- in European Union

- within Criminal Law topic(s)

- in European Union

INTRODUCTION

During the recent years there have been several key developments around the world in relation to the application of the double tax treaties and international taxation in general. These changes have been primarily driven by the OECD through the BEPS initiative which came about after the 2008 financial crisis, but have since been transposed into most local legislation, as well as case law, which set a precedence of clear rules as to when any benefits under a double tax treaty can be denied or granted.

In the context of financing transactions, which have historically been a common area of abuse and aggressive tax planning, and in light of older structures involving so called back-to-back loans especially in Cyprus after the 2013 banking crisis, the need to find a solution for robust financing arrangements able to withstand these new challenges arose.

To this respect, the Government of Cyprus in an attempt to address the risk that heavily leveraged Cyprus companies were facing, introduced in 2015 the Notional Interest Deduction ("NID") regime. The main purpose of introduction of NID was to assist Cyprus companies to de-leverage the and provide a tax efficient alternative to debt financing, whilst enriching corporate and economic substance for such entities in Cyprus.

In this brochure, we shall examine the main features of NID and identify the benefits that NID offers and how NID interacts to the tax developments.

A. WHAT IS NID

NID is a theoretical or inferred interest expense granted on New Equity introduced into a Cyprus company. NID is calculated for tax purposes only and has the same tax treatment as that of interest expense. In effect, NID encourages equity finance in corporate structures by granting a notional interest deduction, substituting the interest from debt finance, which was otherwise preferable for tax purposes.

B. WHO CAN CLAIM NID

Eligible to claim NID are any Cyprus tax resident companies and Cyprus permanent establishments (PEs) of non-tax resident companies, provided that:

- "New equity" is introduced into the business, which will be used by such business for the purpose of generation of taxable income.

- Such new equity is duly paid, either in cash or in kind, and

- The relevant tax declaration in relation to the claim of NID is duly completed and submitted to the Tax Authorities, and in case that the Tax Authorities require particulars in relation to the computation of the NID, such particulars should be duly completed and submitted in due time to the Tax Authorities.

Eligible to claim NID are also those companies that relocate their tax residency to Cyprus, on or after the 1st of January of 2015, subject to conditions.

C. BENEFITS USING NID

Despite the obvious tax benefit of having a deductible expense for tax purposes without incurring an actual cash outflow, equity financed companies can also address certain substance requirements and associated constraints imposed through recent tax developments.

In summary, current tax environment constrains companies' strategies by enforcing the following:

- Introduction of Transfer Pricing Study on intra group transactions;

- Introduction of Anti -Tax Avoidance Directive and EU Directive on Mandatory Disclosure; and

- Beneficial Owner of the income concept for avoiding abuse of double tax treaties;

In this respect, the application of NID in combination with equity financing may help corporates overcome the above-described obstacles. In particular, these issues may be addressed through equity financing as follows:

- Transfer Pricing Report Issue:

In Cyprus a full set of Transfer Pricing rules have been introduced as of the 1st of January 2022, as opposed to the previous rules in place since 2016 which covered only so called back-to-back financing arrangements. Under these rules, any "intra group finance transactions" which are defined as an arrangement through which a company receives or grants loans or cash advances to/from related parties, are subject to Cyprus Transfer Pricing rules. This means that they are required to proceed with the preparation of a Cyprus Local File, which includes a full Transfer Pricing study and accompanying benchmarking analysis, aimed at establishing the 'arm's length' remuneration applicable in related party transactions.

Therefore, by substituting the debt finance with equity finance for the purpose of granting intra group loans, the company's obligation for the costly and administratively burdensome Transfer Pricing requirement are eliminated.

- Anti - Tax Avoidance Directive Provisions:

The General Anti-Abuse Rule aims to eliminate artificial arrangements whose main purposes is the tax benefit that defeats the object or purpose of the tax laws. Aggressive financing arrestment's, including specifically back-to-back transactions, have been considered in many cases by authorities or courts as being artificial arrangements, with the main purpose of obtaining a tax benefit from though a Double Tax Treaty, which could be denied. Therefore, the current tax environment promotes shifting from such financing arrangements, to more equity financing in capital structures. To this respect, NID is a useful tool that can reduce tax burdens, whilst substantially reducing the risk of falling within the general anti abuse rules and other treaty protections, whilst enriching economic and corporate substance.

- Beneficial Ownership Issue:

The purpose of the Beneficial Ownership test is to attack aggressive tax planning structures by refusing the granting treaty benefits to the entities that are not beneficial owners of the income.

