Over the last three years, securities regulators in the United States and Canada have proposed major reforms to securities law requirements to facilitate "equity crowdfunding", or the sale of securities by issuers to large numbers of investors through online portal intermediaries.

With final rules for equity crowdfunding expected to be in place in 2015, widespread equity crowdfunding may soon become a reality in the United States and Canada. However, even in the absence of these rules, more limited forms of equity crowdfunding are already occurring here and in the United States.

In Canada, as explained below, a number of registered dealers already operate or have announced plans to establish online portals to facilitate the sale of securities through the Internet (both primary issuances and secondary trading) in reliance on existing prospectus exemptions, including the "accredited investor" exemption1 and (in the jurisdictions where available) the "offering memorandum" exemption (the OM exemption).2

Crowdfunding in the United States

The United States kick-started recent reform efforts relating to equity crowdfunding with the signing into law of the Jumpstart Our Business Startups (JOBS) Act3 in April 2012. Together with a number of other important amendments to the federal securities laws, Title III to the JOBS Act, called the CROWDFUND Act [or the Capital Raising Online While Deterring Fraud and Unethical Non-Disclosure Act], raised the prospect that U.S. businesses could for the first time raise capital through widespread "equity crowdfunding".

Crowdfunding has become common in a non-securities context through sites such as Kickstarter or Indiegogo. However, equity crowdfunding has been relatively slow to take off in North America due to the difficulty of complying with various regulatory requirements applicable to issuers and intermediaries when selling securities through the Internet.4

The JOBS Act Crowdfunding amendments were intended to address these regulatory difficulties by creating a streamlined regulatory framework that would, subject to appropriate rule-making by the Securities and Exchange Commission (the SEC), facilitate capital raising and reduce the regulatory burden on small and emerging businesses while retaining certain important investor protections.

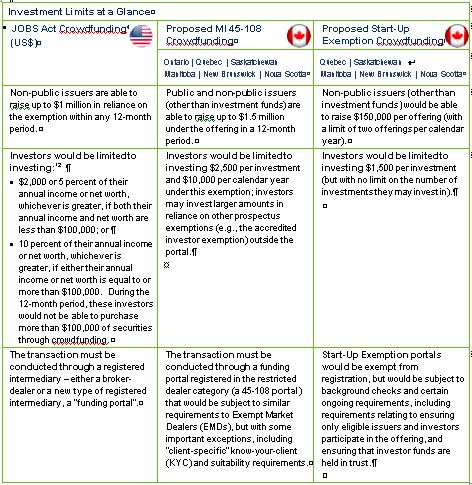

The principal investor protection measures contemplated by the JOBS Act Crowdfunding amendments are the proposed investor limits (see table below), which are intended to reduce the risk of loss to investors, and the requirement that offerings be made through a registered intermediary, either a conventional broker-dealer or a new type of registered firm, a "funding portal".

In October 2013, the SEC published for comment new Regulation Crowdfunding under the Securities Act of 1933 and the Securities Exchange Act of 1934 to implement the requirements of Title III of the JOBS Act. Regulation Crowdfunding proposed rules governing the offer and sale of securities under new Section 4(6) of the Securities Act of 1933. The proposal also set out a framework for the regulation of registered funding portals and brokers that issuers are required to use as intermediaries when using the new crowdfunding exemption.

While the SEC has yet to finalize its crowdfunding rules, a number of state regulators have moved forward with final rules to facilitate equity crowdfunding within their states. For more information about recent developments with equity crowdfunding in the United States, see the SEC JOBS Act webpage.5

Crowdfunding in Canada

In Canada, the Ontario Securities Commission (OSC) announced its own wide-ranging review of the exempt market in June 2012,6 and subsequently published a comprehensive Consultation Paper in December 20127 and a Progress Report in August 2013,8 both of which contained proposals for a crowdfunding prospectus exemption and a new type of registered intermediary, the registered funding portal. The Progress Report also indicated that the OSC was considering adopting a version of the OM exemption based on the Alberta version of the OM exemption in section 2.9 of NI 45-106.

During this period, a number of other Canadian jurisdictions, including Quebec, Saskatchewan and New Brunswick, held panel discussions and public consultations in relation to equity crowdfunding.9

In March 2014, the members of the Canadian Securities Administrators (the CSA) published for comment two sets of proposals relating to the selling of securities through the Internet:

- The OSC and its counterparts in Saskatchewan, Manitoba, Quebec, New Brunswick and Nova Scotia published for comment proposed Multilateral Instrument 45-108 Crowdfunding (proposed MI 45-108).10 Proposed MI 45-108 sets out a proposed prospectus exemption to facilitate capital raising by reporting and non-reporting issuers, other than investment funds, through online portals and a proposed regulatory framework for a new type of registrant, the "registered funding portal" (a 45-108 portal).

