IN BRIEF

On October 8, 136 out of the 140 countries of the OECD Inclusive Framework on Base Erosion and Profit Shifting (IF) politically committed to potentially fundamental changes to the international corporate tax system. The agreement allows for some optionality in terms of implementation of both constituent pillars.

On October 13, the G20 endorsed the above through a communiqué and remarks from the Italian presidency of the G20 at the Press Conference of the G20 Finance Ministers and Central Bank Governors Meeting.

Cyprus (which is not currently a member of the IF) has, through an announcement issued by the Cyprus Ministry of Finance on October 9, highlighted that Cyprus is in alignment with the principles governing the two-pillar plan of the IF's agreement (link to the relevant announcement can be found here).

Under Pillar One, a formulaic share of the consolidated profit of certain multinational enterprises (MNE) will be allocated to markets (i.e. where sales arise). Pillar One will apply to MNEs with profitability above 10% and global turnover above EUR 20bn. The profit to be reallocated to markets will be calculated as 25% of the profit before tax in excess of 10% of revenue.

Two sectors remain carved out from Amount A of Pillar One: extractive industries and regulated financial services (although, we believe, on a narrower basis than under the 2020 Blueprint).

Under Pillar Two/GloBE, the IF members have agreed to enact a jurisdictional-level minimum tax system with a minimum effective tax rate (ETR) of 15%. Companies with global turnover above EUR 750m will be within the scope of Pillar Two, with headquarter jurisdictions retaining the option to apply the rules to smaller, domestic MNEs.

Exclusions from the GloBE rules are available for pension funds or investment funds that are Ultimate Parent Entities (UPE) of an MNE Group, or any holding vehicles used by such entities, organisations or funds. Various International shipping services will also be excluded from the GloBE rules. Countries also agreed on a number of carve-outs to the GloBE rules.

Importantly, IF members will not be required to adopt the GloBE rules. The rules will have the status of a common approach and not of a minimum standard.

The Statement of the IF (the Statement) still maintains that both Pillar One and Two will come into effect in 2023, with the multilateral convention for the former developed and open for signature in 2022, and legislation for the latter brought in 2022 via national, domestic legislation. This remains an exceptionally ambitious timetable and appears to elevate political considerations over technical feasibility.

IN DETAIL

The announcement reinforces the earlier political agreement that was reached on July 1 and indicates the direction of travel for work on the significant technical details for the coming months. With respect to the IF Statement released in July (PwC Cyprus' insights on the July 1 agreement are available here), little additional technical detail has been shared in the October Statement. The agreed key components of each Pillar are described in the following paragraphs.

Key changes since July

The most significant changes since the announcements of the provisional agreement in July are set out below:

- Pillar One will be implemented via a multilateral convention in line with the Implementation Plan set out in an Annex to the Statement.

- The scoping rules have been modified with a reference not only to a profitability of 10% (profit before tax/ revenue) but to a profitability above 10% calculated using an averaging mechanism. It is unclear what the average mechanism will be.

- The Pillar One allocation will be in respect of 25% of the profit classified as 'residual return' firming up on the intention for it to be between 20% and 30%.

- Principles for determining the surrendering entities from which Amount A will effectively be reallocated to markets have not been clarified.

- An elective binding dispute resolution mechanism for Amount A issues for certain developing economies will be available.

- The Pillar Two minimum tax rate is now firmly expressed as 15% rather than 'at least 15%', potentially satisfying concerns about the rate subsequently being moved higher.

- Details of Pillar Two substance-based carve-outs are more specific, with regards to the amounts that will be carved out, but a precise definition of payroll and tangible assets has not yet been provided.

- An exclusion from the Undertaxed Payment Rule (UTPR) will be available for MNEs of a certain size that have just started expanding abroad.

- The application of the Subject To Tax Rule (STTR) has been restricted to double tax treaties between a developing country and a country with a corporate statutory tax rate lower than 9% (previously 7.5% to 9%).

- Repeal and prevention of Digital Service Taxes (DSTs) and new unilateral measures with similar objectives to Pillar One or Two have been restated but there is no new definition of what exactly the in- scope unilateral measures are.

- There is still no definitive statement on the status of the US minimum tax regime (GILTI) as a compliant Pillar Two regime.

- The timeline for implementation of both Pillars has been updated with reference to intermediary stages that need to happen before the rules can be brought into effect. Target dates for implementation of some of the key components (for example, the UTPR) have been pushed back from 2023 to 2024, reflecting more detailed consideration of the implementation requirements.