An important factor for determining whether a company is the beneficial owner of income or not, is whether the company retains and exercises the power to dispose the income as it considers best, or whether all or almost all of the income is directly transferred to another entity.

One of the measures that may assist in addressing the Beneficial Ownership Issue is the presence of ample equity within the capital structure, through the contribution of new equity (directly or in-kind), and/or the conversion of debt into equity. This is because through equity finance, a company's obligation for further transferring its profits onto another entity is eliminated, as subsequently, the control of the economic destiny of the income is retained by the company.

D. HOW TO CALCULATE NID

NID is calculated by multiplying the amount of the "New Equity" introduced into the company, with the "Reference Interest Rate".

NEW EQUITY * REFERENCE INTEREST RATE = NOTIONAL INTEREST DEDUCTION

However, the following restrictions apply which limit the amount of the NID granted to the lower of the:

- 80% of the taxable profit that each asset or activity or group of assets or activities separately has generated.

- 80% of the taxable profit that the assets or activities collectively have generated.

In case where tax losses arise from the injection of new equity into the business, no NID should be granted in the relevant tax year.

The terms "New Equity" and "Reference Interest Rate" are defined below.

- Definitions

In order to obtain a clear understanding of the NID equation, the following terms are defined:

- New Equity:

New Equity is defined as the "capital introduced" into the company, which is represented by "shares".

Capital Introduced:

Capital introduced comprises the following:

- Issuance of shares as from 01/01/2015;

- Conversion of loans payable, payables and other debt instruments into issued share capital, on or after 01/01/2015;

- Conversion of non-refundable capital contribution into issued share capital, on or after 01/01/2015; and

- Conversion of realized reserves created after 1 January 2015 into issued share capital.

In accordance to the Cyprus Income Tax Law, Non-Refundable Financial Assistance, and Shares in Partnerships or other transparent entities, explicitly disqualify for the "capital introduced" definition. Shares must be fully issued and paid up (or a taxable obligation recognized), in order for NID to be applicable.

Shares:

The term shares include shares of any class and type. More specifically the type of shares may be:

- Ordinary;

- Preference;

- Redeemable;

- Convertible;

- Share premium;

Unpaid share capital shall be considered as paid-up capital and qualifying as "New Equity" for NID purposes, provided that a corresponding claim will be recognized, which will give rise or is deemed to give rise to interest, subject to income tax.

- Old Equity:

Old equity is defined as the share capital and share premium which is issued and settled prior to 31/12/2014. As of 01 January 2021, any reserves existed before the introduction of NID provision in Cyprus (01 January 2015) and which are "capitalised" after 01 January 2015 are not allowed to be included in the amount of qualifying equity for the purpose of calculating the NID of the year.

- Reference Interest Rate:

Reference Interest Rate is the 10-year government bond yield of the country in which the funds raised from the new equity are invested or employed, increased by 5%.

The 10-year government bond yield used for the calculation of the NID is the rate as at 31st of December of the year preceding the tax year in which the NID is claimed and there is no minimum reference rate.

In the event where the country in which the new equity is invested has not issued a government bond up to and inclusive the 31st of December of the year preceding the tax year the NID is claimed, the reference rate will be equal to the Cyprus 10-year government bond yield plus 5%, of the year preceding the tax year the NID is claimed.

The 10-year government bond yield is obtained from the official site of the Tax Department in Cyprus, in which the 10-year government bond yields for selected countries on an annual basis is issued.

- Basic Principles/Limitations:

In order to calculate NID, the following basic principles should be taken into account.

- Time apportionment of NID:

The NID deduction is granted proportionally for the months for which the company is eligible to the new equity (the capital introduced is both issued and paid) provided that taxable income is generated from the use/investment of such new equity.

NID is subject to an option which can be exercised in each year of assessment in respect of total or part of the NID (for indefinite period).

For better understanding, please refer to the example in Section G, Appendix A.

- Matching Concept:

The matching concept is used by allocating the New Equity to the assets or activities of the business that were financed. NID is calculated for each asset/activity/group thereof separately.

Therefore, on calculating NID of each asset/activity, the value of the new equity contributed together with the Reference Interest Rate for each asset/activity/group should be identified. Further on applying the 80% restriction of NID, the taxable profit of each asset/activity should be identified separately.

For a better understanding, please refer to the example in Section G, Appendix B.

