- within Intellectual Property, Litigation, Mediation & Arbitration and Employment and HR topic(s)

- in United States

If you are an owner of an Intellectual Property asset, you must select the appropriate jurisdiction to establish your business. The factors to consider when making this decision include taxation, legal framework and development prospects in the local business environment.

Cyprus has developed a favourable Intellectual Property jurisdiction, namely the IP Box Regime; also called Patent Box or Innovation Box. This is a business tax regime used to encourage research and development activities regarding an Intellectual Property asset. Its main function is to tax the income derived from a licence, a sublicence, a sale or a transfer of Qualified IP assets. It offers business people an ideal environment with low taxes, a flexible legal framework and development opportunities.

IP Box Regime in Europe can be divided into two categories::

- The one providing reduced rates of tax on qualifying income - implemented by France, Netherlands, United Kingdom.

- The one providing an exemption of a specified proportion of revenues - implemented by Spain, Luxembourg, Belgium, Hungary and Cyprus. This is subdivided to schemes that exempt a proportion of gross and those that exempt a proportion of net revenues.

Comparisons of Cyprus Jurisdiction with Other Countries

✓ Cyprus has the lowest effective tax rate at 2.5%,

in contrast to Belgium at 4.44%; Hungary at 4.5%; Luxembourg at 5.2%; and Netherlands at 7%.

✓ It offers one of the highest deduction rates of 80%,

with Hungary offering 50%, Belgium 85%, Luxembourg 80%, and Netherlands offering none.

✓ There is no overall limit of deduction,

in contrast to Belgium with 100% of pre-tax income, and Hungary: 50% of pre-tax income.

✓ Cyprus has a wide range of Qualifying Revenue:

Royalty, licensing fees, compensation income, trading profits from the IP's disposal, capital nature gains from the disposal not subject to any tax. There are less options in other European countries.

Definitions:

Qualifying IP Assets

Qualifying IP Assets are those which were acquired, developed or exploited by a person within the course of their business.

Such assets are the result of Research and Development (R&D) activities, and they are only subject to economic ownership.

QI assets include patents, computer software, and other non-obvious, useful and novel IP assets. Brands, trademarks, image rights and other intellectual property rights used to market products and services are not considered as qualifying intangible assets.

Qualifying Persons

Qualifying Persons include: Cyprus taxpayers, tax resident Permanent Establishments of non-tax resident persons, and foreign PEs that are subject to tax in Cyprus.

Overall Income (OI)

Overall Income (OI) is the gross income in a tax year less the direct costs incurred to produce the income.

Such income includes royalties connected with the use of IP assets, any amount received from its operation licence or from insurance or compensation.

Qualifying Expenditure (QE)

Qualifying Expenditure (QE) is the sum total of research and development costs incurred for the development, improvement or creation of IP assets. The costs must directly relate to the qualifying intangible assets in question.

Some examples include salaries, general expenses relating to installations, and expenses for supplies related to research and development activities.

Uplift Expenditure (UE)

Uplift Expenditure (UE) is the added cost to the QE, which means the lower of 30% of the eligible costs, or the total amount of the cost of acquisition and outsourcing to related parties for research and development in relation to the eligible intangible asset.

Overall Expenditure (OE)

Overall Expenditure (OE) is the total capital expenditure, qualifying or not, relating to the creation of the IP assets.

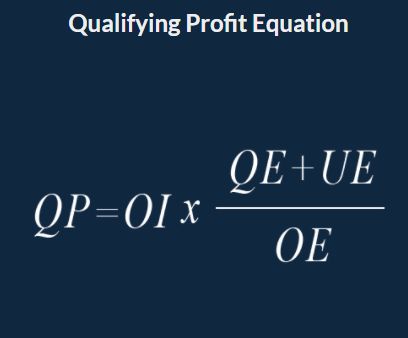

Qualifying Profit (QP)

Qualifying Profit (QP) is the proportion of the overall income (OI) derived from the qualifying assets, corresponding to the fraction of the qualifying expenditure (QE) plus the uplift expenditure (UE) over the overall expenditure (OE) incurred for the qualifying intangible asset.

This is the nexus fraction calculation for the Qualifying Profit formula:

Benefits of the Patent Regime in a Nutshell

- The IP Box includes all different types of Intellectual Property.

- One of the most beneficial tax regimes in Europe for Intellectual Property rights, with an income tax rate on worldwide income at most 2.5%.

- Corporation tax liabilities can be substantially reduced, or even eliminated, when the IP is sold.

- The IP acquisition and development costs can be amortised over 5 years.

- Expenses accrued from the production of royalty income are tax deductible.

- Cyprus signed double taxation treaties with almost 50 countries and has access to the EU Interest and Royalty Directive. This enables intellectual property owners to exploit rights in many countries.

- It has a sound legal system, based on English common law, which ensures that intellectual property owners' interests are protected.

Steps for obtaining the Benefits of Cyprus IP Box Regime

- Set up a Cyprus based company. This company will be wholly owned by the IP's owner(s). This can be done remotely through legal representation.

- Transfer the ownership of the IP to the newly established Cyprus company.

- The Cyprus company will then be able to licence the rights to use the IP to any other company.

- The owners may need to prepare legal agreements to effectively organise the patent box structure. It's always better to seek legal advice.

- Any income the IP owner receives will be taxed at most at 2.5%. The dividends that the IP owner will receive will be totally tax free at source.

Additional Benefits of the Cyprus IP Regime

Cyprus is considered an excellent choice for business purposes due to its

- strategic location,

- its favourable tax system,

- and its low operating costs.

People also choose to live in Cyprus due to the high standard of living, infrastructure, and the general skilled workforce.

Cyprus offers IP owners one of the most advantageous intellectual property tax regimes in the world. Your business can flourish within the advantageous Cyprus IP Box Regime.

Originally Published 8 February, 2021

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.