- with readers working within the Banking & Credit and Law Firm industries

- within Strategy topic(s)

This edition of the Conyers Investment Funds Report provides a variety of updates and insights relevant to the investment funds space in the Cayman Islands, British Virgin Islands, and Bermuda. The report provides access to Conyers resources, including details of key industry events and recent thought leadership.

In this edition we touch on trending topics including VASP amendments in the Cayman Islands, CIMA deregistration, and the launch of a tokenised fund in BVI. We also share key regulatory updates for Bermuda investment funds, and reflect on takeaways from recent key industry events.

Featured thought leadership focuses on BVI Approved Managers and BVI Incubator and Approved Funds.

Conyers investment funds guides, tools, and relevant legal memoranda are also linked for easy reference.

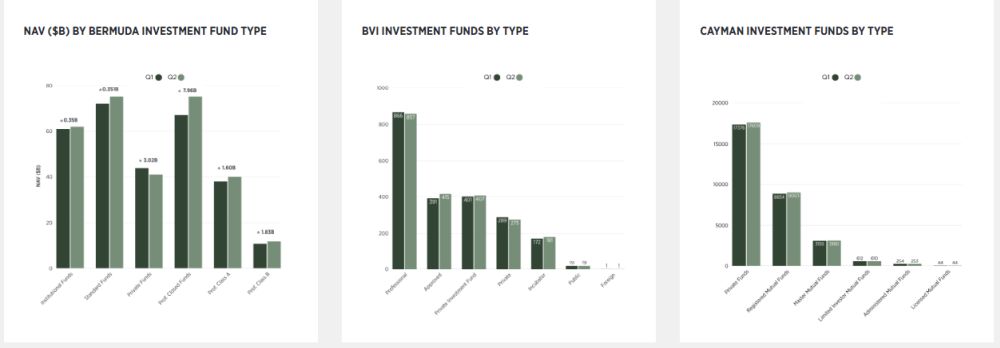

Industry Statistics

Trending Topics in Investment Funds

Bermuda Beneficial Ownership Act 2025

The Beneficial Ownership Act 2025 (BOA) has been enacted in Bermuda, having received assent on 28 September 2025, and is expected to come into operation on or around 3 November 2025 along with related Regulations and Guidance Notes. The purpose of the BOA is to establish a comprehensive framework for the identification, registration, and disclosure of beneficial ownership of legal persons in Bermuda, and it will replace similar provisions in various existing legislation, including the Companies Act 1981 and the Partnership Act 1902. Funds that are registered or authorised under the Investment Funds Act 2006 (along with various other BMA-regulated entities) are currently exempted from the requirement to maintain a beneficial ownership register under applicable legislation. However, no such exemption is planned under the BOA and, accordingly, we are expecting that Bermuda registered and authorised funds will need to establish and maintain beneficial ownership registers for the first time under the BOA. It should be noted that the threshold for being considered a "beneficial owner" under the BOA is expected to be 25%. As such, investors holding less than a 25% interest in a fund generally would not qualify and would not need to appear in the register of beneficial owners. Conyers will be able to assist clients with advice and taking any necessary steps when the BOA comes into operation.

Bermuda Monetary Authority Consultation Paper

In September 2025, the Bermuda Monetary Authority (BMA) issued a Consultation Paper titled "Framework Enhancements Introducing Sustainability Disclosures and Prohibition on the Use of Misleading Fund Names" (Consultation Paper) seeking input on proposals to introduce certain amendments to the Investment Funds Act 2006 (IFA). According to the Consultation Paper, these proposed amendments would primarily (i) require Bermuda registered and authorised funds that claim to be "sustainable" or to have sustainable investment strategies, to provide additional disclosures, including material sustainability risk disclosures, in fund offering documents and (ii) prohibit the use of misleading names by Bermuda registered and authorised funds, to codify existing BMA practices. Notwithstanding the focus on ESG matters, the Consultation Paper suggests there may be changes that apply to funds more generally. In particular, the Consultation Paper contains a more general statement that the Authority intends to focus on certain product-level disclosures which are considered foundational, to ensure that Bermuda's funds regime is aligned with evolving global standards. Additionally, the proposed prohibition of misleading fund names is not specific to ESG-related names- as an example, the Consultation Paper notes that the amendments would prohibit a fund that does not invest in insurance-linked securities from including "insurance-linked securities" or "ILS" in its name. Conyers will be able to advise further on any proposed legislative amendments arising out of the consultation if and when implemented.