- Method of finance of the new equity:

The method of financing of the new equity by the shareholder may vary, which impacts the calculation of NID, since different treatments apply in each case as analysed below:

- Financed from new equity of another Cyprus company:

NID may be claimed only by one company, unless the reinvestment of the new equity generates different taxable income.

- Financed directly or indirectly from loans:

NID is reduced by the amount of the interest expense claimed for tax purposes by the shareholder if the shareholder is Cyprus Tax Resident.

For a better understanding, please refer to the example in Section G, Appendix C.

- If the new equity is a result of conversion of loans payable into capital:

NID is calculated on the taxable income generated by the assets or activities that the loans payable are financing.

- If the new equity contributed by the shareholder is paid in kind:

The value of the new equity is the market value of the assets contributed at the date of the injection of the assets into the company, provided that such value is accepted by the Tax Authorities.

NID is claimed provided that the injected assets contributed by the shareholder produce taxable profits to the company.

- Restrictions on the grouping of the assets/activities subject to NID:

NID is calculated separately on each asset or activity, unless the assets or activities qualify for grouping.

Therefore, unless the assets/activities form part of a group, the income and expenses of each asset/activity needs to be clearly defined and documented, since the 80% restriction will apply on the taxable profit generated from such asset/activity respectively.

- If the new equity is a result of reorganisation:

NID is claimed by the surviving company on the new equity that results from the reorganisation, subject to conditions.

- Cessation of NID:

NID ceases to be granted if the new equity is withdrawn via a capital reduction (typically requires a court order), or in the instance that the company purchases its own capital, or in the instance the company stops using the new equity for the generation of taxable income.

In the instance of reduction of capital, then the capital is matched to the assets/activities in order to result to the amount of new equity subject to the capital reduction and consequently the restriction of the NID.

- Capital Increase:

Where there is capital increase from the capitalisation of reserves that cannot be matched to assets/activities, then the capitalisation of reserves is conducted in a predetermined order. The order will be analysed on a case-by-case basis.

- Profit/Loss generated from the disposal of the asset or from the activities subject to NID and reinvestment into same type of assets/activities:

Where there is a disposal of an asset generating taxable income and a further reinvestment of the proceeds into another taxable income generating asset, then the profit/loss on disposal is not taken into consideration when calculating the amount of the New Equity for NID purposes.

- Conversion of debt:

Where there is conversion of debt that financed non-taxable income generating assets/activities, into equity, then NID may be claimed if the assets are disposed and the proceeds are used for the acquisition of new taxable income generating assets/activities. However, unless the disposal of the assets and purchase of new assets is incurred after the capitalisation of debt, NID is not granted.

For a better understanding, please refer to the example in Section G, Appendix D.

- Limitation of the taxable loss:

Any brought forward loss that an asset or activity or group thereof may produce is not included in the calculation of arriving to the taxable profit of that asset or activity or group thereof subject to NID.

For a better understanding, please refer to the example in Section G, Appendix E.

A collective restriction applies by which up to 80% of total taxable profit of all assets or activities is calculated. In order to arrive at the total taxable profit of all assets or activities, both the taxable profits and taxable losses generated by each asset or activity are taken into consideration.

NID cannot create or increase taxable losses.

- Limitation on Reference Interest rate:

As of 01 January 2020, there is no minimum reference rate.

Where the subject country has issued 10-year government bond yields for various currencies, then the 10-year government bond yield of the transactions' currency is used. If the subject country has not issued a 10-year government bond yield of the transactions' currency, then the 10-year government bond yield of the country's currency is used.

- NID Anti-Abuse Rules:

- Capital Reduction and Reissuance of New Equity

If there is a capital reduction and increase of capital in relatively short time, then the grant of NID is not allowed.

- General Anti abuse Provisions

The Tax Authorities do not have to grant the NID where the company is entering into certain transactions or arrangements having no commercial or economical rational, as main purpose is to obtain the tax benefit through the NID regime.

Furthermore, the Tax Authorities do not have to grant the NID where the origin of the new equity of the company is from equity existed as at 31/12/2014 and through transactions or arrangements between related parties whose main purpose was is to obtain the tax benefit through the NID scheme.

- Value of New Equity:

Where the capital is introduced in the form of assets through an in-kind capital contribution, the value of the assets should be determined through a report of an external independent expert, unless certain conditions apply. Kinanis LLC remains available to provide assistance with such valuation report, upon request.

