- within Corporate/Commercial Law topic(s)

The revised corporate law will enter into force and effect as of January 1, 2023. The revision focuses on liberalizing provisions governing the formation and capital requirements, improving corporate governance, and introducing electronic media at the general meeting. Statutory provisions governing restructuring were also rendered more precise and more flexible in the course of the corporate law reform, adding new obligations to act. Furthermore, the provisions of the Ordinance Against Excessive Remuneration in Listed Stock Corporations ("VegüV"), which arose from the Minder Initiative, will be incorporated into the Swiss Code of Obligations. Some of the new provisions, specifically with regard to the gender quota and transparency requirements for commodity companies, have already been in force and effect since January 1, 2022.

1. Introduction

This briefing is intended to provide an overview of the most important changes in the law and point to potential areas where action needs to be taken. In this briefing, we focus on changes that concern non-listed corporations; where use ful, we also show the effect that those changes have on listed corporations and limited liability companies.

2. Provisions regarding capital

The corporate law reform aims at adjusting Swiss corporate law not only to current but also future needs. The provisions regarding the capital were therefore subjected to comprehensive revisions. Thus, the legislator's focus on greater flexibility extends from the formation of a company all the way to capital increases, provisions regarding reserves, and the distribution of dividends.

2.1 General adjustments to the share capital

In its endeavor to be able to guarantee greater coher ence between corporate and accounting law, the legislator now provided for the possibility of carrying the share capital in a foreign currency that is essential for the company's business. The capital must correspond to the equivalent of at least CHF 100'000 at the time of incorporation or conversion (Art. 621(2) new Swiss Code of Obligations ["nCO"]). In this case, bookkeeping and accounting must also be done in that same currency. The determination of the currency of the share capital is an inalienable competence of the general meeting, which is subject to a qualified majority. The articles of association must state the amount and the chosen currency of the share capital as well as the exchange rate applied. Any change of currency can only occur as of the beginning of a new fiscal year. The respective resolution of the general meeting may either be adopted prospectively for the following fiscal year, or retrospectively for the current fiscal year. The Federal Council determines which currencies are permitted; currently, these are the British pound (GPB), the euro (EUR), the US dollar (USD) and the Japanese yen (JPY).

While the minimum capital and the payment for the shares subscribed to in a stock corporation or limited liability company, respectively, remain unchanged, the current minimum nominal value of CHF 0.01 for shares in a stock corporation or CHF 100 for shares in a limited liability company, respectively, has been abolished. The minimum nominal value must now only be greater than zero (Art. 622(4) and Art. 774(1), respectively, nCO).

2.2 Intended acquisitions in kind and definition of capability of making contributions in kind

The provisions regarding the (intended) acquisition in kind has been deleted without substitution. Where provisions regarding acquisitions in kind have been set forth in the company's articles of association, they can be revoked only after ten years, even after the new corporate law becomes effective, or by waiver of such acquisition in kind. The deletion of this qualified formation requirement means that the special provisions, such as the obligation to disclose the articles of association and the registration, the auditor's certificate and accountability in the formation or capital increase report no longer apply in case of an (intended) acquisition in kind once the revision of the Stock Corporation Act has entered into force and effect. Therefore, in the future, the question until what point in time after the formation or capital increase (in the event of an acquisition in kind) a relevant connection to the formation or the capital increase does exist, has become moot. This new rule provides greater legal certainty because until now a violation of this provision resulted in nullity.

However, the abolition of the provisions governing acquisitions in kind will not result in the loss of capital protection. Rather, the current (partially supplemented) provisions will generally provide sufficient protection. Should damage occur in the future in connection with "acquisitions in kind", specifically the elements of liability set forth in Art. 754 CO and the claim for return of benefits pursuant to Art. 678 CO will apply.

Moreover, the legislator codified the criteria for ma 2 king contributions in kind, which had previously been used by the Swiss Office of the Commercial Register. These criteria are consistent with current practice, according to which assets are considered eligible for contributions in kind if they meet the following four criteria: capable of being carried as assets (capitalizability), transferability, availability, and realizability (Art. 634 nCO).