BVI – Launch of a British Virgin Islands Tokenised Fund

Conyers has recently advised Mantle in connection with the launch of the Index Four (MI4) Fund as a tokenised fund domiciled in the British Virgin Islands. Mantle is a leading blockchain ecosystem at the forefront of decentralized finance (DeFi) and MI4 fills a key market gap, namely an institutional-grade crypto product with native yield generation, structured within a traditional fund format.

MI4 Fund is structured as a British Virgin Islands limited partnership and is managed by Mantle Guard Limited (a newly established investment manager). Conyers acted as legal counsel to MI4 Fund and its investment manager as to British Virgin Islands law in connection with the fund launch and the regulatory matters.

Partner and Global Head of Investment Funds Piers Alexander, Senior Associate Flora Zeng, both of the Hong Kong office, and Counsel Nicholas Kuria of the BVI office advised on the matter.

Cayman – Tokenized Funds

It is hard to escape the web3 and digital assets hype these days, and over the last 12 months, we've seen an increase in manager queries on tokenized funds. In simple terms, a tokenized fund is an investment fund that uses blockchain technology to issue digital tokens to represent ownership interests. There are a few reasons for doing so, including marketing and appeal to an investor class that are keen on blockchain technology, and also other operational efficiencies that blockchain technology can provide to fund managers. The most interesting use case being that it would in the future potentially create a more liquid market for these types of interests.

The Cayman Islands has been the incumbent jurisdiction of choice for many web3 and digital assets projects and the government has also embraced regulation of the industry by introducing a Virtual Asset (Service Providers) Act (VASP Act) a few years ago now.

The VASP Act governs many digital asset activities, and recent legislative amendments have been passed to clarify that entities already registered or required to register under the Mutual Funds Act or the Private Funds Act, are no longer required to also register under the VASP regime. This change eliminates the previous ambiguity around dual registration and confirms that tokenized funds fall outside the scope of the VASP Act. The move is widely welcomed by fund managers and investors, as it reduces regulatory burden, accelerates fund launches, and reinforces the Cayman Islands' position as a leading jurisdiction for digital asset innovation.

To address the growing interest in tokenized structures, there have been amendments proposed for the Private Funds Act and the Mutual Funds Act. Currently, the Cayman Islands Government is considering industry feedback to align any proposed new rules with existing industry practices and operational realities. Further updates are expected as the legislative drafting stage progresses, and we will continue to monitor and report developments closely.

Year-End Reminder: CIMA Deregistration

As year-end approaches, clients with CIMA-registered funds nearing the end of their term should begin planning for deregistration with CIMA and winding up with the Registrar. Timely action helps avoid delays and unnecessary costs (CIMA fees are not pro-rated for the year of registration), especially given longer government processing times in Q4.

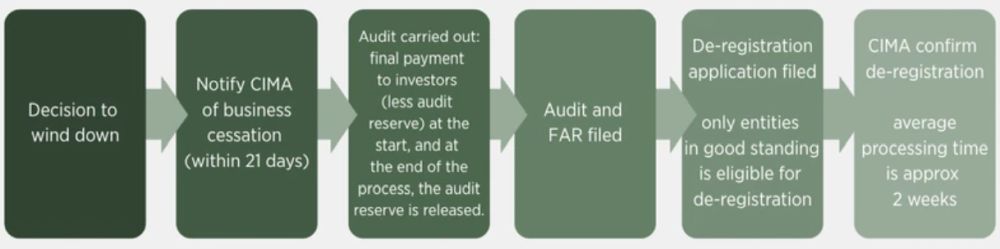

The deregistration and dissolution process requires close coordination between sponsors, auditors and Cayman Islands counsel. Key steps for deregistration include notifying CIMA of cessation of business within 21 days, completing and filing final audits and fund annual returns with CIMA, and ensuring the fund is in good standing. Once CIMA has processed and confirmed the deregistration, the entity can then be wound up and dissolved accordingly:

- For an exempted limited partnership, it may take a further week for the winding up and dissolution of the entity to be processed

- For an exempted company, it may take a further 1-2 months to process the voluntary liquidation with the Registrar of Companies. Note also that an exempted company is only deemed to be formally dissolved 3 months after the filing of the final return with the Registrar.

We strongly encourage clients to engage early – ideally before the end of term – to ensure all filings and approvals are completed in time. For funds aiming to complete deregistration, winding up and dissolution before 31 December, please contact your usual Conyers representative for guidance and support.