- Accounting Records:

In closing, we note that in order for Cyprus tax authorities to ensure that NID is allowed as a tax deduction in full, proper accounting records should be maintained, to show the amount and timing of equity introduced, its use in taxable activities, as well as the direct and residual items financed.

E. CONCLUSION

Recent international tax developments applied universally necessitate that companies reconsider their business structures, and consider whether it would be more beneficial to shift from debt finance to equity finance.

As analysed, equity financing assists in conformance of the globally applied regulations, and whilst also offering a notional interest deduction of up to 80% of the taxable income, which can result in an effective rate of taxation of only 2.5%, through the application of the NID.

F. DISCLAIMER

This publication has been prepared as a general guide and for information purposes only. It is not a substitution for professional advice. One must not rely on it without receiving independent advice based on the particular facts of his/her own case. No responsibility can be accepted by the authors or the publishers for any loss occasioned by acting or refraining from acting on the basis of this publication.

G. APPENDIXES

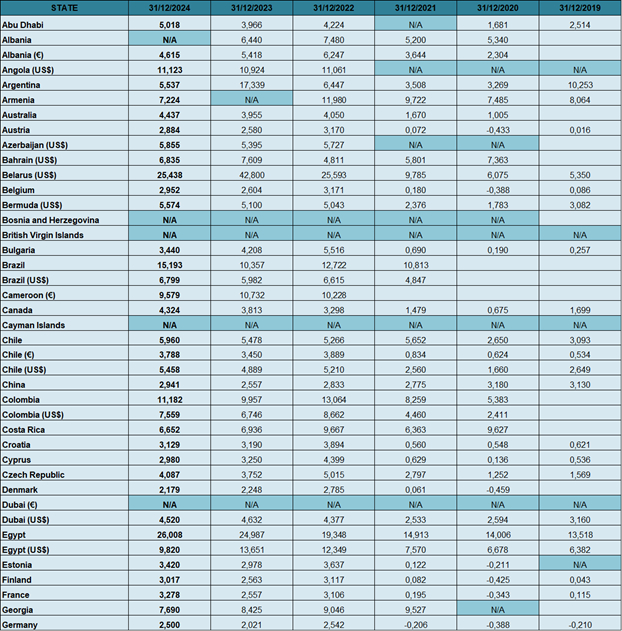

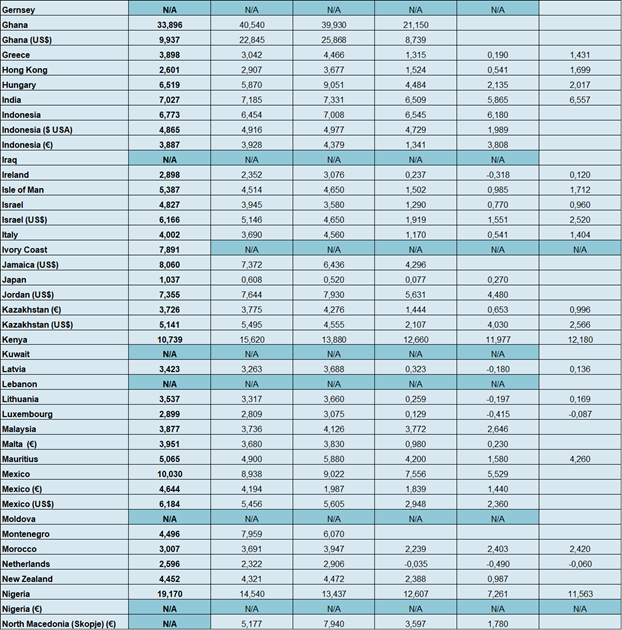

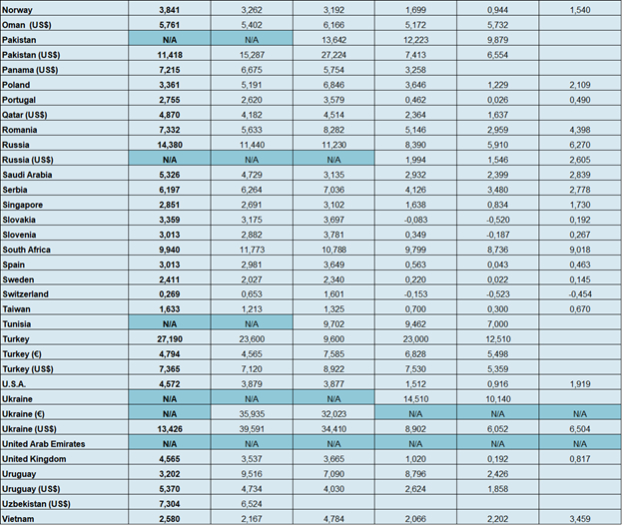

SCHEDULE 1 – REFERENCE INTEREST RATES

The following table gives a summary of the 10-year government bond yield of EACH country since 2017 as issued in the official site of the Tax Department in Cyprus, forming the reference interest rates:

