- within Corporate/Commercial Law topic(s)

- in European Union

- with readers working within the Technology industries

- within Law Department Performance, Insolvency/Bankruptcy/Re-Structuring and Criminal Law topic(s)

After months of negotiations in the European Parliament, there is finally some more clarity on where the EU is heading with the European Commission (EC)'s Sustainability Omnibus package, launched late February 2025. This bulletin provides an interim update on the current state of play (November 20, 2025).

In June 2025 the EU Council agreed its position on the EC's proposal for a Directive amending the CSRD and the CS3D (COM(2025) 81) (the Substantive Proposal) and published the text of the Council's negotiating mandate (the Council Position). In the same week, rapporteur Jörgen Warborn of the European Parliament's Committee on Legal Affairs presented his draft report.

Shadow rapporteurs and other members of the European Parliament (EP) across political parties commented on the draft report and submitted over 800 draft amendments. Negotiations within the EP have been going on since and on November 13 a plenary vote took place. The EP's negotiation position entails more significant reductions in the EU's sustainability reporting and due diligence regulations than those proposed by the Commission and the Council.

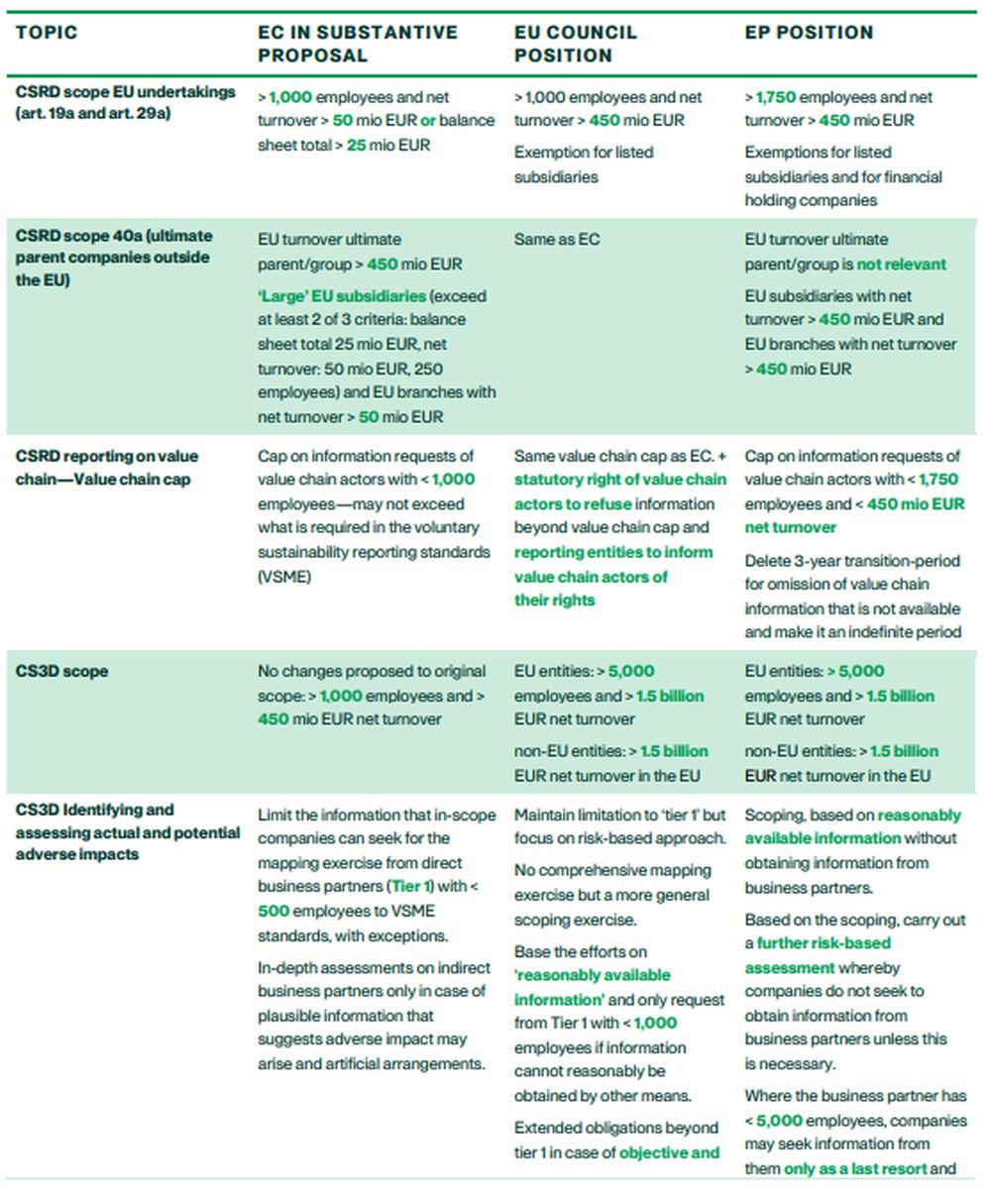

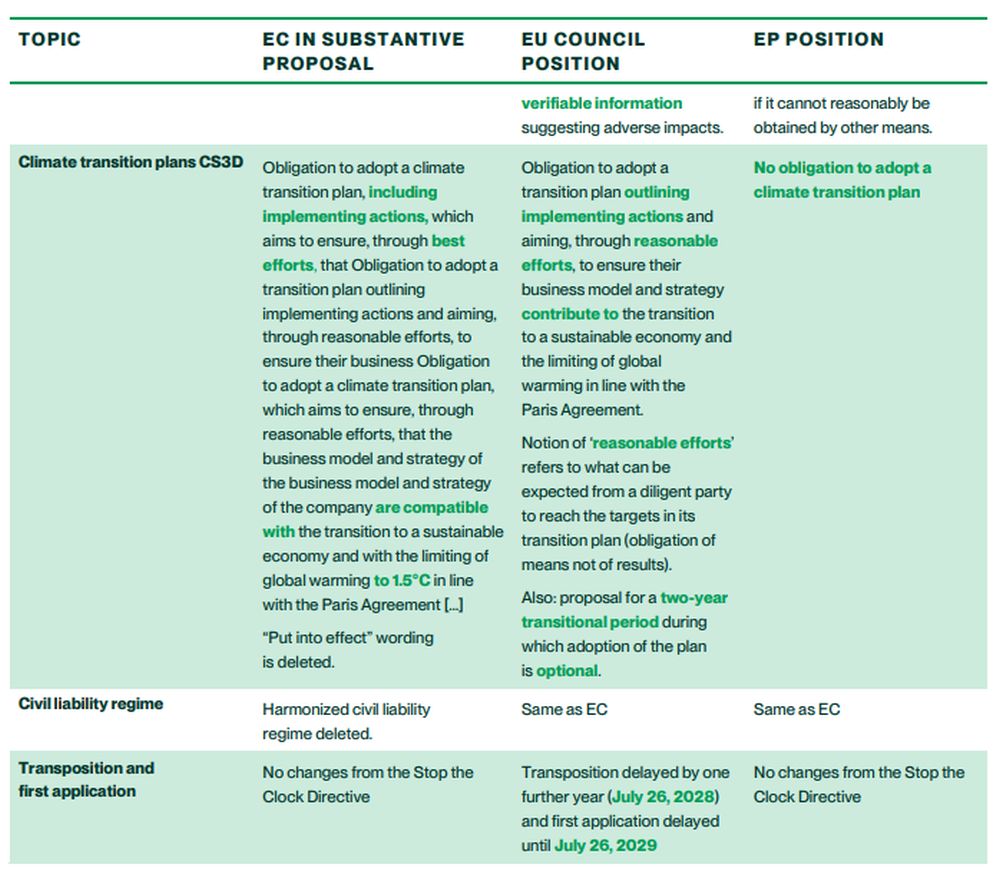

1. The ECs Substantive Proposal and the negotiation positions of the Council and the EP

We have summarized below the different positions on the most important topics for the coming trilogue negotiations.

2. Next step: negotiations on the Substantive Proposal

The trilogue negotiations between the European Commission, the Council and the EP started on November 18, with the aim to finalize them in December 2025. A final directive can therefore be expected by the end of December 2025 or early 2026.