Please note: the diagram below outlines the typical process steps for deregistration with CIMA only and does not include winding up and dissolution of the entity. The timing referenced in the last box of the diagram is an indicative timing from CIMA only and is not a processing time that is guaranteed during Q4.

Click here to read more.

Team Spotlight: BVI

In this edition of the Conyers Investment Funds Report we introduce some of the key BVI funds experts at Conyers. The team combines deep industry knowledge with practical insight in crafting tailored fund and finance structures. In addition to the core team based in the BVI, the global network includes experts in London, Hong Kong and Singapore.

Partner Robert Briant is the Head of the British Virgin Islands Corporate practice and provides specialist advice to hedge funds and private equity funds, as well as advising on a broad range of financing transactions. He sits on the Securities, Investment Business and Mutual Funds Advisory Committee and was also responsible for forming a consortium of the largest law firms in the BVI to make recommendations to Government on issues affecting financial services in the BVI.

BVI-based Partner Anton Goldstein is a leading adviser on some of the largest and most prominent transactions in the BVI with a particular expertise in investment funds, private equity, fund finance and corporate law. His broad corporate practice spans the structuring and financing of investment vehicles, advising fund managers, and institutional investors on complex cross-border matters. He is consistently recognised as one of the jurisdiction's leading lawyers in both funds and corporate transactions.

Partner Rachael Pape, also based in the BVI, has extensive experience in corporate and finance matters, with a particular expertise in investment funds. She has acted on some of the most prominent transactions in the BVI. She advises on a wide range of fund vehicles and provides guidance on cross-border corporate, regulatory and finance transactions. Rachael is consistently recognised by the leading legal directories for her specialist expertise in investment funds, corporate and finance.

Partner Piers Alexander is the Global Head of Investment Funds at Conyers. Based in Hong Kong, he has particular expertise in investment funds, including private equity, venture capital, real estate and hedge funds. He acts as offshore counsel to international and Asia-based fund managers, advising on the establishment of investment fund structures, through all aspects of the continuing operations and other long-term business requirements of investment funds.

Partner Eric Flaye is the Head of the London office and has a broad corporate practice with particular expertise and interest in private investment funds, mergers and acquisitions, and joint ventures. He is a key member of the firm's growing Fintech (blockchain & digital assets) practice. Eric moved offshore in 2015 with 8 years of onshore transactional and funds experience (first with Herbert Smith Freehills' Tier 1 M&A/PE team in Sydney, then later with Sullivan & Cromwell in London), and relocated to London in early 2019.

Director Preetha Pillai is the Head of the Singapore office of Conyers. Preetha advises investment funds alongside her broader corporate practice. With clients based in Singapore and the ASEAN region, Preetha's clients include publicly-listed and private companies, banks and financial institutions, venture capital funds and investment managers/advisers, SMEs, and private individuals. She is consistently recognised by Lexology Index and Best Lawyers in Singapore for her work in private funds, mutual funds, and private equity law.

Hong Kong Partner Vivien Fung has specialist expertise in venture capital transactions and private equity investments. Her practice includes advising on Cayman and BVI investment fund formation, investment and restructuring (hedge funds and private equity funds in the form of offshore companies, partnerships and unit trusts).

Senior Associate Flora Zeng, also based in Hong Kong, has deep experience in the structuring, formation, and operation of a wide range of investment funds, with a focus on venture capital funds, digital assets funds, private equity funds, project funds, real estate funds, credit funds, hedge funds and funds of funds. She also advises on downstream investments, including private equity and financing transactions, and assists clients in obtaining the necessary securities investment business licenses in the BVI and the Cayman Islands.

Click here to read more.

Key Conference Takeaways

Cayman Finance Members Q3 Event – Cayman Funds: The New York Perspective

Cayman Counsel Nick Ward recaps his key takeaways from the Cayman Finance Members Q3 Event, held on 12 September 2025.

The Cayman Islands continues to enjoy a stellar reputation in global finance: the jurisdiction strikes an effective balance between regulatory oversight and operational flexibility. Its dominance remains unchallenged and other offshore jurisdictions are not closing the gap.

- Fundraising activity remains somewhat stifled due to interest rate uncertainty, but private credit is continuing to gain traction with notable innovation and investor interest. Access funds are also expanding rapidly, though growth is concentrated among established managers and existing products.

- 2024 growth was driven primarily by asset price appreciation and performance rather than fresh capital inflows.