2.3 Capital band ["Kapitalband"]

One of the most comprehensive elements of the corporate law reform concerns the introduction of the new legal institution referred to as the "capital band" (Art. 653s – 653v nCO), allowing for capital requirements with greater flexibility being incorporated into the legal system. This capital band can be used only by a stock corporation, not by a limited liability company or a company of any other corporate form. Under the new rule, the board of directors is authorized according to the respective provision of the articles of association to increase and/or reduce the share capital entered in the commercial register by up to 50% and can do so for a duration of no more than five years within a bandwidth determined by the general meeting. The lower limit of the capital band is in the amount of CHF 100'000.

It is by way of the provisions contained in the articles of associations that the powers of the board of directors can be limited (or that the board of directors can be authorized to carry out only a capital increase or reduction, as the case may be) and other requirements and conditions can be adopted. For reasons of protection of creditors, the authorization to reduce the share capital can be granted to the board of directors only if the company has not waived the limited audit of the annual accounts. Where the articles of association grant the board of directors an authorization only for an increase, the capital band basically corresponds to an authorized capital increase as currently provided under the law. The authorized capital increase will become obsolete by the revision of the Stock Corporation Act.

As a rule, the capital band ceases to exist upon expiration of the authorization of the board of directors under the articles of association. The capital band also lapses if the general meeting decides during the validity of the authorization of the board of directors to cancel the capital band, to carry out an (ordinary) increase or reduction of the share capital, or to change the currency of the share capital. Finally, the capital band also expires if the upper or lower limit has because the board of directors' authorization was only for an increase or reduction of the capital.

2.4 Abolition of "authorized share capital"

Companies still holding authorized share capital as of January 1, 2023, are entitled to dispose of it until its expiration. Once the revision has come into force and effect, no authorized share capital can be created, or existing capital adjusted any more.

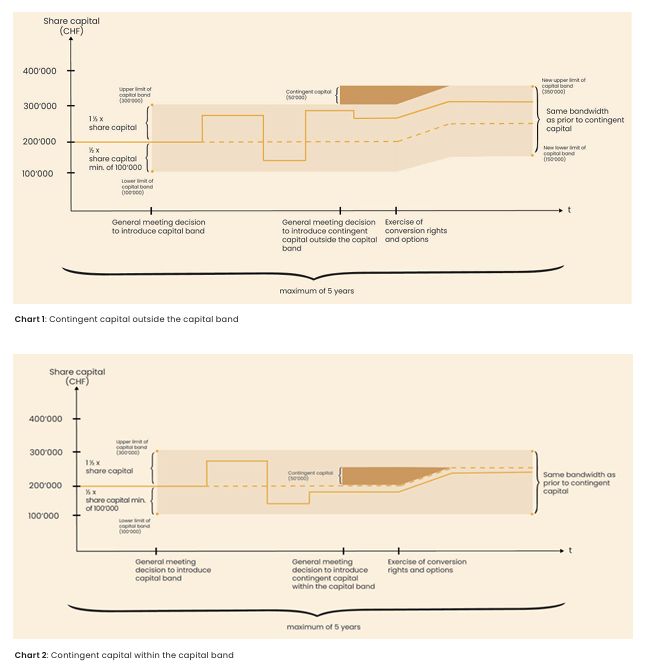

2.5 Contingent share capital

The law continues to provide for capital increases by way of contingent share capital (cf. Art. 653 et seq. nCO). Contingent share capital may exist either outside the capital band or be integrated into it. If the contingent share capital is integrated into the capital band, the limits of the capital band as per the articles of association remain unchanged. A change or adjustment of the capital band is not necessary. If the contingent share capital exists outside the capital band, this will result in a dynamic increase of the lower and upper limits of the capital band (cf. Charts 1 and 2 on p. 4).

2.6 Provisions on reserves (capital reserves / revenue reserves)

The revised Stock Corporation Act adjusts the provisions governing reserves to the extent necessary to the new accounting law. As a result, reserves are subdivided into capital reserves and revenue reserves. Revenue reserves are reserves generated from the company's activities (retained profits), while the capital reserves are created from the contributions of equity providers. An amount of 5% of the annual profit must be allocated to the statutory revenue reserve until, together with the statutory capital reserve, it reaches 50% of the share capital entered in the commercial register. In the event that voluntary reserves are to be created, the general meeting may provide for this in its articles of association or by way of a shareholder resolution. However, voluntary revenue reserves may be created only if this is justified by the continued prosperity of the company and by taking all shareholder interests into account.

