- within Energy and Natural Resources topic(s)

- in United States

- within Technology topic(s)

1. Introduction

With the inauguration of the Trump administration in the United States in January 2025, the ideas of prioritizing carbon net-zero (carbon neutrality) and emphasizing fossil fuels have once again become intertwined. However, if we view carbon net-zero (carbon neutrality) and green transformation (GX) not as narrow climate change measures, but as a medium- to long-term shift in industrial structures, the trend toward carbon net-zero is likely unstoppable, particularly in the EU and Japan. For instance, the Japanese government has decided to submit an ambitious Nationally Determined Contribution ("NDC") to the Secretariat of the United Nations Framework Convention on Climate Change (UNFCCC) as part of Japan's 2035/2040 NDC, setting a target to reduce greenhouse gas ("GHG") emissions by 60% in fiscal year 2035 and by 73% in fiscal year 2040, compared to fiscal year 2013 levels.Carbon credits are expected to be one of the means to promote carbon net-zero, but carbon credit regulations are likely to evolve in different directions in different countries. In particular, Japanese companies with global operations will need to develop their investment strategies while closely monitoring changes in carbon credit regulations in various nations. In this newsletter, we will provide an overview of carbon credit regulations in Japan and abroad and highlight some of the issues that both Japanese and international players should be aware of.

2. Recent developments in Japan

2.1. Japanese ETS (GX League Phase 2)

Based on the Paris Agreement, an international agreement on climate change, the Japanese government has set a target of net zero carbon emissions by 2050 and a 46% reduction in GHG emissions by 2030 from 2013 levels, with only five years remaining until 2030.

The GX Implementation Council and other deliberative bodies have been established as forums to discuss macroeconomic strategies for achieving the government's GHG emission reduction target, and the direction of various carbon credit regulations, including the GX League, has been decided. For example, on December 27, 2024, the "GX2040 Vision (Draft) - Revised Strategy to Promote the Transition to a Decarbonized Growth-Oriented Economic Structure" was released, and on page 35 and the following pages, it positions emissions trading systems as institutionalized measures to realize the growth-oriented carbon pricing concept. The GX2040 Vision (Draft) also outlines the direction of the consideration of specific issues, including measures to be implemented through the design of appropriate systems, based on discussions to date.

Among these measures, the GX League, an emissions trading system, has been established as an institutionalized measure to realize the growth-oriented carbon pricing concept, and a voluntary participation system has been in operation as the first phase from FY2023 to FY2025. Companies accounting for 50% or more of Japan's GHG emissions have already participated in the first phase of the GX League, and active discussions are underway. A mandatory emissions trading system (capand-trade system) similar to the EU ETS is planned to be introduced in April 2026. Based on the discussions by the following working groups established during 2024, the draft amendment to the Act Concerning the Promotion of a Smooth Transition to a Decarbonized Economic Structure (the "2025 Draft Amendment to GX Promotion Act") has been approved by the Cabinet Office of Japan on 25 February 2025.

- Special Working Group on Carbon Pricing to Achieve a Green Transformation (the Cabinet Office) (the "CPWG");

- Legal Issues Study Group Conducive to Examining Emissions Trading Systems for Achieving a Green Transformation (the Ministry of Economy, Trade and Industry and the Ministry of the Environment) (the "Legal Issues Study Group"); and

- Working Group on Financial Infrastructure for Carbon Credit Transactions (the Financial Services Agency) (the "Financial Infrastructure Working Group").

This newsletter discusses (A) major issues under the 2025 Draft Amendment to GX Promotion Act and (B) major issues (focusing on civil and regulatory laws) discussed at the CPWG, the Legal Issues Study Group, and the Financial Infrastructure Study Group mentioned above.

2.1.1. 2025 Draft Amendment to GX Promotion Act

2025 Draft Amendment to GX Promotion Act provides statutory framework of Japanese ETS (GX League Phase 2) which will have impact over Japanese companies in all sectors. Although 2025 Draft Amendment to GX Promotion Act is still a draft which is subject to changes, major issues are summarized below.

- Compulsory Participation: From April 2026, Large Emitters (i.e., Companies with Scope 1 GHG emission of 100,000tone/year (CO2 equivalent)) will be obliged to participate in Japanese ETS (GX League Phase 2).

- Allowances (haishutsuwaku): Allowances will be allocated to Large Emitters without any fee/auction in accordance with the allocation guideline to be determined by the Japanese government (which has not been published yet). It is expected that allowances will work as "cap" of Scope 1 GHG emission of Large Emitters.

- A Large Emitter will need to purchase allowances and/or other carbon credits if such Large Emitter will have emitted Scope 1 GHG exceeding the total amount of allowances allocated to such Large Emitter. We will need to take a close look at detailed rules (which have not been published yet) on to what extent carbon credits other than allowances (e.g., J credits, JCM credits or Japanese / international voluntary carbon credits) can be used for offsetting Scope 1 GHG emissions of such Large Emitter.

