- with readers working within the Metals & Mining and Pharmaceuticals & BioTech industries

Switzerland is currently negotiating alongside the other EFTA states (Iceland, Liechtenstein and Norway) with the Mercosur states regarding a free trade agreement with Argentina, Brazil, Paraguay and Uruguay. According to the chief economist of the Swiss business association Economiesuisse, Rudolf Minsch, there are a number of reasons why the free trade agreement is very important for Switzerland (e.g. free trade agreements promote prosperity, there are advantages through greater value creation, Mercosur countries have a huge domestic market with strong growth prospects and competitive advantages can arise, e.g. through customs concessions).

Once the agreement has been successfully concluded, it is likely that there will also be an increase in the number of employees working in Brazil and people from Brazil working in Switzerland. It is therefore important to take a closer look at the individual aspects that are decisive for international employee assignments.

What points need to be taken into particular consideration when seconding employees from Switzerland to Brazil, for example for a period of 2 years?

Labour law aspects

Brazilian labour law must be taken into account for an assignment of 2 years. If Brazilian labour law has provisions that are more favourable than Swiss labour law, these must be taken into account. This is because labour law primarily pursues the idea of employee protection.

Contractual aspects

There are various ways to contractually regulate a secondment. The most common options are

- Addendum to the existing Swiss employment contract

- "Suspension agreement" to the existing Swiss employment contract and secondment agreement

- "Suspension agreement" to the existing Swiss employment contract and local (fixed-term) Brazilian employment contract

- Local (fixed-term) Brazilian employment contract only

If the employee is seconded for a fixed-term period and the employer wishes to bring the employee back, the above-mentioned variants 1 to 3 best reflect this. This is because the employment relationship with Switzerland remains in place in each of these variants, even if this is only subliminally the case in variants 2 and 3.

Authorisation law aspects

As the employee is gainfully employed in Brazil, a work permit must be obtained in Brazil.

In Switzerland, the employee must deregister in Switzerland for 2 years due to the move to Brazil.

If the employee is a Swiss citizen, this has no effect under authorisation law.

If the employee is in possession of a Swiss B permit, they would lose this when they deregister in Switzerland. For an EU/EFTA citizen, this is also "not a tragedy", as they will receive a B permit again after returning to Switzerland after two years and resuming work. However, to ensure that a non-EU/EFTA citizen does not have to provide proof of priority for Swiss nationals after returning to Switzerland, an application for quota-free entry can be submitted. If the employee remains with the same employer and returns to the same position, they would then receive a B permit again.

If the employee has a C permit, they will also lose this when they deregister in Switzerland, but this can be "frozen" for the posting period of 2 years, regardless of nationality. This means that the employee will receive their C permit again after their return.

Compensation

One of the mandatory conditions under labour law is that each country ensures that the salary or wage level does not fall below the domestic level. As the Swiss salary level is generally higher than the Brazilian salary level, the employee can continue to be paid their Swiss salary for the assignment in Brazil. However, two points should also be borne in mind here:

Firstly, that the cost of living in Brazil is lower than in Switzerland and the employee would therefore receive an indirect salary increase for the assignment period and secondly, that with the Swiss salary, the employee is likely to earn far more compared to local Brazilian employees.

In addition, the employee will usually receive additional bonuses for the assignment in Brazil, as they are leaving their familiar environment to work in Brazil. The most common allowances are, among others, reimbursement of rental costs or a rent difference, international health insurance, tax equalisation, school costs for the international school for the children, so-called "home leaves", tax consultant costs for the preparation of the Brazilian tax return, relocation costs, housing search, compensation for exchange rate fluctuations. This list is not exhaustive.

Due to the different costs of living, the base salary is usually adjusted for these differences.

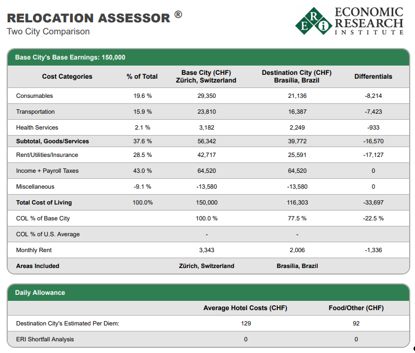

The table below shows the difference in the cost of living for a salary of CHF 150,000 for a family of two. It can be seen that if the employee were to be posted to the Brazilian capital Brasilia, the cost of living would be 22.5% lower than in Zurich.