SCHEDULE 2 – NID CALCULATION EXAMPLES

Appendix A

|

Notional Income Deduction Calculation Based on Scenario A |

||||

|

Financial Year 2024 |

||||

|

Facts of Scenario A:

Assumptions of Scenario A:

|

||||

|

Data |

||||

|

Date |

EUR |

|||

|

New Equity Issued |

05.05.2024 |

2,000,000.00 |

||

|

New Equity introduced to be used for trading purposes |

30.06.2024 |

1,000,000.00 |

||

|

New Equity used for trading purposes - proportionate to the days of use |

10.08.2024 |

139,726.04 |

||

|

Year 2023 |

Goods |

Investment of funds in fixed deposit |

Dividend Distribution |

Total |

|

Cost of Assets |

1,000,000 |

1,030,000 |

35,000 |

|

|

Income |

1,065,000 |

50,000 |

0 |

1,115,000 |

|

Taxable Profit (subject to Income Tax) |

65,000 |

0 |

0 |

65,000 |

|

NID Calculation |

||||

|

Taxable Profit |

10Year Government Bond+5% |

Market Value of new equity |

||

|

Data |

65,000 |

10.590% |

139,726 |

|

|

(10Year Government Bond+5%) * MV (new equity) |

14,797 |

|||

|

80% of the Taxable Income |

52,000 |

|||

|

Restriction on NID |

14,797 |

|||

|

Points to Note: |

||||

|

1. New equity is restricted for the calculation of NID to the period in which the new equity belongs to the company (issued and paid) and it is used for the purpose of taxable income. Therefore, the new equity is restricted to the number of days that the new equity was used in trading for goods (from 10.08.2024 till 30.09.2024). |

||||

|

2. NID cannot be claimed on income derived from assets/activities that produce income which is not subject to corporation tax. 3. NID will NOT be granted in respect of the new equity which is used for the investing of funds into the fixed deposit (since the fixed deposit generates investment income, subject to Special Defence Contribution, rather than taxable income). |

|

Computation of Corporation Tax Based on Scenario A |

|

|

EUR |

|

|

Total Income |

1,115,000.00 |

|

Cost of Sales |

1,000,000.00 |

|

Gross Profits |

115,000.00 |

|

Less: |

|

|

Non Taxable Income |

-50,000.00 |

|

NID Deduction |

-14,797 |

|

Taxable profits for the year |

50,203 |

|

Corporation tax @ 12,5% |

6,275 |

|

Computation of Special Defence Tax Based on Scenario A |

|

|

EUR |

|

|

Income subject to Special Defence Tax |

50,000 |

|

Special Defence Tax @ 17% |

15,000 |

Appendix B

|

Notional Income Deduction Calculation Based on Scenario B |

||||

|

Financial Year 2024 |

||||

|

Facts of Scenario B:

Assumptions of Scenario B:

|

||||

|

Data |

||||

|

Data |

Asset A |

Asset B |

Asset C |

Total |

|

Country in which asset is situated |

Country A |

Country B |

Country C |

|

|

10 Year Government Bond+5% |

17.00% |

12.00% |

15.00% |

|

|

Date of introduction of New Equity |

01.01.2024 |

01.01.2024 |

01.01.2024 |

|

|

New Equity (in EUR) |

200,000 |

300,000 |

500,000 |

1,000,000 |

|

Taxable Profit/Loss (in EUR) |

50,000 |

-30,000 |

80,000 |

100,000 |

|

NID Calculation |

||||

|

Asset A |

Asset B |

Asset C |

Total |

|

|

(10Year Government Bond+5%) * MV (new equity) |

34,000 |

36,000 |

75,000 |

145,000 |

|

80% of the Taxable Income |

40,000 |

0 |

64,000 |

104,000 |

|

Restriction on NID |

||||

|

1.Restriction on the lower amount (separately) |

34,000 |

0 |

64,000 |

98,000 |

|

2.Restriction on the lower amount (collectively) - 80% x 100,000 |

80,000 |

|||

|

NID allowed |

80,000 |

|||

|

Points to Note: |

||||

|

1. NID is restricted to 80% of taxable profit that each asset or activity or group of assets or activities separately generated. |

||||

|

2. NID is further restricted to 80% of taxable profit that the assets or activities or group of assets or activities collectively generated. |

||||

|

3. Any loss that an asset or activity may produce is taken into consideration when accumulating the taxable profits of the assets, activities, groups, for the application of the collective restriction to 80% of the total taxable profit generated. |