- GX Accelerating Agency (GX-shiishin-kikou) will operate the allowance trading market (haishutsuwaku-torihiki-shijou). We will need to take a close look at how the allowance trading market will be operated together with other carbon credit markets in Japan (e.g., the carbon credit markets operated by Tokyo Stock Exchange).

- Certain mechanism for stabilizing the price of allowances will be put in place (e.g., the highest/lowest price of allowances will be determined by the government).

- Statutory protection of allowance trading will be put in place under the GX Promotion Act (e.g., legal requirement for valid transfer of allowances, protection of bona-fide purchasers). In this regard, 2025 Draft Amendment to GX Promotion Act does not contain any provision which prohibits creation of pledge over allowances while there are provisions under the Global Warming Countermeasures Act which prohibits creation of pledge over Kyoto credits (santei-wariateryou) and JCM credits. We will need to take a close look at on-going discussions on whether or not any security interests (e.g., pledge) can be validly created over allowances and / or other types of carbon credits (e.g., J-credits or JCM credits) since demands for secured finance in terms of underlying GHG reduction projects may be increasing.

- Based on discussions at Legal Issues Study Group below, it is expected that certain regulations (e.g., obligations for allowance trading to be centralized at the designated exchange and prohibition on unfair allowance trading) will be put in place.

2.1.2. CPWG

The CPWG discussed the overall system design to promote carbon net-zero investments once the second phase of the GX League becomes fully operational. In particular, issues related to emission allowances in the second phase of the GX League were identified. As a result of discussions during the five meetings, the Secretariat made the following proposals, and it was confirmed that the system will be reconstructed in accordance with future changes in economic and social conditions, etc., while fully ensuring the continuous review and predictability of the system.

| Issues related to the framework of the system in the second phase | Concrete proposals |

|---|---|

| (i) Basic concept of the system | (i) Business operators that emit a certain amount of greenhouse gases or more will be required to amortize their emission allowances in an amount equal to their actual emissions in each fiscal year. To this end, a system will be introduced under which business operators will be allocated 100% of their calculated emission allowances free of charge. |

| (ii) Persons covered by the system | (ii) Companies with direct GHG emissions ("scope 1 emissions") of 100,000 tons or more of CO2 equivalent per year ("large emitters") |

| (iii) Concept of allocation of emission allowances | (iii) Calculations will be made based on industry-specific benchmarks, particularly in energy-intensive sectors where there is a strong need to consider industry characteristics. For sectors where it is difficult to create benchmarks, allocations will be made based on a grandfathering basis. |

| (iv) Rules imposed on persons covered by the system (rules for the performance of the amortization obligation) | (iv) In the event of non-performance of the amortization obligation, a monetary payment equal to the shortfall in the procurement of emission allowances will be required. |

| (v) Emission allowance exchange (rules on emission allowance trading) | (v) It was proposed that measures be taken to ensure that orders for emission allowance trading are concentrated on exchanges (e.g., an exchange-trading obligation). As for market trading participants, some business operators will be allowed to participate in trading on the condition that they have a certain level of experience in emission allowance trading. |

| (vi) Investment predictability (price stabilization measures) | (vi) The upper and lower price levels will be determined based on the opinions of the industry and other stakeholders in the future, assuming that the upper and lower limits of the trading price of emission allowances will be set and the price range will be indicated in advance to increase the predictability of the trading price and promote investment. |