- These jurisdictions – with the exception of Ontario -- also published for comment parallel proposals for a more lightly regulated equity crowdfunding regime, the Start-Up Crowdfunding Prospectus and Registration Exemption (the Start-Up Exemption). This exemption is generally similar to the Saskatchewan equity crowdfunding exemption first introduced by way of blanket order in December 2013.

- The British Columbia Securities Commission (BCSC) published a local notice requesting comment on the Start-Up Exemption (but not proposed MI 45-108). The BCSC has elsewhere published guidance11 that suggests that they take the view that crowdfunding offerings above the Start-Up Exemption level can be achieved through existing prospectus exemptions, such as the OM exemption, and through existing dealer categories.

Ecosystem of Crowdfunding Regimes

Although the proposed crowdfunding regimes contemplated by proposed MI 45-108 and the Start-Up Exemption appear to represent alternative approaches to the regulation of crowdfunding offerings, the Multilateral CSA Notice indicates that the participating jurisdictions intend for both exemptions to coexist "as they target issuers at different stages of development".

This concept of a hierarchy (or "ecosystem") of crowdfunding regulation regimes – with smaller offerings more lightly regulated than larger offerings – is also consistent with the view that crowdfunding offerings at levels higher than permitted under the Start-Up Exemption or the 45-108 regime can and should be achieved through existing prospectus exemptions, such as the OM exemption, and through existing dealer categories. As discussed below, this is already occurring in Canada.

As of the date of this nutshell, the members of the CSA have not yet published a substantive update on these proposals relating to the Start-Up exemption or the MI 45-108 proposals.

In part, this appears to be due to the fact that, in Ontario at least, the crowdfunding proposals were published as part of a broader package of capital raising proposals, including proposals to introduce a version of the OM exemption to Ontario, as well new exemptions based on the "friends, family and business associates" exemption in section 2.5 of NI 45-106 and an "existing securityholder exemption".13

On February 5, 2015, the OSC announced that it was proceeding with amendments to OSC Rule 45-501 that give effect to the proposals for an "existing securityholder" exemption. These amendments came into force on February 11, 2015.14

On February 19, 2015, the OSC announced that it was proceeding with amendments to NI 45-106 to introduce a "friends, family and business associates" exemption to Ontario and to eliminate the carve-out in Ontario for investment funds in the managed account category of the accredited investor exemption definition in s. 1.1 of NI 45-106.

The proposal to introduce to Ontario a version of the OM exemption – albeit a version of the OM exemption subject to investment limits for individual investors who do not qualify as accredited investors ($10,000 or $30,000 under the exemption in a calendar year depending on the circumstances of the investor) – together with the coordinated proposals by the securities regulators in Alberta, Quebec and Saskatchewan15 to introduce similar investment limits to their existing versions of the OM exemption, have triggered strong industry opposition particularly in jurisdictions that already have this exemption.

In a related "Backgrounder" notice,16 the OSC stated that "the participating CSA jurisdictions collectively received approximately 916 comment letters17regarding the OM exemption and approximately 45 comment letters regarding the crowdfunding regime. [CSA staff] are reviewing the comments and our goal is to publish the OM exemption and the crowdfunding regime either in final form or, if warranted, for a second comment period, in summer 2015."

Equity Crowdfunding is Already Happening in Canada

As noted above, a number of registered dealers, including exempt market dealers (EMDs) and restricted dealers, already operate or have announced plans to establish online portals to facilitate distributions and other trades of securities through the Internet (both primary and secondary trading) in reliance on exemptions other than the prospectus exemption in proposed MI 45-108 Crowdfunding or the Start-Up Exemption.

These portals generally facilitate private placements in reliance on one or more existing prospectus exemptions:

- the accredited investor exemption (all jurisdictions)

- the OM exemption (all jurisdictions other than Ontario – but, as discussed above, Ontario has announced it is proposing to introduce this exemption)

In theory, these portals could also facilitate distributions made in reliance on other prospectus exemptions, including the following:

- the "private issuer" exemption in section 2.4 of NI 45-106

- the minimum amount exemption in section 2.10 of NI 45-106 (although this exemption will shortly cease to be available for distributions to individuals as a result of the amendments announced by the CSA on February 19, 2015)

- the "existing securityholder" exemption that was adopted in Canadian jurisdictions other than Ontario in 201418 and that came into force in Ontario on February 11, 2015

The following are examples of dealers that have established or announced plans to establish online portals:

|

|

While the expected introduction of new equity crowdfunding rules in 2015 will be welcomed by many Canadian market participants, in view of the investment limits and other conditions that were included in the equity crowdfunding proposals that were published for comment in March 2014, the proposed introduction of the OM exemption to Ontario in 2015 may well prove to be more significant from an equity crowdfunding perspective.