- Artificial intelligence is emerging as a transformative force across fund management and compliance.

- Fully independent boards are increasingly becoming favoured for governance reasons and to support investor confidence.

- Middle Eastern markets are becoming increasingly relevant and warrant strategic attention. Japan and unit trusts are also currently experiencing heightened interest and activity for open-ended strategies.

- The "Product of the Future" must deliver transparency, speed, and cost-efficiency. At least two of these three will be non-negotiable.

- A series limited partnership structure in Cayman would be a welcome innovation, mirroring its rising popularity in the US.

Spectrum Conference

Spectrum 2025 was an exceptionally informative conference, especially in the ways that it showcased the latest technological trends shaping our industry. The panels provided practical insights into AI's impact on insurance and CIMA's regulatory updates. It is clear that Cayman is taking proactive steps towards digital transformation across financial services. With enhanced risk-based supervisory frameworks and practical sector-specific manuals, the coming year promises even greater stability and innovation. Cayman continues to stand out as a jurisdiction of choice, thanks to its commitment to robust governance, regulatory clarity, and ongoing collaboration between industry and regulators.

Our key takeaways from:

AI Panel

- The insurance sector is being transformed by AI, affecting all functions.

- Companies should embrace AI proactively rather than reactively; technological adoption may reduce premiums and improve efficiency.

- The benefits of AI in insurance are still uncertain, so it is crucial to establish proper governance models and international regulatory frameworks.

- AI can enhance human interaction, for example, by assisting with client call notetaking, leading to greater efficiency and conciseness.

- AI enables contracts to be hyper-personalized for clients' specific needs, but this creates challenges for lawyers who must analyze these complex agreements.

- Most international regulators are cautious about AI, believing current regulations are sufficient for governance, though the EU is stricter regarding privacy.

- The international regulatory framework is not highly prescriptive, leaving room for interpretation.

- Cybersecurity risks and crime are potential threats, with bad actors possibly exploiting new technologies.

- Companies must use AI to remain competitive, but ethical use is not guaranteed, creating a catch-22 situation.

- There is uncertainty about whether AI is being used appropriately, which is a common issue with new innovations.

- Fraud prevention is a major area where AI is making a significant impact.

Regulatory & Sector Updates Panel

- Regulatory bodies like CIMA are developing crisis management frameworks and updating strategic plans to align with global standards, including FATF regulations and Basel III reforms.

- The insurance sector is leveraging technology to enhance data analytics and improve turnaround times for applications, to align with international standards.

- The funds sector continues to grow, with mutual and private funds expanding and new risk assessment frameworks being introduced. Mutual funds were on par with growth as private funds which historically is not the case as mutual funds are slower growth area.

- Enforcement is focused on encouraging compliance and remediation rather than punishment, with an emphasis on self-correction within the industry.

- Tokenization is a key issue for digital assets and funds, with further guidance expected.

- Corporate governance (CG) is under ongoing review, with many board charters not being fully implemented in practice, highlighting a gap between policy and execution.

- Strategic priorities for the next 12 months include tightening regulations around establishing a presence, reducing outsourcing abuse, and enhancing internal controls.

- Risk-based supervisory frameworks are being refined, including the introduction of a risk rating system and changes to data collection terminology.

- Enforcement is not intended to be punitive but rather to encourage remediation and self-correction.

Singapore Regulatory Update for Funds and Fund Managers

Alexander Doyle and Roisin Liddy-Murphy spoke at a seminar on Cayman Islands legal and regulatory updates for funds and fund managers in Singapore on 30 September. Topics included an overview of the Cayman Islands FATF status, key regulatory considerations for funds and fund managers under the CIMA Rules, legal implications of the Defense Against Money Laundering regime, beneficial ownership transparency and reporting, navigating economic substance, FATCA/CRS compliance, managing legal risks as a director, and enforcement, audits and regulatory inspections.

Token2049

Alexander Doyle and Roisin Liddy-Murphy attended the Token 2049 conference in Singapore from 1-2 October. The event was attended by a diverse array of participants from Asia, the Middle East, Europe and North America. There was continued strong interest in the use of Cayman Islands funds for investment in cryptocurrencies as an asset class and the equities of both established and early-stage virtual asset service providers. There was also extensive discussion on RWA tokenisation and stablecoin issuance through the use of Cayman Islands entities as well as updates to Cayman Islands securities regulation for both regulated funds and managers in relation to virtual assets.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]