2.1.3. Legal Issues Study Group

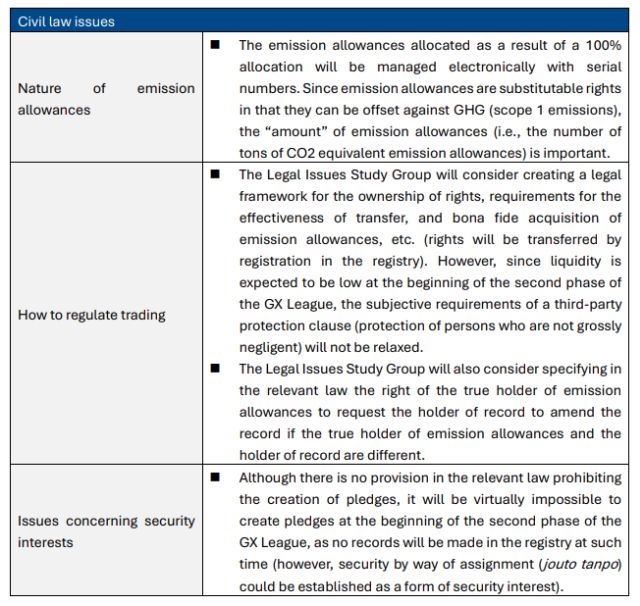

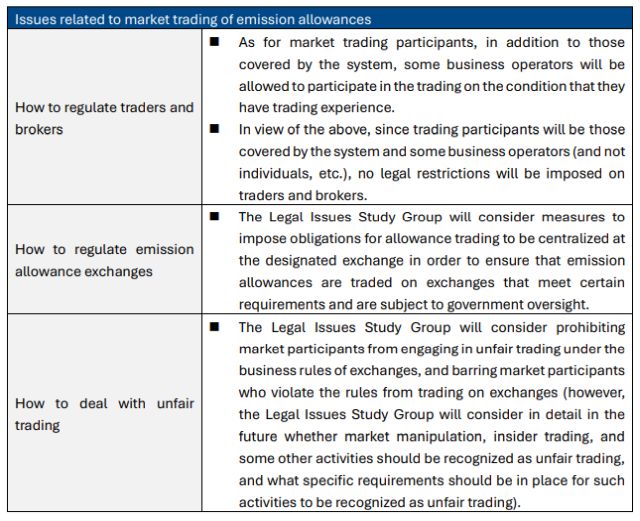

In the Legal Issues Study Group, constitutional, administrative law, and civil law issues related to emission allowances in the emissions trading system were discussed in more detail, and a "Draft Report on Legal Issues and Concept of the Emissions Trading System Conducive to Achieving a Green Transformation" (the "Draft Report") was formulated. The following is a summary of the policies on civil law, regulatory law, and market trading, as proposed during the 6th meeting of the Legal Issues Study Group based on the Draft Report.

2.1.4. Financial Infrastructure Working Group

Direction of development of a trading infrastructure for carbon credits was discussed at the Financial Infrastructure Working Group. To date, the working group has held three meetings, discussing issues such as the ideal form of carbon credit trading and application of technologies such as blockchain to such trading for more transparent and sound voluntary carbon credit trading.

In the meantime, the (proposed) GX2040 Vision and the Legal Issues Study Group, etc., have pointed out the use of external credits (such as J-Credits) for emissions trading and a need for alignment with the existing legislation for that purpose, which will be discussed in the future, and it is, thus, necessary to pay close attention to how carbon credit trading will be utilized in the second phase of the GX League.

2.2. Disclosure regulations

The Financial System Council of the Financial Services Agency established the "Working Group on Sustainability Disclosure (Reporting) and Assurance" ("Disclosure WG") to discuss the disclosure of sustainability information and how it should be verified based on the proposed standards disclosed by the Sustainability Standards Board of Japan (the "SSBJ") on March 29, 2024 (collectively, the "Proposed SSBJ Standards").

As for the disclosure standards, the policy was presented to incorporate the SSBJ Standards into the Financial Instruments and Exchange Act and related regulations of Japan assuming that the functional consistency with the standards disclosed by the International Sustainability Standards Board (the "ISSB") (the "ISSB Standards) is ensured. In addition, the Disclosure WG (5th session) discussed (i) the scope and timing of application of the SSBJ Standards as well as the timing and method of sustainability disclosure, (ii) the method of disclosure in Japan for overseas, (iii) disclosure of GHG emissions from the entire supply chain (the "Scope 3 Emissions"), (iv) material false statements concerning sustainability disclosure, and (v) a verification system.

2.2.1. Overview of Disclosure WG

The Disclosure WG discussed sustainability disclosure, sustainability verification system, and the direction of sustainability information verification system in the total of five sessions. While the current Financial Instruments and Exchange Act (the "FIEA") provides for an obligation to disclose sustainability information, companies are not required to disclose total GHG emissions. The Disclosure WG is currently discussing to impose an obligation to disclose total GHG emissions on companies listed on the Tokyo Stock Exchange Prime Market with market capitalization of 3 trillion yen or more from around 2027.

2.2.2. Points of discussion on sustainability disclosure

There have been discussions on the need for review of safe harbors in particular for disclosure of Scope 3 Emissions in addition to the statements regarding the liability for false statements concerning future information in the Guideline for the Disclosure of Corporate Affairs 5-16-2, which were added by the amendment that came into effect on January 31, 2023. This is because the disclosure of Scope 3 Emissions in particular involves uncertainty, as such disclosure relies on data from third parties (such as direct or indirect business partners in the supply chain) over which the reporting company has no direct control. At the Disclosure WG (4th session), the secretariat, therefore, proposed to amend the guidelines to clarify that a company would not be held liable for false statements if (1) it has explained that it had properly examined internally the appropriateness of the use of information obtained from third parties over which the company has no direct control and the reasonableness of estimates, and (2) the contents of the disclosure fall within the range considered reasonable in general. Members generally agreed with the proposal. In response to the proposal, there was also an opinion that that discussion need not be limited to Scope 3 Emissions, as the discussion was also relevant to value chain information in general. The Disclosure WG (5th session) confirmed that it would continue discussions, including the necessity of law amendment, on the assumption of amending the guidelines to address the safe harbors for false statements concerning disclosure of Scope 3 Emissions.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.