Pillar One

Pillar One will apply to MNEs with profitability above 10% (calculated as profits before tax over revenue) and global turnover above EUR 20bn, decreasing to EUR 10bn after 7+1 years from implementation if a year-long review establishes that the new system was successfully implemented in the first seven years and achieved tax certainty.

Observation: Using publicly available data, it has been calculated that the EUR 20bn in-scope threshold and the 10% profitability margin imply that about 50% of the MNEs in scope of Amount A are US MNEs. About 22% are headquartered in other G7 countries and about 8% are headquartered in China (Kartikeya Singh, 2021)1.

Amount A will be calculated as 25% of the profit that exceeds a deemed normal return of 10% ('residual profit').

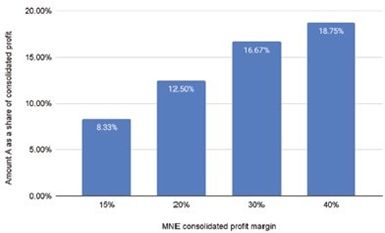

Figure 1. Amount A at different levels of profit margin; profit before tax of 100

Observation: Depending on the profit margin, Amount A will constitute between 8.3% and 18.75% of consolidated profit of an MNE, assuming a profit margin between 15% and 40% (Figure 1). This share of profit will be allocated to markets without relying on the current transfer pricing system. For example, for an MNE with a 40% margin, almost one-fifth of its profit will be allocated using the formula for Amount A. This share will no longer be subject to transfer pricing, implying that transfer pricing policies will also have to be adjusted on the remaining four-fifths of profit, following the introduction of Amount A. It remains an open question whether it will be possible to adjust transfer pricing policies in line with the OECD Guidelines once as much as one fifth of global profit is taken out of the traditional transfer pricing allocation system.

The Statement does not clarify the extent to which the proposed multilateral instrument will try to lock in the 25% share and what the mechanism for changing it will be. This is crucial as the agreed share is not the result of a principled approach but of a political negotiation. For this reason, with enough countries willing to change, the 25% share could be increased just a few years after the initial agreement.

Observation: The G24 is a group of countries established in the 1970s to help developing economies appropriately represent their interests in international negotiations. Many of the G24 countries have now transitioned into also being G20 countries (Argentina, Brazil, China, India, Mexico and South Africa) and middle-income countries (e.g. Colombia, Egypt, Morocco, Pakistan). In September, the G24 issued a statement supporting a formula for the calculation of Amount A with a share of the above-normal-profit to be larger than 30%. This represented the outer limit of the 20%-30% share announced in July. Although the October IF Statement confirms that the G24 were unsuccessful in arguing for this higher share, the agreed 25% is well above the 10%-20% figures which were initially discussed at the OECD when Pillar One was first presented.

When segments of an MNE meet the scoping rules and are disclosed as such in the financial accounts, the segment will be subject to the new allocation rules. No other type of segmentation, e.g. geographical segmentation, will be allowed. It is assumed that segmentation will not be required where the group in its entirety meets the general in-scope rules.

The Statement confirms that the new nexus for the taxation of Amount A in the markets will be purely based on revenue. In particular, most countries will apply a revenue threshold of EUR 1 million, unless their GDP is below EUR 40bn (countries and their GDP). In that case, the nexus for the taxation of Amount A will be established at EUR 250,000.

These primary design features were already broadly agreed in the July IF Statement. However, at a more granular level, little remains known about three other key design features: the mechanism for identification of surrendering entities (i.e. the elimination of double taxation), the safe harbour for marketing and distribution, and the sourcing rules for B2B products and services.

On sourcing rules, the Statement generally indicates that, "Revenues will be sourced to the end market jurisdictions where goods or services are used or consumed," but admits that "detailed source rules for specific categories of transactions will be developed" recognising that for some B2B activities it is not clear what the end market is.

The work on Amount B continues to be postponed to 2022. The Statement does not give details on the design of Amount B or on its scope, but it refers to countries with low administrative capacity in the context of Amount B. Hence, it remains uncertain whether the frequent disputes already arising from income allocation in markets, also beyond developing countries, will be reduced with the introduction of Pillar One.

Unilateral measures

The multilateral convention will remove existing DSTs and "relevant similar measures" for all companies, including those that are not in scope of Amount A. It also commits signatories not to introduce additional, new DST-like measures. This implies that DSTs will be repealed when the multilateral convention is in place. There is no further detailed explanation of the mode of removal of existing DSTs and measures will be coordinated (with reference in the Implementation Plan that signatories to a multilateral convention will need to remove such unilateral measures). There is reference in the Statement to some members having reported that transitional arrangements to remove DSTs are already being discussed.