On the other hand, the crowdfunding proposals that were published for comment in March 2014 generally contemplate a "lighter regulatory touch" than is the case with existing prospectus exemption and dealer registration categories. Accordingly, in keeping with the concept of a hierarchy of regulatory regimes crowdfunding regulation regimes – with smaller offerings more lightly regulated than larger offerings – Canadians may soon have a variety of equity crowdfunding options from which to choose.

Footnotes

1 See section 2.3 of National Instrument 45-106 Prospectus and Registration Exemptions (NI 45-106).

2 See section 2.9 of NI 45-106.

3 Jumpstart Our Business Startups Act, Pub. L. 112-106, 126 Stat. 306 (2012) [the JOBS Act].

4 or a discussion of the U.S. regulatory issues with crowdfunding, see Bradford, Crowdfunding and the Federal Securities Laws, Columbia Business Law Review, Vol. 2012, No. 1; and Bradford, The New Federal Crowdfunding Exemption: Promise Unfulfilled, Securities Regulation Law Journal, Vol. 40, No. 3, Fall 2012.

5 http://www.sec.gov/spotlight/jobs-act.shtml

6 OSC Staff Notice 45-707 OSC Broadening Scope of Review of Prospectus Exemptions (June 2012).

7 OSC Staff Consultation Paper 45-710 Considerations for New Capital Raising Prospectus Exemptions (the Consultation Paper) (December 2012).

8 OSC Notice 45-712 Progress Report on Review of Prospectus Exemptions to Facilitate Capital Raising (the Progress Report) (August 2013).

9 The New Brunswick Securities Commission held panel discussions on crowdfunding on November 27, 2012. The Autorité des marchés financiers (the AMF) published a Notice of Public Consultation dated February 25, 2013. In July 2013, the Saskatchewan Financial and Consumer Affairs Authority (theFCAA) published a concept proposal for equity crowdfunding and then, in October 2013, published for comment a framework for a proposed Saskatchewan-only equity Crowdfunding exemption. On Dec. 6, 2013 the FCAA adopted a blanket order implementing this framework. See the FCAA equity crowdfunding page at http://www.fcaa.gov.sk.ca/skec.

10 In Ontario, see the OSC Notice and Request for Comment relating to Proposed Amendments to NI 45-106 Prospects and Registration Exemptions and related instruments (including Proposed Multilateral Instrument 45-108 Crowdfunding and proposed Multilateral Policy 45-108CP Crowdfunding) dated March 20, 2014 (the March 2014 OSC Proposals). In the other CSA jurisdictions that published proposed MI 45-108 for comment, see the Multilateral CSA Notice of Publication and Request for Comment re Draft Regulation 45-108 respecting Crowdfunding (the March 2014 Multilateral CSA Crowdfunding Notice).

11 See, e.g., the British Columbia Securities Commission commentary on "crowdfunding" at p. 8 of the Guide to Capital Raising for Small Business, available at http://www.bcsc.bc.ca/.

12 The investment limits for investors are set out in subsection 4(6) of the Securities Act of 1933 (as introduced by section 302 of Title III of the JOBS Act).

13 See the March 2014 OSC Proposals, supra. For a high-level overview of the four new capital raising exemptions proposed for Ontario, see the OSC Backgrounder dated March 20, 2014, available at

14 See the Notice of Ministerial Approval of Amendments to OSC Rule 45-501Ontario Prospectus and Registration Exemptions dated February 5, 2015.

15 Multilateral CSA Notice of Publication and Request for Comment re Proposed Amendments to National Instrument 45-106 Prospectus and Registration Exemptions Relating to the Offering Memorandum Exemption and in Alberta, New Brunswick and Saskatchewan, Reports of Exempt Distribution dated March 20, 2014 (the March 2014 Multilateral CSA OM Proposals), available at

16 http://www.osc.gov.on.ca/documents/en/News/nr_20150219_family-friends-business-backgrounder.pdf

17 http://www.osc.gov.on.ca/en/23986.htm The AUM Law comment letter can be found at

18 See Multilateral CSA Notice 45-313 Prospectus Exemptions for Distributions to Existing Security Holders.

19 The MaRS VX portal is unique in that it is so far the

only online portal to be granted exemptive relief from certain

"client-specific" KYC and suitability requirements. See

the summary of this relief in the Progress Report and OSC Staff

Notice 33-742 2013 OSC Annual Summary Report for Dealers, Advisers

and Investment Fund Managers. The OSC has indicated that this

relief should not necessarily be considered a precedent for other

types of portals, such as EMD portals that facilitate offerings in

reliance on existing prospectus exemptions. However, this relief is

also contemplated for the funding portals described in proposed MI

45-108. This relief and the MaRS VX model generally is described in

the following two orders:

http://www.osc.gov.on.ca/en/SecuritiesLaw_ord_20140313_214_marsx-vx.htm

http://www.osc.gov.on.ca/en/SecuritiesLaw_ord_20130620_215_mars-vx.htm

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.