- within Technology topic(s)

Statistics of the expatriate population and short stays with Swiss employers subject to reporting requirements

On 11 June 2020, the State Secretariat for Economic Affairs SECO published the reports on the implementation of the accompanying measures (FlaM) and the Federal Act against Illegal Employment (BGSA) in 2019. The accompanying measures concern the implementation of the provisions of the Agreement on the Free Movement of Persons between Switzerland and the EU in the context of postings to Switzerland. This concerns the monitoring activities of the enforcement bodies with regard to compliance with the working and salary conditions of foreign employees. For those areas in which there is a valid generally binding collective labour agreement (CLA), the joint commissions are responsible, and for the rest of the labour market, the cantonal tripartite commissions are responsible.

In 2019, the number of short stays from the EU subject to reporting requirements was 3.8 % higher than in the previous year. However, short-term job applications with Swiss employers are the largest group of reportable stays with a share of 56.4% (2.8% more than in the previous year), followed by posted employees working in Switzerland for longer than 90 days with 36.2%. The smallest group of all, is that of self employed service providers with 7.4% (1.6% less than in the previous year).

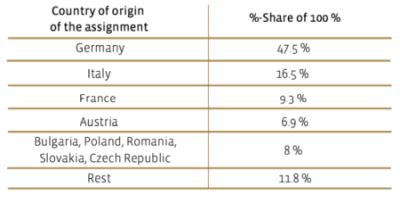

The increase in the number of short-term jobs started with Swiss employers, were mainly due to the agricultural sector (+7.2%, 1233 persons), the hotel and restaurant industry (+5.2%, 985 persons) and the personnel leasing sector (+2.3%, 874 persons). From a cantonal perspective, the majority of shortterm job openings are in the cantons of Zurich (14.0%), Geneva (11.5%), Vaud (9.1%) and Ticino (8.6%). This year , the Canton of Valais recorded the largest increase in short-term job applications with Swiss employers, with 16.3% in the areas of agriculture and personnel hire. After two years of decline, the number of posted employees rose again in 2019. The origin of the posted employees has not changed in the composition of the countries of origin. The largest group of posted employees comes from Germany with 47.5%, followed by Italy with 16.5%, France with 9.3% and Austria with 6.9%. Posted workers from Bulgaria, Poland, Romania, Hungary, Slovakia and Czech Republic account for only 8%. Most of the secondments take place in the manufacturing sector with 33.7% and in the ancillary building trade with 26.3%.

The number of self-employed service providers continues to decline. The reason for this, is the failure to report self employed persons in the main and ancillary building trades. However, the number of declarations of self-employed persons in the trade sector remains constant. The number of self employed persons in the church, culture, sport and entertainment sector has increased sharply, which means that the number of postings in the main construction and ancillary construction sectors has fallen by more than half. Trade was overtaken. More than half of the reports, 51.5%, are from the five cantons of Zurich, Geneva, Bern, Ticino and Basel City, with the largest increase in the canton of Ticino (+14.2%).

Control system for accompanying measures

The Law on Posted Workers (EntsG) forms the legal basis for the accompanying measures. In addition, there are the generally binding collective employment agreements and the enactment of standard employment contracts. The aim of the accompanying measures is to comprehensively monitor the Swiss labour market, and to control the working and wage conditions of Swiss employers and companies that employ them. The aforementioned executive bodies, namely the parity and tripartite commissions, have SECO as their supervisory authority, which determines the qualitative and quantitative requirements of the supervisory bodies. Based on the legal obligation in the law on the posting of officers, the canton pays 50% of the remuneration, and the Confederation and SECO pay 50%. The joint commissions receive a lump sum of CHF 650 for each inspection and are financed with an hourly rate of CHF 100 for special inspections.

The minimum national target for checks is set at 35,000 per year. The controls between the different categories of employees are risk-based, reflecting the intention to increase controls on posted workers who are most affected by the pay gap between Switzerland and EU/EFTA countries (e.g. Italy, Poland, etc.).

