- within Intellectual Property topic(s)

- with Finance and Tax Executives

- with readers working within the Pharmaceuticals & BioTech industries

- with readers working within the Pharmaceuticals & BioTech industries

- within Government, Public Sector, Privacy and Technology topic(s)

As one of the world's largest drug consumer and manufacturing markets, China plays a pivotal role in global pharma patent strategies – and changes in the country's IP landscape can have profound commercial implications.

Nevertheless, clear and reliable insights into pharma patent litigation in China can be difficult to come by for IP strategists around the world. That's why we have put together this article examining the key trends shaping China's pharmaceutical IP landscape, including its four-year-old patent linkage system, invalidation actions, and patent enforcement. The insights it provides can help both generic and branded drug companies to avoid tactical pitfalls and make the best of strategic opportunities in China. Stakeholders, in generic or innovative medicine, may find both opportunities and challenges from these new trends in the pharmaceutical sector.

Section I: Chinese patent linkage disputes 2021-2024

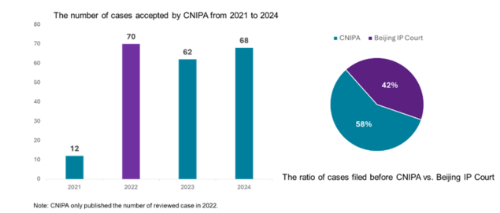

The Chinese version of patent linkage system, officially called the Early Resolution Mechanism for Drug Patent Disputes, launched when its implementing guidelines and judicial interpretation went into force on July 4, 2021. Unlike the United States, where all patent linkage cases are determined by the court, China has implemented a bifurcated approach to reviewing such cases. Cases are adjudicated either by the China National Intellectual Property Administration (CNIPA) or the Beijing IP Court. From 2022 to 2024, an average of 60 to 70 cases were filed with the CNIPA each year. It is important to note that in 2021, the system operated only after July, limiting the number of cases during that year. Additionally, patent rights holders (or marketing authorisation holders, "MAHs"), demonstrated a slightly greater tendency to file linkage cases with the CNIPA compared to the Beijing IP Court. Specifically, cases filed with the CNIPA accounted for 58% (200 cases) of the total, while those filed with the court represented 42% (144 cases). This preference might be attributed to the more streamlined procedural requirements, as CNIPA generally does not require legalisation of all procedural documents.

1. Patent linkage decisions published by CNIPA in 2024

In 2024, CNIPA published 45 patent linkage decisions on its official website. The focus of these cases primarily centres on critical therapeutic areas, including cancer, immune diseases, cardiovascular diseases and diabetes. A total of 14 drugs were involved in the treatment of various conditions, with the distribution of cases as follows: cancer (10 cases), immune diseases (10 cases), cardiovascular diseases (nine cases), diabetes (eight cases), and additional significant conditions such as hyperlipidemia and chronic kidney disease. The majority of these cases involved small molecular chemical drugs, with only two biologic molecules—Linaclotide and Pertuzumab—addressed in the decisions. The three drugs that produced the highest number of decisions were: Eltrombopag Olamine Tablets (seven cases); Bisoprolol Fumarate and Amlodipine Besilate Tablets (five cases); and Sitagliptin Phosphate/Metformin Hydrochloride Tablets (five cases).

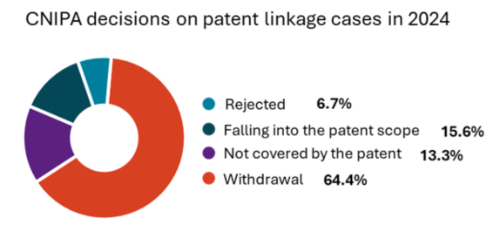

Over 60% withdrawn before reaching a final decision as generic company demonstrate non-infringement

More than 60% of patent linkage petitions were withdrawn before the CNIPA issued a decision. This trend suggests that, in many instances, the Abbreviated New Drug Application (ANDA) documents effectively demonstrate that the generic drug is not covered by the existing patent. Specifically, 29 cases—approximately 64%—were withdrawn by patentees prior to the CNIPA's final ruling, while three cases were rejected due to the invalidation of patent claims. Typically, respondents submit ANDA documents during the proceedings to illustrate that their generic drug does not infringe on the patent's scope. After reviewing the evidence, patentees often reassess their likelihood of patent infringement and choose to withdraw their cases to avoid unfavorable rulings.