For the interim period before the multilateral convention is signed, the Statement states that signatory countries will not introduce any newly enacted DSTs (or similar) from 8 October 2021, until the earlier of 31 December 2023 or the coming into force of a Pillar One multilateral convention.

Observation: It remains to be seen whether countries will seek to keep their DSTs in place for groups headquartered in countries that will not sign up to Pillar One or are not able to get the approval of their Parliaments or Congress) to repeal the unilateral measure.

It is still unclear what impact this agreement will have on the EU (27)'s ability to introduce a digital levy, for which a proposal is scheduled for release this month.

Pillar Two

Pillar Two will apply a minimum effective tax rate of 15% to the profits of in-scope multinationals at the jurisdictional level. The July IF Statement tabled a minimum effective rate of "at least" 15%, indicating a floor for the minimum rate, whilst the October Statement indicates 15% as more of a ceiling.

Observation: The Statement does not clarify the extent to which the proposed model legislation will try to lock in the 15% minimum rate across countries and across time -- and what the mechanism for changing it will be. However, it has been confirmed that any EU Directive implementing Pillar Two will not look to introduce a rate higher than 15%.

The Pillar Two proposals consist of two main elements:

- The GloBE rules which are the Income Inclusion Rule (IIR) and the Under Taxed Payment Rule (UTPR).

- The Subject to Tax Rule (STTR).

Global Anti-Base Erosion proposal (GloBE)

The IIR imposes a top-up tax on a parent entity in respect of the low-taxed income of a constituent entity (i.e. income that has not been subject to an effective minimum tax of 15% on a country-by-country basis).

The UTPR will apply where the IIR has not captured any top-up tax or has not absorbed all the top-up tax, and it will ensure that the low-taxed entities pay a minimum effective tax rate of at least that 15%, under a methodology to be agreed. This also applies to the entities in the UPE jurisdiction.

Where the rules are adopted, they must be locally implemented and administered in a way that is consistent with the stated outcomes for Pillar Two, including agreement as to rule order and the application of any agreed safe harbours.

The language about rules being implemented and administered in a manner consistent with Pillar Two is quite broad, and countries are permitted, for example, to choose how to capture the appropriate amount under the UTPR, in denying a deduction, imposing a charge or otherwise. How this consistent application will be ensured is not stated.

A temporary exclusion from the UTPR will be available for 'new' MNEs, i.e. MNEs with no more than EUR 50m of tangible assets abroad and that operate in no more than five countries. The exclusion will be limited to five years after the date on which the MNE becomes in-scope for the GloBE rules for the first time. If the MNE is in-scope at the time the GloBE rules come into effect, the MNE will be subject to the UTPR only five years from the time the UTPR rules come into effect.

Finally, the question of GILTI 'coexistence' is left unresolved and the Statement report uses language that is essentially identical to that of the July Statement.

Observation: The Statement suggests that there will be a phased implementation with the IIR being implemented before the UTPR. This raises the question of whether it is in the interest of any country to apply the IIR when the UTPR does not yet apply.

Subject to Tax Rule

The STTR would apply to royalties, interest, and other defined payments made from a developing country to an IF member state that applies a nominal corporate tax rate lower than a minimum STTR rate of 9%. The additional tax payable would be limited to the difference between the STTR minimum rate and the tax rate that would otherwise apply to the payment.

Observation: The STTR is really of very limited applicability being confined to existing tax treaties and, basically, to the statutory rate. Originally provided as a benefit for developing countries, it does not quite live up to its billing.

Switch Over Rule (SOR)

The SOR was part of the original Pillar Two rules, and it is now stated that Commentary on the Model Rules and on a model treaty provision (as well as a multilateral instrument) will address the "need for a switch-over rule in certain treaties and in circumstances that otherwise commit the contracting parties to the use of the exemption method".

The calculation of the Effective Tax Rate

The country-level ETR calculation will consist of covered taxes (including taxes resulting from the STTR) over profits deriving from the consolidated financial statements. Without giving any further detail, the Statement describes how the measure of accounting profit will be subject to certain adjustments to address, for example, permanent and temporary differences between the taxable and accounting profits.

Although the October 2020 Blueprint (on which the PwC network has commented in this submission) seemed to indicate that cash taxes were to be used for the ETR calculation, the October Statement seems to leave room for both deferred taxes and carryforward mechanisms.