3. What about wave 1 entities with 501-1000 employees?

Entities that had to start reporting for financial year (FY) 2024 under the CSRD are commonly referred to as "wave 1" entities. Wave 1-entities with 501-1000 employees and/or net turnover below 450 million EUR are in a particularly uncertain position. These entities will likely have reported for the first time in 2025, either on a mandatory basis or on a voluntary basis, if they are in a Member State that has not yet transposed the CSRD, and would need to continue CSRD reporting in 2026 and 2027. However, looking at the Substantive Proposal, the Council Position and the EP position, it is very likely that these entities will no longer be in scope for reporting once the changes to the CSRD are adopted. Given the EP position on scope with > 1,750 employees, the threshold for the final directive may be even higher than 1000 and even more entities may be out of scope

To address this issue, the Council Position suggests to limit the application of the (current) CSRD to wave 1 companies to three financial years from January 1, 2024. For financial years starting on or after January 1, 2027, the amended CSRD, including the amended scope, should apply. Accordingly, wave 1 entities that will be outside of the revised scope, will not have to produce CSRD reports as of financial years starting on or after January 1, 2027. In addition, with a view to reducing burden as swiftly as possible, the Council Position suggests Member States should be able to exempt such undertakings (wave 1-entities with 501-1000 employees) from reporting obligations as regards the financial years beginning between January 1, 2025 and December 31, 2026. It remains to be seen whether this suggestion will be agreed upon in the trilogue negotiations and, if so, how and when Member States will be able to apply the latter exemption. That would in principle only be possible once there is a final agreement on the Substantive Proposal, including the suggested provision. Wave 1 companies are likely already in the process of preparing their CSRD report for FY 2025, and wave 1 companies with 501-1000 employees have no certainty that agreement between the three EU institutions will be reached in time for Member States to offer them such an exemption for their CSRD report for FY 2025.

4. Quick fix delegated act for wave 1 companies adopted

On July 11 the European Commission has adopted targeted "quick fix" amendments (published in the Official Journal on 10 November) to the first set of ESRS aiming to reduce the burden and increase certainty for companies that had to start reporting for financial year 2024 ("wave 1"). The ESRS permit companies reporting on FY 2024 to omit certain information, the so-called phase-ins as set out in Appendix C of ESRS 1. The "quick fix" amendments, which apply from FY 2025, will allow them to omit that same information for FYs 2025 and 2026.

This means wave 1 companies will not have to report additional information compared to FY 2024. Moreover, for FYs 2025 and 2026, wave 1 companies with more than 750 employees will benefit from most of the same phase‑in provisions that currently apply to companies with up to 750 employees. Here you can find a summary of the modifications.

5. Progress on the simplification of the ESRS

On July 31 EFRAG published revised ESRS exposure drafts. Following extensive feedback from companies already reporting under the CSRD as well as those preparing to do so, EFRAG focused on cutting complexity and improving usability. The changes include streamlining the double materiality assessment, reducing overlaps across standards, clarifying language and structure, and removing all voluntary disclosures. New relief mechanisms have also been introduced, such as exemptions where reporting would cause undue cost or effort.

According to EFRAG, mandatory datapoints (to be reported if material) have been cut by 57%, and the full set of disclosures—mandatory and voluntary—reduced by 68%. The overall length of the standards has been shortened by over 55%.

The public consultation on the draft simplified ESRS ran from July 31 to September 29, 2025. Stakeholders were invited to review the revised drafts and share their views. EFRAG also (co-)organized outreach events throughout September and October, gathering further feedback ahead of its final technical advice to the European Commission. In parallel, EFRAG performs a cost benefit analysis and targeted field tests which are also open to participation from stakeholders. EFRAG will present its Draft Simplified ESRS at its next conference on 4 December 2025.

The Commission has stated that the revision of the ESRS is expected to be completed by FY 2027. The European Securities and Markets Authority (ESMA) in the European common enforcement priorities for 2025 corporate reporting published on October 14, 2025, stated that the revised ESRS will only be applicable after the corresponding Delegated Act is published in the Official Journal. According to ESMA "wave 1" companies should therefore not rely on EFRAG's exposure draft or final technical advice to the EC to prepare their sustainability disclosures for financial year 2025.