Quelle: ERI Economic Research Institute, USA

As an assignment is a very costly endeavour, most companies now also take a negative cost of living difference into account.

In many cases, a balance sheet calculation is also used to determine the remuneration for secondments, so that the employee can be shown transparently what the individual elements mean for them financially. Many companies still use the so-called "net approach" so that the employee usually knows exactly how much they will receive during their assignment. All the extrapolations from a tax and social security perspective run in the background.Tax

The employee's unlimited tax liability in Switzerland ends when they move to Brazil and deregister in Switzerland. If the employee is still paid remuneration after deregistration in Switzerland that relates to his Swiss employment and is therefore also subject to Swiss tax liability, the Swiss withholding tax rate of the employer's canton of domicile must be applied.

All remuneration payments relating to the activity in Brazil, regardless of the place of payment, are generally subject to Brazilian taxation.

There is a double taxation agreement between Switzerland and Brazil, which avoids double taxation.

Due to the different tax levels, most companies apply a tax equalisation model. The idea is that the employee does not have to pay more tax during an assignment than if they had stayed at home.

If the employee's tax burden in Brazil is higher than in Switzerland, the employer would bear these additional costs. It should be noted that this assumption of additional costs represents a wage component under tax and social security law and must be extrapolated accordingly. Processing a tax equalisation is administratively complex for payroll accounting and not always easy, but can be handled well with a well-structured process.

Social security

As a rule, you want the employee to be insured under the Swiss social security system for a posting of two years, provided this is legally possible. The insurance cover or scope of insurance is also a key point for most employees when negotiating an assignment.

There is a social security agreement between Switzerland and Brazil, although this only covers AHV/IV. The existence of the social security agreement helps to ensure that every employee - regardless of nationality - can continue to be insured in Switzerland for an assignment to Brazil, provided that they were subject to the Swiss social security system for at least one month prior to the assignment in Brazil. In order to continue Swiss social insurance for the period of the assignment, the employee must maintain their Swiss health insurance. This is one of the key conditions.

In Switzerland, the employee can then remain insured in all branches of insurance (AHV/IV/EO, unemployment insurance, pension fund, accident insurance, daily sickness benefits insurance and health insurance).

However, the social security agreement does not cover all branches of insurance, which means that the employee cannot be exempted from compulsory insurance in Brazil for the branches of insurance that are not covered. It now depends on which additional contributions have to be paid in Brazil in accordance with Brazilian social security law. These costs are often borne by the employer, as these contributions would otherwise have to be paid in addition to the existing Swiss social security contributions. However, the assumption of the employer's contributions represents a salary component under tax and social security law, which must also be extrapolated.

From an administrative point of view and as confirmation of Swiss social security coverage, a certificate of coverage (CoC) must be applied for via the ALPS platform. The certificate received must then also be submitted to the employee and the Brazilian company of assignment.

Payroll

Due to the fact that the employee remains subject to social security in Switzerland during the assignment abroad, but becomes liable for tax in Brazil, payroll accounting must be kept in both Switzerland and Brazil. If you do not wish to make a salary payment in both countries, the payroll accounting of the country in which no salary payment is made becomes the so-called "shadow payroll accounting".

However, this does not primarily play a role in setting up and maintaining payroll accounting, as the entire remuneration must be recognised in both countries and then assessed from a social security law perspective in Switzerland and from a tax and social security law perspective in Brazil. Good co-operation and an understanding of the basic principles of the other country's payroll accounting is important for this. Experience has shown that this is a very time-consuming process until it is properly organised.

Conclusion

It is important to look at each assignment individually and to analyse the individual aspects and details of the assignment in detail. Even if one secondment "superficially" looks the same as another, this does not always mean that the result is the same. It should also be noted here, and especially in advance, that "unfortunately the devil is often hidden in the details".

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.