2.7 Interim dividend

The possibility of an interim dividend had not yet been provided under the law. Under the new rules, the general meeting may adopt a resolution to distribute an interim dividend on the basis of interim financial statements (Art. 675a nCO), which dividend will have to be distributed out of the results of the current fiscal year. This is subject to compliance with the general provisions on dividends and to the preparation of audited interim financial statements. An audit is not required if the company has waived the limited audit. There is also no need for an audit if all shareholders waived it and the claims of creditors are not jeopardized as a result (Art. 675a(2) nCO).

3. General meetings modernized and more flexible

Modernizing and making general meetings more flexib le is another focus of the corporate law reform. Particular consideration is given to the new forms of holding general meetings and the use of electronic means.

3.1 Access to annual reports and audit reports

The annual report and the audit report must be submit ted to the shareholders at least 20 days prior to the general meeting, with the shareholders now being able to access them by electronic means (e.g., posting on a website). If the docu 3 been reached and there is no possibility of providing otherwise ments are not available in electronic form, each shareholder may request that they be delivered to them in a timely fashion (Art. 699a(1) nCO).

3.2 Forms of the general meeting

The legislator went on to provide much more flexibility in the manner of holding general meetings by adding various other options in addition to the physical general meeting (held in Switzerland). The revised law now explicitly states that the general meeting may also be held at a location abroad, provided that this has been laid down in the articles of association and the board of directors has designated an independent proxy in the convening notice of the meeting (Art. 701b nCO). Non-listed companies have the option to dispense with the designation of an independent proxy if all shareholders agree. Holding general meetings abroad may be challenging in numerous ways, for example, when it comes to matters such as notarizations abroad or the possibility of establishing foreign jurisdiction, as well as potential fiscal consequences.

Another supplement to the provisions governing general meetings provides that those meetings may now also be held at several locations at the same time without this having to be stipulated in the articles of association. In this case, the votes of the attendees must be transmitted directly in sound and vision to all meeting locations.

A third option provides for the holding of a virtual general meeting that takes place entirely without a physical meeting location. Accordingly, the shareholders can exercise their rights electronically. Holding a virtual general meeting must be laid down in the articles of association. As a rule, an independent proxy must be designated by the board of directors, while non-listed companies may provide for a waiver of such designation of independent proxy in their articles of association.

The hybrid general meeting is a mixture between a virtual and physical general meeting. This means that the shareholders exercise their rights either at the physical location or without physical attendance by using electronic means (direct voting).

The revised law further provides for the general meeting to be held by circular letter without the need to comply with the rules applicable to the convening of meetings. In this case, the resolutions may be adopted in writing on paper or in electronic form unless any of the shareholders requests oral deliberation. This form of the meeting also does not need to be laid down in the articles of association.

A prerequisite of conducting a general meeting with the use of electronic means is the proper functioning of the technology used. The task of governing the use of electronic means falls within the province of the board of directors. The board of directors must also ensure that the identity of the attendees is established, that the votes cast in the general meeting are transmitted directly, that each attendee is in a position to submit motions and participate in the discussion, and that the result of votes cannot be falsified (Art. 701e nCO). Should technical problems on the part of the company occur during the general meeting, the vote or election must be repeated by the board of directors and the general meeting must, if need be, postponed to a later date if the problems cannot be solved immediately. All resolutions adopted by the general meeting prior to the technical problem remain valid (Art. 701f nCO). If the technical difficulties occur on the part of a shareholder, then they are within that shareholder's sphere of responsibility and this shareholder therefore bears the associated risks.

As before, shareholders do not have a right to request a certain form of holding a general meeting. The choice of the location of the meeting is up to the board of directors, who is merely responsible to ensure that the determination of such location will not unduly impede the exercise of shareholders' rights in connection with the general meeting (Art. 701a nCO).

3.3 Minutes and passing of resolutions

The minutes of the general meeting must be made available to the shareholders of non-listed companies upon request within 30 days and must satisfy the new statutory minimum requirements (Art. 702 nCO).

As regards the adoption of resolutions by the general meeting, it should also be noted that the articles of associa tion may provide that the chairperson is to have the casting vote in the event of a tie (Art. 703(2) nCO).

Please click here to read the full report.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.