On July 23, 2025 EFRAG also launched its "EFRAG 2025 State of Play" portal. This is a live, interactive platform presenting key insights from EFRAG's latest market study on the early implementation of the ESRS under the CSRD. The portal provides access to detailed results via a statistics dashboard and repository of 656 analyzed sustainability statements issued in 2025 collected between January 1 and April 20.

6. Voluntary standard for SMEs published

On July 30 the EC has adopted a recommendation on voluntary sustainability reporting for small and medium-sized companies (SMEs). The standard adopted in the recommendation aims to reduce administrative burden on SMEs by making it easier for them to respond to requests for sustainability information from companies and financial institutions which are subject to mandatory reporting under the CSRD and which have such SMEs in their value chains.

The voluntary standard for SMEs (VSME) was developed by EFRAG. In the Substantive Proposal the EC introduced the so-called value chain cap, which entails that information requests from value chain actors with less than 1,000 employees may not exceed what is required in the VSME. This EC recommendation is therefore an intermediary solution to address market demands until the delegated act on a voluntary standard is formally adopted. The content of the delegated act could vary compared to the recommendation. The timing of adoption will depend on the pace and conclusion of negotiations between the co-legislators on the Substantive Proposal. The EC encourages companies and financial institutions that seek sustainability information from SMEs to base their requests on the VSME as far as possible.

The EC also states that SMEs may wish to voluntarily report sustainability information based on the VSME to improve their access to sustainable finance and better understand and monitor their own sustainability performance, thereby improving their resilience and competitiveness.

7. Measures to simplify the application of the EU taxonomy

On July 4, 2025, the Commission adopted a set of measures to simplify the application of the EU taxonomy, which will reduce the administrative burden for companies. The changes are adopted in the form of a Delegated Act amending the Taxonomy Disclosures, Climate and Environmental Delegated Acts. The Commission published the draft of this Delegated Act in February 2025 as part of Omnibus I package, allowing stakeholders to provide feedback on the draft measures.

For non-financial undertakings, only disclosure obligations related to the proportion of turnover derived from economic activities and the proportion of capital expenditure related to assets or processes associated with economic activities would remain mandatory. The Commission also proposes to allow non-financial undertakings to omit disclosures for economic activities that are not material, meaning that those activities, cumulatively, account for less than 10% of turnover or capital expenditure. Financial undertakings have an exemption from making disclosures until 31 December 2027 if they do not claim that their activities are associated with the Taxonomy Regulation and provide a statement to that effect in the management report.

The Delegated Act is transmitted to the EP and the Council for their scrutiny. The changes will apply once the scrutiny period of 4 months, which has just been prolonged by another 2‑month period, is over. The simplification measures laid out in the Delegated Act will apply as of January 1, 2026 and will cover the 2025 financial year. However, undertakings are given the option to apply the measures starting with the 2026 financial year if they find this more convenient.

The European Commission has also launched a call for evidence for the review of the Taxonomy Climate and Environmental delegated acts on 7 November 2025. The consultation is open until December 5, 2025.

8. Commission notice on the application of the sustainable finance framework and the Corporate Sustainability Due Diligence Directive to the defense sector

As part of the Defence Readiness Omnibus, the Commission published a Commission Notice to clarify that the EU sustainable finance framework is compatible with investing in the defense sector. The Commission recalls that the framework sets no limitations on the financing of any sector, including the defense sector, and encourages defense sector investments, like those in any other sector, to be assessed on a case-by-case basis. In the Notice the Commission provides further guidance on risk mitigation in different legislative files of the sustainable finance framework, such as the CSRD and the EU Taxonomy Regulation, and the CS3D.

9. Transposition of the STC Directive in selected EU Member States

An EU-wide level playing field on CSRD continues to remain elusive because some EU Member States have still not even implemented the CSRD yet. The same applies for the "Stop the clock directive" published on April 16, 2025 (the STC Directive), which should be transposed by December 31, 2025 at the latest. We recommend closely monitoring transposition of the CSRD and the STC Directive in relevant Member States.

CONCLUSION

The EU's sustainability reporting and due diligence landscape remains in flux and entities should monitor developments closely, particularly as the Substantive Proposal and ESRS revisions progress, and as Member States clarify their national transposition strategies.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]