The CNIPA issued 13 decisions with clear conclusions. Among these, seven cases were determined to fall within the patent's scope, while 6 cases were ruled as outside the patent's scope. In patent linkage proceedings, the responsibility falls on the respondent—specifically, the generic drug company—to provide evidence demonstrating that their generic drug differs from the patented invention. In the seven cases found to be within the patent scope, respondents either refused or failed to submit adequate evidence, leading the CNIPA to conclude that the generic drug indeed falls under patent protection.

In the six cases where the generic product was ruled to be outside the patent scope, the patentee argued that the generic drug was covered by the patent based on the doctrine of equivalents. However, the CNIPA disagreed in these cases, stating that the doctrine of equivalents could not be applied if the patentee had previously excluded the features utilised by the generic drug from the patent's scope through subsequent claim amendments or written arguments during the prosecution process.

2. Patent linkage decisions published by court in 2024

First instance patent linkage decisions are exclusively reviewed by the Beijing IP Court, whose rulings are in turn reviewed by the Supreme People's Court (SPC) IP Tribunal if there is a further appeal. From 2021 to 2024, the Beijing IP Court reviewed 144 patent linkage cases and the SPC issued 37 decisions on appeal cases. Notably, the SPC handed down some significant rulings on crucial issues in several landmark cases in 2024.

Courts should review and correct the type of patent declarations (Apremilast Tablet Case)

The SPC ruled that a patent holder can challenge the type of declaration made by the generic within a reasonable timeframe via patent linkage lawsuit, and that the court should review this issue even though the current patent linkage framework lacks clear guidelines.

This decision arose from a dispute concerning Apremilast tablets, a treatment for psoriasis, in which Amgen filed a patent linkage lawsuit arguing that the generic company should have submitted a Type IV declaration instead of Type I when it filed its Abbreviated New Drug Application (ANDA). Amgen's branded drug had received approval from the National Medical Products Administration (NMPA) on August 16, 2021. They registered the related patents on an online platform (zldj.cde.org.cn) on September 13, 2021, within the required 30 days. The generic company submitted its ANDA on September 10, 2021, just three days before the patent registration.

They declared a Type I patent declaration, indicating that no patent information for the branded drug was registered. The Beijing IP Court rejected Amgen's claim at first instance, stating that the ANDA application was filed before the patent registration, which is consistent with the Type I declaration requirements.

ANDA applicants can file a patent linkage lawsuit based on modified ANDA documents (Edoxaban Mesylate Tablet Case)

Following the first proactive patent linkage lawsuit filed by a local generic company in China, the SPC concluded that the generic company has the right to initiate patent linkage proceedings if the patent holder fails to file a new case regarding the modified generic formulation within the statutory time period.

The product involved in the dispute is the Edoxaban Mesylate Tablet, an anticoagulant medication developed by Daiichi Sankyo. A local generic manufacturer challenged the validity of Daiichi Sankyo's composition patent (ZL20140468293.6) and submitted a Type IV declaration. In response, Daiichi Sankyo initiated a patent linkage petition with CNIPA. Ultimately, CNIPA upheld the validity of the patent and determined that the generic formulation fell within the scope of the patent.

To navigate around the patent constraints, the generic company modified the film coating premixed agent and submitted supplementary technical documents as part of its ANDA documents. Subsequently, the generic company filed a patent linkage lawsuit in court, asserting that the revised formulation was not covered by the patent.

The effect of claim amendment in patent invalidation on patent linkage lawsuit (Cyclosporin Eye Drops Case)

In this case, the SPC held that the court can decide whether to continue the patent linkage proceedings if the claims involved in the litigation have been amended and accepted by CNIPA in the patent invalidation.

In principle, when a patentee amends their claims during patent invalidation, it is deemed to be an abandonment of the originally granted claims. Consequently, this leads to the termination of patent linkage proceedings that were based on those original claims, as the amendments can change both the registered claims and the declarations submitted by generic drug manufacturers.