In current practice, 30-50% of all posted workers and self employed service providers subject to declaration are checked. In contrast, only 3% to 5% of all Swiss employers are subject to controls.

In 2019, around 121 inspectors were working for the cantonal tripartite commissions. This means that 121 inspectors checked the working and wage conditions of companies that are not subject to a generally binding CLA. It is difficult to estimate the number of inspectors on the joint commissions for those areas in which there is a generally binding CLA.

Results of labour market controls of Swiss companies

The results of the labour market inspections in 2019 have exceeded the national minimum target of 35,000 inspections per year. In 2019, 41,305 checks actually took place. As expected, 29% of the reported delegates and 8% of all Swiss employers were checked.

The lower proportion of checks on Swiss employers can be explained by the fact that checks on posted employees cannot always be made, especially retrospectively. In this circumstance however, Swiss employers are subject to stricter and more intensive controls in return for the posted workers in the case of the fight against illegal employment. In 2019, for example, 58% of company inspections were carried out on Swiss employers. The remainder of the controls were carried out at posted service providers with 27% and self-employed persons subject to reporting requirements with 15%. In the area of checks on persons, 80% of these checks were carried out on Swiss employers. 16% of the checks on persons were carried out on posted employees and 4% on self-employed service providers.

The most controlled sectors without a generally binding CLA, with a control volume of more than 57% compared with the previous year, are business services (banking, insurance, real estate and IT). In 2018, the labour inspectors focused on the retail trade and in 2017 on the health sector, which is why the breakdown by sector varies from year to year. Although the volume of inspections in the retail sector has been reduced, inspections in this area remain intensive and at a high level. The level of undercutting fund ?? has remained constant at 11- 13% over the last four years, i.e. from 2014 to 2018. The same rate for Swiss employers also remained stable at 7%-8% over the same period. The most controlled sectors with generally binding CLAs are the ancillary building trade and the manufacturing industry, in which the number of posted employees and self-employed service providers is also highest. The volume of inspections was highest in the Canton of Ticino, with 60% of all inspections.

Results of labour market controls on postings

The majority of posted employees and self-employed service providers work in the ancillary building trade and manufacturing industry. Hence, most checks on postings in these sectors are carried out under generally binding CLAs. The rate of infringements of the minimum wage regulations has increased slightly by 1%, i.e. from 20% to 21% for companies and from 21% to 22% for individuals. Overall, there has been a decline in the number of checks carried out, mainly in the four following areas: metalworking, carpentry, woodworking and building services. Despite the decline, these four sectors have the highest number of inspections carried out. In these sectors 59% of the sending enterprises were checked. In the case of secondments in sectors without a generally binding CLA, the volume of checks has fallen slightly. However, the number of infringements has remained constant. The majority of checks in 2019 were carried out in the manufacturing sectors (55%), business services (finance, real estate and business services) (21%) and ancillary building trades (15%). The wage undercutting rate for secondments was 15%, with the Canton of Ticino leading the way with the highest cases. Among the self-employed, the checks were most frequent in the manufacturing and ancillary building trades. These sectors also recorded the largest proportion of bogus self-employment (43%). One third of pseudo self-employment occurred in the cantons of Ticino and Basel-Land. In 2019, 610 fines, 71 interruptions of work and 272 suspensions of services were imposed due to the documentation obligation to prove self employment.

Sanctions

The mutual agreement procedures between law enforcement bodies and controlled persons is at a very high rate of 84%. However, the cantons also distributed 2,503 fines and 931 service suspensions for Switzerland. The canton of Ticino imposed the most fines and service blocks, followed by Bern, Zurich and Aargau. Only the Canton of Geneva did not impose any fines at all.

In conclusion, the implementation of the accompanying measures in 2019 was a success. The control objectives of the cantonal enforcement bodies have largely been achieved. The protection of wage and working conditions is thus assured. Nevertheless, optimisation projects for 2020 are on the agenda, in particular the revision of the law on the posting of workers in the sense of compliance with cantonal minimum wages by posting companies (motion 18.3473 Abate).

Originally published March 10, 2021

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.