- within Finance and Banking topic(s)

- in United States

- within Insurance, Tax, Government and Public Sector topic(s)

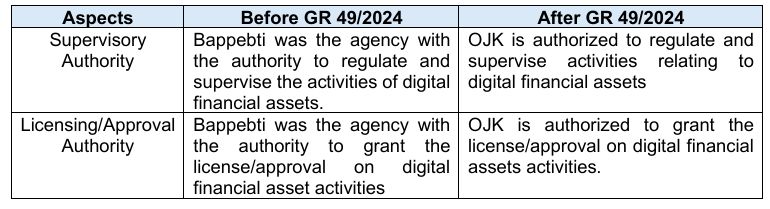

On 10 January 2025, the supervision of crypto assets including cryptocurrency was effectively transferred from the Commodity Futures Trading Regulatory Agency (Badan Pengawas Perdagangan Berjangka Komoditi or "Bappebti") to the Financial Services Authority (Otoritas Jasa Keuangan "OJK"). After such transfer, OJK has supervised, not only cryptocurrency, but also other forms of digital financial assets.

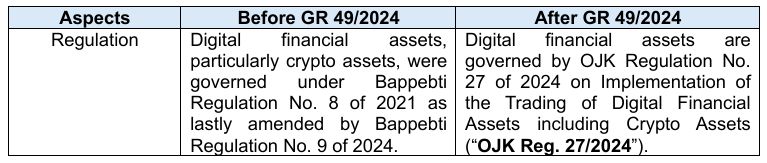

It is important to note that the transfer of supervision was made as an implementation of Law No. 4 of 2023 regarding Development and Strengthening of the Financial Sector ("P2SK Law") and Government Regulation No. 49 of 2024 on Transfer of Regulation and Supervision Duties of Digital Financial Assets Including Crypto Assets as well as Financial Derivatives ("GR 49/2024"). These law and regulations marked the important shift in how cryptocurrency and other crypto assets are reclassified as financial instruments rather than trade commodities. In general, GR 49/2024 defines cryptocurrency and other crypto assets as digital financial assets. A digital financial asset is defined as the asset stored or represented in digital form, which includes cryptocurrency/assets.

The significant changes as stipulated in P2SK Law were introduced due to the nature of cryptocurrencies and other forms of Digital Financial Assets. They have the potential to pose high risks to the players and stakeholders (particularly on the investment of cryptocurrencies and digital assets). Hence, OJK has to supervise the use of cryptocurrencies and other forms of digital assets to maintain the financial system's stability, market integrity, consumer protection, as well as personal data protection.

Additionally, cryptocurrencies are operated under distributed ledger or blockchain technology. Therefore, P2SK Law classifies cryptocurrencies under the category of the financial digital innovations (Inovasi Teknologi Sektor Keuangan or "ITSK").

To help better understand this supervisory transition and the related implementation, this article provides a general overview of GR 49/2024, particularly on: (i) Transition (ii) Implementation, and (iii) Concluding Remarks.

Transition: Based on P2SK Law and GR 49/2024, the supervision over commodities constituted as financial instruments as the basis for the futures or other derivatives contracts related to digital financial assets including crypto assets, has been transferred effectively from Bappebti to OJK since 10 January 2025.

As a general guideline, please refer to the table below, summarizing the transition of authority from Bappepti to OJK based on GR 49/2024:

Implementation of the Transition from Bappebti OJK: For the purpose of transitioning the authority from Bappebti to OJK, a transition committee was established. Such committee has the following duties and responsibilities:

- identifying and submitting data/information related to the transaction of digital financial assets, not limited to the mechanism, infrastructure/framework, and implementation;

- mapping and reviewing licenses and regulations on digital financial assets, including crypto assets;

- evaluating the readiness and ability of digital financial asset business actor;

- preparing the resources to carry out regulatory and supervisory duties of digital financial assets; and

- preparing other matters as required for the transfer of duties.

During the transition period, Bappebti gradually (i) submits the documents/data, (ii) provides access to the supervisory and regulatory infrastructure of the digital financial assets, and (iii) assigns the licensing, approval, and registration of the digital financial assets' instruments or products has been issued to OJK.

Since 10 January 2025, any decision for the licensing, approval, and registration of products or instruments related to digital financial assets shall continue to be processed by Bappebti, however under OJK supervision.

The transfer of authority from Bappebti to OJK and BI is expected to be completed in two years since the effective date of the transition period (i.e.,10 January 2027).

Following the effective date of the transition, OJK issued OJK Reg. 27/2024, under which, several new elements have reaffirmed and strengthened the provisions for participating in activities related to digital financial assets, including crypto assets.

Among the key changes, OJK now requires digital financial asset organizers – such as Digital Financial Assets Exchange, Clearing Guarantee and Settlement Institutions, Digital Asset Custody, and Digital Financial Asset Traders/Brokers – to meet the new standards of fit-and proper test, examination of operational readiness, and minimum paid-up capital thresholds. In addition, OJK has transitioned away from the previous Online Single Submission system. Now all registrations, licensing, and reporting shall be conducted via the OJK-established Integrated Licensing and Registration System (Sistem Perizinan dan Registrasi Terintegrasi or "SPRINT").

OJK further regulates digital financial asset activities under OJK Circular Letter No. 20 of 2024 regarding Reporting and Supervision Mechanism of Digital Financial Assets and Crypto Assets.

Based on OJK Reg. 27/2024, operators of digital financial assets and crypto assets must fulfil all requirements on corporate governance, personal data protection, and consumer protection within 6 months since the effective date of OJK Reg. 27/2024 (i.e.,10 July 2025). Meanwhile, the deadline for compliance with the costumer protection requirement was 12 January 2025. Additionally, the Digital Financial Asset Exchange can only facilitate the trading of the Digital Financial Assets already included in the List of Digital Financial Assets as determined and evaluated by the Digital Financial Asset Exchange from time to time. In this case, Digital Financial Asset Exchange must provide the List of the Digital Financial Asset within 3 months since the effective date of OJK Reg. 27/2024, on 10 April 2025.

The assets already included in the List of Digital Financial Assets, but not yet obtain the required approval need to reapply to OJK within 1 month since the effective date of OJK Reg. 27/2024, on 10 February 2025. Failure to submit the reapplication means the assets cannot be traded.

Concluding Remarks

OJK has made some substantial changes in regulating activities related to crypto and other digital financial assets in Indonesia. The initiatives are made ultimately to protect the customers by ensuring good practice of digital financial asset trading, fostering the economic growth, and providing the alternative investment in the form of digital financial assets, while maintaining the financial system stability and market integrity.

To ensure the financial system stability and market integrity and provide the necessary customer protection, P2SK Law requires a transfer supervisory authority from Bappebti to OJK, which is further regulated under GR 49/2024.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.