However, this approach does not effectively resolve the underlying dispute and often extends the duration of the proceedings. In this case, the SPC clarified in its second-instance judgment that courts possess the discretion to determine whether to resume patent linkage proceedings based on the amended claims. This decision may take into account several factors, including the objective of achieving an early resolution of patent disputes prior to the approval of generic drugs, the impact of the claim amendments on the substantive and procedural rights of both parties, and the willingness of the parties to continue with the proceedings.

Section II: 2024 Trends of pharma patent invalidation

In April 2025, CNIPA released 2024 top 10 re-examination and invalidation cases, three of which were related to the pharmaceutical sector. Recent trends in pharma patent invalidation and notable cases handed down in 2024 were discussed below.

1. 2024 overall data of pharma patent invalidation in China

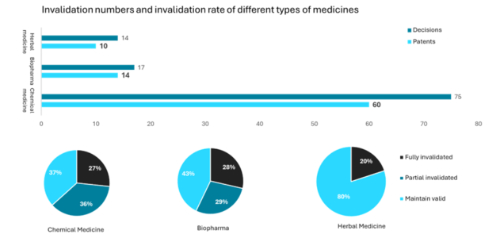

To assess the recent trends in pharma patent invalidation in China, we conducted a comprehensive review of the patent invalidation decisions issued in 2024. Our search identified a total of 106 invalidation decisions pertaining to 84 pharmaceutical patents. The search results exclude cases that have been withdrawn or are still pending without a final decision. Among the 84 patents, 36 patents were maintained valid (43%), 22 patents were partially invalidated (26%) and 26 patents were fully invalidated (31%). In comparison to a report from a third-party commercial database, the overall invalidation rate has decreased from 40% in 2023 to 30% in 2024.

2. Chemical drug patents face more patent invalidation challenges, while biopharmaceutical and herbal medicine patents show greater ability to withstand invalidity actions

In 2024, CNIPA issued 75 invalidation decisions concerning 60 chemical medicine patents, which represents 70% of all patent invalidations in the pharmaceutical sector. In contrast, herbal medicine and biopharma patents saw a similar number of cases, with 14 and 17 invalidation decisions, respectively. This trend can be attributed to the continued dominance of small molecular medicine products in the pharmaceutical market.

Regarding the invalidation rates, 80% of herbal medicine patents and 43% of biopharma patents were upheld as valid – figures significantly exceeding the validity rate for chemical medicine patents, which stands at only 37%.

In recent years, CNIPA has placed a strong emphasis on the protection of patents related to traditional herbal medicine. Many of these patents involve complex formulations and preparation methods for various herbal components, making their invalidation inherently challenging. Meanwhile, biopharma patents encompass a range of advanced technologies, including small RNAs, gene editing, and antibodies, which have received substantial support from the Chinese government. The innovation in these cutting-edge technologies requires significant financial resources. CNIPA is aware of the importance of IP protection for these innovations.

When reviewing invalidation cases for biopharma patents, CNIPA tends to maintain patent validity, exercising caution before making decisions to invalidate patents.

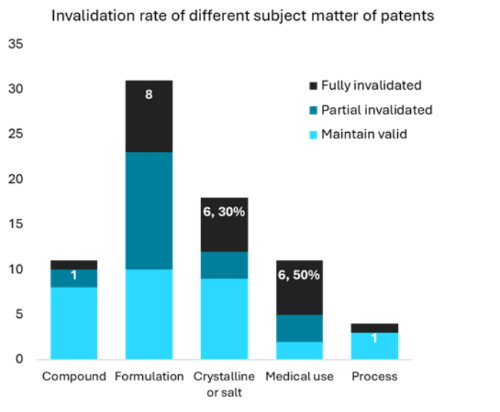

3. The patentability criteria for crystalline form patents become more objective, while claims of medical use defined by physiological indicators are often considered as not inventive

It was also notable that only approximately 30% of challenged crystalline form patents were fully invalidated, a significant decrease from the 75% reported by Pharmcube.com in 2023. This shift suggests that the CNIPA has adopted a more objective approach in evaluating the patentability of crystalline form patents. For instance, in Dapagliflozin propylene glycol solvate case (4W115264, 4W115516, 4W115700, and 4W116571), CNIPA recognised that propylene glycol, particularly the S-type chiral propylene glycol, is not a commonly used solvent for forming solvated crystalline compounds. This crystalline form is suitable for industrial formulations and inventive over prior arts.