Appendix C

|

Notional Income Deduction Calculation Based on Scenario C |

|

|

Financial Year 2024 |

|

|

Facts of Scenario C:

Assumptions of Scenario C:

|

|

|

Data |

|

|

10 Year Government Bond+5% |

10.00% |

|

Date of introduction of New Equity |

01.01.2024 |

|

New Equity (in EUR) |

150,000,000 |

|

Loan granted (in EUR) |

150,000,000 |

|

Taxable Profit/Loss (in EUR) |

10,800,000 |

|

NID Calculation |

|

|

Holding Company |

Financing Company |

|

EUR |

EUR |

|

Loan Amount @7% 150,000,000 |

(10Year Government Bond +5%) * MV (new equity) 15,000,000 |

|

Interest Expense 10,500,000 |

80% of the Taxable Income 8,640,000 |

|

Restriction on NID 8,640,000 |

|

|

NID allowed 0 |

|

|

Points to Note: |

|

|

As the new equity obtained is financed by debt, NID is reduced by the amount of the interest expense claimed for tax purposes by the parent company. |

|

|

Therefore, given that the interest expense claimed by the parent company is EUR 10,500,000, which exceeds the maximum NID allowed to be claimed by the company of EUR 8,640,000, the company is not allowed to claim any NID. |

Appendix D

|

Notional Income Deduction Calculation Based on Scenario D |

|

|

Financial Year 2024 |

|

|

Facts of Scenario D:

Assumptions of Scenario D:

|

|

|

Data |

|

|

10 Year Government Bond+5% |

5.05% |

|

Date of introduction of New Equity |

01.01.2024 |

|

New Equity (in EUR) |

150,000,000 |

|

Loan granted (in EUR) |

150,000,000 |

|

Taxable Profit/Loss (in EUR) |

10,800,000 |

|

NID Calculation |

|

|

(10Year Government Bond+5%) * MV (new equity) |

7,575,000 |

|

80% of the Taxable Income |

8,640,000 |

|

Restriction on NID |

8,640,000 |

|

NID allowed |

7,575,000 |

|

Points to Note: |

|

|

Since the conversion of debt into equity was made before the disposal/realisation of the non-taxable income generating assets/activities, and invested into new taxable income generating assets/activities, the Company can apply for NID. However, unless the disposal of the assets and purchase of new assets is incurred after the capitalisation of debt, NID is not granted. |

Appendix E

|

Notional Income Deduction Calculation Based on Scenario E |

||||

|

Financial Year 2024 |

||||

|

Facts of Scenario E:

Assumptions of Scenario E:

|

||||

|

Data |

||||

|

Date |

EUR |

|||

|

Taxable Loss b/f |

5,000 |

|||

|

New Equity introduced to be used for trading purposes |

01.01.2024 |

2,000,000 |

||

|

Country A |

Country B |

Country C |

Total |

|

|

Cost of Assets |

1,000,000 |

500,000 |

500,000 |

2,000,000 |

|

Trading Income |

150,000 |

100,000 |

20,000 |

270,000 |

|

Taxable Profit |

100,000 |

70,000 |

-50,000 |

120,000 |

|

10Year Government Bond+5% |

10.590% |

5.10% |

10.000% |

|

|

NID Calculation |

||||

|

Country A |

Country B |

Country C |

||

|

(10Year Government Bond+5%) * MV (new equity) |

105,900 |

25,500 |

50,000 |

181,400 |

|

80% of Taxable Income (separately) |

80,000 |

56,000 |

0 |

136,000 |

|

80% of Taxable Income (collectively) |

96,000 |

|||

|

Restriction on NID |

96,000 |

|

Computation of Corporation Tax Based on Scenario E |

|

|

EUR |

|

|

Income from trading goods |

270,000 |

|

Cost of Sales |

-150,000 |

|

Gross Profit |

120,000 |

|

Less: |

|

|

NID Deduction |

-96,000 |

|

Taxable income for the year |

24,000 |

|

Less: |

|

|

Taxable Loss b/f |

-5,000 |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.