Gateways/Safe harbours

The IF seems to have reached some agreement in terms of gateways. The GloBE rules will exclude jurisdictions where the MNE has a minimal presence (less than €10m revenues and €1m profit) and an amount of revenues representing the substance it has there (revenue = substance-based carve out). That carve-out will be equal to a percentage of the carrying value of tangible assets and of payroll. That figure will be reduced to 5% after the transition period of ten years, during that transition the mark-up on:

- the carrying value of tangible assets begins at 8%, with a 0.2% reduction for each of the first five years (after which it will be 7%) followed by a 0.4% reduction per annum;

- payroll begins at 10%, with a 0.2% reduction for each of the first five years (after which it will be 9% followed by a 0.8% reduction per annum.

Timeline for implementation

An implementation plan was released in addition to the Statement. This plan notes that the text of a multilateral convention (MLC), which will cover the calculation and application of Amount A, will be prepared and concluded, together with an explanatory statement, with a view to it coming into effect in 2023. Similar to the multilateral instrument (MLI) which was concluded in 2017, the MLC will need a critical mass of countries to agree to the text before it can come into force and effect in 2023. However, 'critical mass' is not further defined.

Amount B final deliverables are expected to be released by the end of 2022.

Model rules for GloBE will be developed before the end of November 2021. Pillar Two should be brought into law in 2022, to be effective in 2023, with the UTPR coming into effect in 2024.

The STTR will require modifications to tax treaties and, hence, it will progress by way of a model treaty provision (with commentary) being developed by the end of November 2021. An MLI will be developed by the IF members by mid-2022 to facilitate the adoption of this model treaty STTR provision within bilateral treaties.

Observation: The timelines for implementation remain extremely ambitious. Given the level of technical detail that needs to be finalised across both pillars, it will take a huge effort from all parties to facilitate agreement within this timeline. Unfortunately, because Amount B is not being developed in conjunction with the timeline for Amount A, it appears that Amount A profit reallocations will, at least in the initial year of implementation, not take account of in-country baseline marketing and distribution activities.

WHAT'S STILL TO BE AGREED?

The Statement is very general with respect to some of the key design features of the two Pillars. This implies that the IF will continue to work in an effort to reach agreement on some of the key features of both Pillar One and Two until November 2021 for some designated items, with other elements intended for early, mid, or the end of 2022.

| Elements left to be agreed | ||

| Pillar One | Pillar Two | General/ other |

|

|

|

WHAT'S NEXT?

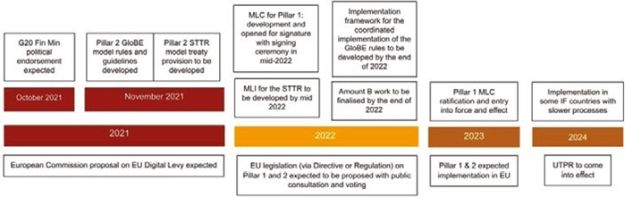

A significant amount of political and technical work still remains to be finalised, with a suggestion that more detailed documents, including draft rules, will be released by the end of 2021 (Figure 2). A consultation would seem to be indicated but has not been announced. The potential complexity of both the Pillar One and Pillar Two rules cannot be overstated, and, hopefully, reducing that complexity will be a key focus over the coming months.

Additionally, there may well be work to bring the 'holdouts' into the agreement, as well as fleshing out some of the concessions won by certain countries over the past few days.

While much has been achieved, it is difficult to see how either Pillar One or Two could be in force at the beginning of 2023. The Pillar One MLC, for example, presents some enormously challenging technical issues. So, notwithstanding the Statement, there is still a high degree of uncertainty regarding the path forward from here.

Figure 2. Possible Timeline

THE TAKEAWAY

Pillar One and Two will introduce two very new and very considerable sets of changes to the international corporate tax system.

The application of Pillar One to the above-normal profit of less than 100 corporate groups means that many MNEs will not be in scope. Nonetheless, the focus of the Pillar on allocating more profit to markets and on using a formula has the potential to change the approach and expectations of tax authorities around the world for all taxpayers, which may be reflected more broadly on audit.

Pillar Two has a much broader application and many MNEs will have to comply with it and line up the resources to calculate the ETR across many jurisdictions, using a mix of accounting and tax rules.

There remains, however, broader uncertainty around the effective implementation of the agreement.

Although a lot of political and technical work is needed before the end of the year, the Pillars now constitute a key tax input for any MNE's scenario planning.

Footnote

1. Kartikeya Singh, "Amount A: The G-20 Is Calling the Tune, And U.S. Multinationals Will Pay the Piper", Tax Notes International, August 2021.

Originally published 19 October 2021

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.