Furthermore, the table above indicates that over 50% of medical use patents have been fully invalidated. A notable trend among these invalidated patents is the use of specific physiological parameters to distinguish them from known medical uses.

However, CNIPA expressed negative opinions regarding such claims in several invalidation decisions. For instance, in the Digarex case (4W117065), the main distinction of this patent from prior art lies in that the claims define the subject with a baseline serum alkaline phosphatase (S-ALP) level of approximately 150 IU/L or greater before treatment. CNIPA opined that, in the absence of evidence demonstrating that the S-ALP level is a unique indicator of prostate cancer progression, this physiological parameter does not define a new indication or produce any unexpected technical effect. Therefore, the patent was judged to lack inventiveness and invalidated.

4. Patent invalidity rates: European and Japanese companies comparable to Chinese firms, while U.S. patents show significantly higher rates

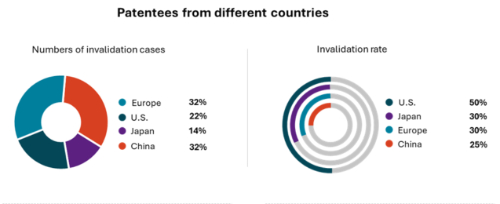

Excluding cases related to traditional herbal medicine patents, nearly 70% of pharmaceutical patent invalidation cases involve foreign pharmaceutical companies, primarily from the United States, Europe and Japan. Notably, European companies had the highest number of 24 patents involved in invalidation proceedings, which accounts for 32% of the cases, while patents from the United States and Japan represent 22% and 14%, respectively.

Patents from Japanese and European companies were fully invalidated at a rate comparable to that of Chinese companies. It is noteworthy that the patents for Dapagliflozin from Europe's AstraZeneca and the patent for Cyclosporine eye drops from Japan's Santen still remained valid after undergoing multiple rounds of invalidation challenges. In contrast, patents from American companies are more vulnerable to invalidation challenges, 50% patents were fully invalidated. For example, the only compound patent that has been entirely invalidated is the U.S. patent for Baricitinib (4W116401). Although CNIPA accepted supplementary experimental data recorded in research literature after the filing date, it concluded that Baricitinib did not achieve an unexpected technical effect compared to Ruxolitinib. Furthermore, the Markush formula of Ruxolitinib patent provided sufficient technical guidance, leading to the conclusion that Baricitinib is not inventive.

Section III: 2024 Pharma Patent Enforcement

1. Administrative enforcement may become an efficient solution for pharma patent disputes.

CNIPA is enhancing and improving its administrative enforcement procedures for patent disputes. In December 2024, CNIPA issued Regulations on Administrative Adjudication and Mediation of Patent Disputes, providing clearer guidelines for handling patent infringement cases. In 2024, administrative agencies across the country received 72,475 patent infringement cases, an increase of over 4,000 compared to 2023.

The administrative enforcement approach offers several advantages for resolution of pharma patent disputes, especially those involving compound patents. For instance, the timeline is much shorter, generally within three months. Additionally, the approved generic drug product should have the same ingredient as innovation medicine, making claim construction straightforward. In 2024, the Shanghai IP office made several administrative decisions regarding pharmaceutical patents, ordering the cessation of the acts of offering for sale on online related to drugs such as Gilmelisib and Unecritinib.

2. Traditional pharmaceutical patent litigation primarily targets the offering for sale of generic drugs before the expiration of patents.

With the implementation of the patent linkage system, a significant number of patent infringement disputes related to pharmaceuticals have already been adjudicated before the approval of generics. Consequently, if a generic drug is determined to fall within the scope of patent protection, these companies typically refrain from launching their products during the patent term. However, to rapidly capture market share after the patent expiration, generic manufacturers often apply for local centralised drug procurement or seek inclusion in medical insurance before the patent expired.

The question of whether such acts constitute "offering for sale" under patent law has become a focal point in pharmaceutical patent litigation. In sitagliptin/metformin case, SPC ruled that applying to join the medical insurance drug list within the patent term is an application for administrative licensing rather than an act of offering for sale, and thus does not constitute patent infringement. Conversely, Beijing IP Court handed down in propranolol case that participation in local drug centralised procurement qualifies as offering for sale, constituting patent infringement.

This article was first published on IAM in July 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.