary for Cross-border Payment Collection Services of certain types to be regulated. These are discussed in more detail below.

- Cross-border Payment Collection Services provided by those

involved in transactions that give rise to monetary claims

In the context of payment collection services provided by platform operators or consignment distributors, etc. who are involved in transactions that give rise to claims, as delivery of items and fund transfers are generally carried out in an integrated manner, risks of any misuse of funds for money laundering and fraud would be prevented by enabling payment collection service providers to verify the details of their transactions. Anti-money laundering and countering terrorist financing (the "AML/CFT") risks can be further lowered if such payment collection service providers establish adequate measures for prevention of AML/CFT risks. Moreover, the involvement of such payment collection service providers would likely enhance the likelihood of funds being received by the intended beneficiaries. Moreover, payment collection services of this type have, to date, resulted in no social and economic detriment in Japan nor have they caused harm to Japan resident users of these services.

In view of the above, it was concluded in the WG Report that, on the condition that payment collection services of this kind are operated legally on the basis that the right to receive payments has been properly subrogated from the creditor of the monetary claims to the payment collection service provider, such payment collection services are not necessarily subject to immediate regulation. - Escrow services

Escrow services are provided in various situations, including in the context of trading at online marketplaces provided by platform operators and overseas cash-on-delivery service providers. There is currently no consensus on whether to regulate escrow services. However, as escrow services have to date resulted in no social and economic detriment in Japan, and because escrow services operate presumably on the basis that they have the right to receive payment in escrow, it is stated in the WG Report that regulation of escrow services are currently not contemplated. - Cross-border Payment Collection Services provided by those with certain capital relationships with customers Payment collection services of this type will also be exempt from regulation, as they pose little operational-related risks and AML/CFT risks.

- Cross-border Payment Collection Services that are expected to

be provided by an entity or provided through an activity in areas

governed by other Japanese laws and regulations Such services will

also be exempt from regulation as they are already subject to

riskmitigation measures, and are therefore deemed subject to

Japanese laws and regulations to a certain extent.

In light of the above, the typical types of Cross-border Payment Collection Services to which fund transfer regulations should be applied are as follows:

- Payment collection services in respect of money used for placing bets on overseas online casinos

- Payment collection services in respect of overseas investments

- Payment collection services that only provide such services upon entrustment by overseas EC operators

- Payment collection services for payments made by inbound tourists in Japan However, the WG Report does not specify the scope of Cross-border Payment Collection Services that will be subject to fund transfer regulations.

Accordingly, it is necessary to carefully review the Amendment Bill and its subordinate legislation.

Source: Excerpt from p.13 of Material 1 of the "Bureau Explanation Material" of the Working Group on Payment Services System, etc. for the 6th Financial System Council (FSA, December 9, 2024)

C. The Amendment Bill

Currently, Article 2-2 of the PSA provides a prescriptive definition of the scope of funds transfer transactions. It is stated in the Amendment Bill that this Article will be revised to include Cross-border Payment Collection Services that meet certain requirements. Due to this amendment, businesses engaging in such Cross-border Payment Collection Services will be required to obtain either a banking license or a license as a funds transfer service provider. These requirements will be prescribed in detail under a subsequent ordinance, the publication date of which has yet to be announced.

In connection with the above, transitional measures have been set out for the revised Article 2-2 of the PSA. For a period of six months from the effective date of the revised PSA (or, if an application for registration as a funds transfer service provider is submitted within such six-month period and is subsequently rejected, until the date of such rejection), businesses may continue providing Cross-border Payment Collection Services without a banking license or a license as a funds transfer service provider. Furthermore, if an application for registration as a funds transfer service provider is submitted within the six-month transitional period, businesses may continue to provide such services even after the sixmonth transitional period has elapsed, until the relevant authorities render a decision on the application, provided that such services may not be continued beyond two years from the effective date of the revised PSA.

- This newsletter is published as a general service to clients and friends and does not constitute legal advice. Should you wish to receive further information or advice, please contact the authors as follows:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.